Price Action Elevated To Stratosphere

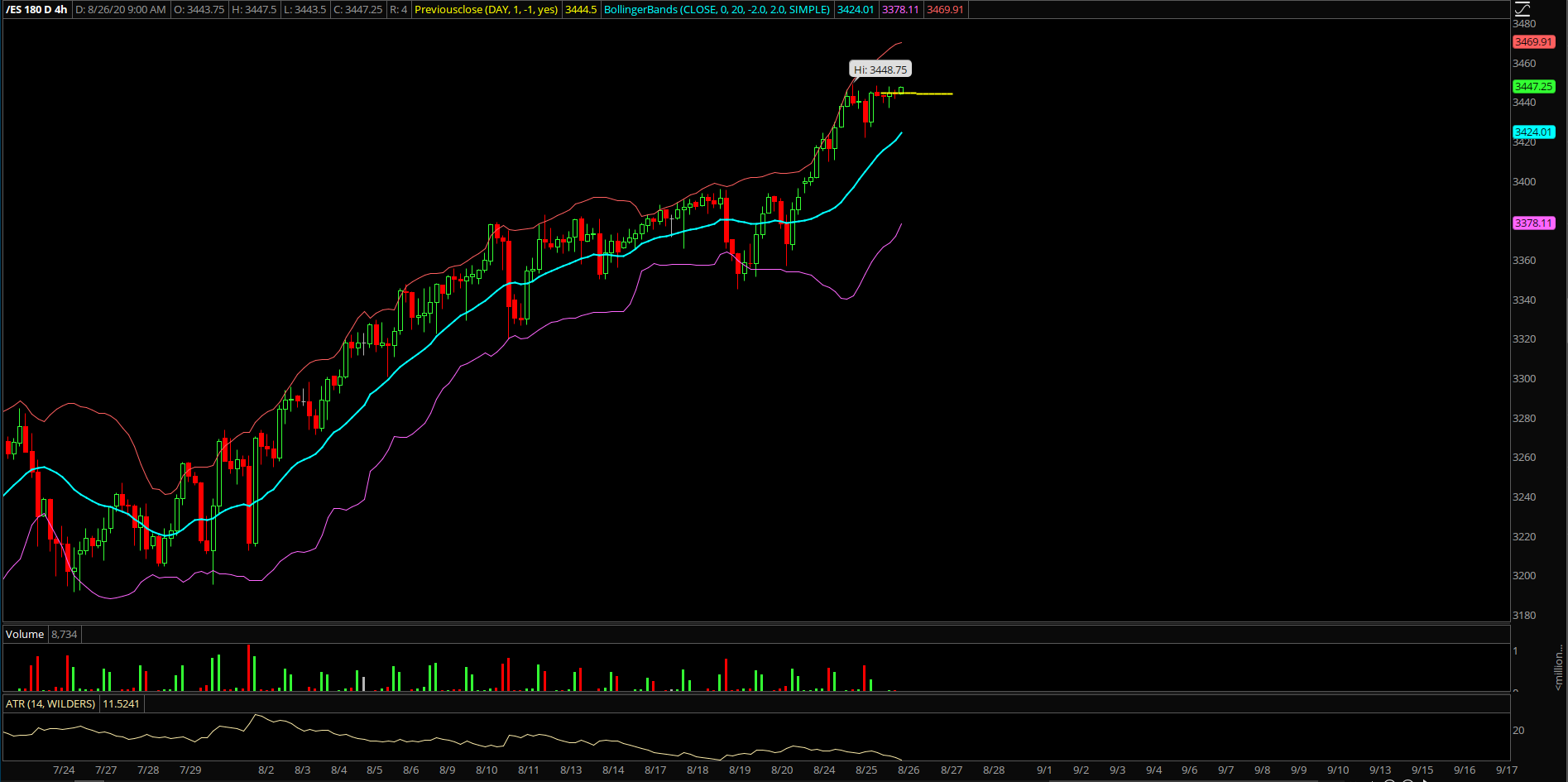

Tuesday’s session played out as a range day consolidation/digestion grinder as price action maintained below the 3450 resistance level on the Emini S&P 500 (ES) since Monday’s overnight. This mini pause allowed for price action to reset and catch up in order to bull flag/consolidate tightly in a range in order to ramp again at a later date. If you recall, yesterday made higher lows and higher highs on the daily chart, so the trending context remains the same as we just push supports a little further up a notch every day or two.

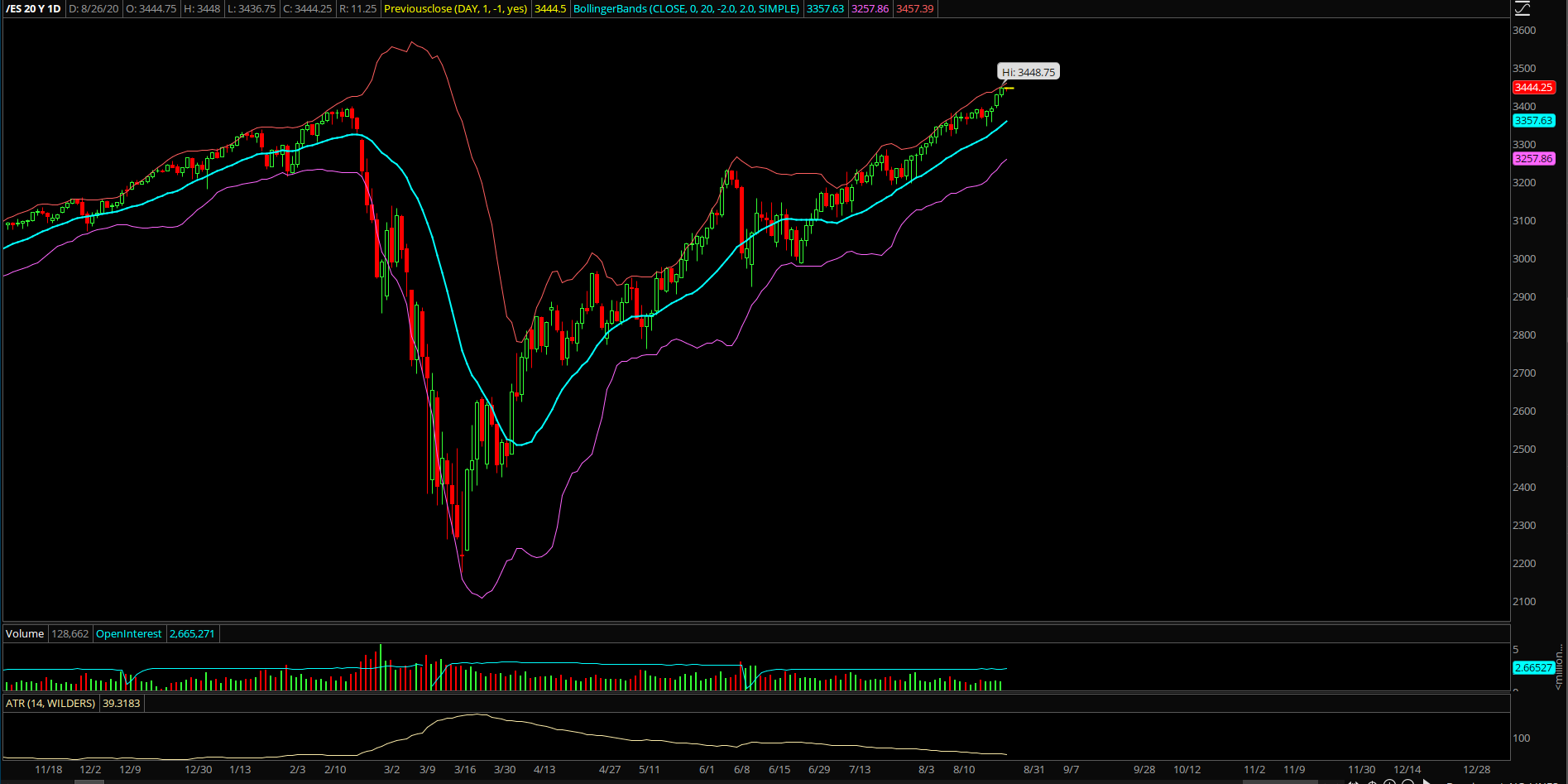

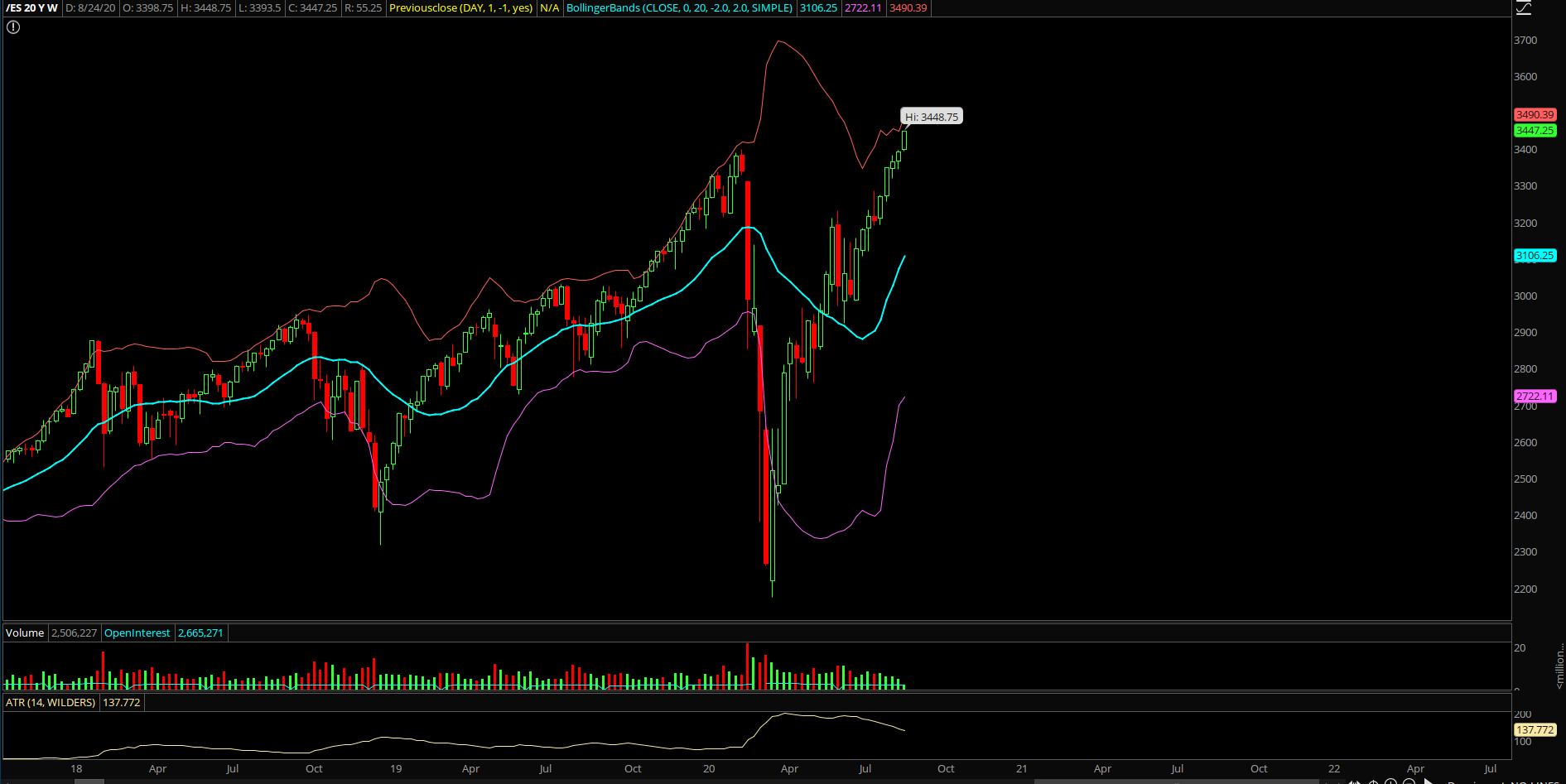

Overall, the main takeaway remains the same as the trend has been one-directional and support levels keep moving higher until something new occurs. Again, price action has established new ATHs and elevated to the stratosphere when judged by the typical BBands on daily, weekly, and monthly charts. We understand the uptrend can last for many weeks and months by embedding and rotating higher, but market participants must be made aware of the risks associated here, so some protection/hedging is appropriate dependent on how the portfolio has been constructed.

For the intraday or short-term opportunities, nothing has changed because all dips have been bought when above support. The tougher thing here is that a big portion of the moves are being played out during overnight so some optimization is needed in strategies.

What’s next?

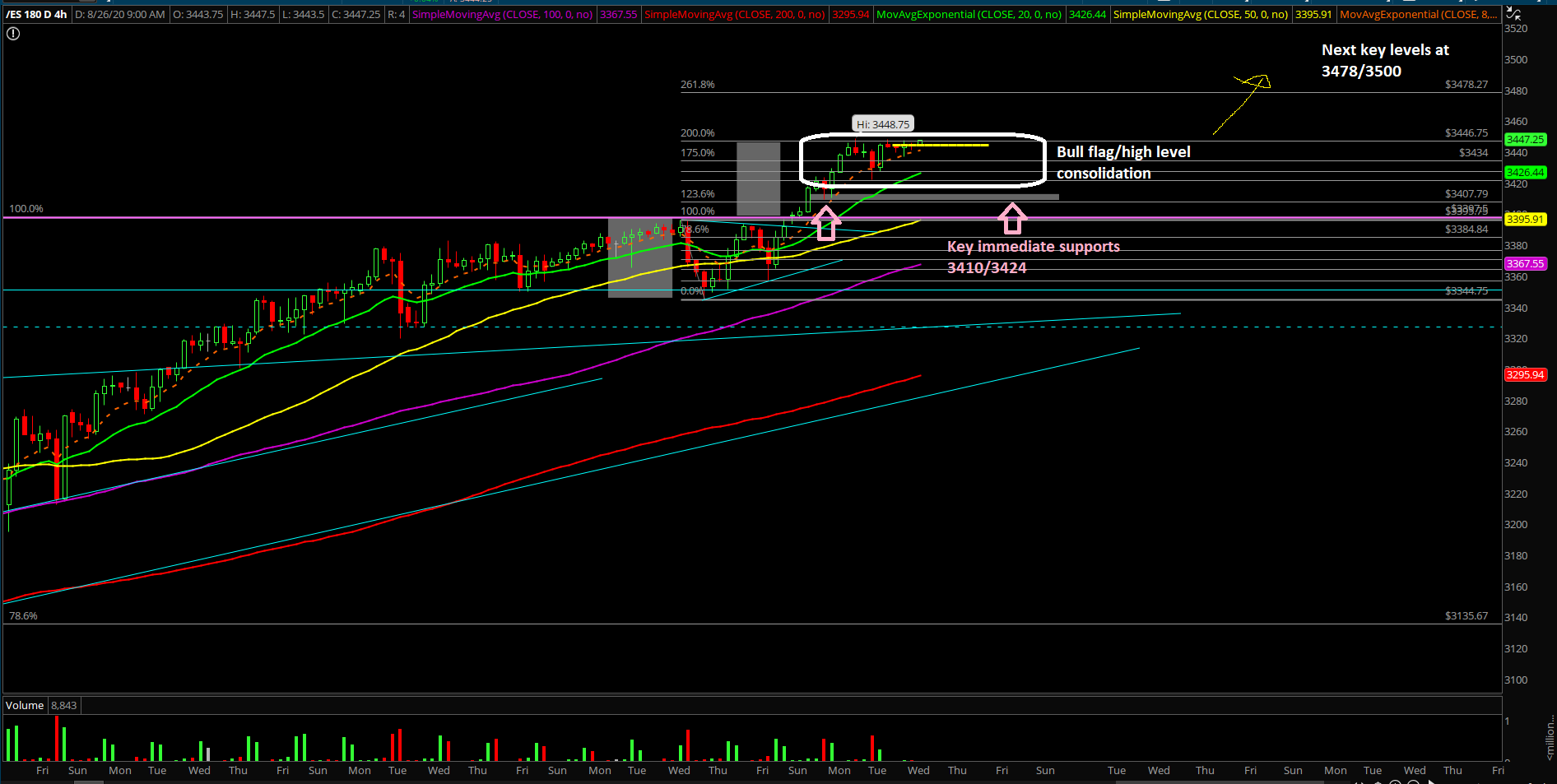

Tuesday closed at 3444.50 on the ES around the highs of the session. With the tight high level consolidation/bull flag from last night, it’s crystal clear on what the market is trying to attempt here by hovering near the 3450 key level in order to expand the range/breakout again.

A summary of our game plan:

- Next key levels or continuation targets are located at 3478/3500 and price action needs to break above 3450 to confirm that it is immediately ready to begin the next ramp up (higher highs). Level by level approach.

- At this point, given how tight overnight high level consolidation, a break below 3424 would be an indication of whipsaw/prolonged consolidation as bulls’ attempt to accelerate again is likely.

- For today, we just have to be aware again that it could be another rangebound day doing the consolidation/digestion when below 3450 key level so be on the lookout.

- Immediate trending supports have moved up significantly to 3424 and 3410 5 which are derived from Monday’s high (acceleration point) and Monday’s RTH low area.

- Bigger support remains constant at the trending daily 20EMA, which is located at 3350s as of writing and it’s been the same established trending context since the April 6, 2020 breakout.