Price Action Still Lacking Bear-Train Momentum

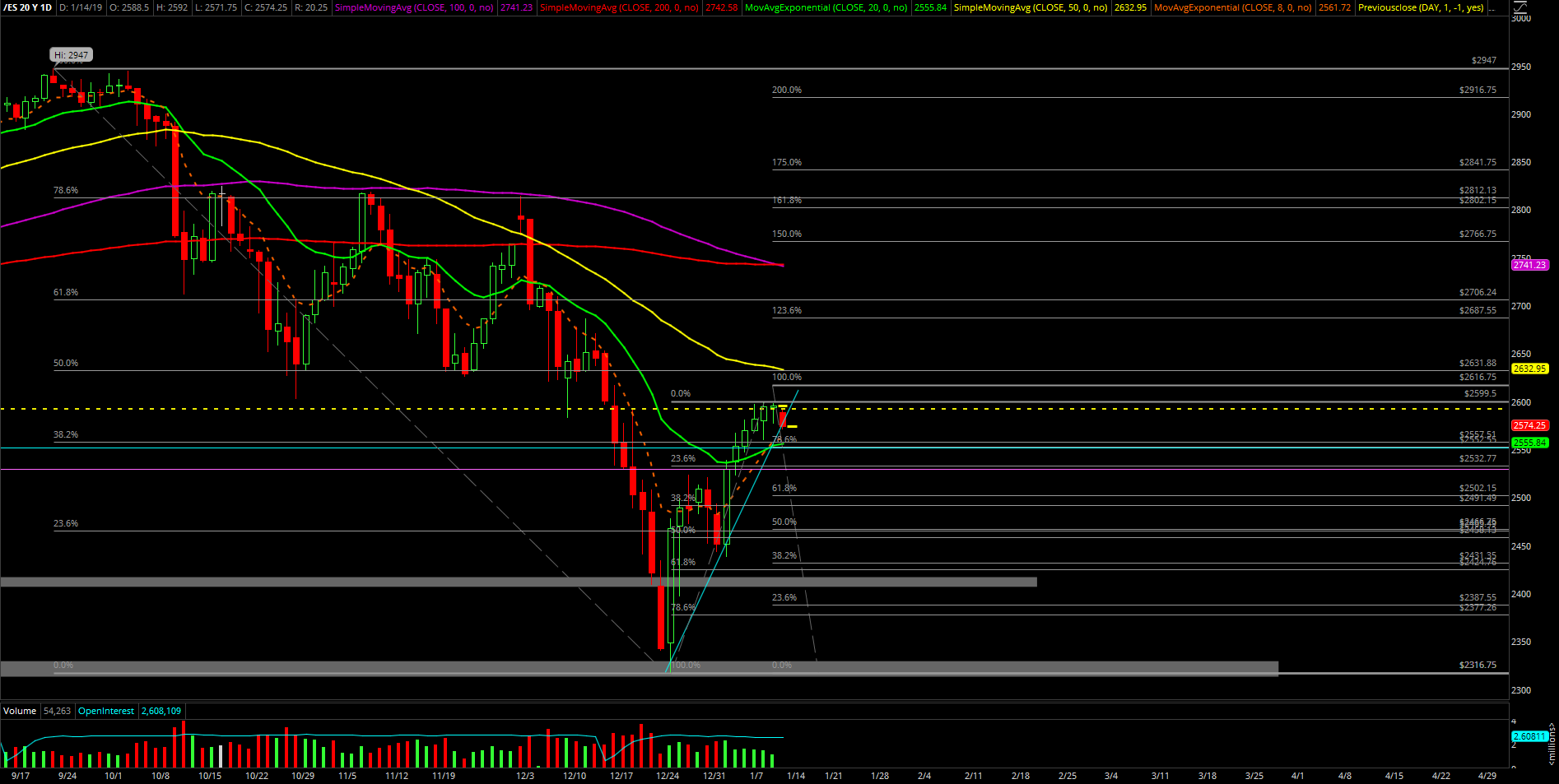

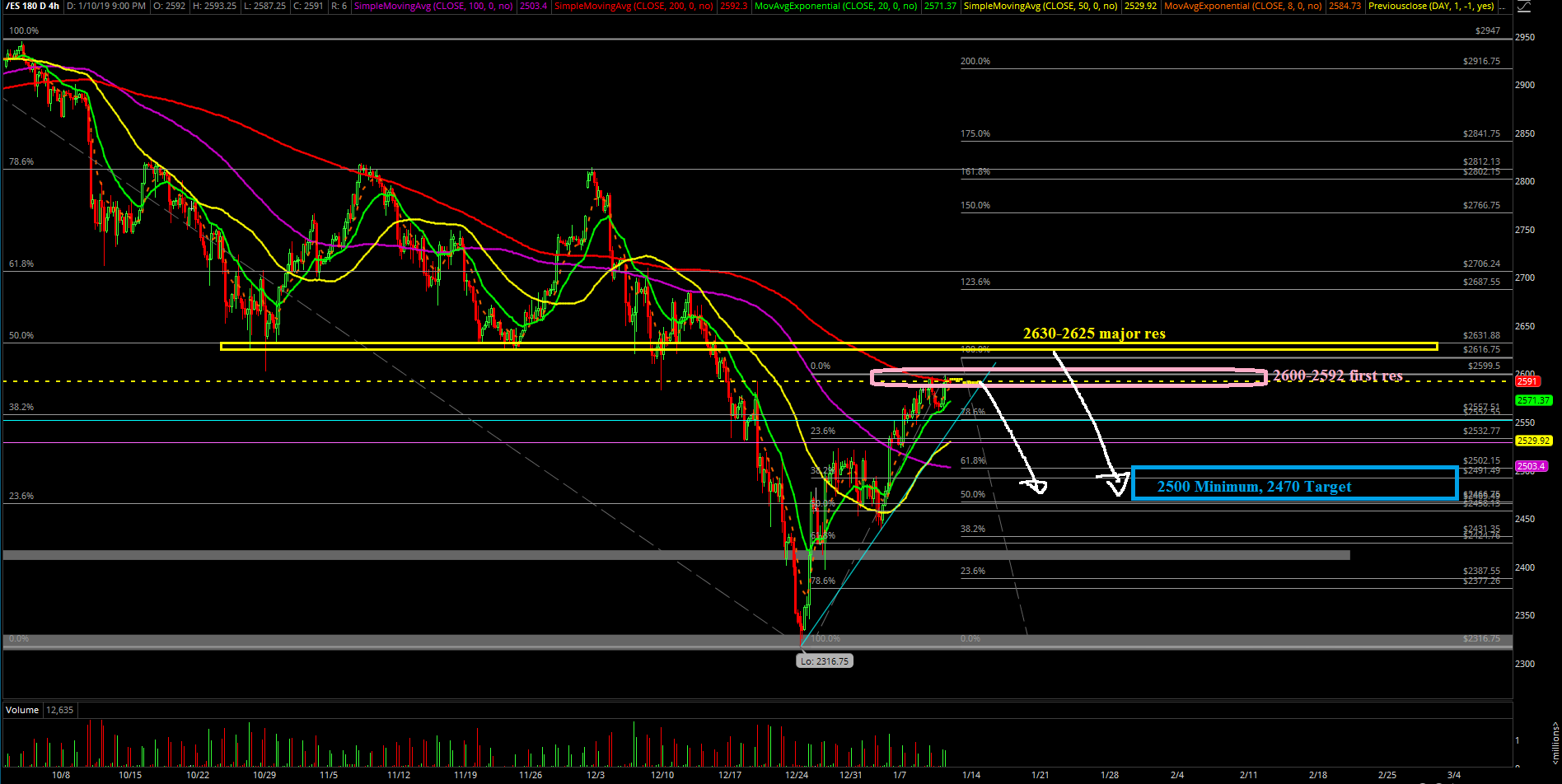

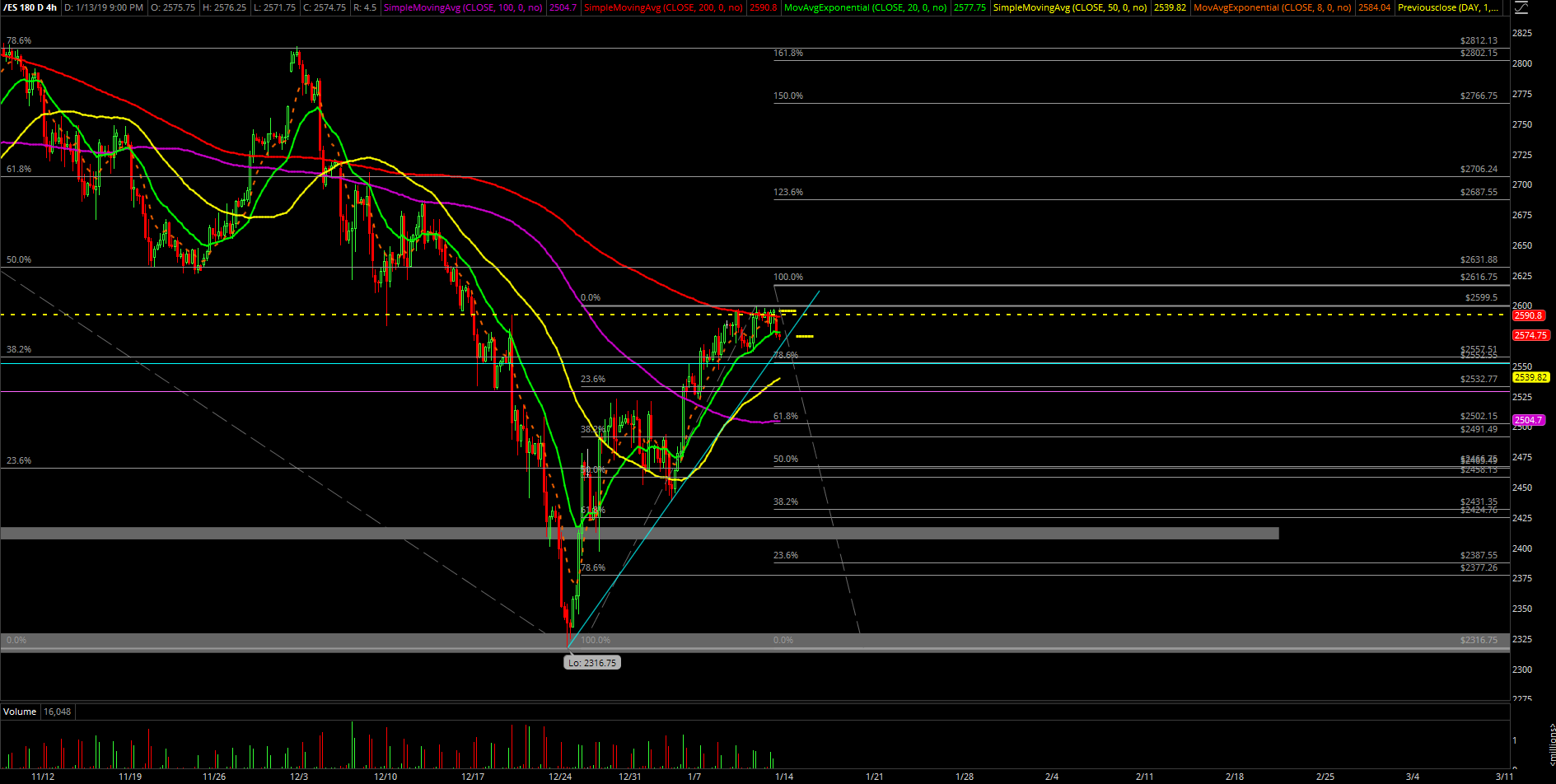

The second week of Jan 2019 played out as a continuation pattern within the context of the prior 2 weeks’ temporary bottom. In simplest terms, the market grinded up a bit more for the week and it was up 2.6% on the weekly closing basis. The price action backtested against the 2592-2600 key resistance area on the S&P 500 multiple times and just flagged and flatlined awaiting for the turning point. If you recall, we’re waiting for the action to confirm the turnaround and flush back towards 2500/2470 targets either at this area of around 2625-2630 as we started acquiring some short positions across the board.

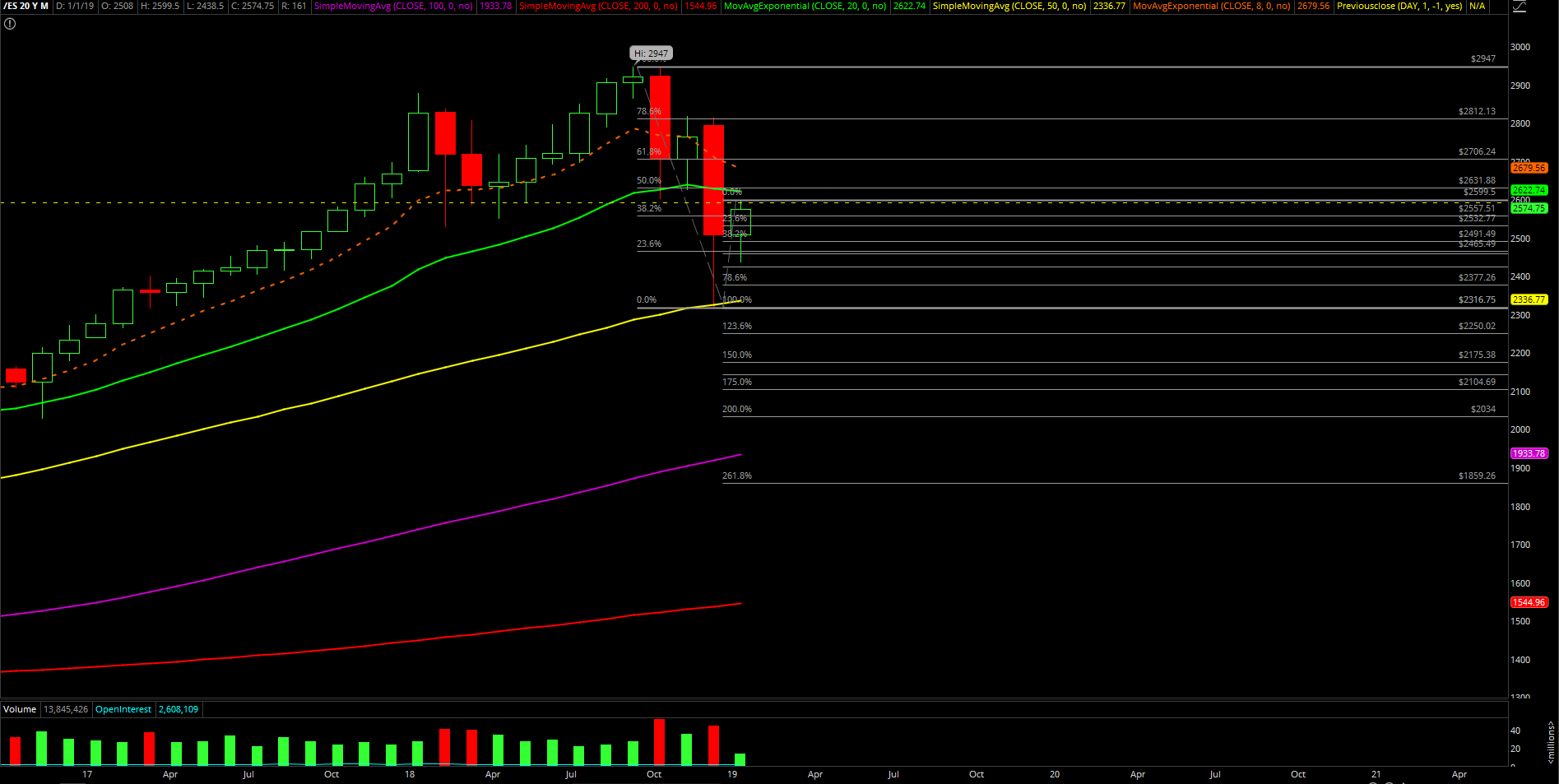

The main takeaway of the week was that the market got rather close (within +1% movement) to the 2631~ major resistance which is the 50% fib retracement of the entire drop from 2947 high to 2316.75 low and everybody and their mother seems to be looking for the next FOMO setup here. Market couldn’t even get through 2600 yet as it tried all week long that acted as a bull flag/temporary wall range. If most market participants waiting for the one more high in order to short this thing into oblivion then perhaps we may not get it like history has shown us. Also, another important stat was that it closed 5 days consecutive back above the trending daily 20EMA so traders ought to be aware that bears have to turn this around fast or else the risk of high level consolidation/bull flag is definitely possible in morphing the overall setup/pattern into higher before the bigger retracement back down.

What’s next?

Friday closed at 2595.5 and it was just a doji that had a tight 20 point intraday range. Nothing has changed in terms of our thesis/gameplan from Friday’s action. However, given the Sunday night gap down and go structure and the market being at an inflection/turning point we are adding a key timing aspect/goal that bears need to establish by tomorrow’s close. In terms of momentum judgement, it’s fairly obvious that if bears don’t break below 2560 decisively by Monday’s RTH close, then we ought to be very cautious of this pattern morphing into a bull flag/high level consolidation extension higher towards 2625-2630 first to hit the perfect 50% fib retracement.

Repeating main context from prior reports below:

Overall, we’re still looking for the turn towards 2500 minimum/2470 ideal target, but the price action is still lacking that bear train momentum confirmation that is needed with a drop below today’s low 2460 and the needed acceleration below the trending support of 2545 to kickstart this southbound train ride. We already started an initial short position given the risk vs reward. Looking to add size or re-attempt around 2625-2630 if stops us out and heads towards higher first to lock in a better average price. There’s really not much else to do here given our current thesis of the bigger picture pattern back towards 2500-2470 until we see a drastic change across the board. (eg. like a surprise continuation to 61.8% at 2706~ for instance before bears regain posture, obviously that’s not the primary thesis at the moment)