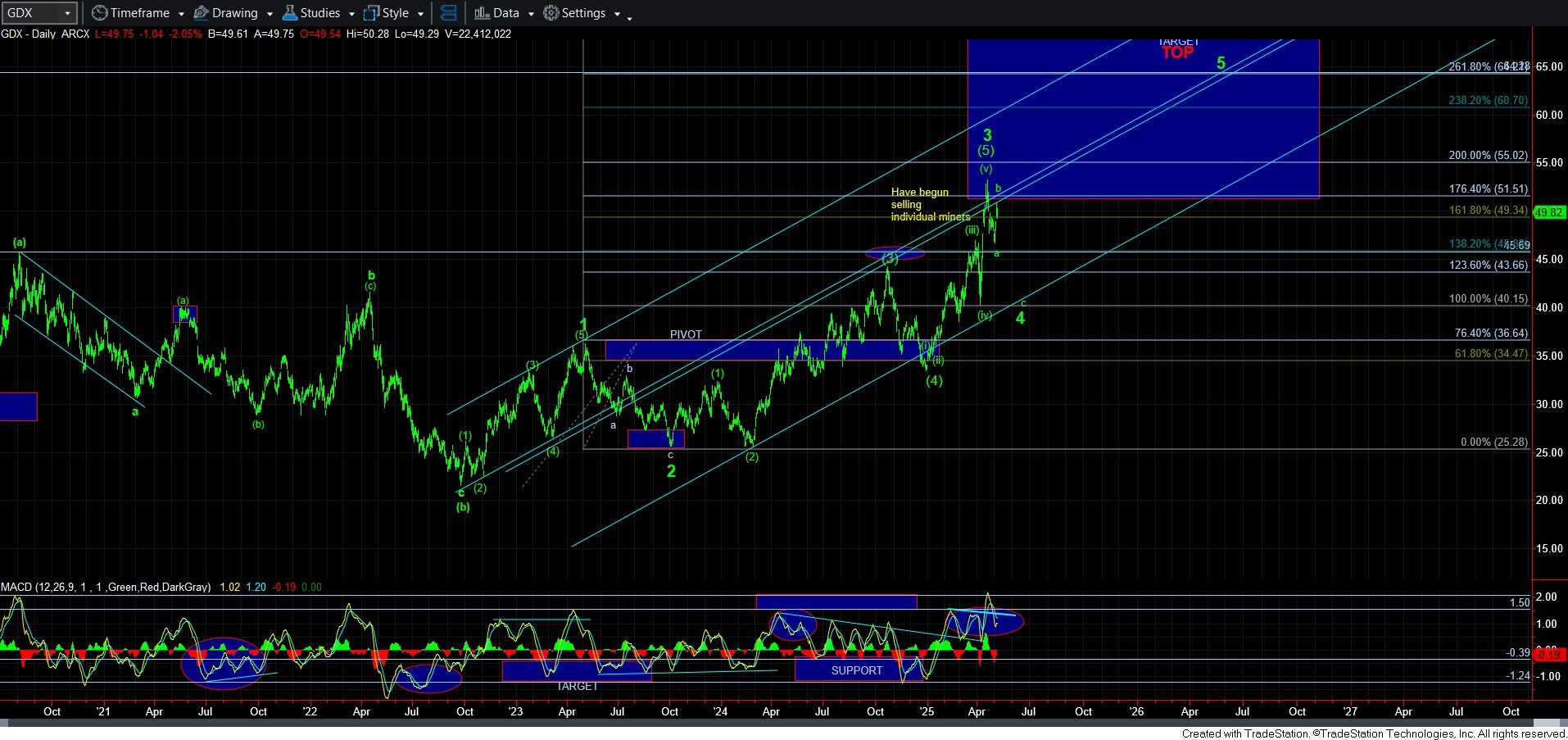

Rally Topping? - Market Analysis for May 7th, 2025

While I was expecting the metals complex to see a b-wave rally in GDX and GLD, the gold rally has begun a bit earlier than I had expected, as I was looking for a bit lower first. But, the market had other ideas.

In both GDX and gold/GLD, it really seems as the more likely perspective is that this rally is a b-wave. In fact, the rally in GDX and gold have retraced to the .764 region of the prior decline. And, while I can make an argument for a 5-wave decline from the high in GDX, I really do not see a clear 5-waves down yet in gold.

However, as long as we remain below this week’s high, I am looking to begin a larger decline in both those charts. Of course, if we take out this week’s high, then I would have to consider an alternative that the prior 3rd waves have not yet completed, and relative marginally higher highs may be seen before their larger degree 3rd waves are complete.

In silver, I have been tracking a potential 2nd wave high within the yellow [c] wave. And, while we have seen an appropriate reaction to the downside, I cannot say that I have a clear 5 waves down in silver just yet. Of course, if silver is able to take out this week’s high, then it can open the door to the green count, but I will still need to see a rally to at least the 1.618 extension (the bottom of the blue box) for me to even consider the leading diagonal count as a reasonably probable wave count.

If we can see clearer 5-wave structures take shape in the coming day or so, then I may even consider shorting various products in the metals market. But, for now, I cannot say that I have a strong downside set up just yet.