Quick Metals Update - Market Analysis for Jun 14th, 2018

The reason I was unable to write something yesterday evening as a metals update was because there was not much for me to update based upon my prior analysis. There are only so many ways I can say the same thing over and over.

And, to be honest, not a lot has changed today, other than in silver. As you can see, we may be completing a very “ugly” leading diagonal up off the recent lows in silver, right into the market pivot I have outlined on our 144-minute chart for quite some time. Yet, many of you know that I do not trust leading diagonals, so I am still not confident in the bullish set up. What I will need to see is a corrective pullback in wave ii, with a break out through 18.12 to be much more convinced that the bull market rally has returned, with an immediate target in the 19-20 region for wave iii off the recent lows.

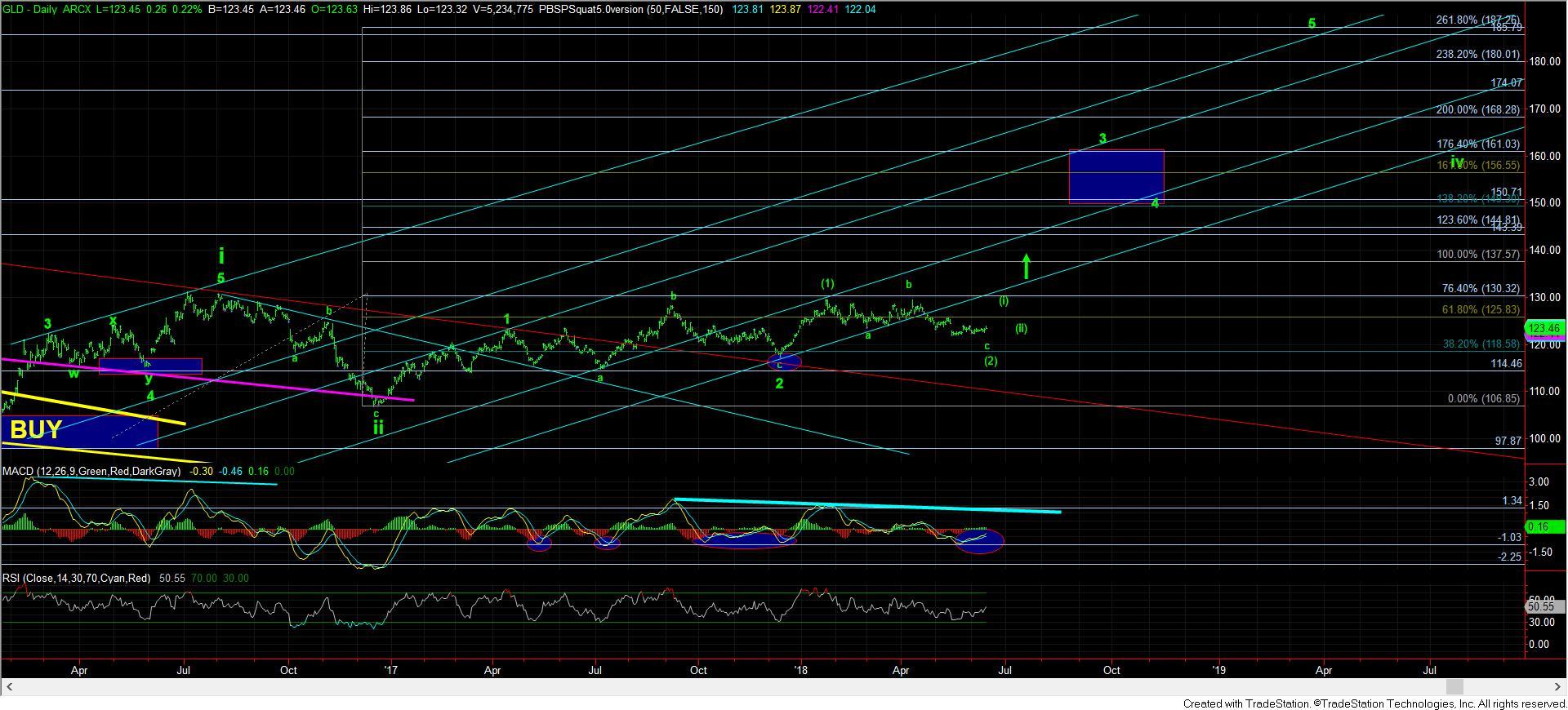

While GDX and ABX are still stuck in their corrective structures, I still think the GLD holds the best clues to this market. But, until we fill in the (i)(ii) noted on the daily chart, I am cannot view the overall complex as being immediately ready for a major break out. Yet, once that fills in, we will be on a “break-out-watch,” as trigger of that set up will finally provide us the break out for which we have been eagerly waiting as this market has consolidated sideways for the last year and a half.

Again, there is not a lot more insight I can offer when the metals do not provide us with any further structure with which to analyze. But, what I intend to do this weekend is to provide a bigger picture of my expectations, which seems to suggest that 2020 is lining up as the biggest rally we have seen in many years in the metals complex.