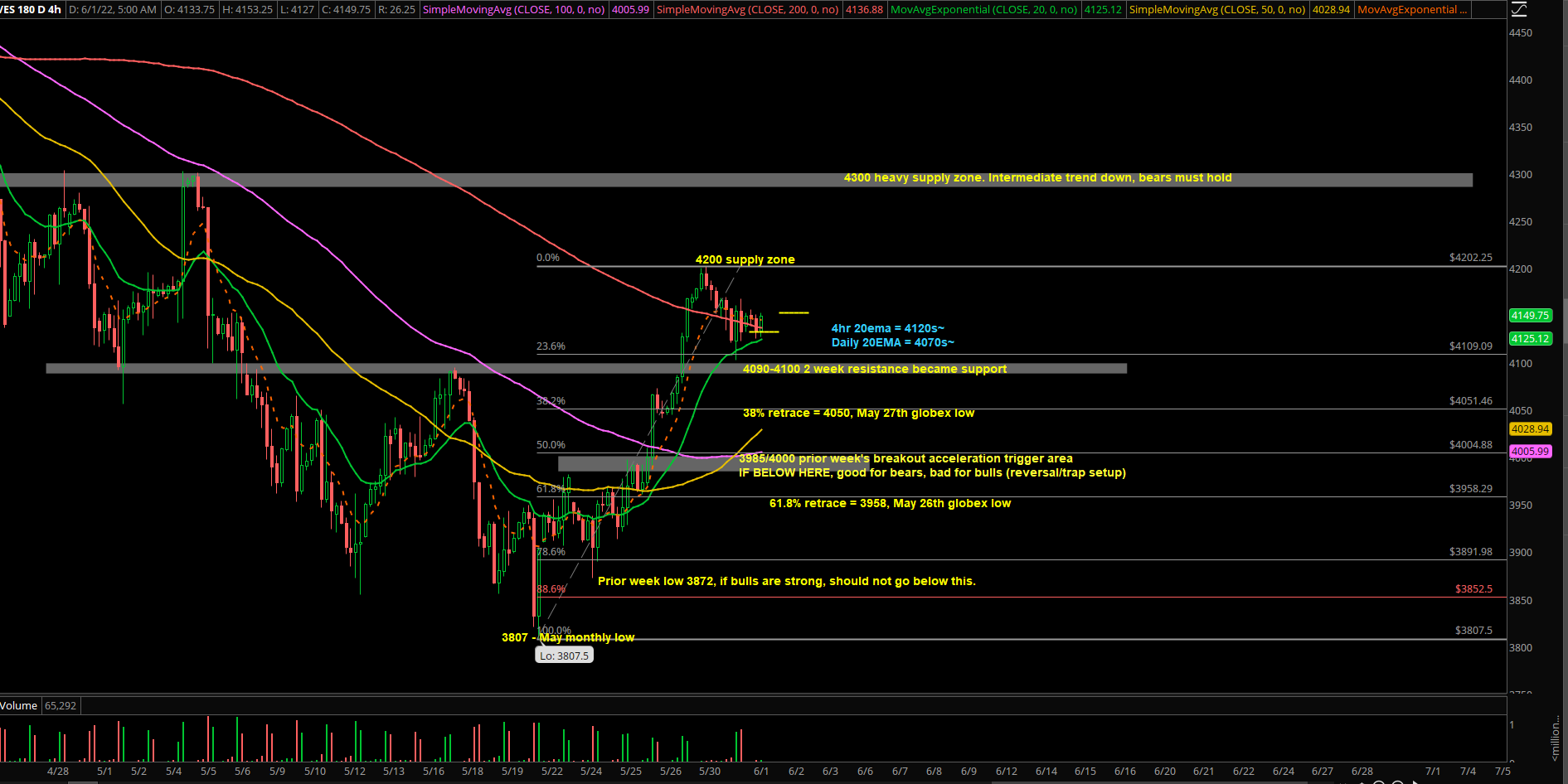

Oversold Bounce - Market Analysis for Jun 1st, 2022

Context section:

- Price action remained trending down below daily since the mid Jan 2022 breakdown of ES 4650s. ES has not stayed above daily 20EMA for more than 25 sessions this year

- ES was down 7 weeks in a row from April 4th to May 20th. A high of 4580 into a temp low of 3807

- If you recall, sentiment + percentage of stocks under 20 day moving average were at rock bottom extremes before the ongoing relief bounce

- Prior week’s ES range = 3872-4168. A weekly gain of +6.5%

- A+9% massive range since the May 20th 3800s lows into May 31st globex highs of 4200s

- Price action is so far staying above the 4090s multi-week resistance that turned into short-term support

- We’ll need to see how the pullback reacts to judge if bulls are able to sustain momentum to build a bigger base over the next few sessions or this is another massive rejection back below daily 20EMA/prior week’s low

Current parameters:

Market is coming off a short-term hot streak from short-term bulls due to the prior +6.5% green week and +10% since 3807 lows into 4200 highs. Price hit a high of 4200s this week and so far just doing a bullish consolidation/basing pattern. Waiting to break yesterday’s range of 4100-4160s in order to do an expansion/follow through.

Given the ongoing context+ levels in play, we’re mostly expecting a two way trading market for this shortened week given the context + ongoing weekly relief bounce + heavy supply zone. Meaning both directions are tradeable given the key levels so you wait for a setup to occur.

- 4hr 20EMA = 4120s

- Daily 20EMA = 4070s

- Multi-week range high turned into support = 4090s

- Heavy supply zones/resistance = 4200, 4250, 4285, 4300 (4300 being the most important due to the late April breakdown setup + May monthly high)

- Prior week’s ES range = 3872-4168. A weekly gain of +6.5%

Key scenarios going into June 1st RTH, primarily concerned with another range day:

- Price action about to open RTH within yesterday’s bullish consolidation 4100-4160s, expecting more rangebound two-way intraday opportunities when stuck

- A sustained breakout above 4168 opens 4185/4200/4225 as follow thru targets

- A break below 4090 opens a trend day down potential into 4050/4030

Additional intraday parameters:

Tight overnight range of 4125-4157 conditions, doing a bullish consolidation above 4hr 20EMA

- Overall, the short-term momentum bias favours upside drift if ES 4090 keeps holding. Meaning we remain short-term bullish given the price action.

- Conversely, a break below 4100 yesterday’s low, may be the first warning sign of range day/chopfest/reversal. Let’s see how the RTH open goes first

Bigger picture:

Supply heavy zone since the end of April breakdown from 4300s high. Intermediate trend remains down when below 4300 so the current bounce is being treated as relief/oversold bounce in the bigger picture if we zoom out into weekly/monthly charts. 7 weeks down in a row followed by 1 week up.

Last week’s price action broke above daily 20EMA and currently staying above it. For the next few sessions, we’re watching closely to see if short-term bulls able to keep retaining last week’s momentum in order to build a bigger basing setup and change the potential intermediate trend. eg. does price keep forming daily higher lows+higher highs for the next few days or does it just shake around with no decisive trend hovering back above/below 4000 area.

As of writing, we’re primarily expecting a massive rangebound shakefest for month of June. Ongoing 3 week range is 10% already and it’s unlikely to go V-shape up to all time highs or sustain break below 3800s with force. The more likely scenario is digestion between ES 4250-3950 with the occasional overshoots. For reference, the May monthly range = 4303-3807. We’ll give more updates on this as market provides us with more info each day.