Ready To Ramp Again

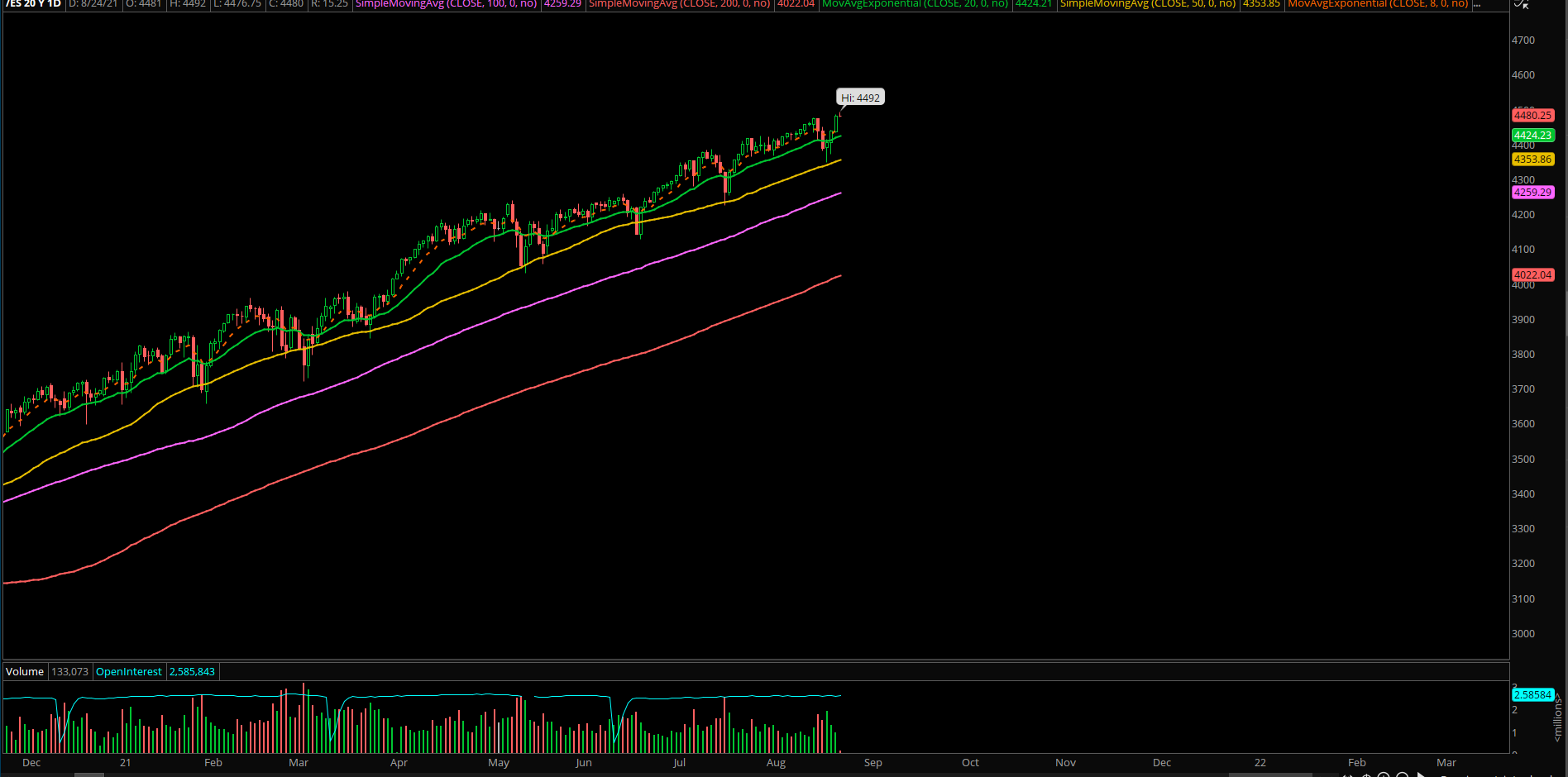

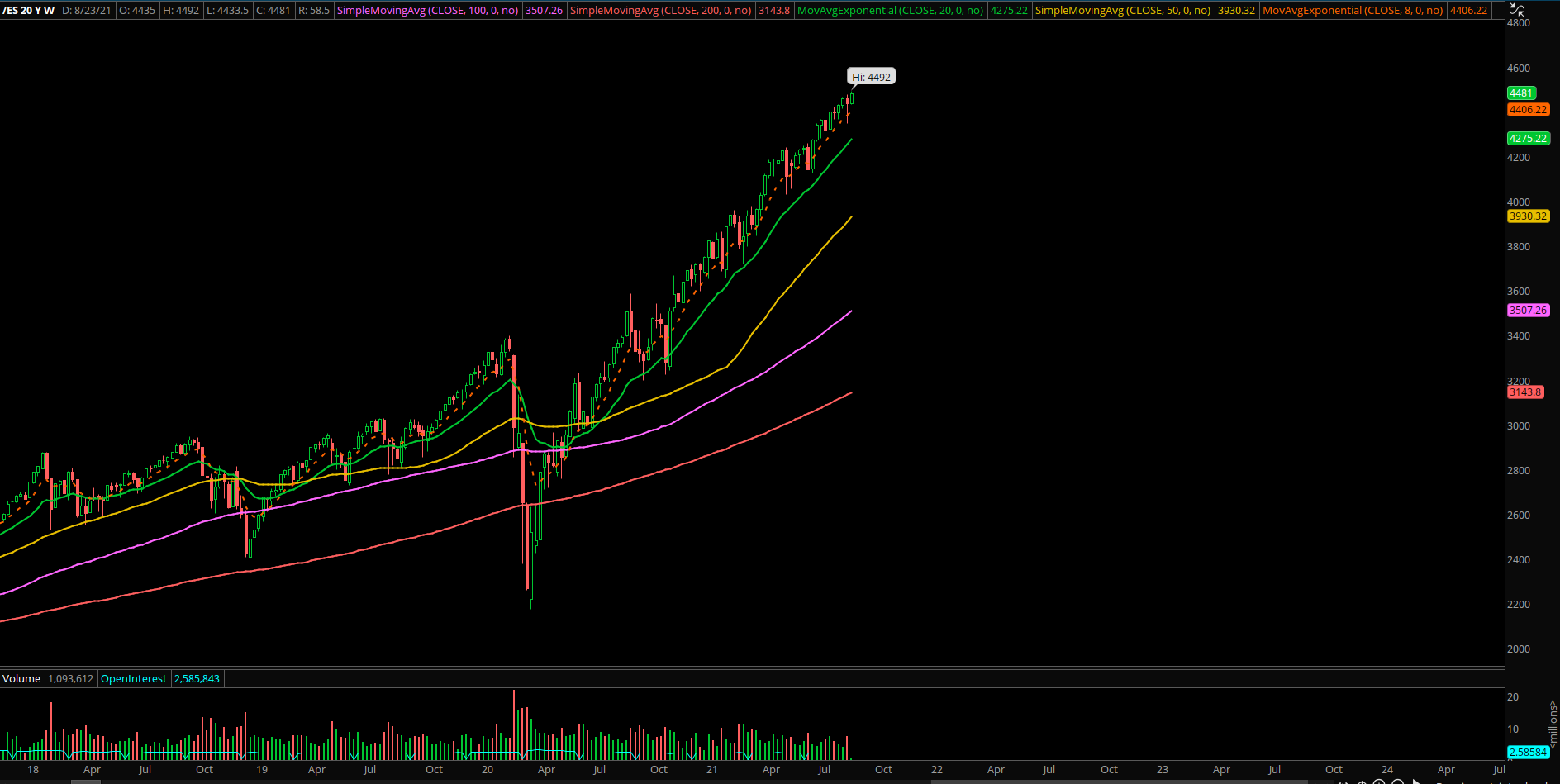

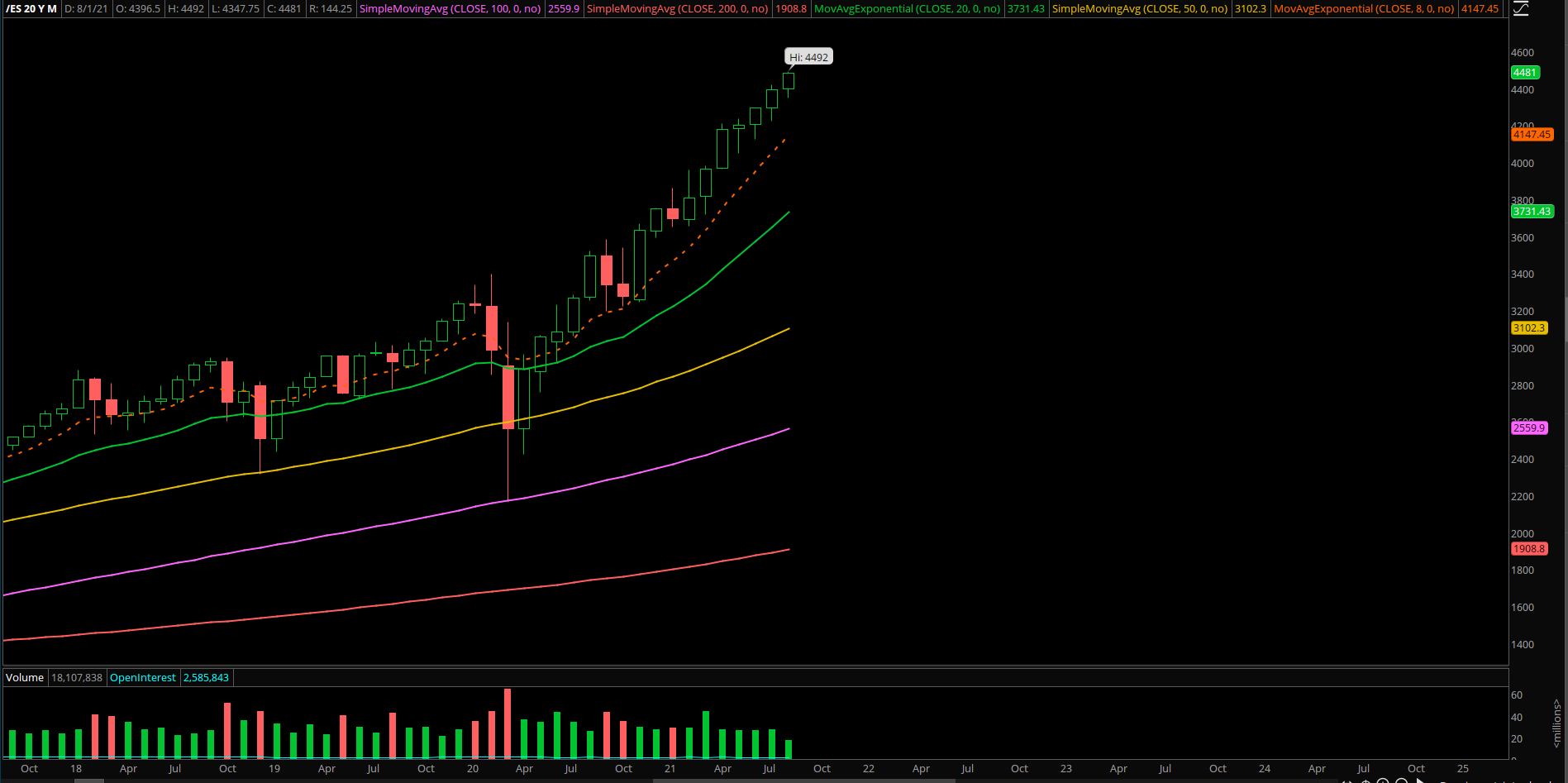

As we noted yesterday, the key is to watch how this trending 50-day moving average stabilizes or loses strength (currently at 4337s), as the past 6 quick corrections have all held the 50-day area and then subsequently made new highs. Let's see if it’s something different here or more of the same.

We could effectively treat last week’s low of 4370s in the Emini S&P 500 (ES) as a successful backtest into the 50 day and now we’re back to the same old grind up environment. Basically, a quick 2% dip off ES all-time highs, and the market is ready to ramp again. The reset allowed for rotation and new leadership. More of the same…no surprises.

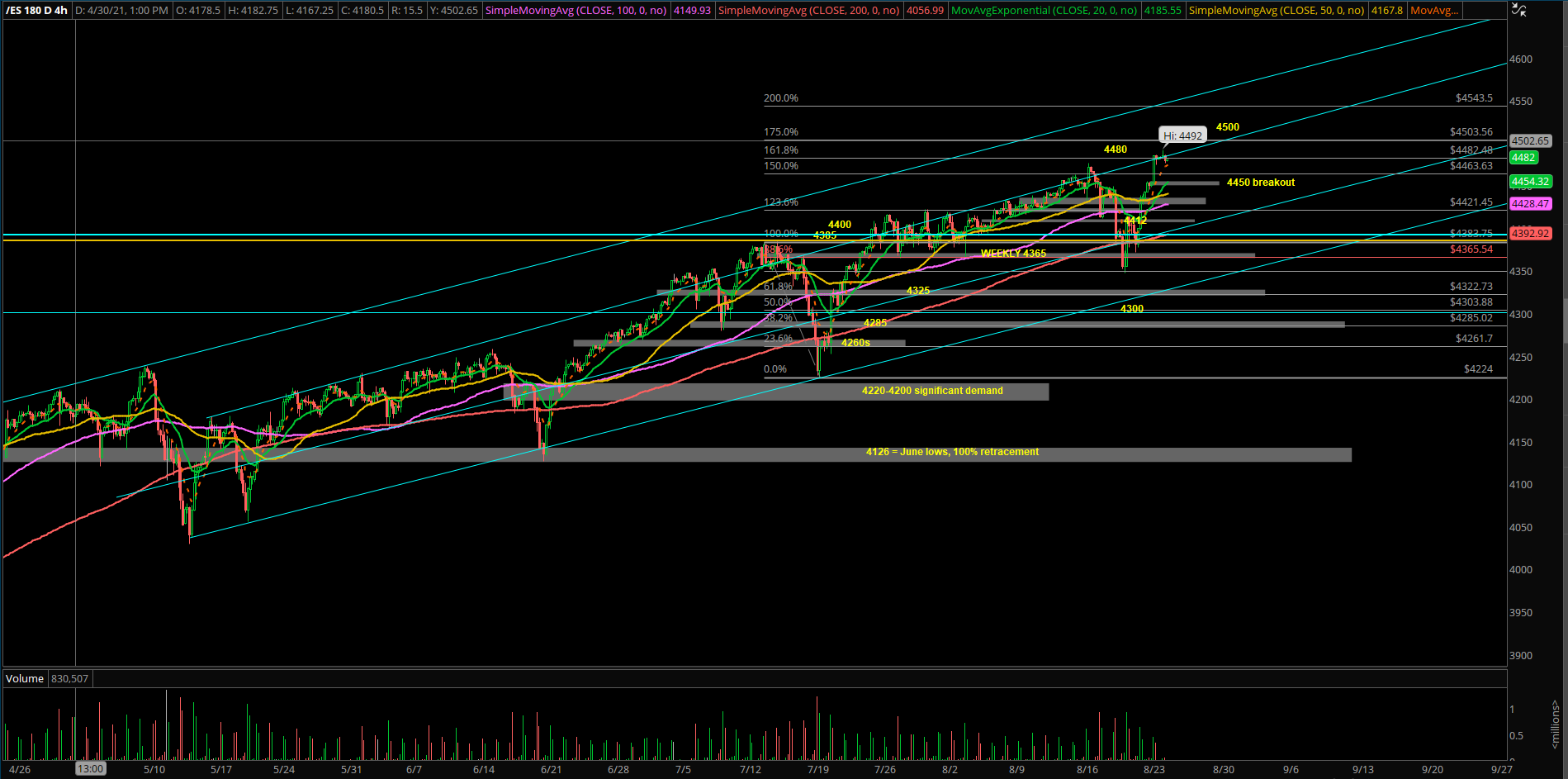

With the 4480 target fulfilled, 4500 and 4520 are next in our level-by-level approach, and dips remain buyable. Immediate supports are 4480 and 4450 where price action must stay above the latter on any dip.

Otherwise, if 4450 fails, a risk of a breakout reversal opens up again back to 4435/4412.

Note: Jackson Hole with Powell on Friday 10AM, so be aware of very important timing catalyst. This could accelerate the on-trend setups even more if things hold together, vice versa failure to sustain…so adapt.