Price Action in a Stalemate

E-mini S&P 500 Futures: Keep It Simple Stupid – Déjà vu

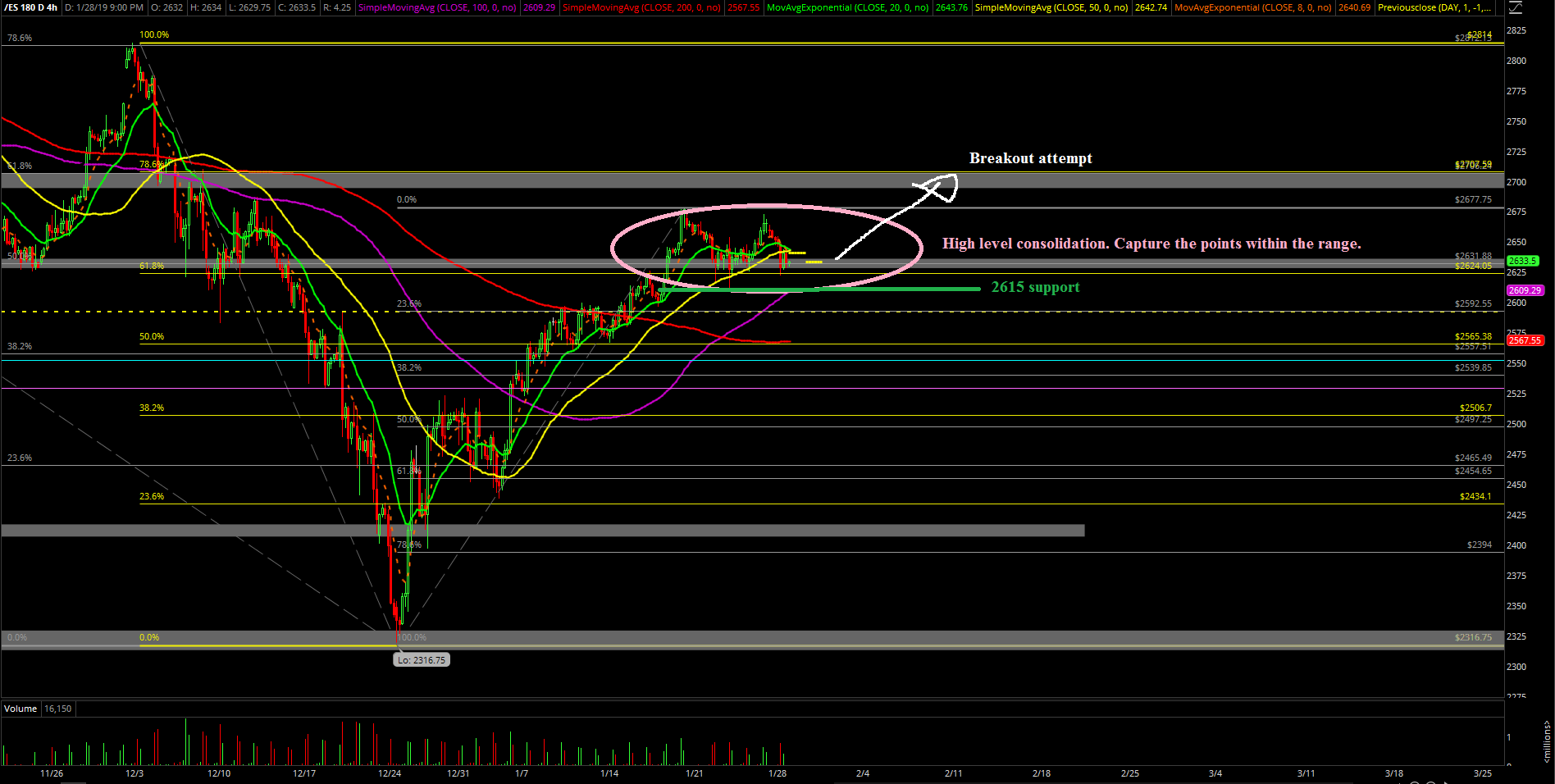

Monday’s session was similar to a textbook range day as the market started with the overnight grind down that created a gap down by the RTH open. The majority of the RTH session was spent in a defined range between support vs resistance. Given it was just like last week, we were able execute the same nimble gameplan as we captured the points in the ES trading room. There are not many new things tonight say if the price action stays within this tight range until the month end closing.

The main takeaway from this session is that the bulls failed their immediate trend continuation setup from Friday’s breakout attempt above 2655. This is because of the gap down open and the failure for both sides to really do anything significant. Currently, price action just in a holding pattern until month end; it’s a stalemate.

What’s next?

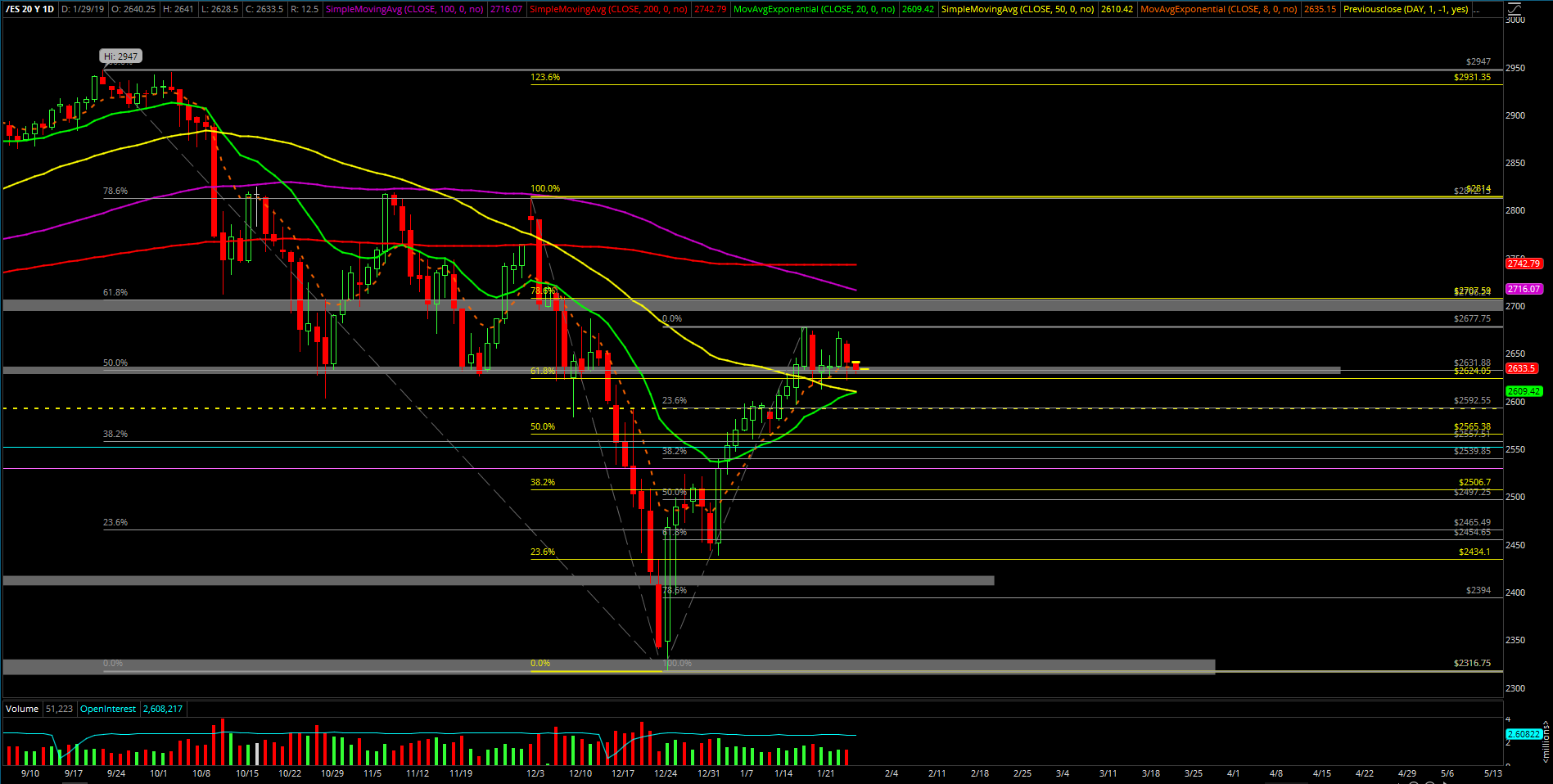

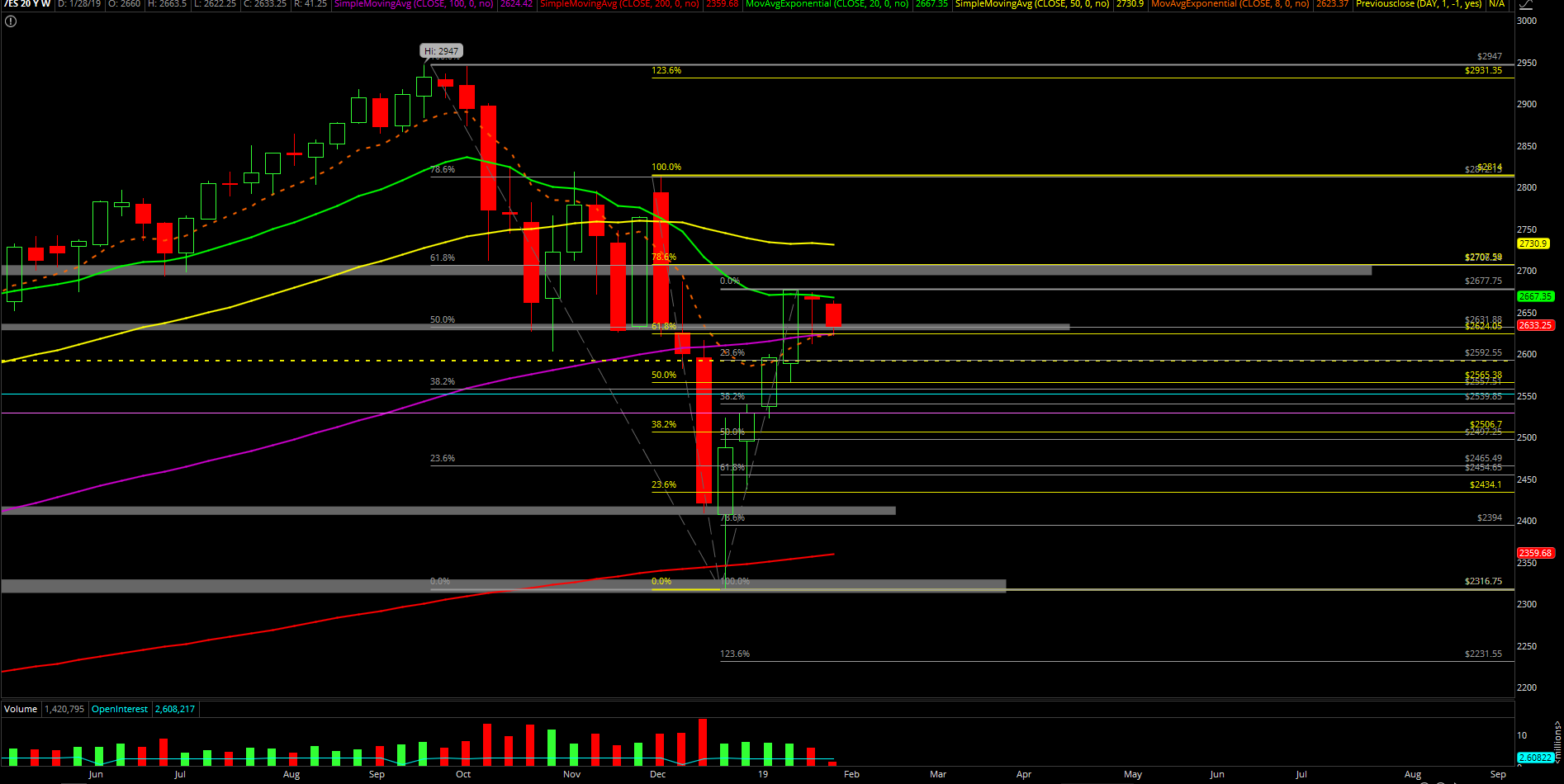

Daily closed at 2640.75 which means that this is the 4th session within the past 5 days that the market has closed within 10 points of last week’s 2632 trending support level. This also means that nothing has occurred and the market is merely in a high level/bull flag rectangle consolidation phase within the overall context of the ongoing bullish grind up from the past 4 weeks. We have to repeat main points with some tweaked number since nothing significant has changed:

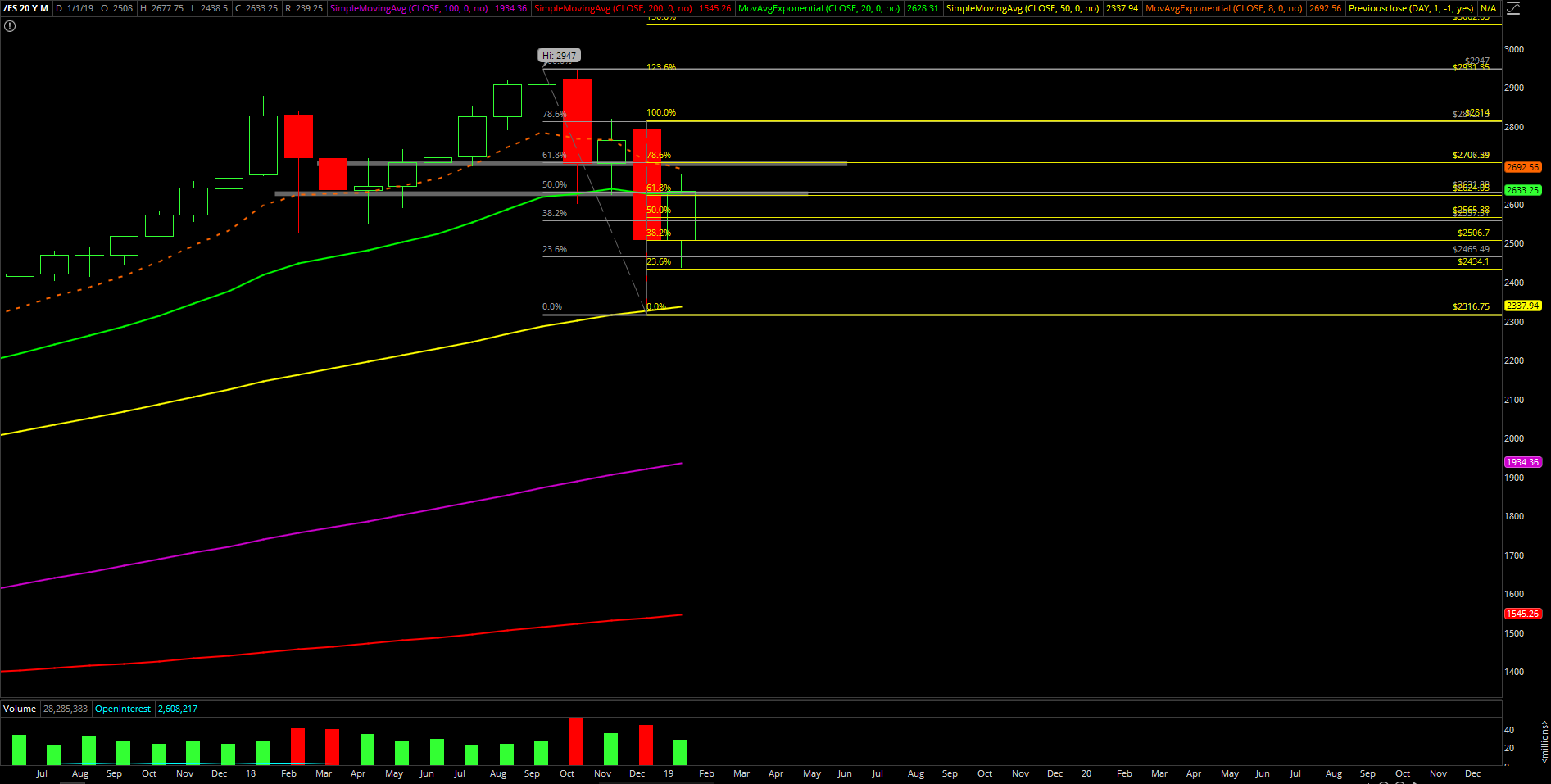

We’re still leaning towards immediate bullish given the current circumstances and how bulls executed properly on Friday with the expected breakout. At the very least, we’re expecting the bulls should attempt a run towards 2700 for the Jan monthly closing print in order to wrap up this upside grind month when above the first trending support. Whether they win or lose, it doesn’t really matter as there should be at least an attempt given 4 week of continuous upside grind already. The trend of grind up followed by shallow pullbacks being consolidated into a bull flag and breaking higher.

Bigger picture wise, the first couple weeks of February will likely be focused on the mean reversion setup back down if everything goes according to plan. Wait and see, too far to tell for now.

Level by level approach:

For bulls, need to re-conquer above 2663 in order to confirm that 2680/2700/higher is not dead yet in terms of the pattern from past few weeks of upside. In that scenario, it’s just an ongoing trend setup doing another sticksave/bull flag/high level consolidation in order to grind higher.

For bears, the key resistance to hold below tomorrow is located at 2663 and key support to decisively break below is 2622 in order to open up the next trending support at 2615 for some follow through. In that scenario, bears still need a daily close below 2615 to be the conservative confirmation that the market has opened back up the 2500-2470 as a legitimate mean reversion target for the bigger picture potential.

Also, we’re maintaining the same short-term gameplan for trading; stay nimble and look for intraday opportunities as range is wide enough to pocket a few points here and there. Similar to what was executed during the past inside week as we continue to try and stay away from FOMO + traps.