Rest/Digestion Ahead Of Higher Highs

The Emini S&P 500 (ES) closed at 4198.5 yesterday, showcasing a gap up and crap session as the bulls were not able to sustain the immediate trend. Price action had to backtest against 4190 key support level and held throughout the day and night.

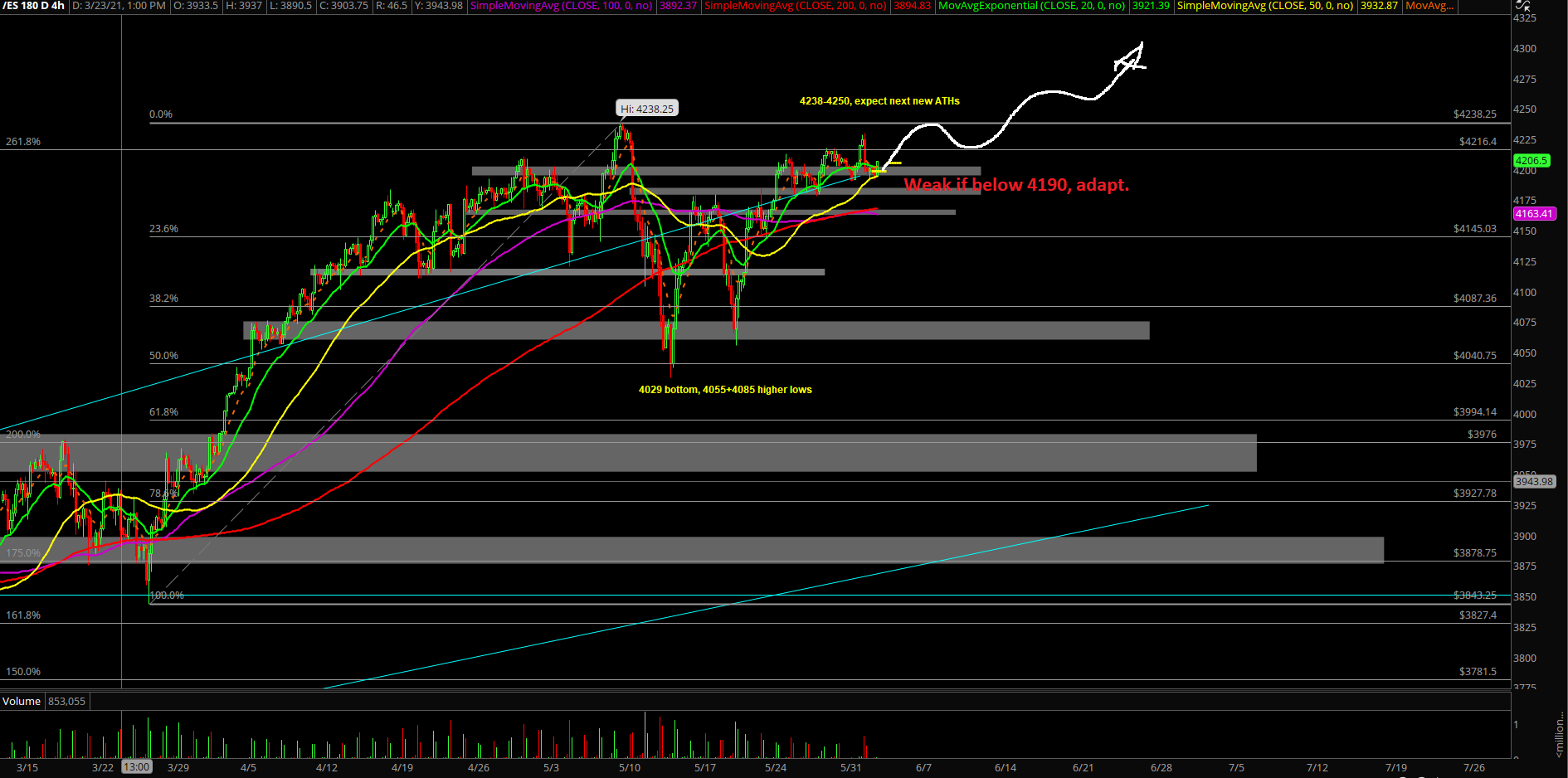

We maintain the same basis going into this week and June: ES 4238-4250 target when above our key trending support at 4190. Every dip is an opportunity given the clear risk versus reward for the next 5-10 sessions. If below support, adapt or die as price action is dynamic, not static.

If/when 4238/4250 targets get fulfilled, then we move onto 4280/4300/sky is the limit.

We have introduced new 4hr white line projection for this week, no alternative at the moment.

Again, ES and NQ have formed their multi-day/week low given the context of ES 4029 vs 4055 lows and NQ 12915 vs 12954. We remain long and strong when above trending immediate support levels.

Bigger picture wise, month of May was just a consolidation setup in a massive bullish trending monthly context. It’s resting/digesting before the market attempts higher highs into rest of this year (when above 3965 SHTF). Pull up our/your monthly chart and you can clearly see it.