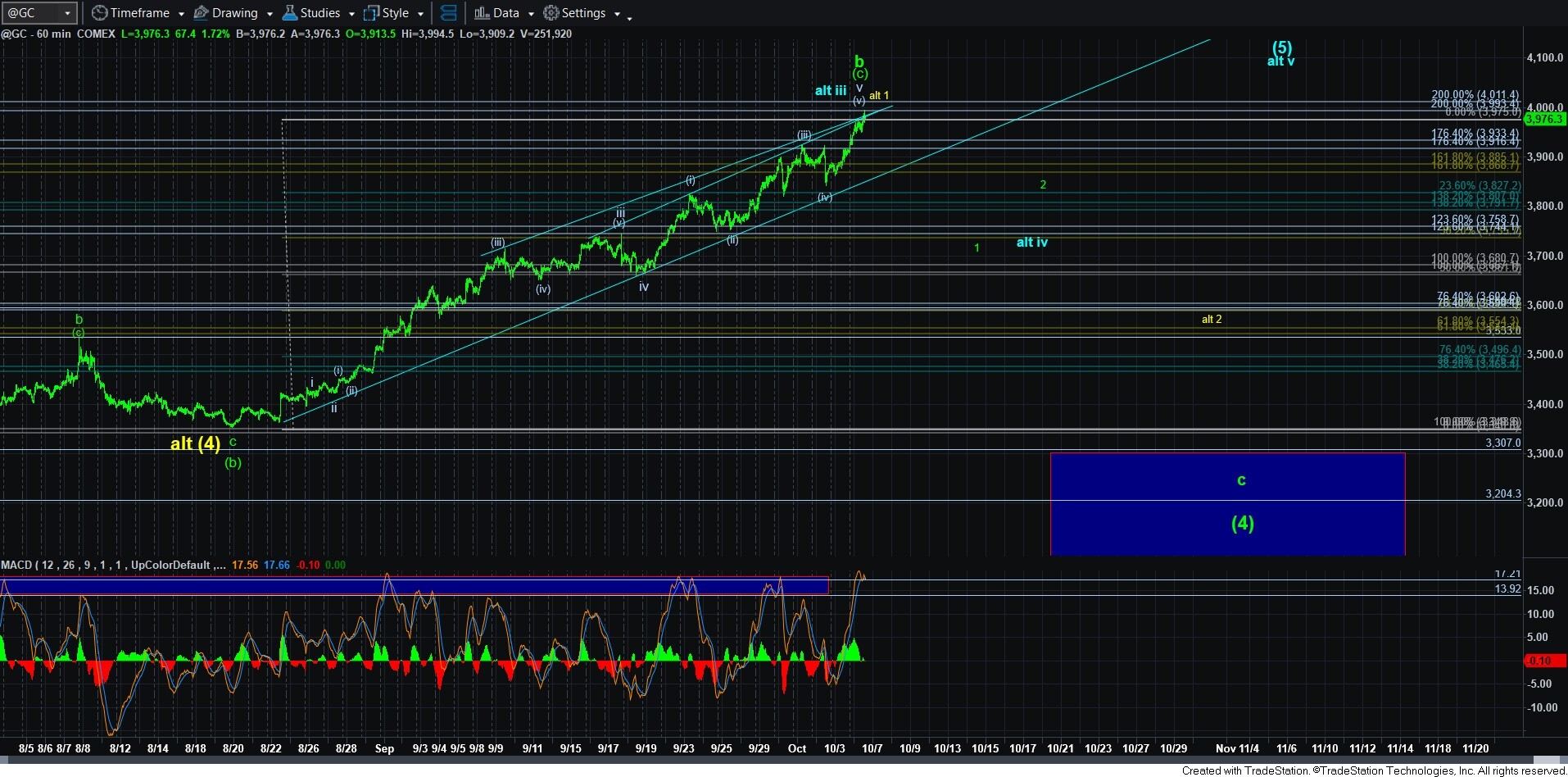

Quick Metals Update - Market Analysis for Oct 6th, 2025

Since I will not be here for the next two days, I wanted to post a quick update on metals.

First, with silver hitting a higher high, I have adjusted the count as per the outline in the weekend analysis:

"With the market pushing higher in silver, I have added the alternative that 4 is done. Again, I do not see this as a high probability. But, we have to at least know where we have to shift into this path.

If the market only provides us a corrective pullback in the coming days, and then breaks back out over the high we strike in this move then that likely puts us in wave (3) of 5 of (3). Until that happens, I will expect more of a 4."

With gold pushing even further, I have moved up the relevant support for the alt iv to the 3740 region. A break down below that will suggest the market likely has much further to run. However, if that is held, and we then rally further in blue v, then this market can complete its cycle sooner rather than later.

GDX continues to push as well, and until we see a sizeable pullback we can assess the next larger degree path. However, the issue remains that I have no 4th wave to which I can point, which means it is still reasonable to expect a larger degree 4th wave, followed by a 5th wave rally.

I personally continue to trim mining stocks as we grind higher.