Overnight Held At Key Level, BTFD In Control

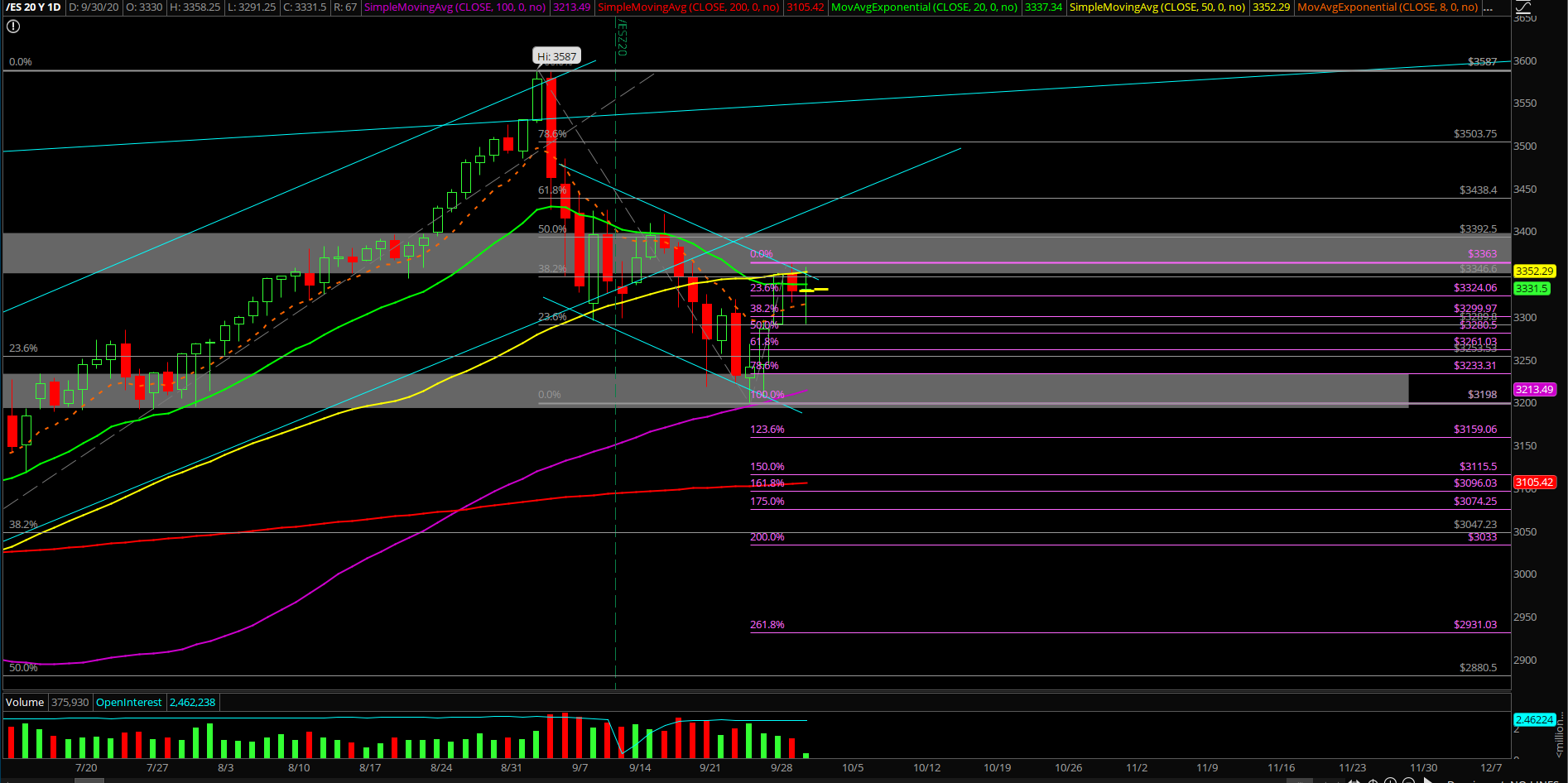

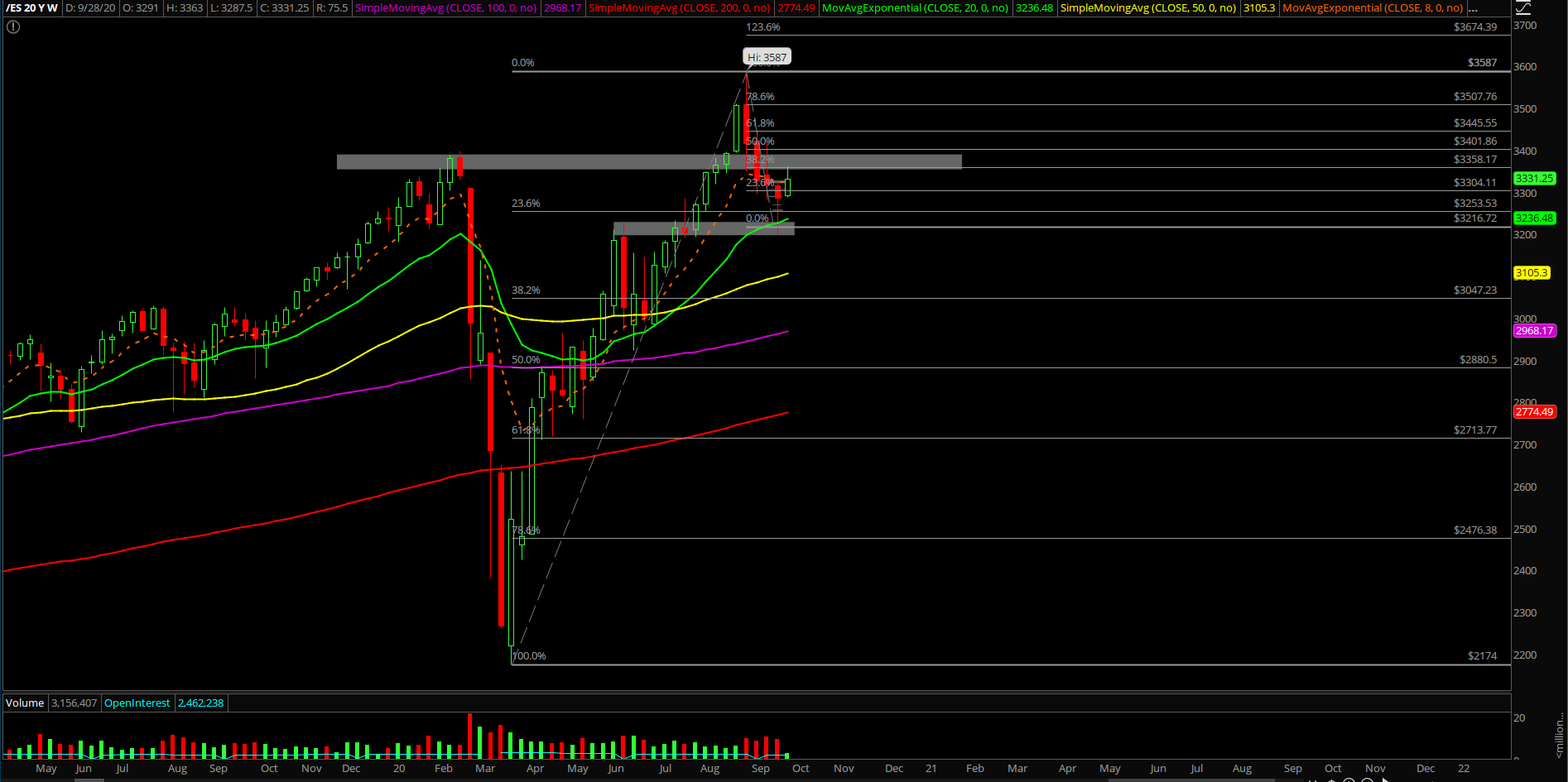

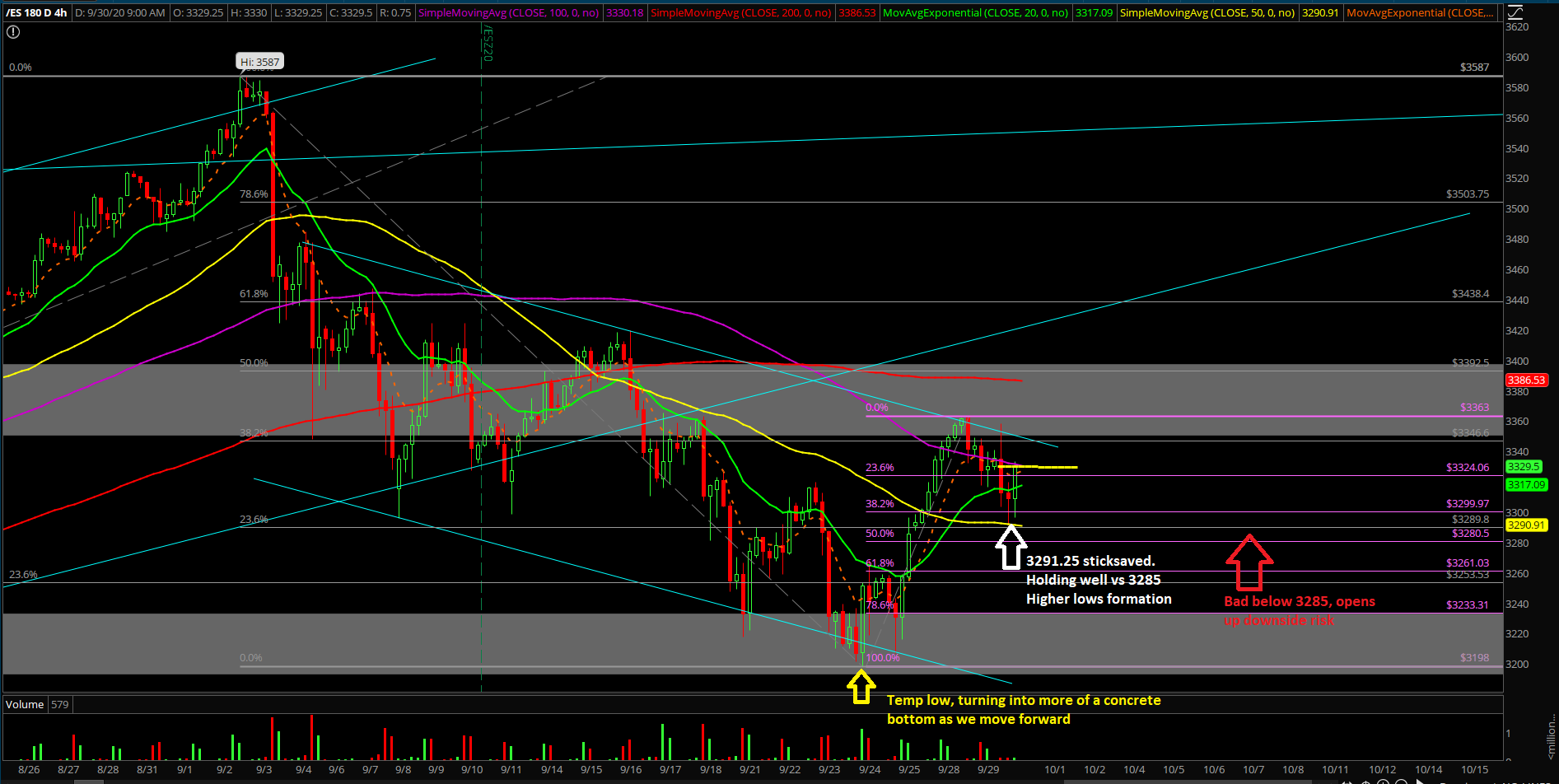

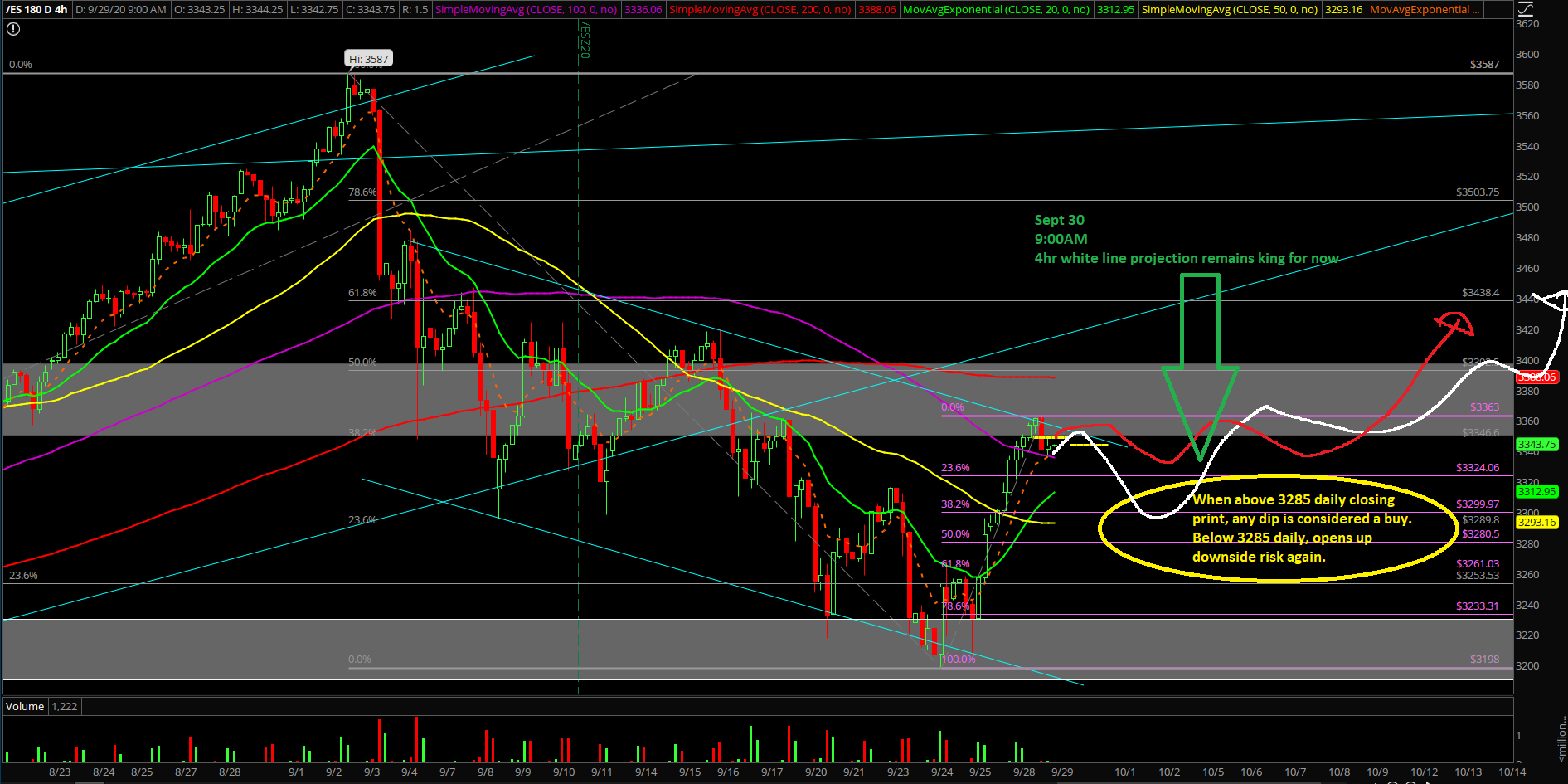

Tuesday’s session was a tight range day doing a 23.6% fib retracement of the 3363-3198 range on the Emini S&P 500 (ES) and then going sideways. The more significant price action occurred overnight as price was able to sticksave/bottom out at 3291.25 vs the 3285 key level. If you recall, 3285 is the must-hold momentum level on the daily chart moving forward, and it is also this week’s current low from Sunday night.

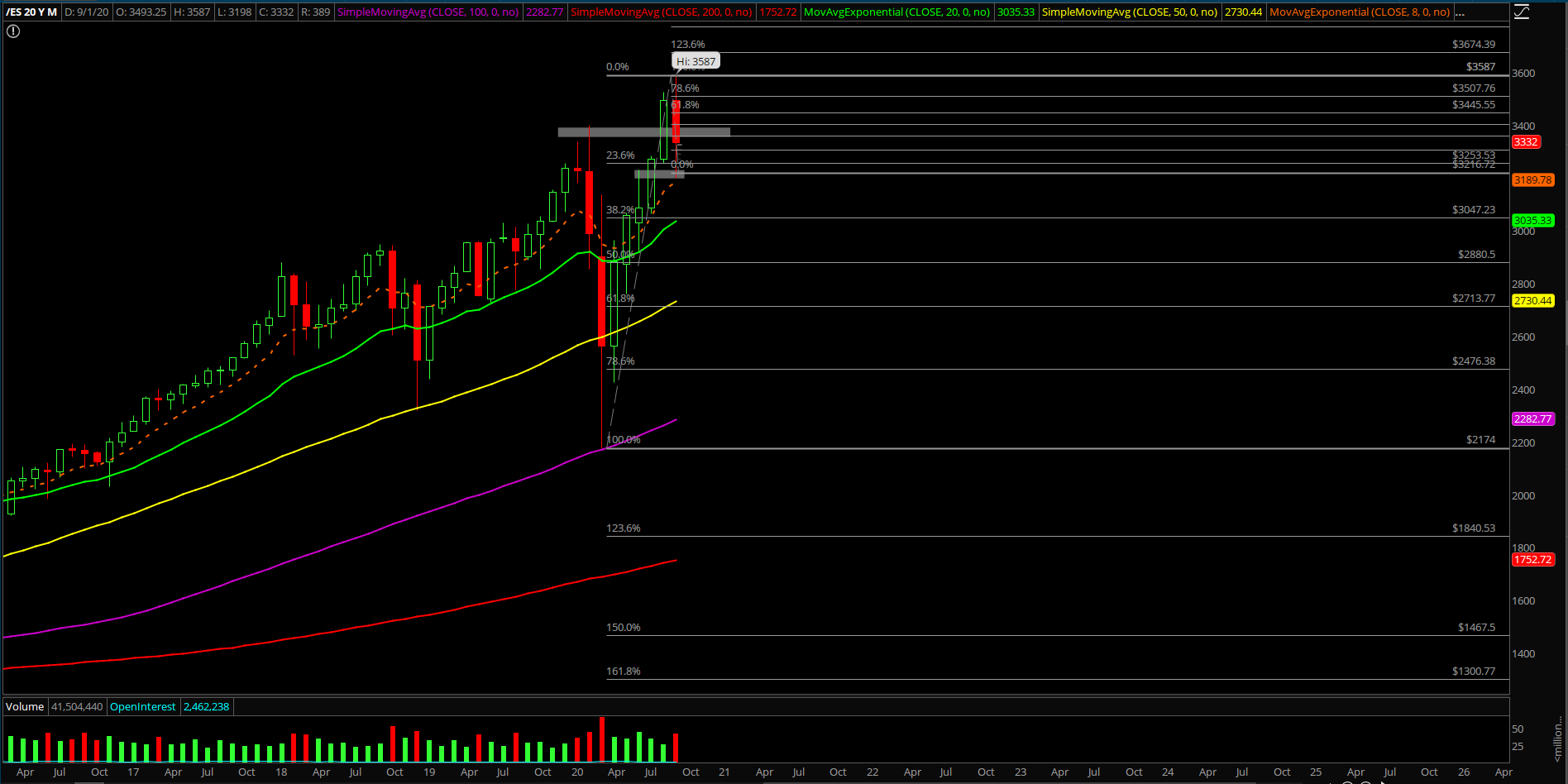

The main takeaway is that the market has successfully made a higher-lows formation in regards to the ‘hold half and go’ setup, and now it’s up to the bulls for some continuation on Wednesday-Friday. At this point, bulls cannot let bears reclaim 3291-3285, otherwise the downside risk opens up immediately due to the weak consolidation.

What’s next?

Tuesday closed at 3329.5 on the ES, near the low of the day to wrap up the range day. For today, it’s still likely a range day when trading within the parameters of 3291.25-3363. However, the bigger picture is upside continuation based off of the recent context from last week’s bottom.

Some key points in our game plan:

- Price action was sticksaved at 3291.25 vs the must hold 3285 level.

- The ‘hold half and go’ daily setup is playing out successfully for the first half by building the higher lows as price action is able to hold against the 38.2-50% fib retracement.

- For the rest of the pattern, we’re expecting an upside continuation into 3397 and 3430s as long as overnight low holds.

- Look to board the bull train quickly this morning as bigger picture remains intact given the R/R.

- 4hr white line projection from yesterday remains king for now