Path To Lower - Market Analysis for Jun 26th, 2024

At this point in time, I have no clear immediate path to a break-out scenario in the metals complex due to the depth of the drop this week. Rather, it seems like a larger a-b-c structure is taking shape, which will likely point us lower in the various charts we track.

The question that I still have is if we drop in a direct manner to complete this structure, or if we see one more rally to complete a bigger b-wave before we get that c-wave down. Right now, I am leaning on the latter scenario, as long as today’s low holds.

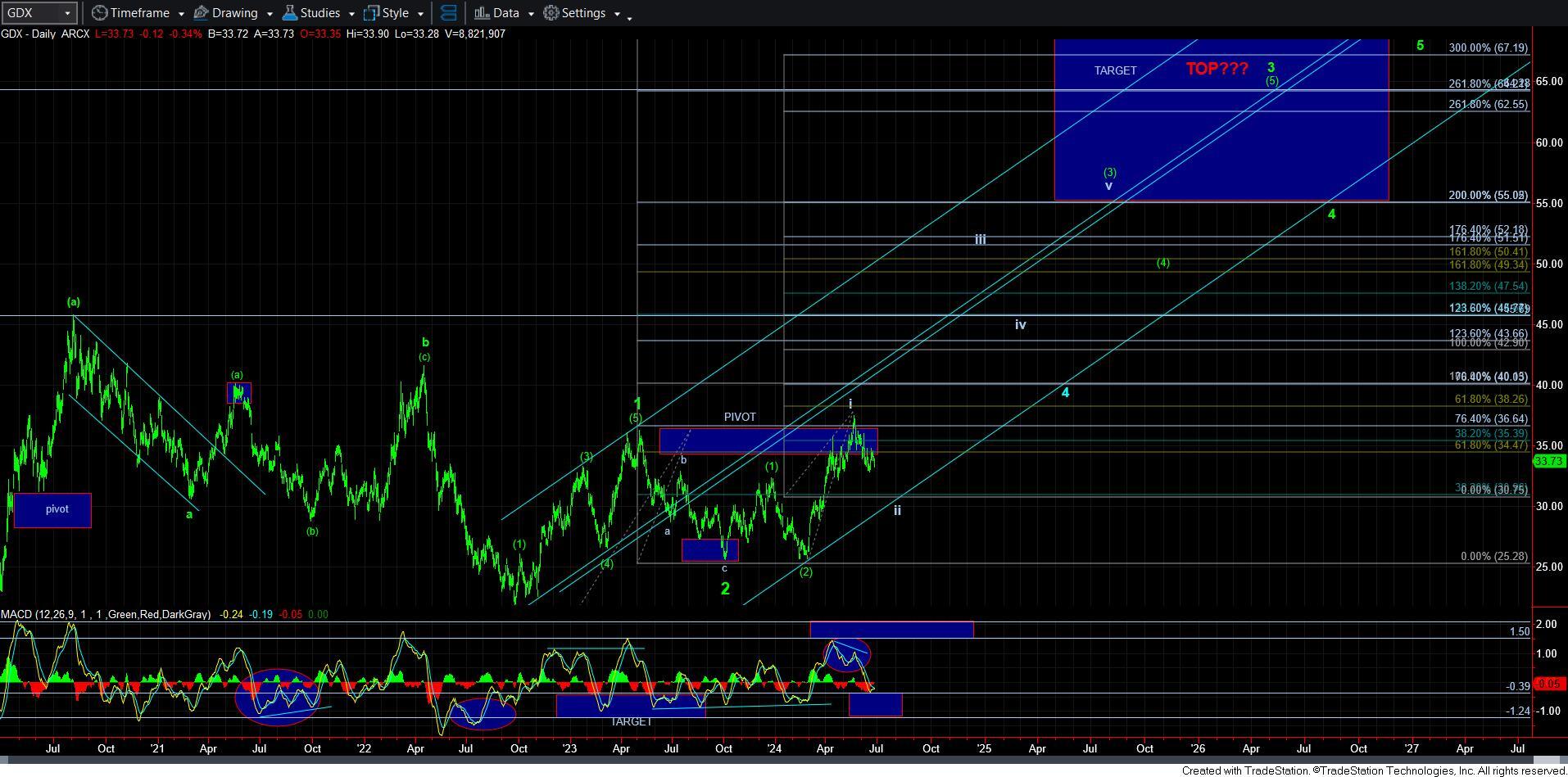

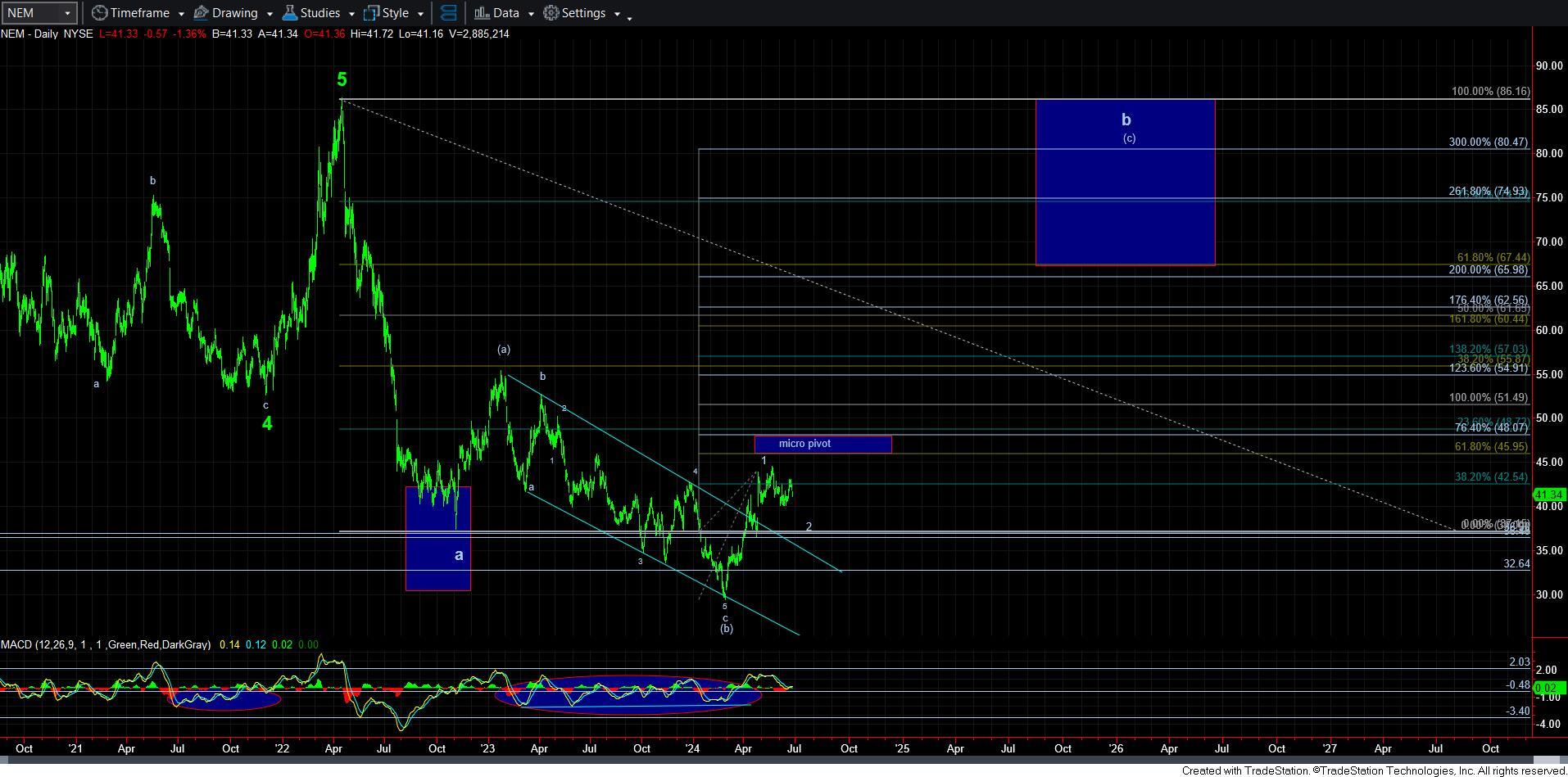

In GDX, the micro structure is really not terribly clear. And, when I do not have substantial clarity in GDX, I will often take a peek at NEM, it’s largest holding. And, NEM seems to clearly be needing a c-wave down in its wave 2, especially since the last rally was a rather clear 3-wave structure.

My general expectation for GDX right now is in the 30/31 region to complete this structure. But, should we see more of a rally take shape in GDX for a bigger b-wave for yellow wave [ii], I will be able to identify a much better target.

Silver has the same quandary as GDX, as more of a b-wave rally is still not a low probability. Yet, I have no clear evidence strongly suggestive of its progress. So, I am a bit torn as to whether we are dropping in an ending diagonal for the c-wave, or if we get that intermediate rally to complete a larger b-wave. If we see some impulsive action off today’s low, then I will likely move into the bigger b-wave camp at a higher probability.

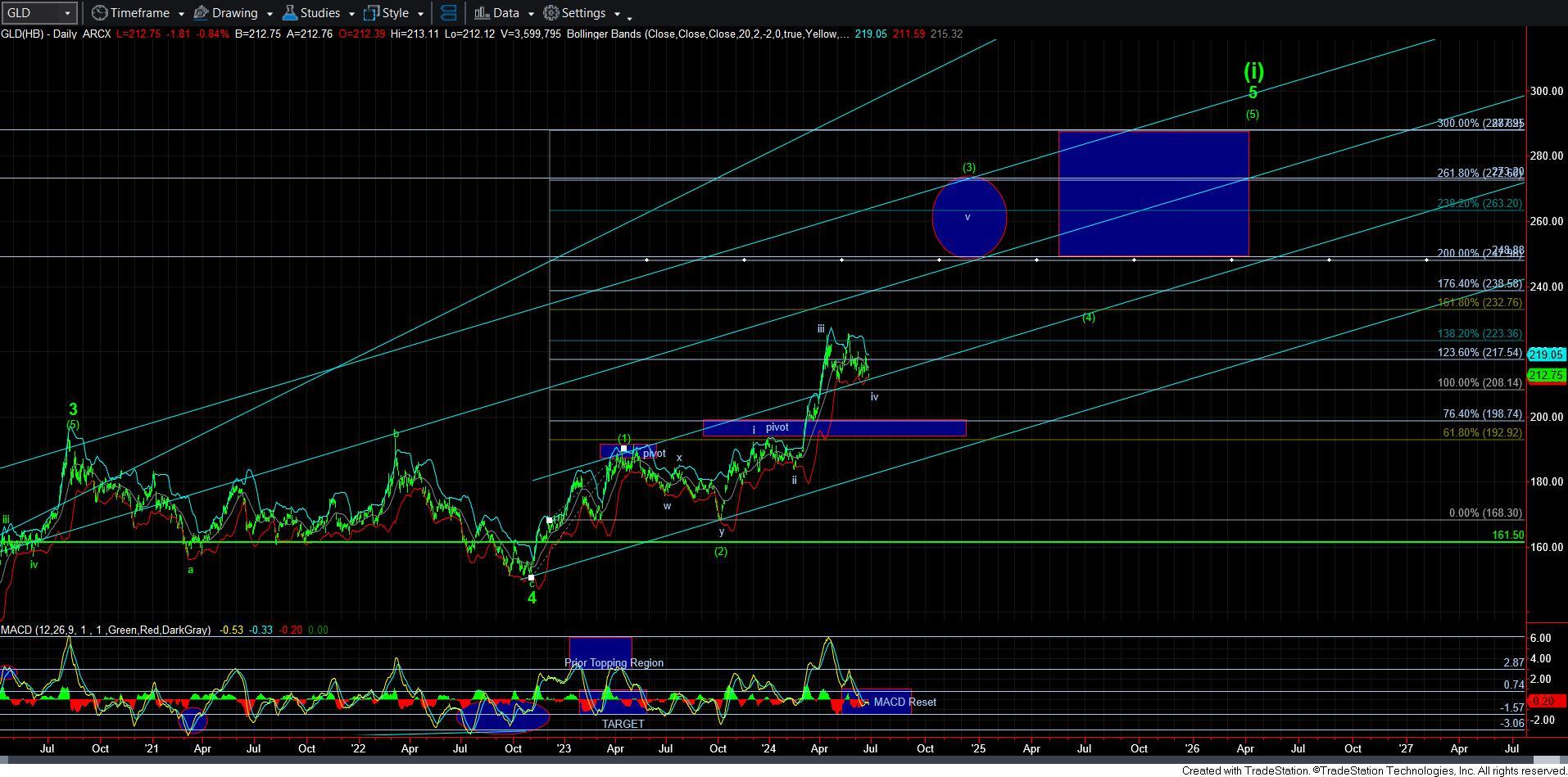

GLD is still suggestive of a bullish resolution to this larger degree structure. Support still remains below us in the 208 region, but the micro-structure is just as unclear as both silver and GDX.

Unfortunately, it still may take a few more days until the market give us a bit more clarity as to how this pullback completes. But, the structures suggest that lower will likely be seen before this does complete.

Yet, I would not be getting bearish right now. The bigger picture is still very bullish for the rest of 2024 once this correction completes. Consider that the daily chart MACD’s have all pulled back sufficiently tos support a very large rally, which we certainly expect. But, if we do see more a b-wave rally, then one can choose to hedge for the potential last downside leg in a c-wave. However, I would be looking at such a decline as an opportunity more so than an inconvenience.