PayPal: Built on Strength, Ready to Run

Ever since the low struck back in April of this year we have been looking for the initial rally and subsequent corrective pullback to give us a bullish setup in PYPL. That now appears to be in place. So, let’s discuss the foundation of our thesis and the specific price parameters going forward.

Lyn Alden shared these thoughts with members in a recent post:

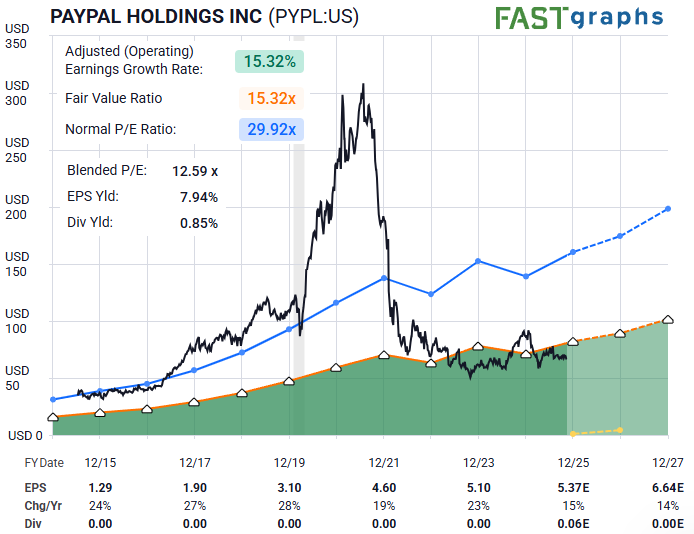

“PayPal reported earnings and mildly boosted their forward expectations, they announced a partnership with OpenAI to embed its digital wallet into ChatGPT, and they also initiated a dividend for the first time. The company's fundamentals continue to look attractive with a very reasonable valuation.

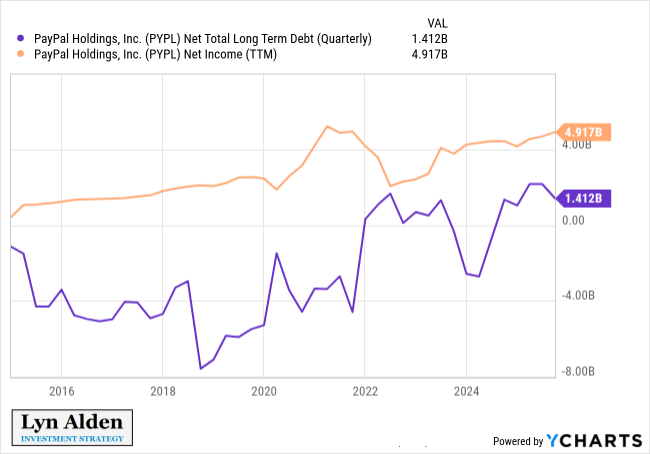

Importantly, PayPal has a great balance sheet. While they have a decent amount of debt, they also have a ton of cash, and so their net debt position (i.e. debt minus cash) is very low. They only have about $1.4 billion in net debt, and they have $4.9 billion in annual net income, and so their debt/income ratio is about 0.3x. The company trades at under 13x earnings, and almost all of the company consists of equity value rather than debt.

Risks certainly remain for PayPal. They're undergoing a transformation to revive growth. I expect it to be successful, but there's no guarantee it will be. However, by having a low earnings multiple, and just as importantly by having low debt, the pressure is mostly off. They're already priced for little growth, and their lack of net debt makes it so that moderate delays or disappointments in their growth initiatives wouldn't greatly threaten the equity value.” — Lyn Alden

What Happens When The Crowd Gets Behind It

We espouse the belief that for as great as fundamentals may appear, the stock simply will not move unless the crowd is involved. Masses will move stocks and markets up and down, — often far beyond — what the fundamentals are telling us. In the case of PYPL, we have a solid wave ‘i’ rally followed by a corrective wave ‘ii’ pullback. This gives us specific price parameters along with upside targets. Here’s what that looks like:

Note the key low in April 2025. Thereafter we have an initial lesser degree rally and pullback. This structure may now be complete. If so, then the upside projected using standard extensions shows $103-$120 as the probable target. Risk would be defined at the low struck in April at $55.

You can also see on Zac’s chart that the low is either a ‘B’ wave or a wave (2) low. This implies that the next rally will be in 5 waves as either a ‘C’ wave higher or an even larger wave (3). It will be the structure of the subwaves of the upcoming rally that will clarify which is which.

A Clean Risk–Reward Setup Taking Shape

When you strip away the noise, what remains is a favorable risk-versus-reward setup with clearly defined boundaries. We know where risk lives — the April low — and we know what a bullish outcome looks like.

We don’t need every detail of the map to begin the journey. What matters is the structure in front of us — a completed wave (ii), supportive fundamentals, low debt, and a sentiment shift that appears to be quietly starting.

If this setup continues to unfold as expected, PYPL may be positioning itself to reward those willing to step in before the crowd fully catches on.