Presidential Impeachments Do Not Cause Market Declines

As the media highlights the potential impeachment process that may begin in the coming weeks, many are so concerned that this will be the “cause” of the market drop we are expecting. Yet, history suggests otherwise.

The narrative will certainly play out as follows: The market likes certainty and stability within our government. (Please ignore that this was the same reason many claimed that the market was going to crash if Trump was elected). However, an impeachment proceeding places us into a very uncertain and unstable situation within our government. Therefore, the market will react negatively to that uncertainty.

It sounds reasonable, right? It makes sense, right? It sounds logical, right?

There is only one problem with such “reason,” “sense,” and “logic:” Why did the market rally 10% during the Clinton impeachment debacle?

Does impeachment not cause uncertainty or instability when it is a Democrat being impeached, whereas it will cause uncertainty or instability when a Republican is impeached? Yes, this is a rhetorical question. So those of you that want to make this a partisan issue or to make it an issue specific to Trump, please spare us the commentary which we can all go to the Yahoo boards to read. I am simply pointing out the foolishness and inconsistency within this line of thinking.

Yet, I am still expecting the market to take us lower in the coming weeks. And, any impeachment discussion will simply be an excuse for what the market is setting up to do. But, make no mistake about it. It will simply be an excuse as history “proves” that impeachments “cause” 10% rallies in the market (smile).

So, before you use any geo-political news to support your market thesis, consider what Ben Franklin once noted about human “reasoning:”

But, clearly, I have digressed. Let’s move back to our analysis of the market.

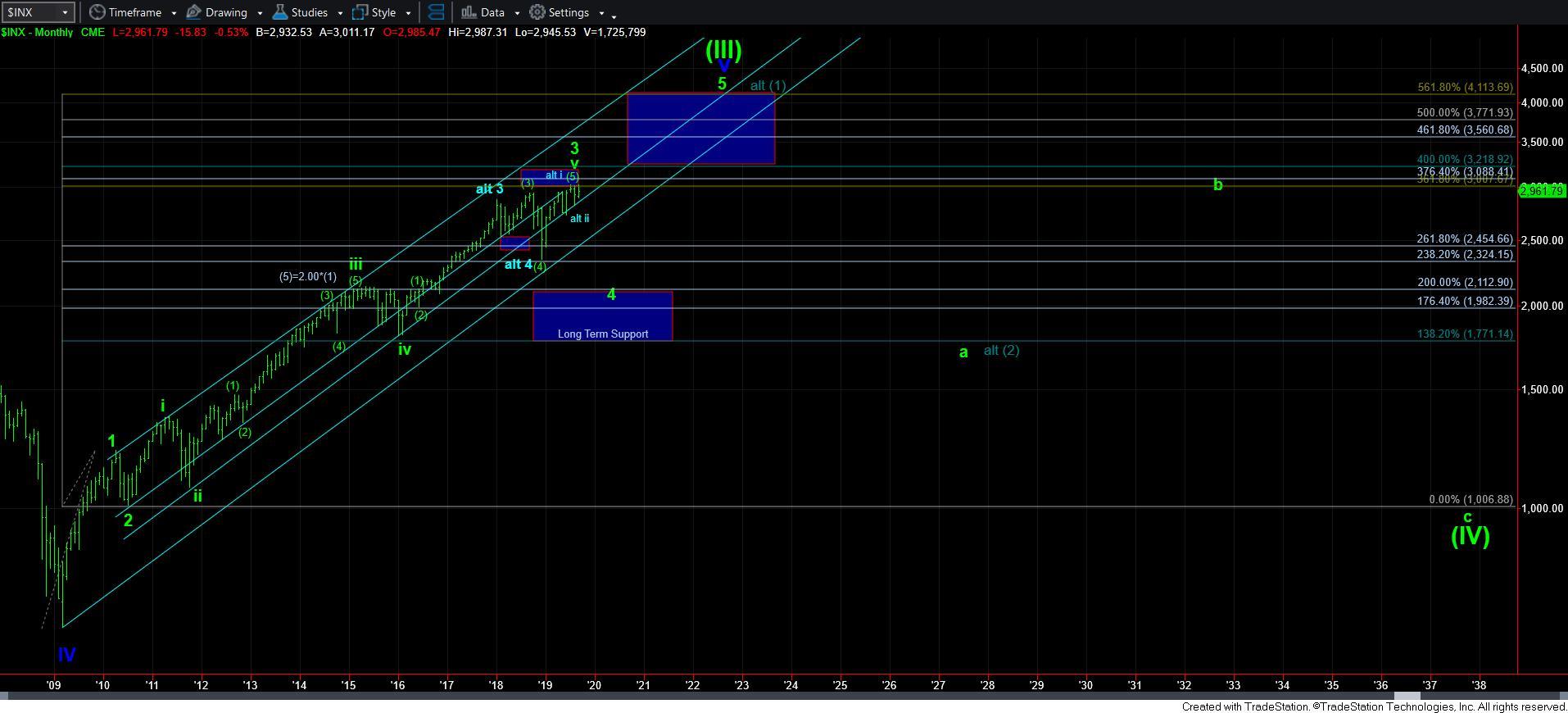

Unfortunately, the market has not made it a high probability that we have topped in the b-wave just yet. Yet, my expectation remains that we are topping in a b-wave, with a c-wave decline to follow. And, with the market following through to the downside on Friday, the initial indications suggest that we have begun that c-wave decline. However, the rally off the pivot that we experienced at the end of the day on Friday was not wholly consistent with a continued drop in an immediate c-wave.

You see, the structure we have been following on the 5-minute SPX chart suggested that the market can break down in the heart of a 3rd wave within that c-wave I am expecting to take us to our support region presented on the higher time frame charts. However, the bounce off the pivot at the end of the day Friday was not consistent with this structure.

If the market has indeed begun that c-wave lower, then we will have to see a large gap down on Monday morning, taking the market below 2930. The market will then have to respect the pivot noted on the 5-minute chart as resistance on the wave (iv) of 3 bounce in order to keep pressure to the downside, which will be pointing us to the 2850 region over the coming week or so.

Alternatively, we were also tracking the potential set up for he market to still take us to one more higher high in the 3030-60SPX region before this b-wave tops out. But, due to the action seen on Friday, there is no immediate clear set up that points to such a conclusion. While another set up may develop, I have no such set ups to point towards at this time.

Yet, if the market is unable to provide us with a large gap down on Monday, then the probabilities start rising that the potential for that higher high still remains quite reasonable.

The last point I want to make is being presented on the daily chart of the SPX. As you can see, the MACD on the daily chart has rolled over. While that does not preclude potential for one more higher high to be seen before the next decline phase takes hold, it makes it rather clear that even if a higher high is seen, the next decline phase is not too far into the future. It also supports my premise noted all week that attempting to trade for any potential higher high carries significant additional risk that you must accept.