Odds of Slightly Better Than A Coin Toss Support Long Positions

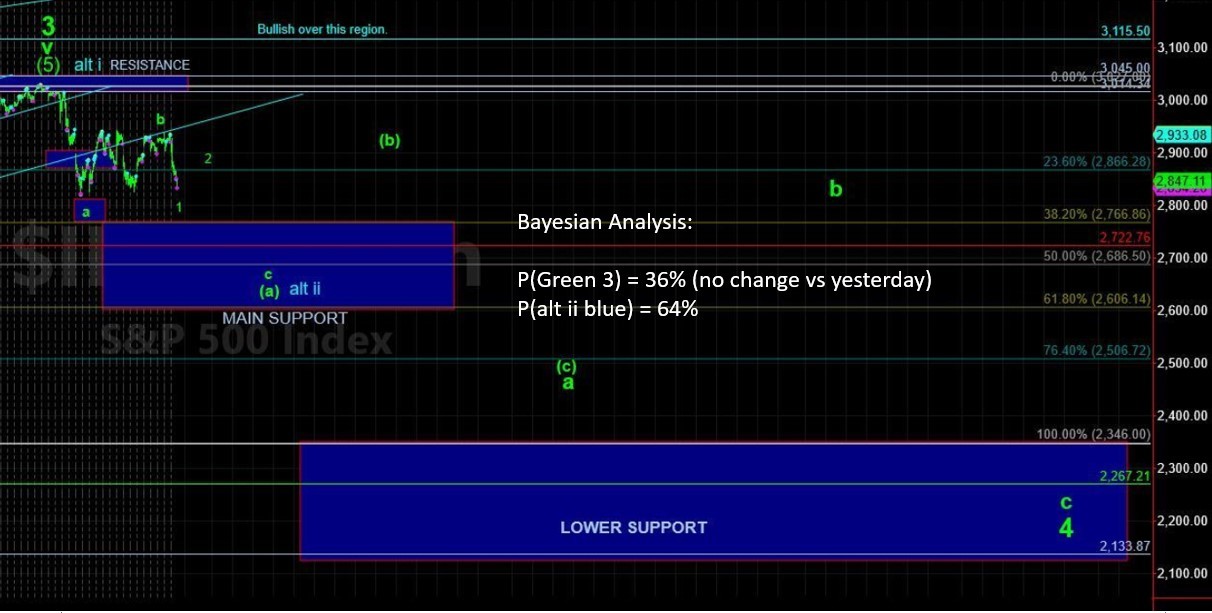

I’m going to simplify the probability paths to better capture recent price action:

(1) 60% Probability: SPDR S&P 500 ETF (SPY) bounces off the 282-286ish zone (of which was hit on 8/23, 8/27, and 8/28) and begins an aggressive move higher. The action on 8/28 was a bit too muted of a bounce to trigger a long signal. So for this path to win out an acceleration higher will need to be seen within the next few days, and

(2) 40% Probability: SPY works its way back to the 292-295 resistance and then has a strong bearish reversal targeting the mid-260s and could even see a 240s handle.

Notes: IMO, the 292-296 band controls the next 12 months from a probability perspective. If SPY gets above 296 then at a minimum expect multi-weeks of upside with 80% probability.

At the micro level, bears really need to see a strong reversal from the 292-293 region as each tick above 293 begins to favor bulls winning the battle. Heck, taking it down to the micro micro micro level the price band 291.75-292 shows importance.

Bottom line: By slightly more than a coin toss, odds continue to support long positions, even if the signal has remained Neutral. As such, the reason the BTS (Bayesian Timing System) didn’t chase a short position over the last week.

In metals, the Gold Miners ETF (GDX) continues to hover above the 27s-29s price range. The BTS was expecting a strong reversal in the 30s and thus far it hasn’t occurred (on 8/29 an intraday Short signal was triggered at the open and was closed for modest profits later in the day because price action was aggressive enough down).

At this point, the best rule of thumb would be the “3-day rule of thumb” –- basically, look at the high of the first 3 days above 30 (as of day 2 that is 30.81 – after 8/29 we will know). If this high is cleared, then expect the trend to continue higher –- if not, then odds support a top.