ORCL: When the Crowd Commits to the Future — Too Early

Markets are often described as forward-looking, as if they possess some collective omniscience that allows them to neatly discount the future in advance. But that framing gives markets far too much credit. Markets don’t know the future — they commit to narratives about it. And those commitments are made incrementally, emotionally, and often well before outcomes are clear.

Oracle now sits squarely at one of those moments.

The company has become swept into the broader hyperscaler AI narrative, where massive capital expenditure is being interpreted as a down payment on inevitable dominance. Datacenters expand, GPUs accumulate, and the story quickly morphs from investment to assumption: that all of this spending must translate into durable revenue, strong free cash flow, and long-term shareholder rewards.

But commitment is not confirmation.

This is especially true in markets driven by sentiment and expectation rather than immediate cash generation. Oracle’s stock has responded not just to what the company is doing today, but to what the crowd believes those actions will mean several years down the road. And belief, once embedded in price, has a habit of outrunning evidence.

This doesn’t imply that Oracle’s strategy is wrong. Nor does it suggest that AI infrastructure spending won’t eventually pay off. The more subtle question — and the one markets often struggle with — is timing.

When expectations compress years of uncertainty into months of price appreciation, risk doesn’t disappear. It merely changes form. That tension becomes even more pronounced when we look beneath the equity narrative and into the credit market. Oracle is drawing increased scrutiny not because its AI ambitions lack scale, but because the financial strain of pursuing them is already showing up where sentiment tends to be less forgiving.

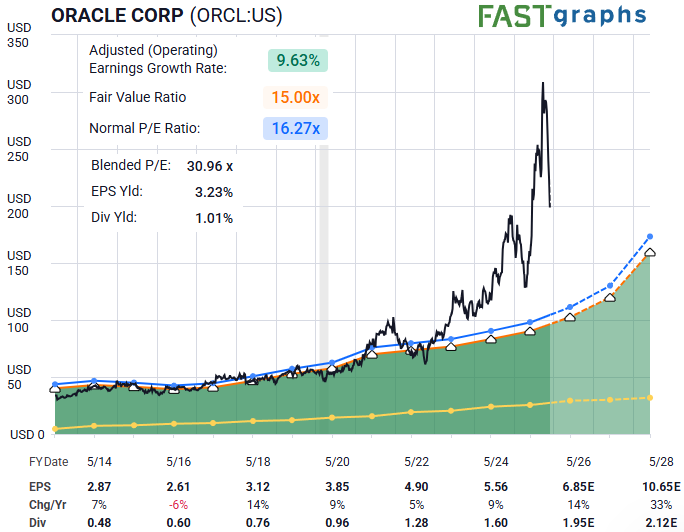

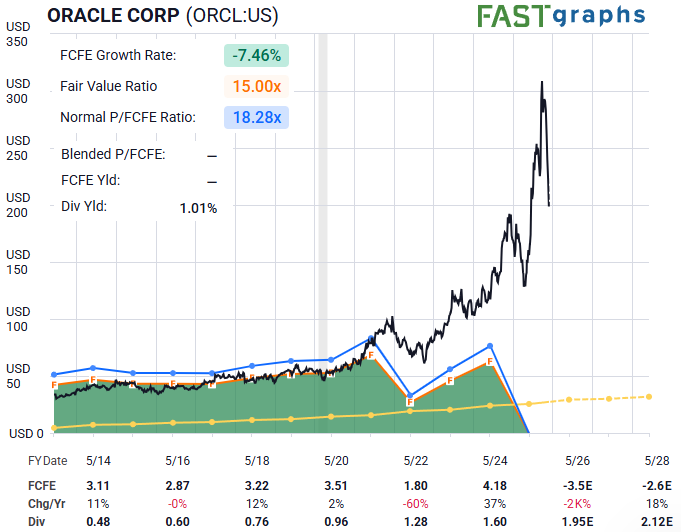

As Lyn Alden recently noted, Oracle’s free cash flow has turned negative — and more importantly, the pricing of its credit default swaps has begun to decouple from broader market conditions.

That divergence matters. Credit markets are not driven by hope or vision; they are driven by repayment risk. When equity enthusiasm and credit caution begin to tell different stories, it often signals that expectations are being front-loaded while financial realities lag behind. This doesn’t mean the strategy fails — but it does suggest the crowd may be committing to the end state of the story before the cost of the middle chapters is fully absorbed.

This is where sentiment analysis becomes indispensable. Not to predict outcomes, but to assess whether the crowd has already leaned too far, too fast — committing to a future that has yet to fully materialize.

Sentiment Speaks

We have an amazing ally on our side — understanding how to interpret crowd behavior via probabilities. What may appear to be unreasoned noise and irrational movement is actually the emotions of the masses playing out right before our eyes via the structure of price on the charts.

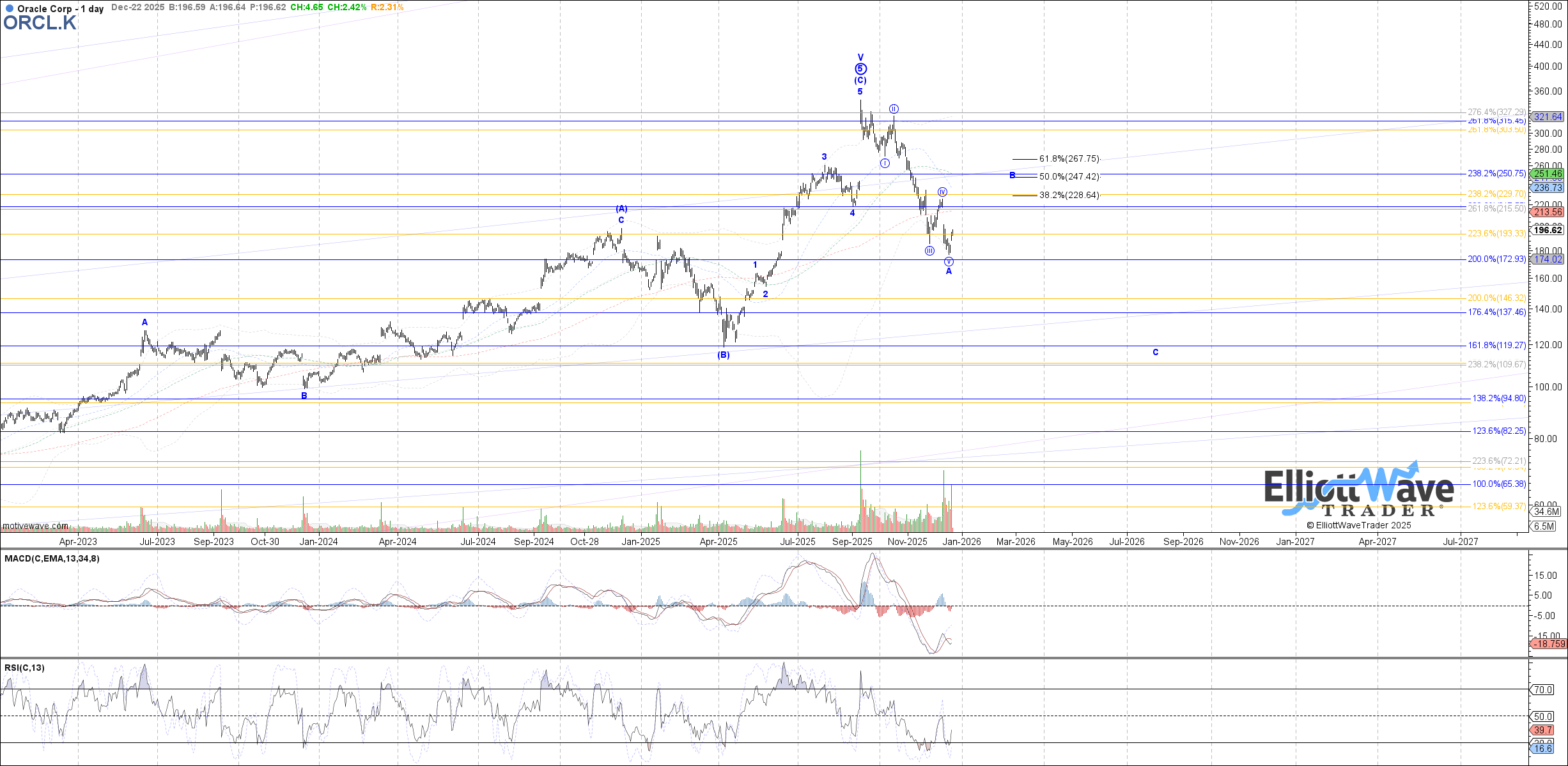

Something key for ORCL has just taken place in that structure. Let’s see this illustrated for us in the price action down from the most recent high struck near $350 back in September. Shares have now seen a price cut of some more than -40%.

However, what is more salient in this picture is “how” price formed this decline. Recall that in Elliott Wave analysis, 5 wave structures are impulsive in nature. This means that they are in the direction of the trend, whether this be up or down.

In the case of ORCL stock, price has formed what appears to be a clear 5 waves down from that last major high. This structure would communicate the likelihood that a long-term peak in price has been struck. It’s a key reversal that will be further confirmed by a corrective bounce, perhaps to as high as the $240 area over the next several weeks.

Thereafter, price would form a smaller 5 waves down and a corrective bounce that stays below the corrective high. A larger picture bearish scenario would then be the most likely outcome and might take price to as low as $125 - $150.

That is the primary scenario that we are currently tracking. Yes, there are other possible paths and it will be the structure of price that either confirms or denies their probabilities.

With Oracle, the question is no longer whether AI matters.

It’s whether the crowd has already decided how the story ends — before the middle chapters have even been written.