One More Extension?

I am writing a mid-week update right now for two reasons. The first is that I am not going to be here tomorrow, as I will be off the desk due to the religious holiday of Shavuot during which I am forbidden from working. The second is that there is a micro set up in silver that is pointing us lower.

As you can see from the attached 8-minute silver chart, I am viewing today's bounce high as important. As long as we remain below 29.66, we have a small degree 5-wave structure down from that level. That could either complete this decline in a truncated fashion, or it could mean the start of an extension lower, which could even reach the lower end of the support box.

So, at this point in time, I wanted to highlight this near term bearish potential. As long as we remain below 29.66, we have a micro set up pointing us lower in an extension within the 5th wave of the c-wave of 2.

However, if the market is able to exceed 29.66 and move through 30 in impulsive fashion, that is our initial indication that a low has been struck in this pullback.

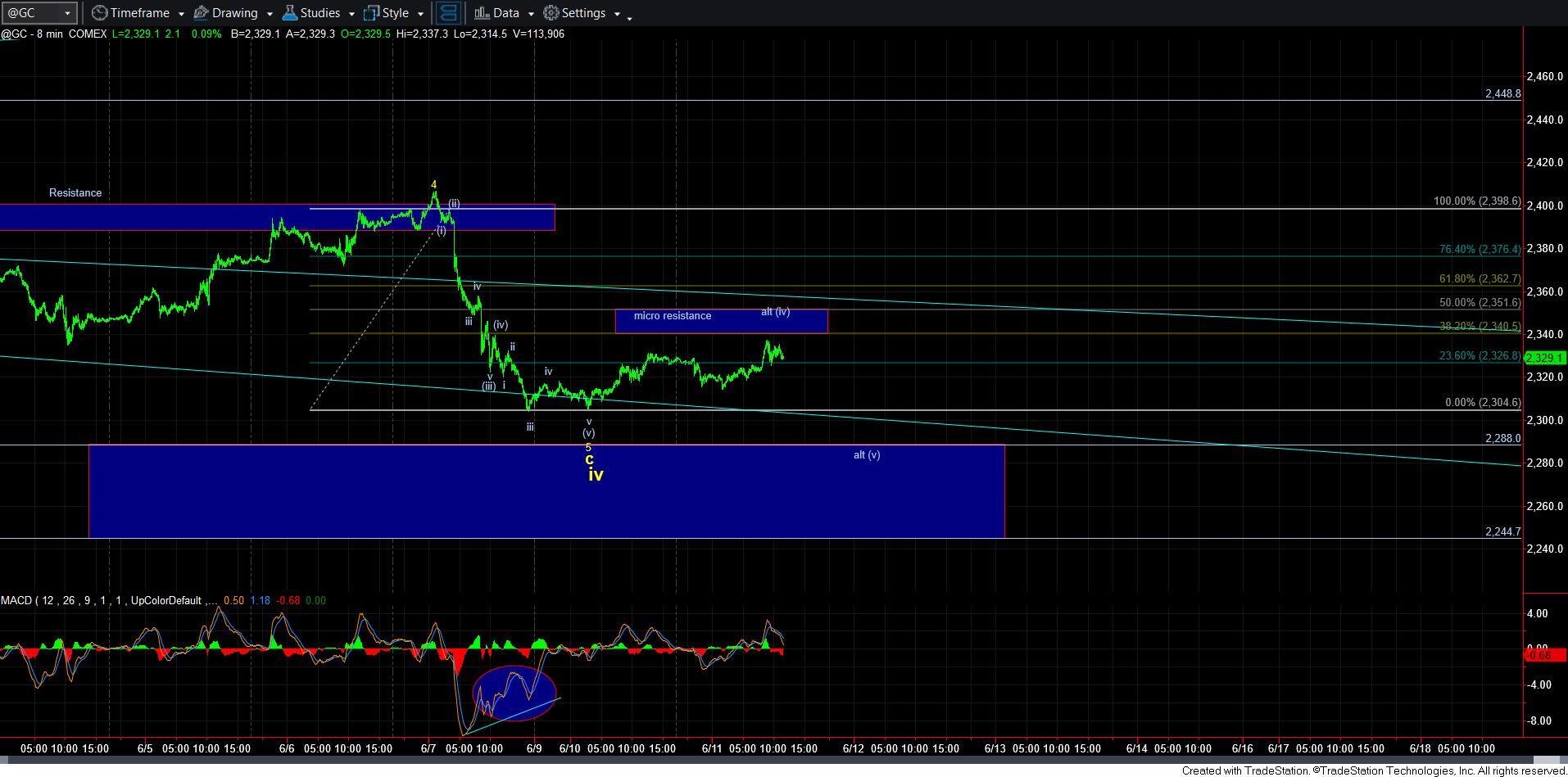

Both GC and GDX retain potential to see lower as well, as neither has successfully broken through their respective resistance boxes with impulsive rallies of their own.

So, as it stands right now, there is no clear indication a bottom has been struck, and there is a micro structure in place that can still point us lower in the coming days before this correction is done. But, as I have noted many times, we are getting very close to the completion of this pullback. We are now simply seeking a 5-wave rally through resistance to signal we have moved back into the bullish trend.