Predicting The Future Is Hard, So Keep Calm and Collect Dividends

Predicting the future is hard, so keep calm and collect dividends

There is an old saying of Danish origin:

“Det er vanskeligt at spaa, især naar det gælder Fremtiden. -

It is difficult to make predictions, especially about the future.”

While attributed to many prominent people, including Mark Twain, Yogi Berra, and Niel Bohrs, the saying likely has a much older origin. It speaks to a shared human experience - dealing with the unknown.

Humans have always dreamed about having the ability to know the future. In modern sci-fi it often takes the form of time-traveling, somehow communicating with people from the future, or having psychic visions of the future. Today's renditions tend to have more of a technology flair, but the underlying story isn't all that different from stories told thousands of years ago. The oldest stories we know of frequently have prophets, fortune tellers, or gods that will provide clues about the future.

As investors, we thirst to know the future for an obvious reason - it makes it a lot easier to know what to buy today. Whenever I think of it, it reminds me of perhaps one of the most ill-timed movie quotes in the history of the movies:

"I want you to remember this word, okay? It's kind of like a code word: Yahoo. Can you remember that?"

This quote comes from the 2000 movie "Frequency", where the main character speaking through a radio that communicates with the past, influences his son to buy Yahoo stock. The movie ends with his son being portrayed as very rich. One year after the movie was made, Yahoo stock had fallen over 98%. Hopefully, the son, Gordo, sold in 2000. Yahoo, once with a market cap of over $100 billion, sold its core business to Verizon for less than $5 billion in 2016.

Let that be a warning to you, if you are passing along a stock tip to the past, provide the date so they know when to sell! Even knowing part of the future can lead you to make very poor investment choices. The reason is that the economy, and therefore the market, is in a constant state of change.

Interest Rate Obsession

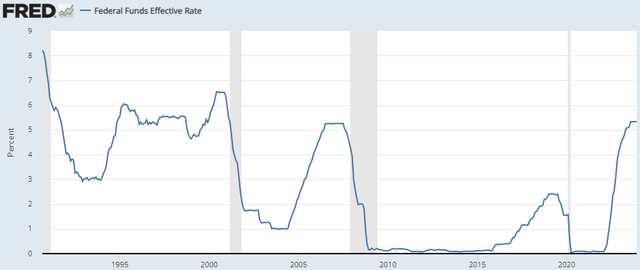

The market is always worried about what interest rates will be, but for the past few years, the influence of the market's projections of what the Fed will do has had a larger than typical influence on prices. This is likely because of how aggressively the Fed has hiked recently compared to prior cycles. Source

St. Louis Fed

Note that the absolute rate today isn't much higher than it was in 2006, and it was higher in 2000. The main difference is the speed at which the Fed hiked. From 2004-2006, the Fed took over two years to go from 1% to 5.25%. Most recently, the Fed took 3 years to go from 0% to 2.4% from 2016-2019. So going from 0% to 5.33% in a year and a half is very fast.

The Fed hiked aggressively, after making its own projections that it would hike very slowly. This created a lot of uncertainty, allowing the market to speculate month to month about what the Fed might do at the next meeting.

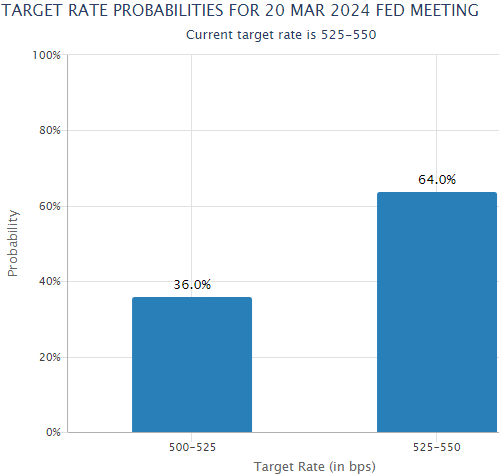

Right now, the Fed left the rates unchanged in January. Just a week before this, the market was projecting a 50/50 chance of a rate cut in March, and now the expectation of a rate cut in March has lowered. Source

CME Group FedWatch Tool

We can expect that a large portion of market movements will continue to be explained as a reaction to economic data, and the market's expectation of how the Fed will interpret that data.

These changing assumptions will continue to drive the market. More interest rate-sensitive investments like fixed-income, REITs, and CEFs will tend to be more reactive.

Focus On The Big Picture

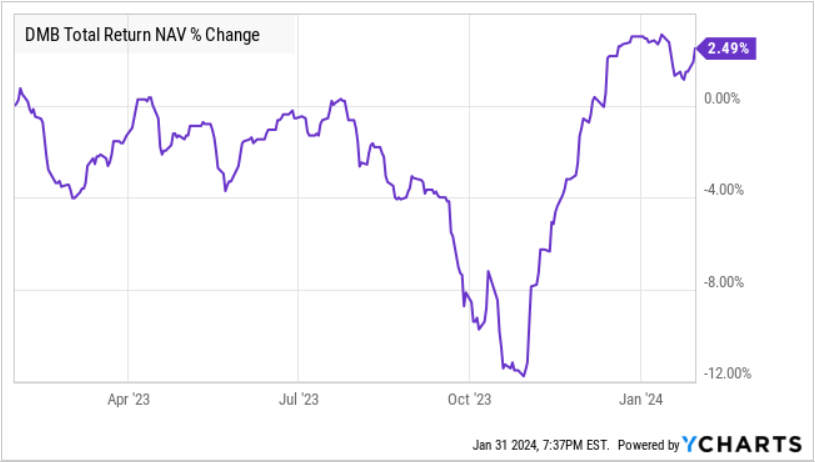

It is easy to get wrapped up in the day-to-day market movements, but it is important to keep an eye on the big picture. Consider BNY Mellon Municipal Bond Infrastructure Fund (DMB), this holding in our portfolio is perhaps the most "pure" exposure we have to interest rates. It holds long-term bonds that have little credit risk. Here is DMB's total return NAV:

Note how it trended down as long-term rates spiked during Q3. The rally was very strong in Q4, and it is an example of how quickly these types of holdings can climb when the market becomes optimistic that rates are coming down.

We can't be certain exactly when rates will come down, but we can have a very high level of certainty that they will be coming down. As a result, when we see these pullbacks in interest rate-sensitive investments because the market is expecting rate cuts might be pushed out a meeting or two, we should view it as a buying opportunity.

On the income side, we have already seen stabilization. A few of our CEFs with variable distribution policy, such as Nuveen Preferred & Income Opportunities Fund (JPC), Flaherty & Crumrine Dynamic Preferred and Income Fund Inc. (DFP), and DMB, accounted for most of our dividend cuts in the past two years. JPC and DFP have both raised their distributions in the past two months. This is a trend we expect throughout the fixed-income sector. As total returns improve for fixed-income, the funds in the sector will start raising their distributions back up.

I am continuing to favor fixed-income and fixed-income funds for my reinvestment.

Earnings Season: Setting Expectations

Interest rate movements will continue to dominate the overall direction of the market, while at the company level, Q4 earnings will be a major differentiator. Q4 earnings kicked off for our portfolio last week.

Q4 earnings are among the most impactful because companies are reporting the final results from last year, and typically follow that up with a projection for this year. Annual guidance is not a guarantee – NextEra Energy Partners (NEP) saw its price collapse last year when it missed annual guidance by a country mile.

Think of annual guidance as the "gameplan". It will show us the goals that the company is targeting, and management will provide the framework of how they intend to achieve those goals. Will it be a year of growing revenues? Cutting expenses? Acquisitions? Dispositions? Restructuring? Getting defensive? Consolidating?

All plans are subject to change when they come in contact with reality, but as investors, it helps us set realistic expectations. NEP, for example, indicated in their Q4 earnings that their guidance for 2024 will remain the same at an annual 6% target growth of distributions. No further clarification or guidance was provided beyond the 5 - 8% distribution growth range. So can we expect the distribution to follow as per guidance, or will the target change in between?

These are the types of questions we can expect to be answered at earnings season, and the answers can be a catalyst for the share price.

Conclusion

Perhaps the most certain thing we can predict about the future is that things will change from where they are today. As investors, we shouldn't fear these changes. Recessions will happen, market crashes will happen, and black swans will cross our paths. They've happened in the past, and they will happen in the future.

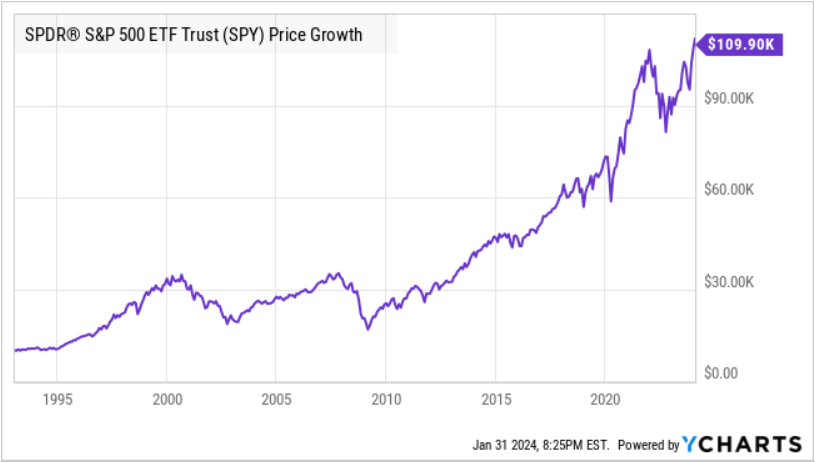

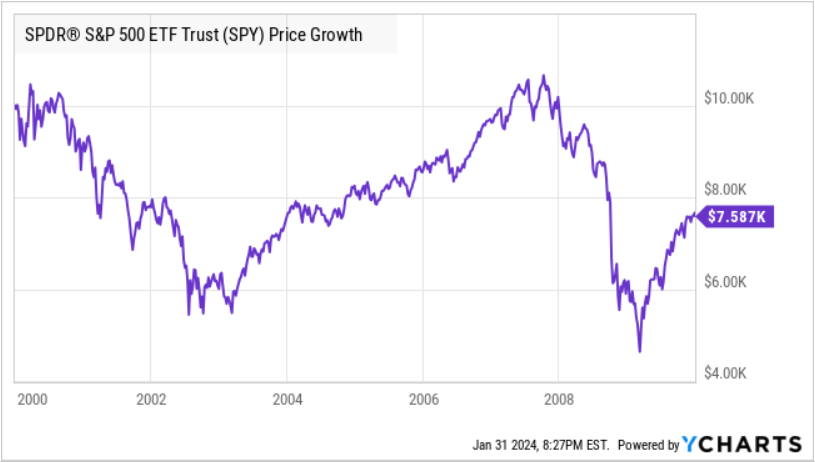

We invest in the stock market because over the long haul, it has proven time and again to be a great generator of high returns. The stock market does not go up in a straight line:

Note the Dot Com Bust and the GFC are visible in the chart, but look like speed bumps. I assure you, for those who lived through them, it felt like a catastrophe. The "lost decade" from 2000-2010 was exceptionally painful for many investors. No sooner did they start getting their money back, and it vanished again:

I invested through these years, and it is why I created my style of investing that would become "The Income Method". Market prices are volatile, and we can't know with confidence what they will be in the future. The income that my portfolio was producing was something tangible that I could focus on, and cause it to grow through my actions regardless of whether share prices were up or down.

Instead of trying to predict far into the future, I can focus on the income being produced right now, and the immediate factors that could cause that income to increase or decrease.

The market came into 2024, very optimistic about rate cuts and now it is less optimistic. As income investors, we can let that work in our favor and take advantage by buying a few more shares every time income investments dip in price. The market can go up or down; either way, we will find a way to make sure our income is going up!