Quick Update - Market Analysis for Sep 13th, 2018

Based upon the micro 5 waves down today, and after a 5 wave rally that came short of all ideal targets we normally see in an impulsive structure with the metals, I have adjusted my primary count to looking for another decline to complete the b/2 wave, which will then set up another rally thereafter. It would take a break out over today's high to invalidate this potential.

And, to be honest, this lower b-wave would fit much better with a c-wave at the 1.00 extension down in the 116.25 region on the daily chart, as it would provide us with an a=c structure right into that target region, which is the standard target for a 4th wave rally.

Silver has the same micro structure pointing down to a lower low to complete wave v, as long as we do not break back over today's high.

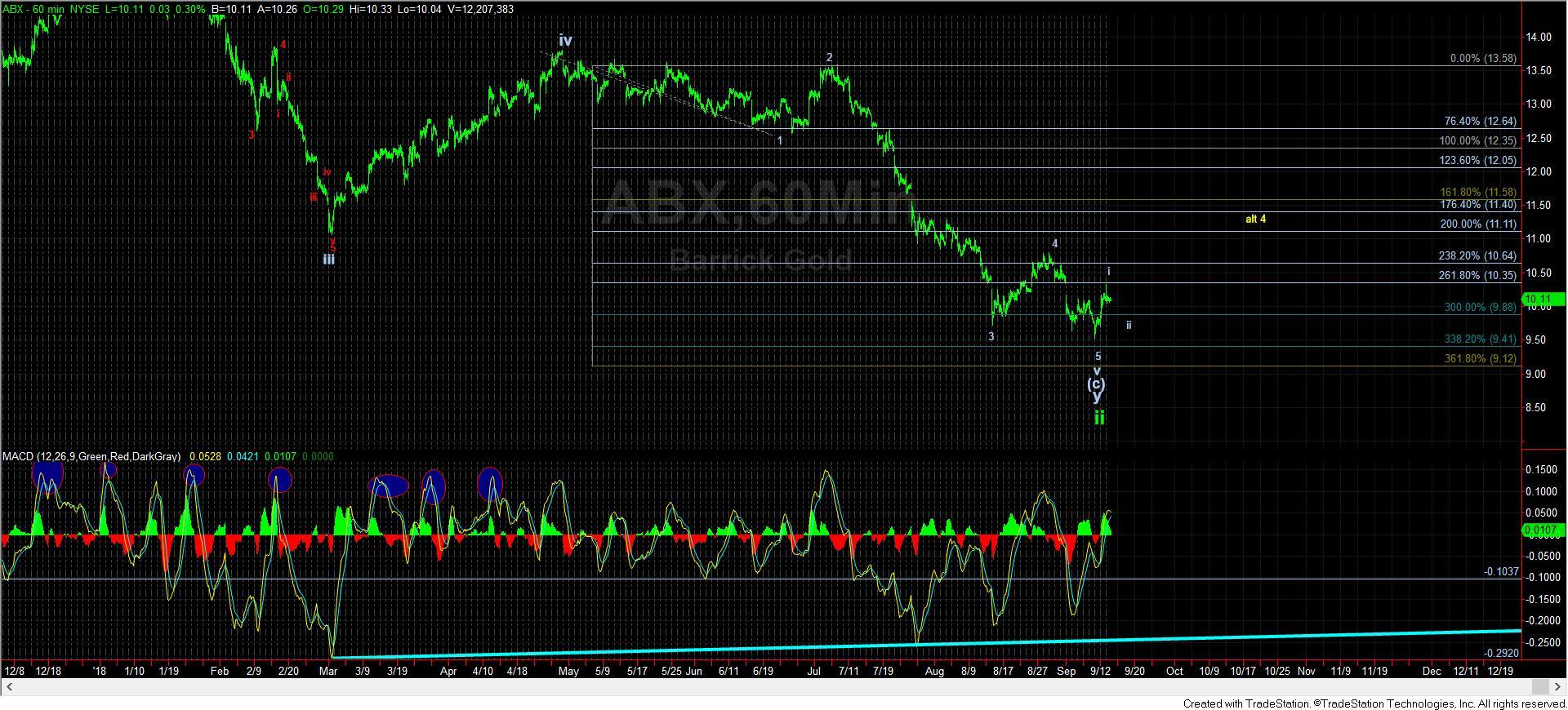

GDX does not have a similar structure, and may very well hold a wave 2 pullback while the metals see their next drop. In fact, ABX completed a very nice 5 wave structure off the lows, and is also likely in a wave ii pullback.