Oh So Close - Market Analysis for May 5th, 2021

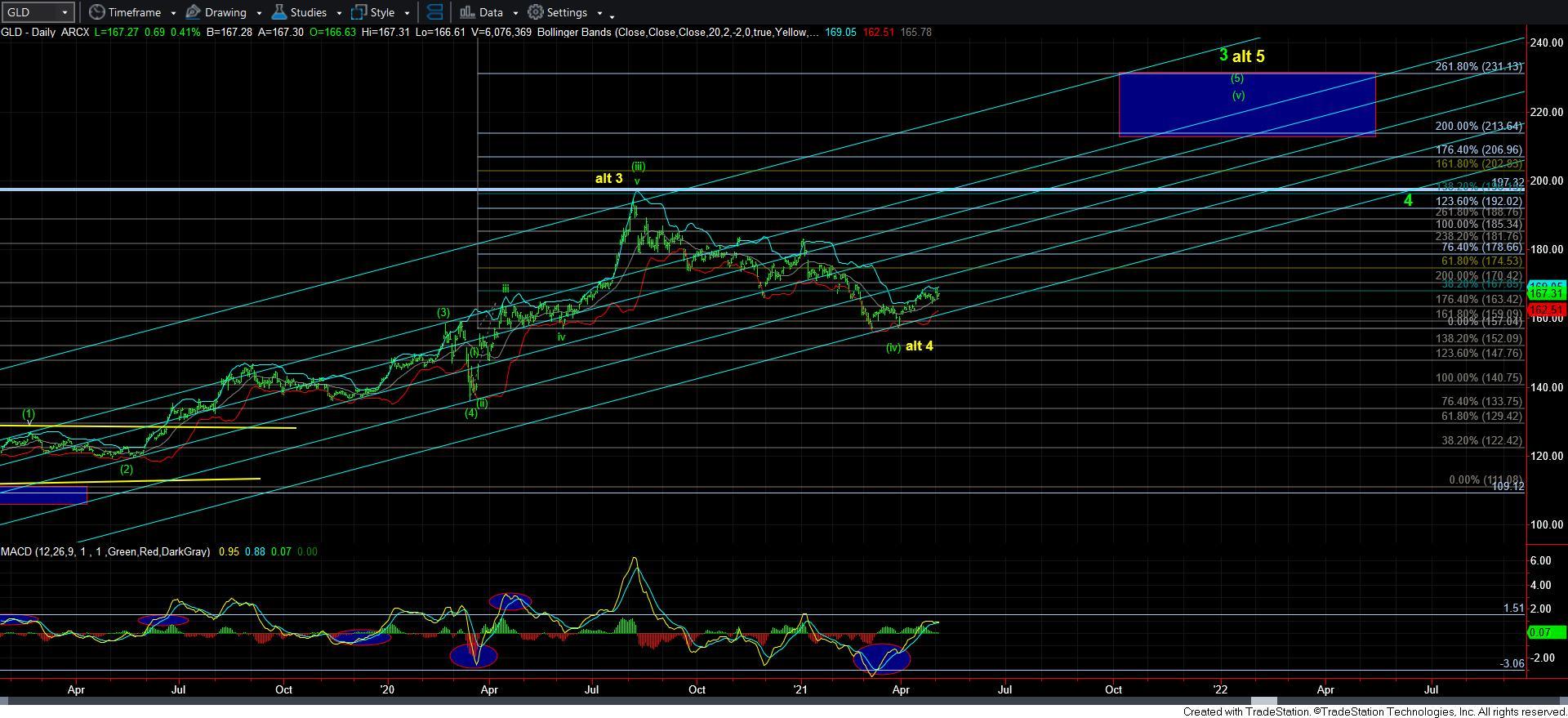

While silver has broken through it’s a=c resistance and can even push higher yet for a more appropriate wave 1, GLD and GDX still leave us with questions as to their intent.

As you can see from the attached 8-minute chart of GDX, this week we saw a spike and reversal right at the top of our resistance box, and what seems to be a corrective pullback since.

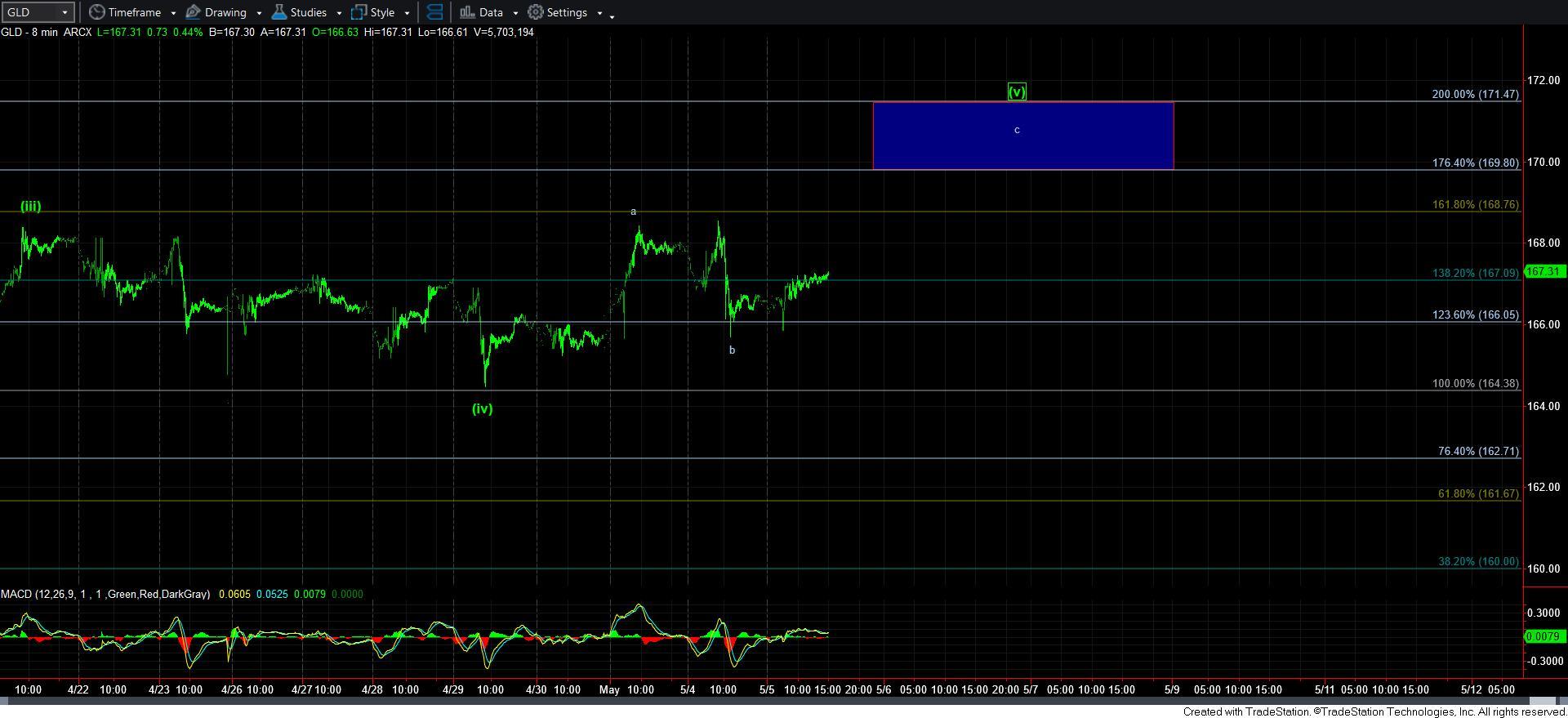

GLD has also provided us with a spike high and reversal this week, followed by what seems to be a corrective decline off this week’s high.

Both of these chart are soooo close to providing us with a 5-wave structure off the low. Yet, without a higher high in each chart, we only have a 3-wave rally, which is only corrective in nature.

I can make this rather simple right now. Both GDX and GLD have to rally towards their 5th wave targets this week, or we have yet another failure to launch.

Also, remember that even if we get that higher high, it still would only count as a leading diagonal for the first wave off the recent lows, which is not the ideal structure from which we want to turn aggressively bullish. Rather, we will still need a corrective 2nd wave pullback, followed by a micro 5-wave rally for the first wave of what we hope will be a 3rd wave. Should we see that set up after a higher high this week, then we go on “BREAK OUT ALERT” for the resumption of the long term rally in this complex.

Until we get that set up, I am going to be cautiously optimistic. For now, the markets have a wonderful opportunity and are so close to providing us with a relatively reasonable 5-wave structure off the recent lows. While we really are close, do not assume anything until the market actually proves its intent.