Resistance Just Above Us in Bitcoin

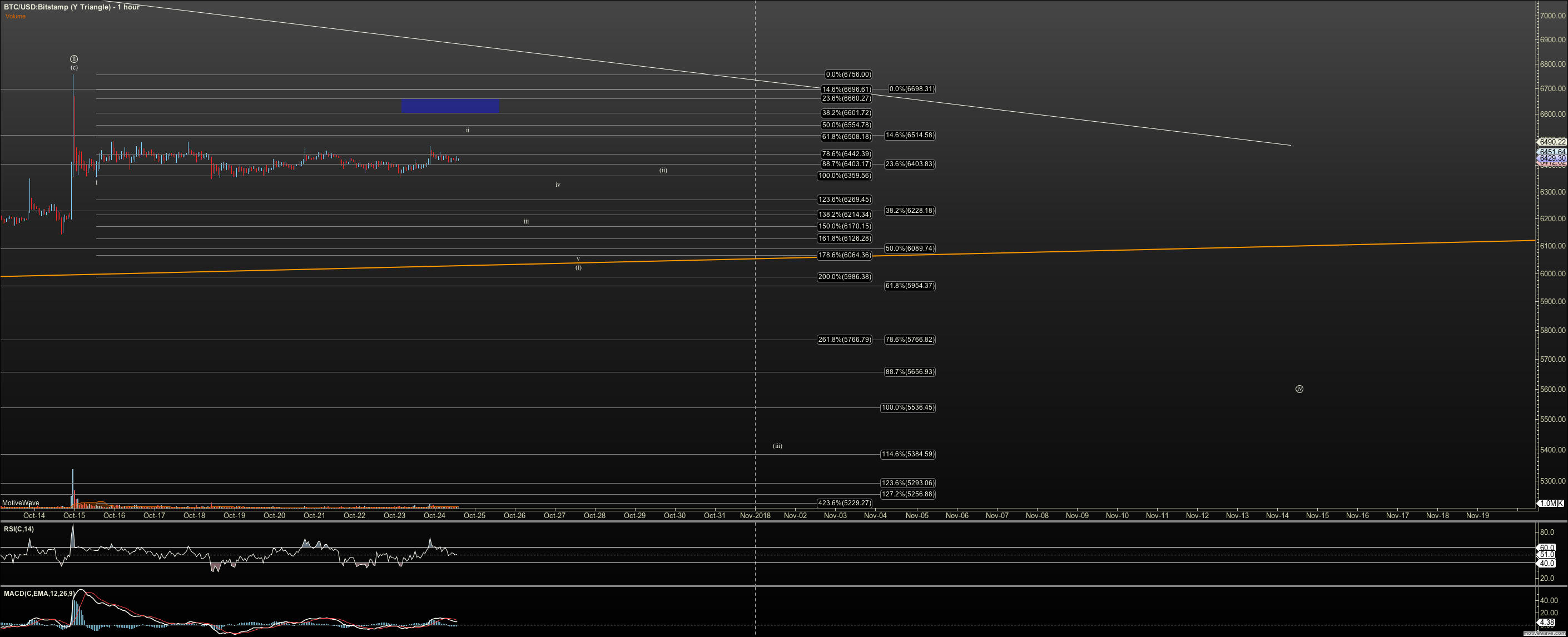

The downside setup in cryptocurrencies off of the Tether spike high is still intact. We have 5 waves down, and three up. But so far the market, obviously has not taken out any support to get going. We remain hovering under resistance, and over the next level of support in the down trend we've had since February. Techs are far more bearish than bullish at this time, but techs are a lagging mathematical construct of price, and so price can force that to change. I do want to remind you that resistance is just above us at $6600-$6680 in Bitcoin, which is $180 to the upside, so there is an early warning that we'll get breakout if Bitcoin decides to take that path. We're obviously seeing potential bottom patterns in a few coins like XLM, VET, NANO, for example. But those bottom patterns are still in position to be undermined, and some like XRP and EBST have been undermined, at least as indication of a strong impulse. But by and large, the downside setup for one more low remains on most coins I'm watching, and if we do breakout over $6680, it will be off a three wave bottom, which is not the material for a strong impulse. So, personally, I'd prefer to see a large reset so the market is free to impulse and not 'drag' off a three wave bottom. But the market doesn't follow my whim. So, patience is wearing thin. I feel it too.

Just a note on sentiment. This is qualitative, and means nothing compared to price, but sometimes price shows later when sentiment is 'wrong'. In general, I've seen sentiment 'out there' turn rather bullish. I cannot write a post or article without some very bullish commentators asking why I am so bearish. I've even received the social media version of giggles regarding my targets in the mid $4000's. That doesn't vex me, so much as I take that as at least a sign to be cautious still, until price action breaks free, either way.

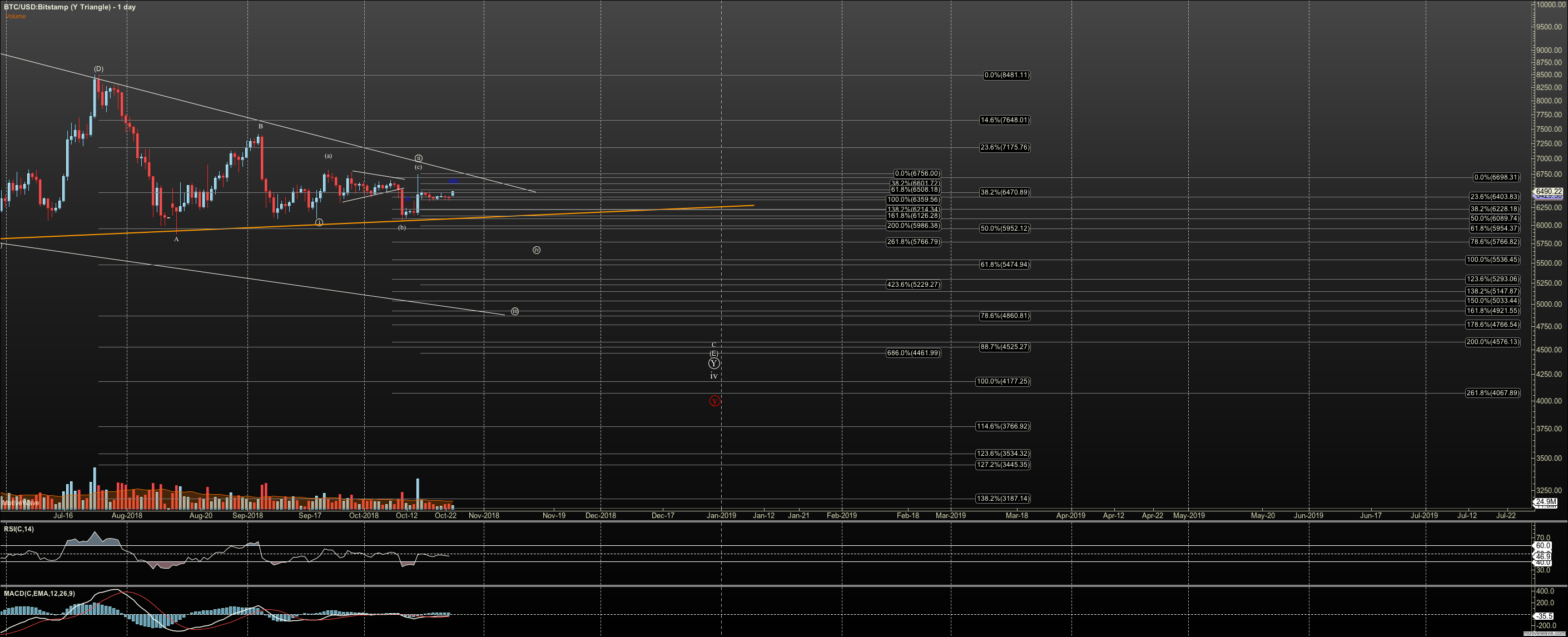

Bitcoin

As mentioned, we still have a 1-2 setup off the high at $6750. 5 waves down, and 3 up. We need to hold $6680 at the highest for this setup to be probable and it STILL aims at the $6000 region for just one of three. If that level is hit then the setup for $4600-4800 grows in probability. Until we break one way or another there is little to say.

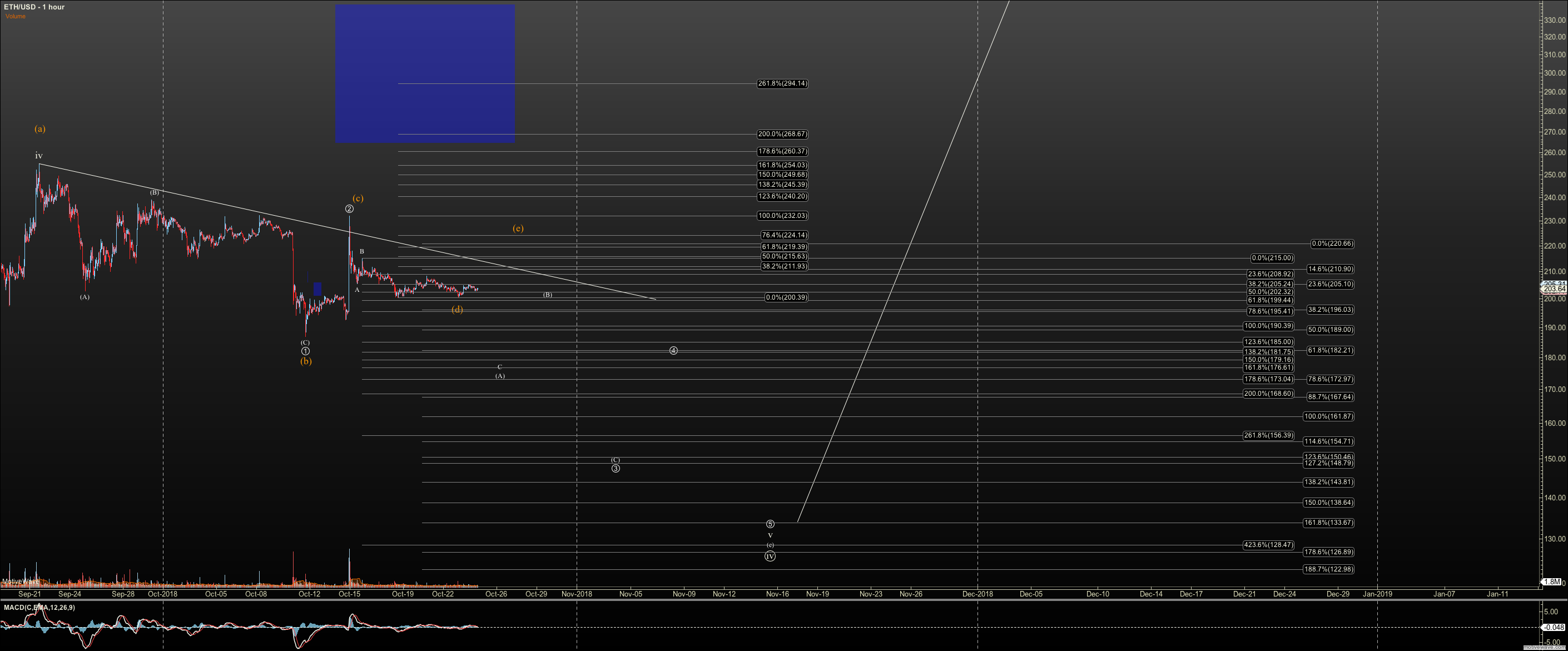

Ethereum

The orange count in Ether is really growing on me. We are getting close to where an E wave will hit. I have adjusted my trendline, by hand, eyeballing where the triangle is most likely to be. This is to 'discount' the Tether spike which wrecked havoc on price structures. I'm going to continue to watch both counts for now, but orange is growing on me, and if the 1-2 is clear off an E wave it will be come primary.

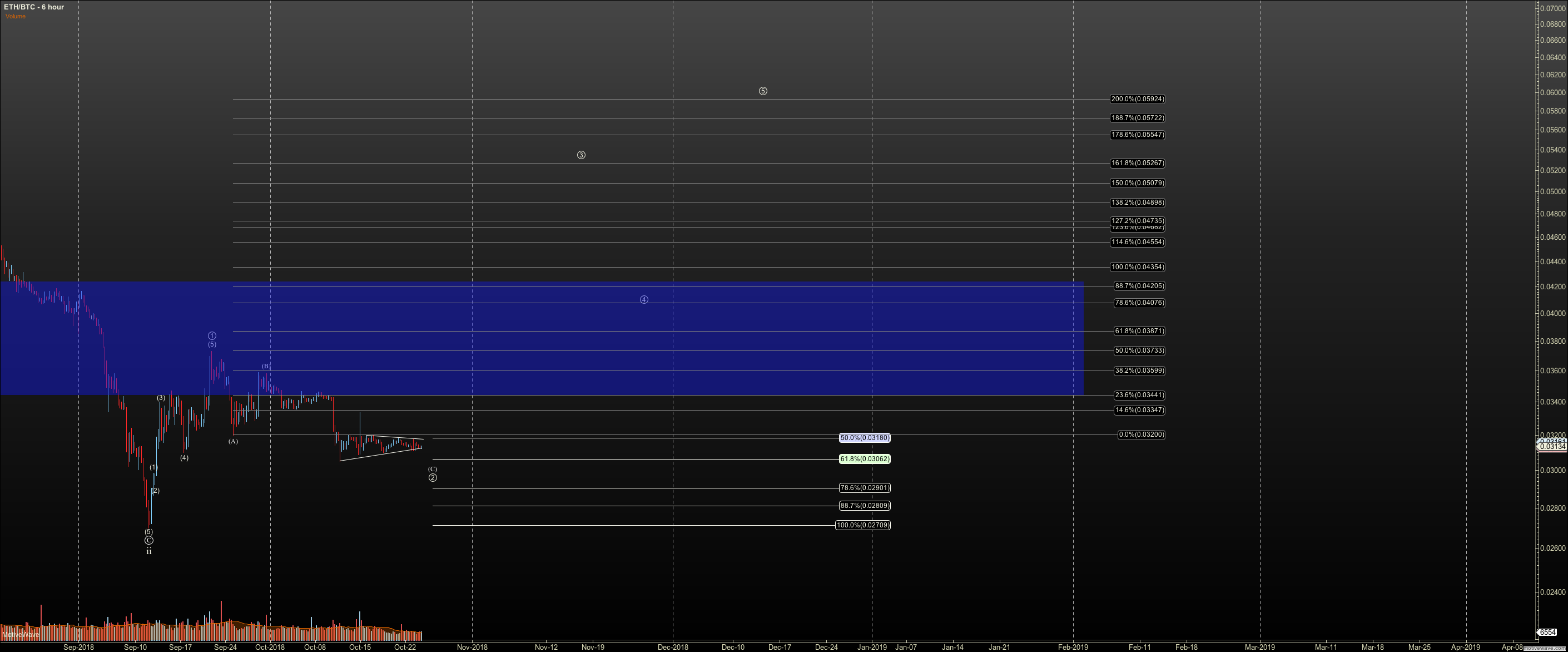

ETHBTC appears to have a triangle forming for wave 4 of C and I've added the trendlines.