Quick Update - Market Analysis for Aug 24th, 2018

First, early this morning, I posted this in the room:

I have seriously been debating with myself for the last 24 hours as to whether or not I am even going to present this potential to our members for fear of the "hope" it may cause. However, from an analytical standpoint, I think I at least owe it to you, but with a VERY stern warning.

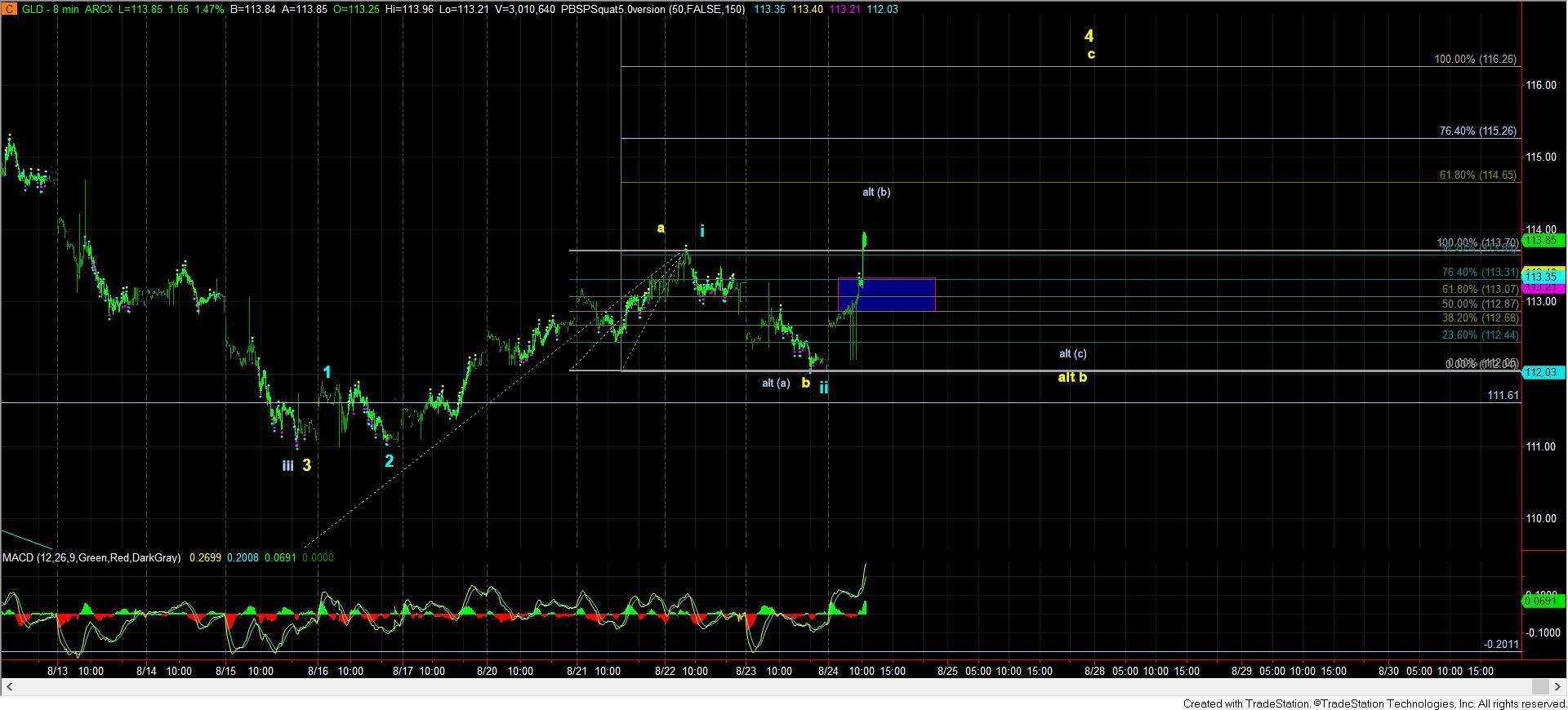

When we look at the gold chart, it hit a lower low than we saw in the GLD. The rally off that low presented us with a nice 5 wave structure off that low. It then pulled back in a corrective fashion into the low struck on the 16th, and then rallied in another 5 wave structure.

While I will NOT call this a high probability bottom being in place YET, if the market now breaks out over the high struck this week, it WILL be something I have to consider a bit more seriously. Again, please recognize the parameter for me to begin this consideration . . . we need to break out over the high we struck this week in impulsive fashion.

With the market breaking out over this week's high, I can now at least keep this on my radar. While there are a number of miners, like the NEM, which do not have a clear completed bottoming pattern in place, I still am viewing the yellow count on the GLD as my primary. That can allow us to rally back up to the 116 region to complete wave 4, which can set us up for that final lower low.

Should the blue count play out, the 116 region would provide no resistance whatsoever, and we should blow through it on our way up towards at least 119/120. Again, this is not my primary expectation right now. For now, I still see the potential for that lower low in GLD as quite strong, and the market will have to prove to me that the bottom is in.

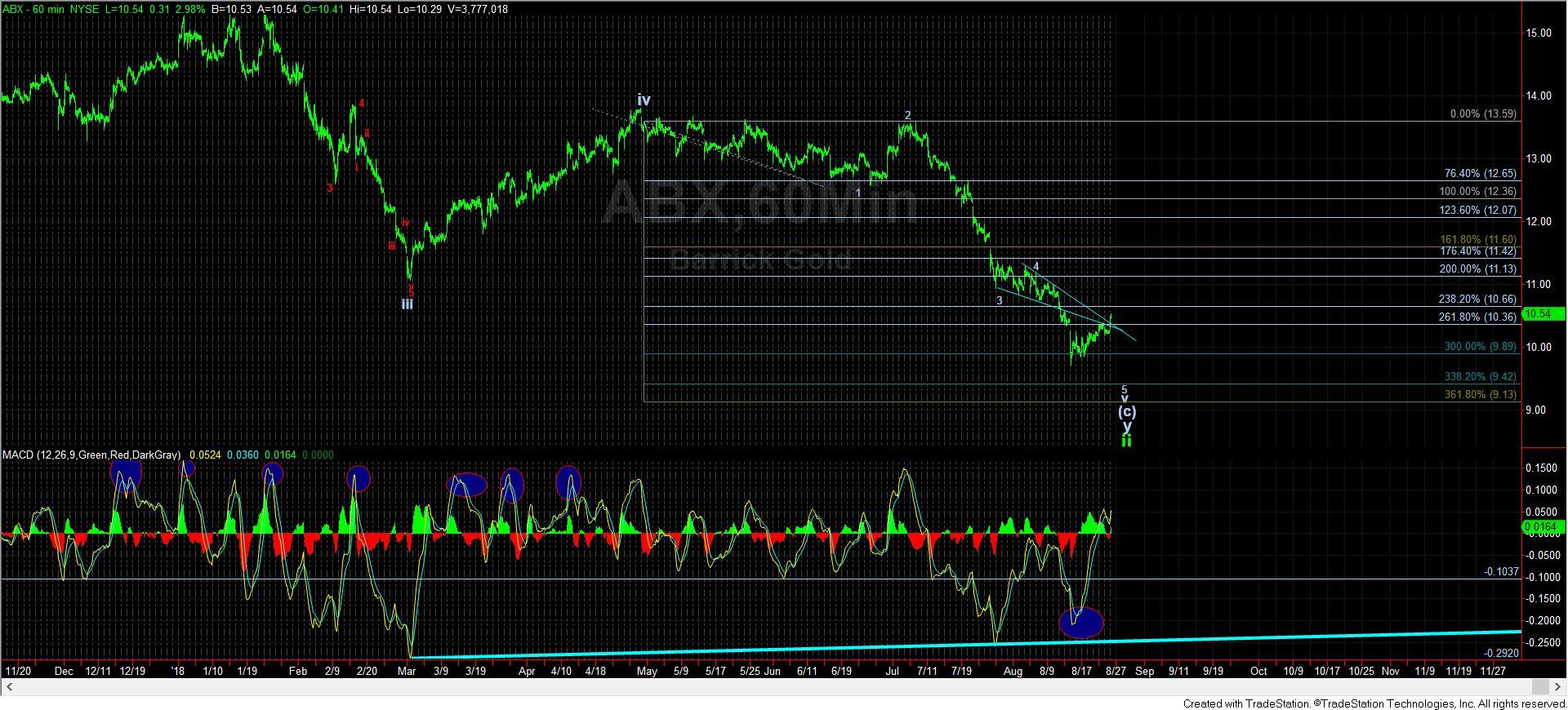

Yet, for other miners, like the ABX, I have no such strong expectations. So, at the end of the day, as I have discussed many times before, there are quite a few miners with the potential for having already bottomed, whereas a number do not have a clear completed pattern having formed for a bottom.