Proceed With Caution in Likely Consolidation Week

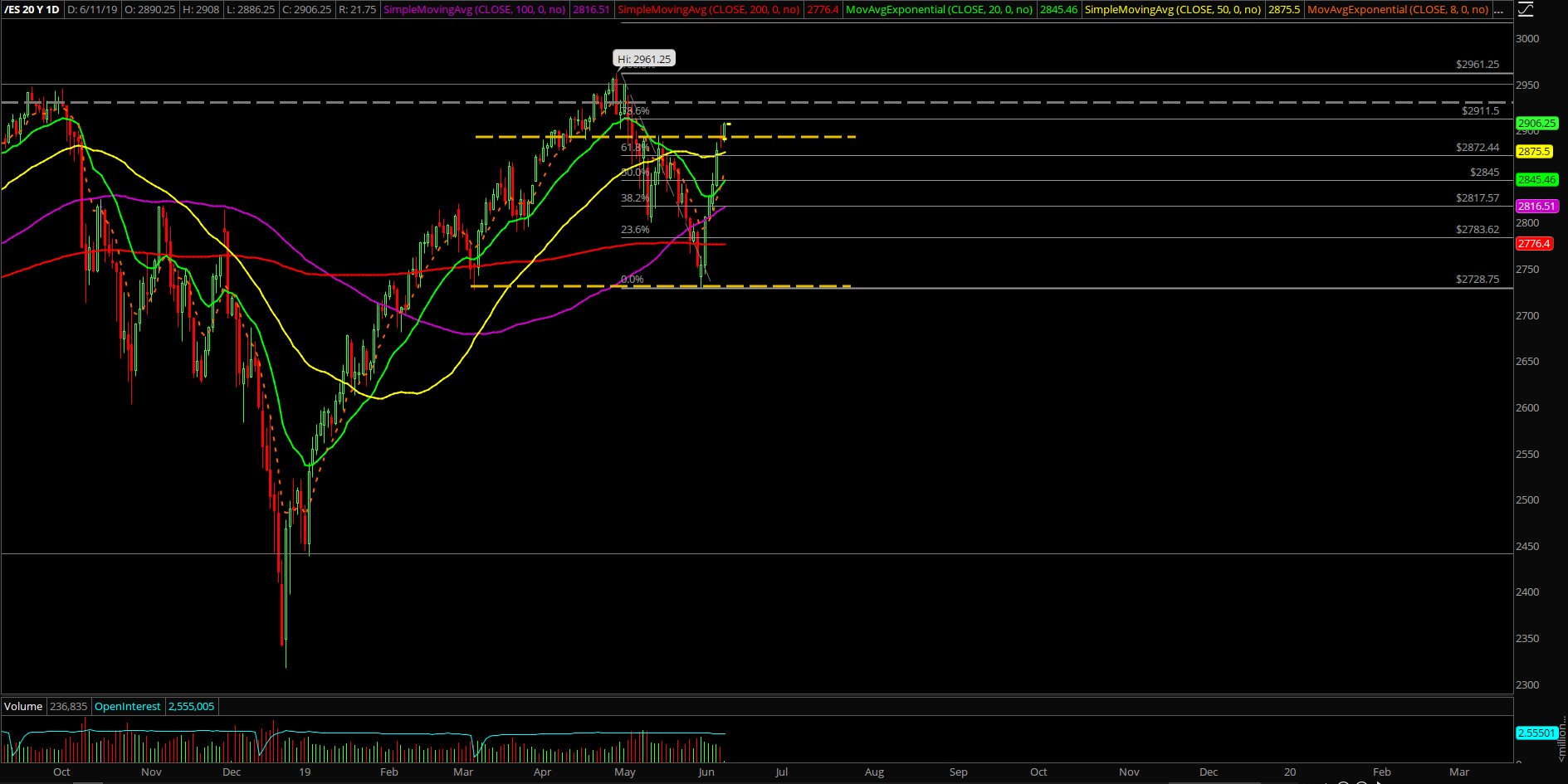

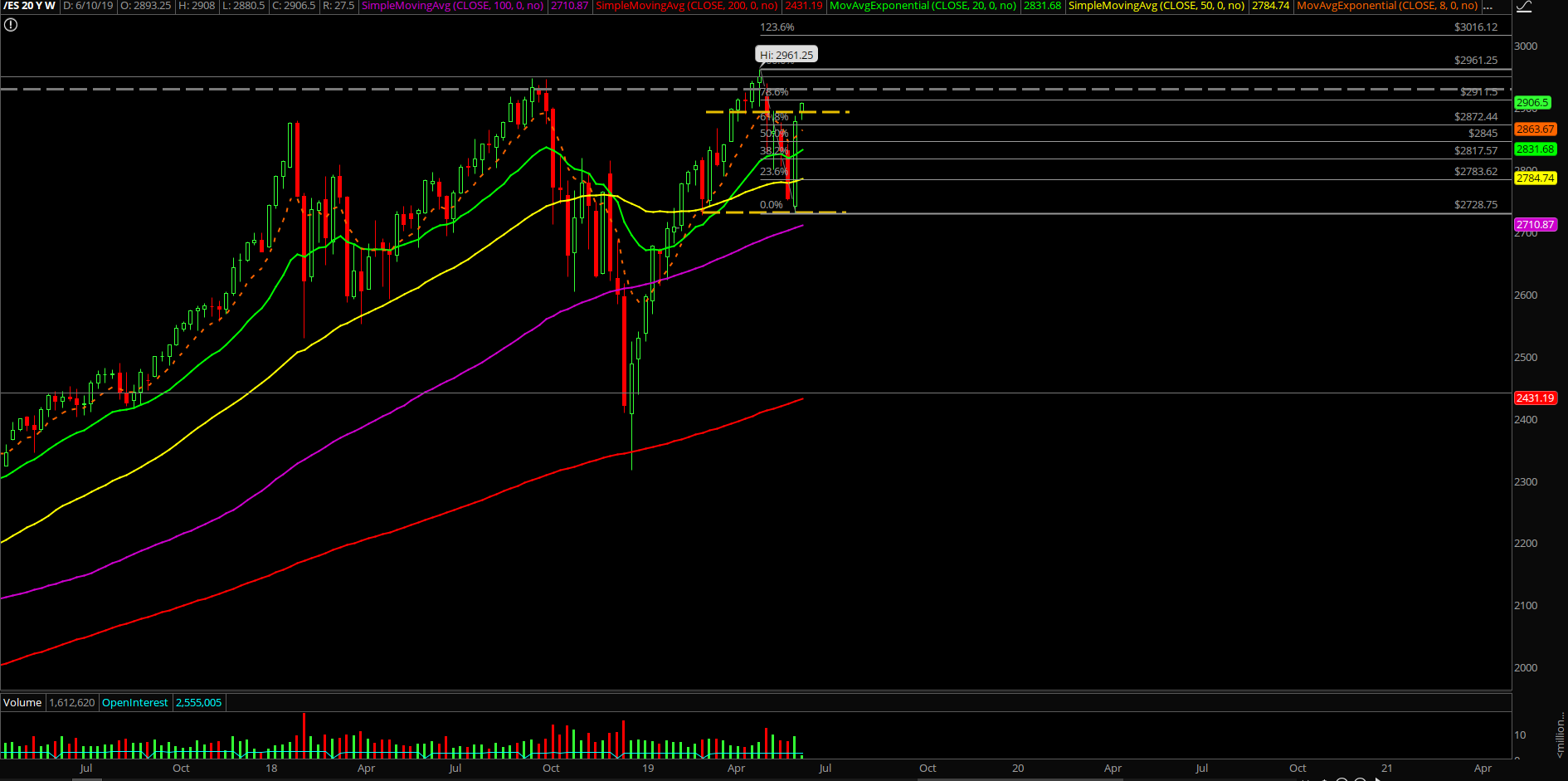

Monday was a slow session, a doji/consolidation day to start off the week. If you recall, we came into the week with the expectations of an overall consolidation range of 2915-2815 on the Emini S&P 500 (ES) based on the bigger picture consolidation thesis on the weekly "hold half and go" structure.

The main takeaway from Monday is that it was a good start, but obviously price action needs to do more to follow the expectations. Put up or shut up time due to the established levels alongside with 78.6% being in jeopardy if no reaction soon.

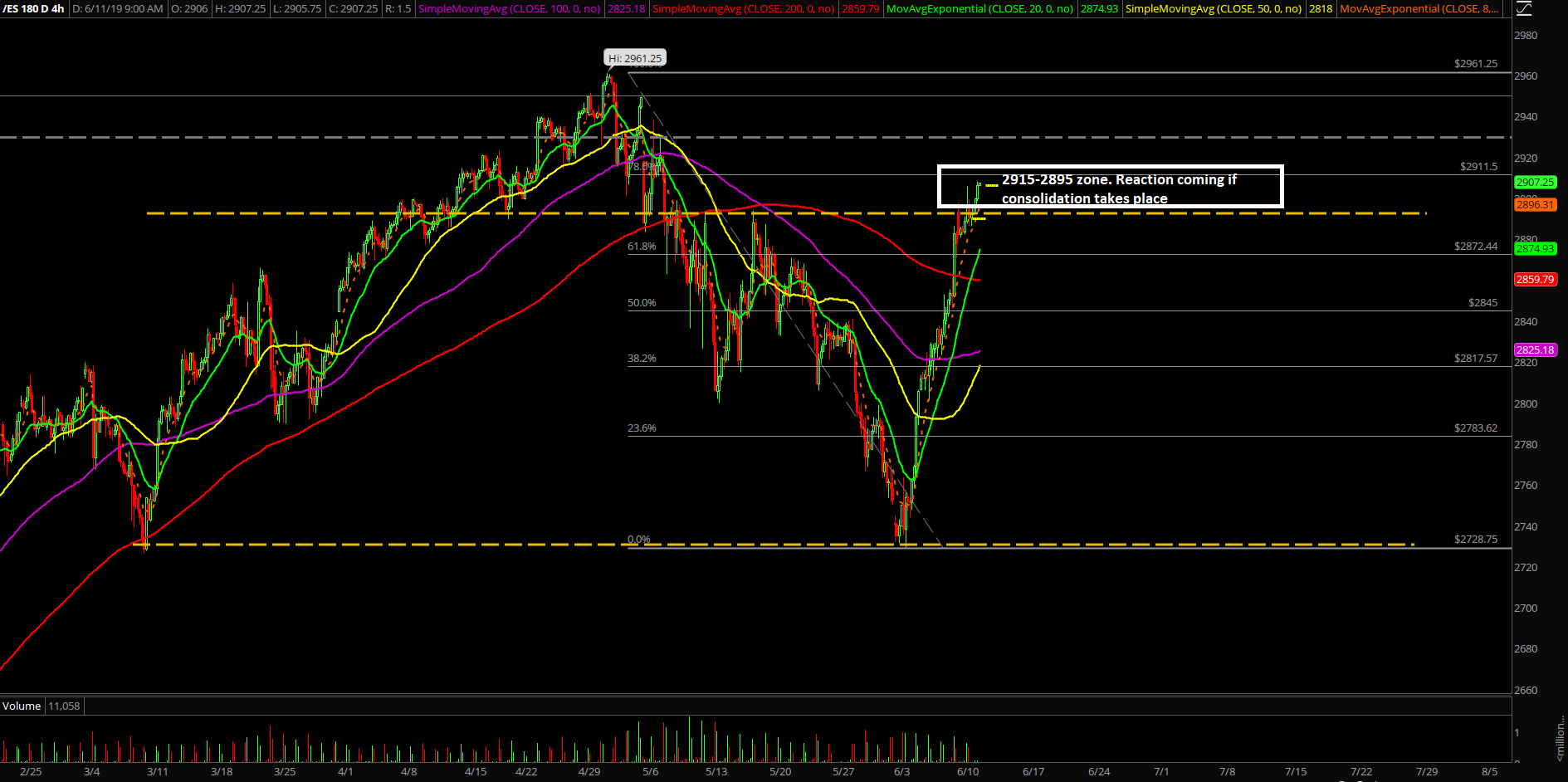

Price action has held overnight at trending support and is now backtesting against yesterday’s intraday high within the 2895-2915 overall resistance zone. If the major resistance does not get defended again, then this continuous grind is forcing its way for the full retracement of May, where it made the temporary top at 2961.25.

What’s next?

The ES closed at 2890 as a doji signifying some sort of consolidation could begin. However, overnight structure/price action remains strong and ground back up. Needless to say, it’s likely an inflection point day given the market is within the vicinity of the resistance of the 2895-2915 zone. Our perspective/analysis remains the same from the prior KISS report. Again, price is just a few points away from the 78.6% retracement of the entire drop, so the confluence of levels in this area is very important.

We’re still expecting an overall consolidation week 2915-2815. However, the levels must be defended today and force a close below support in order to fight back this continuous. Again, price is just a few points away from the 78.6% retracement of the entire drop so the confluence of levels in this area is very important. Otherwise, it becomes a continuous grind and levels get taken out one by one as the market decides to retrace the whole month of May without dropping a beat.

Current parameters/bias:

- It is still an ongoing feedback loop squeeze setup to pair this with the major level vs. the March monthly low so the odds of this structure is still extending and the pre-determined 2845 ‘wall’ was no match for the onslaught of bulls.

- See how price action reacts first 2900 first try basis or within this 2895-2915 major pivot resistance zone

- If consolidation week takes place, it should not go above the aforementioned resistances

- Futures roll week, contract expires next Friday, stay short-term focused in this type of environment. Need to be more nimble compared to last week

- Treat 2915-2815 as the week’s overall range for now. Need to nail down the micro when it offers more clarity

Clear and concise context for June:

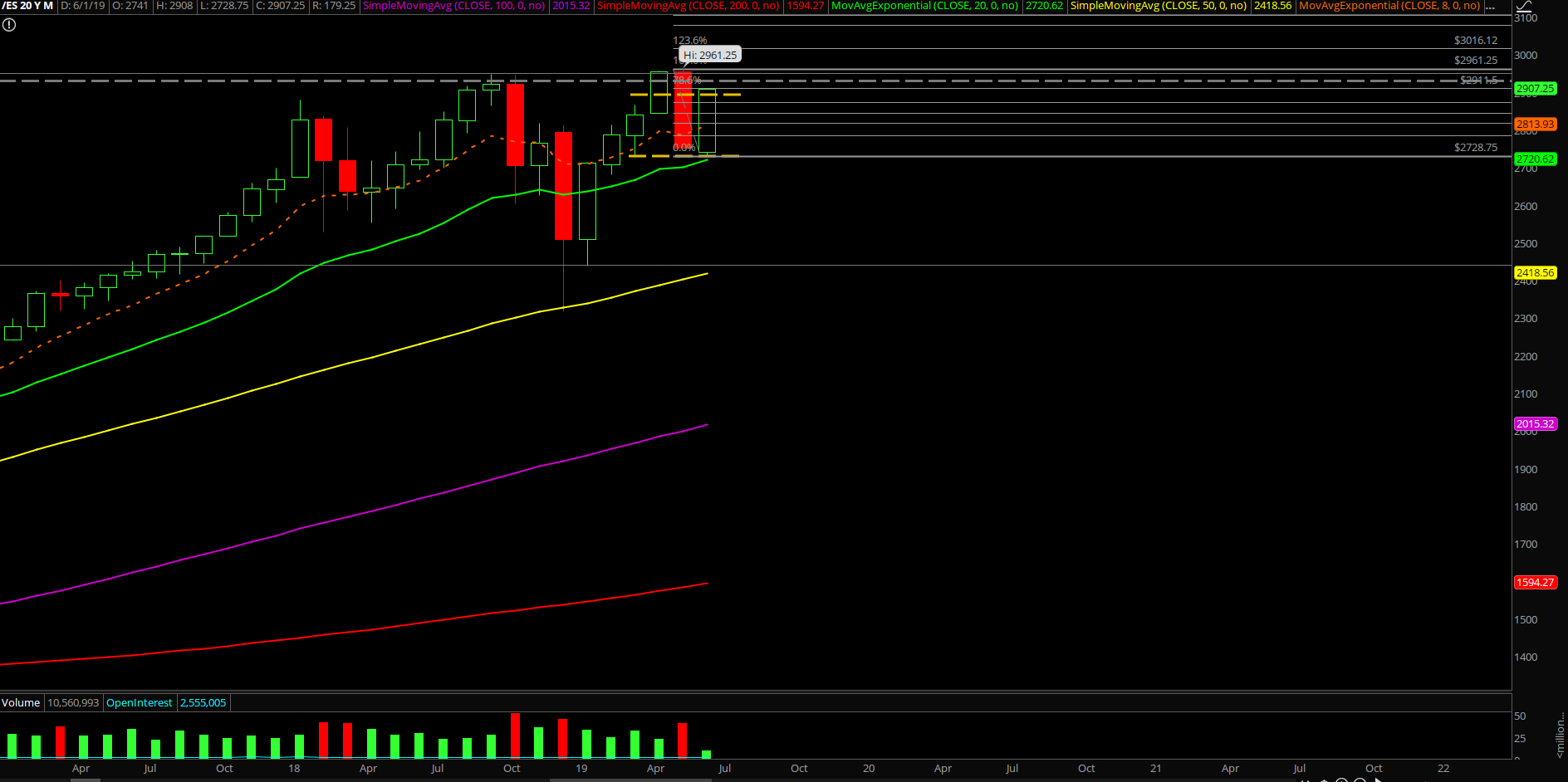

- The market proceeded with the textbook mean reversion playbook that occurred in May and hopefully everybody and their mother were prepared as we discussed with the proprietary signals warning, price action level by level approach and once support broke, the market offered even more clarity.

- Now, the gameplan for month of June is fairly simple. Our current must hold levels is located at 2700 monthly support as the pre-determined floor and treating anything below 2845 as a deadcat bounce due to short-term trend. If price action starts breaking below or above these key levels then we as traders must be going back to the drawing board and reassessing again.

- The overall process remains similar to month of May, traders must remain 4 steps ahead of the market by being nimbler. Continue to utilize quick-hit tactics to generate the quick alpha as we have demonstrated so we protect ourselves once again even if the shit hits the fan.