Restart to P.4 Looking Good So Far.

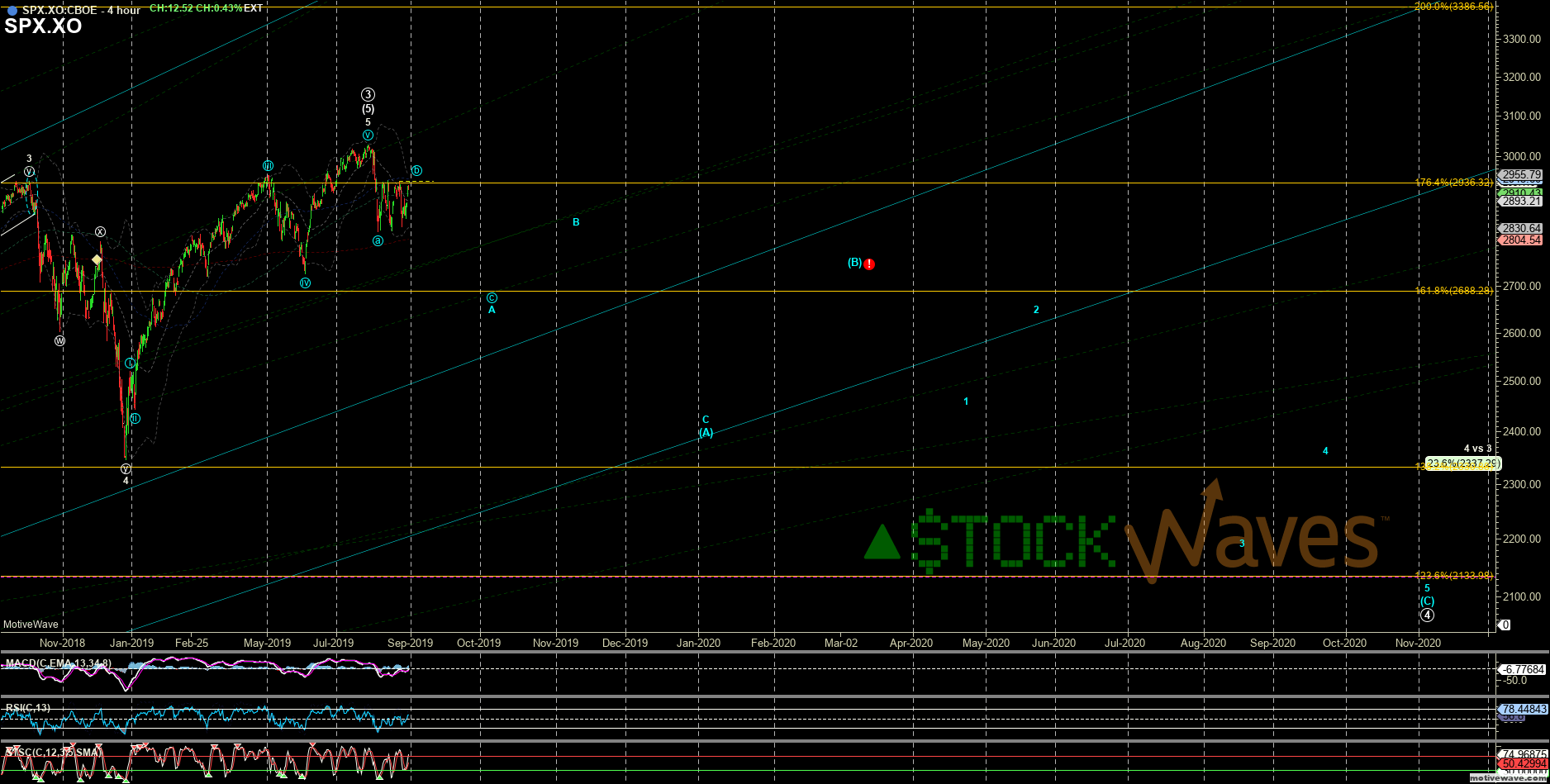

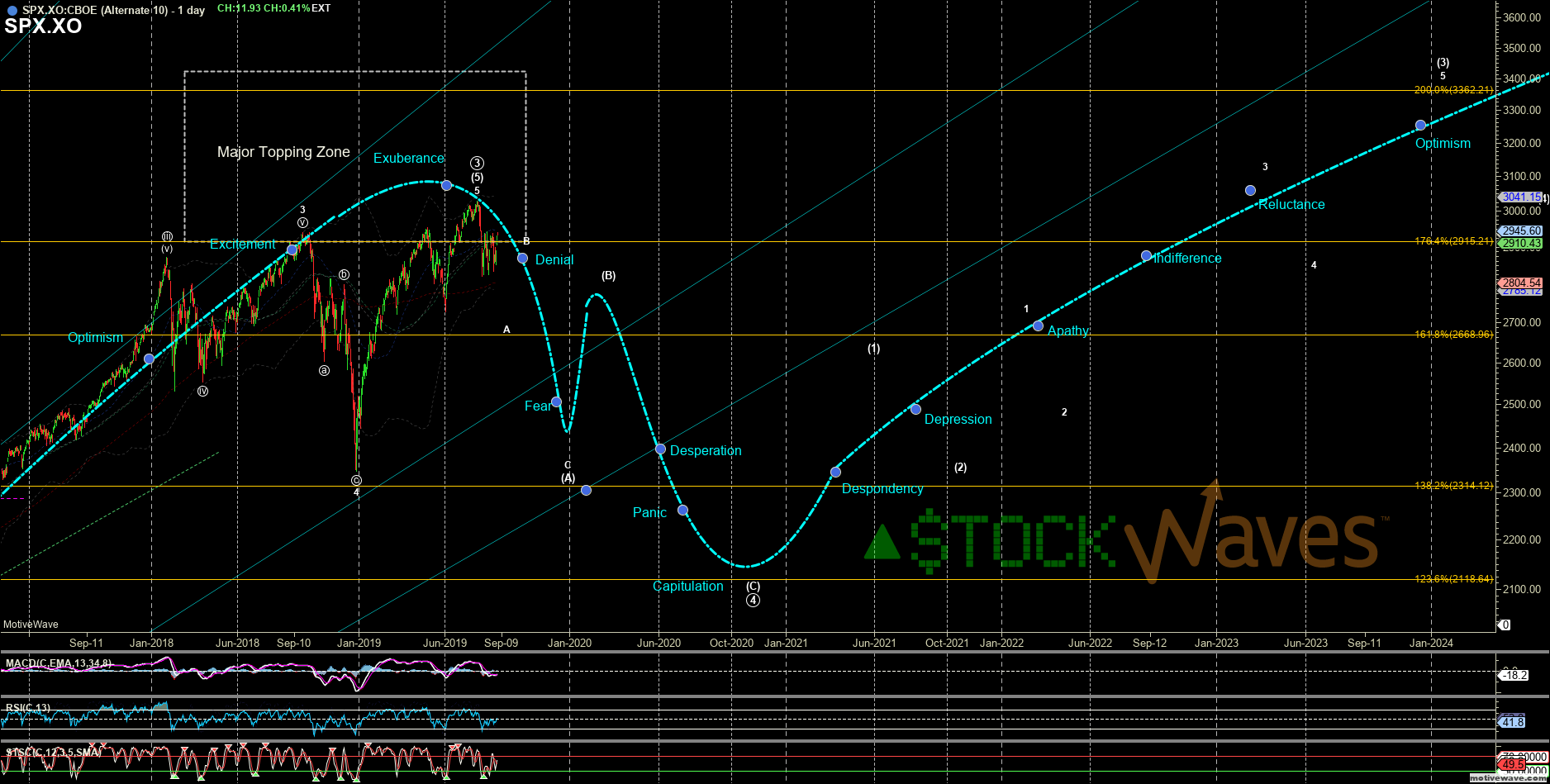

The S&P500 got another extension as v of 5 of (5) of P.3 off the June low to a nominal new high. I have been putting off adjusting my larger #SentimentCycle chart b/c it is a pain to move the curved lines (which you can no longer make in new versions of Motive Wave) and then move each dot and label over. But the structure off the July top counts very well as the first "a-b" inside the A of (A) of the new start to Primary wave 4 still targeting the ideal 2130 region. The confluence of Elliott Wave guidelines making this 2130 region ideal has been discussed in a few of our webinars. Subwaves inside correction (especially) fourths can take lots of twists and turns and we will adapt and adjust sub-wave counts as needed, but current posture with 2950-2970s as heavy resistance looks to be targeting the 2700-2660 region soon as a c down of A.