Quick Metals Update - Market Analysis for May 31st, 2024

Silver is pushing the envelope on both sides of this trade right now. What else is new. So, after doing some further analysis, I am going to lay out the following parameters:

1 - As long as we remain below 32, pressure remains down to below to at last 30.25, but more likely the 28.65 region, of course, depending upon extensions.

2 - Should we rally over 32, then the upper end of resistance is the 33.25 region, which will represent either the completion of wave (1) of iii, or even a more expanded b-wave.

3 - If the market begins breaking out over 33.25, it opens the door to the potential that (1)(2) has already completed with a truncated 5th wave to wave (1).

Again, PLEASE keep in mind the bigger picture is pointing up dramatically as we look out towards the summer and fall of 2024, as the next wave degree is pointing us to 40+ from here and it can move quite rapidly in the heart of a 3rd wave. So, please do not get overly bearish especially if we drop in the coming week or two.

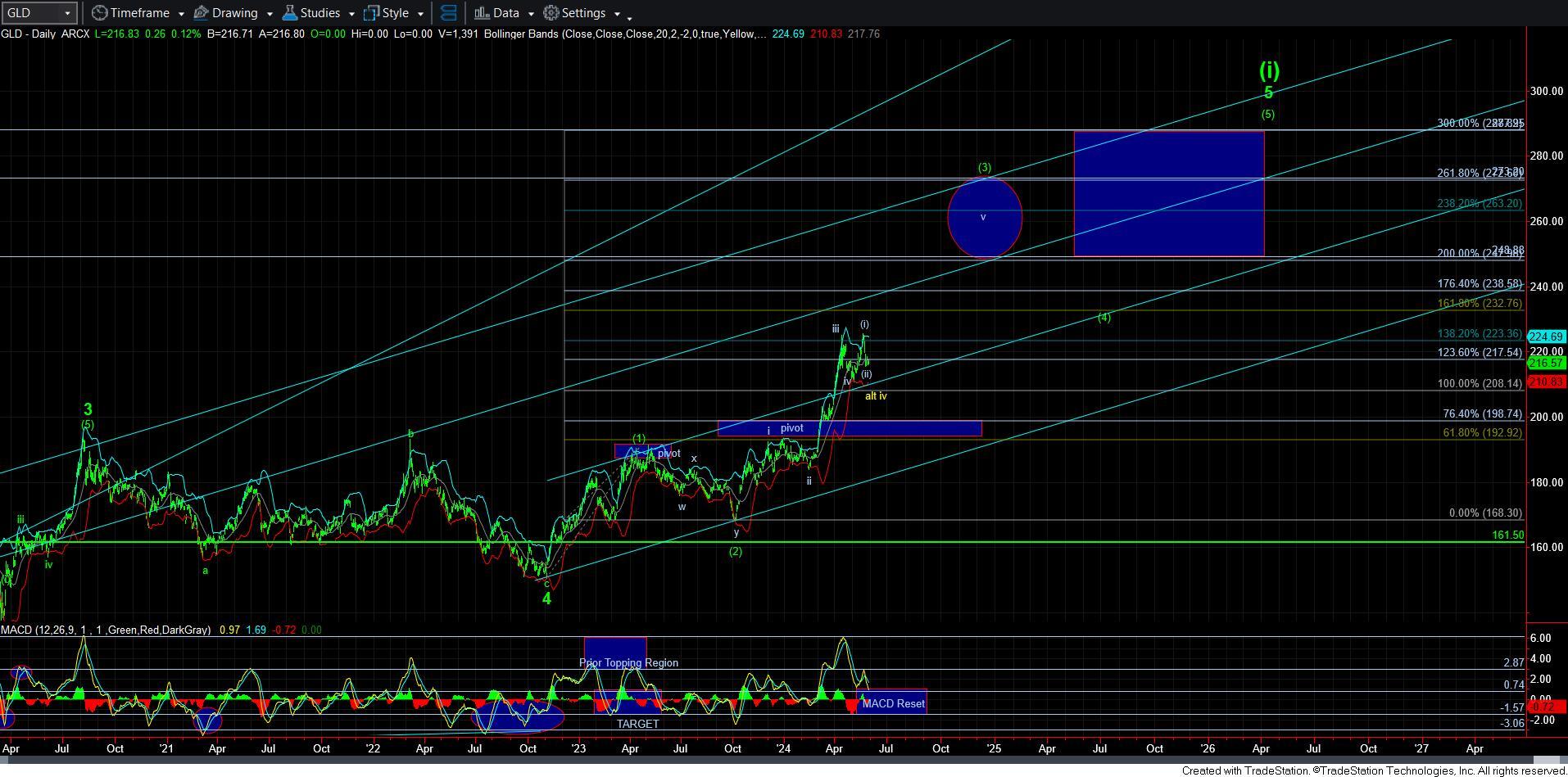

And, a few words about GLD, we are still potentially pointing down to the 208-212 region for a more expanded wave iv, unless we begin to see an impulsive move through the resistance noted on the GC 8-minute chart.

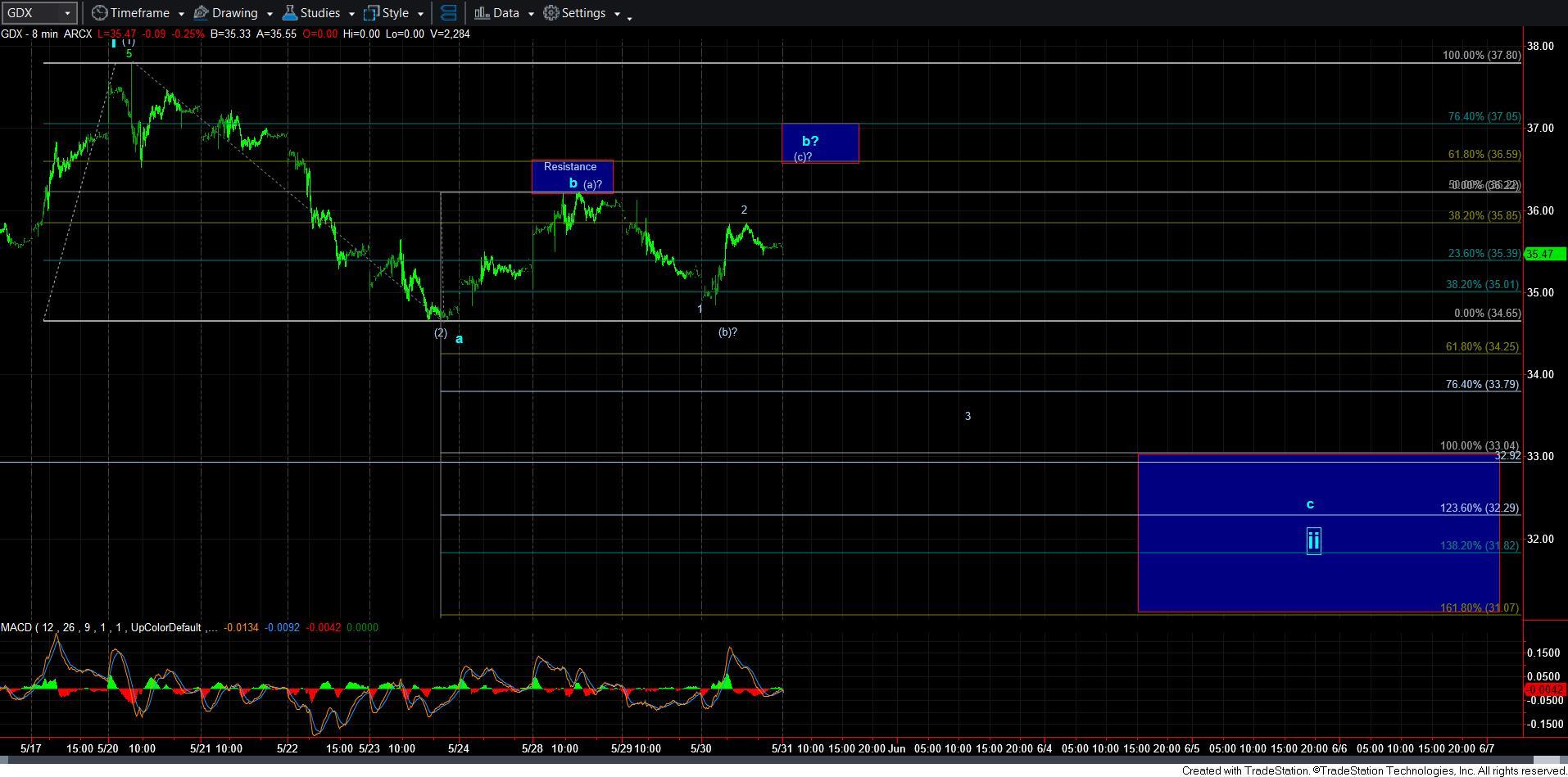

AS far as GDX is concerned, we have a corrective rally off the recent low, and it is pointing down towards the blue box, unless we can see a more impulsive structure begin that takes us through the 37 region. But, I would say that this chart probably suggests downside more than either of the other two.