Now Backtesting Daily 20EMA…Same Old Or Something New?

In our last KISS report on Sep 3 before going on holiday, we showcased the clear parameters with key levels for the next few sessions, writing:

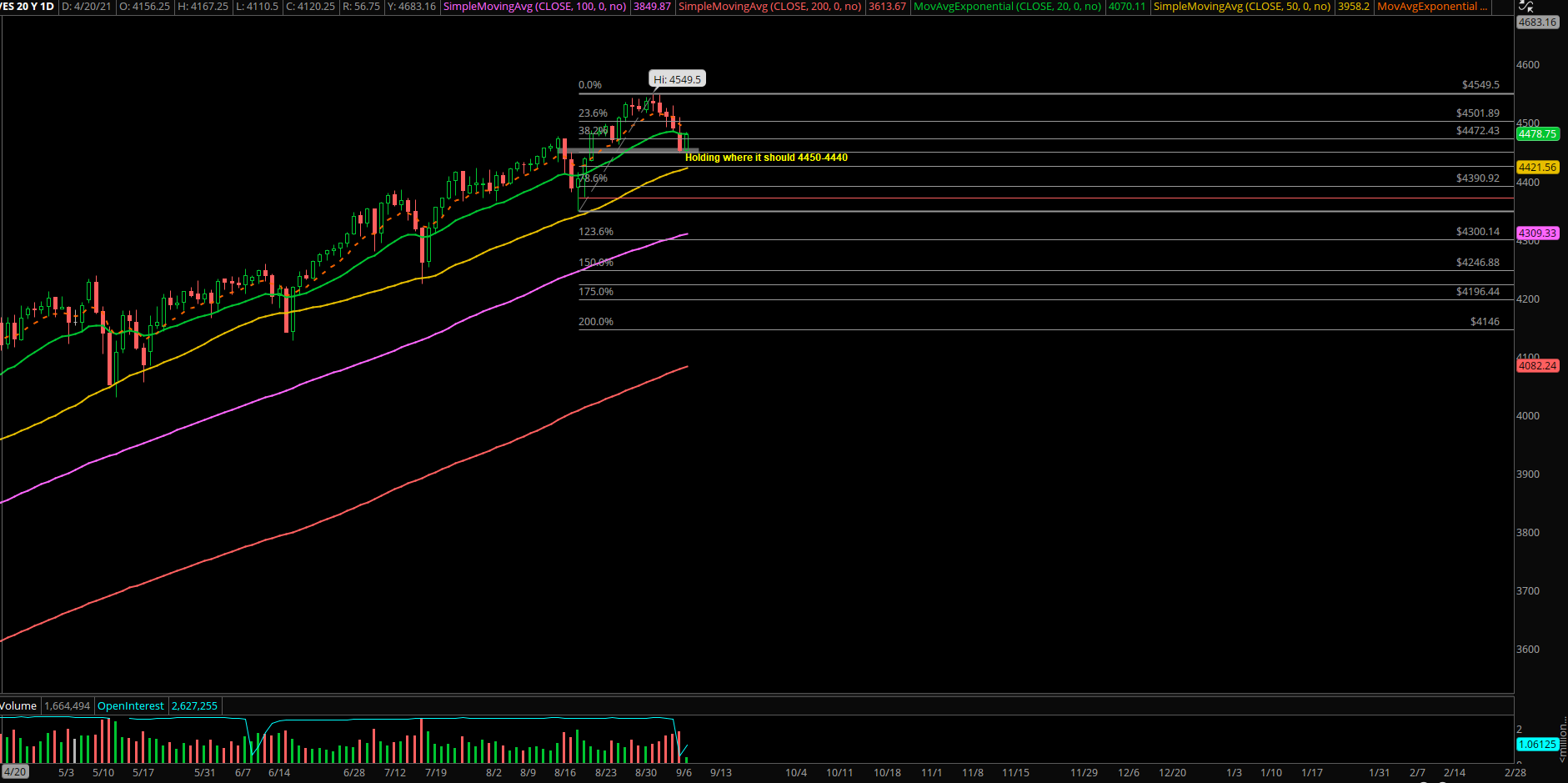

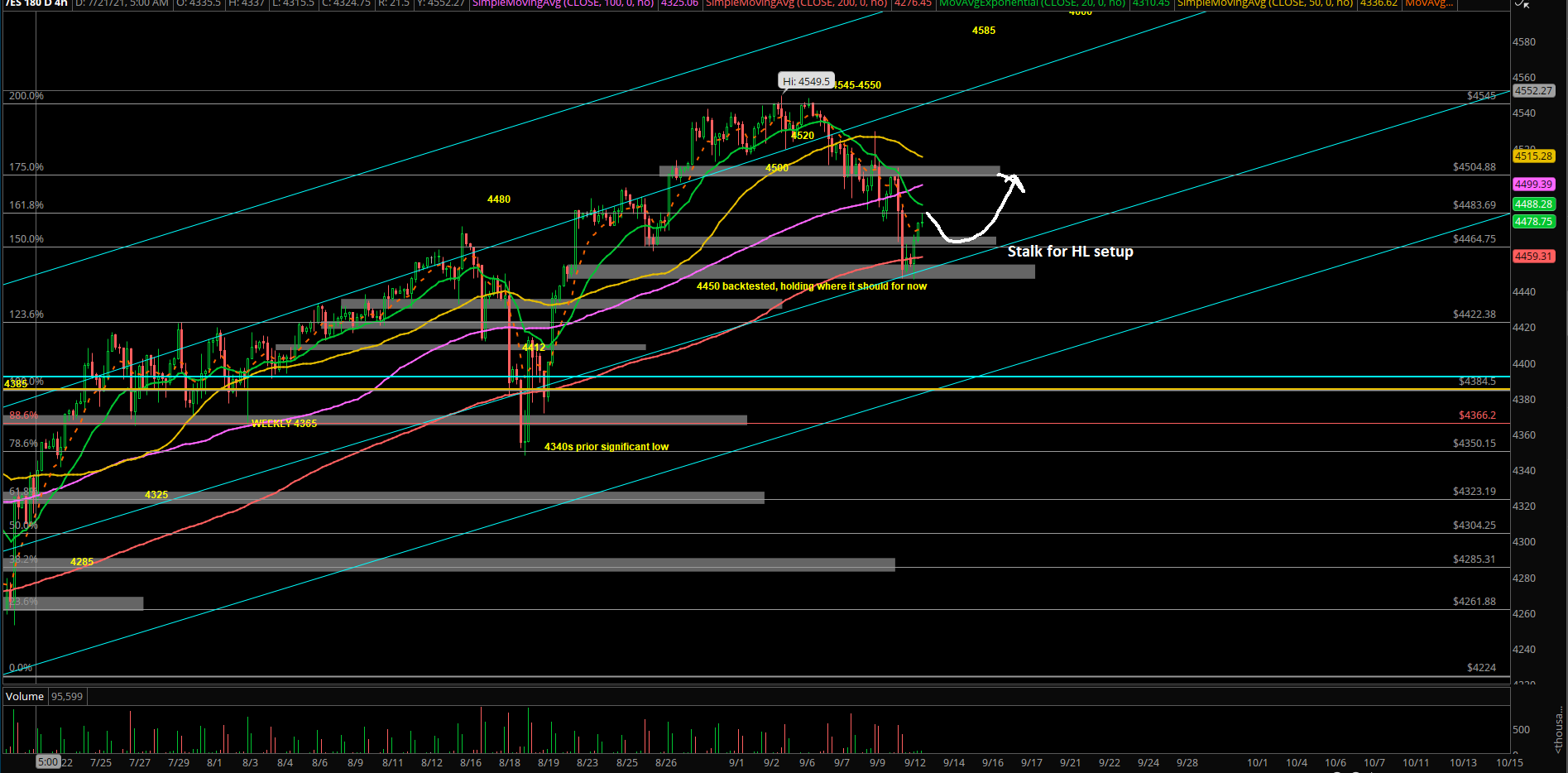

"Overnight price action showing a rejection setup vs the 4545-4550 key targets/area so we’ll need to see how RTH opens. Essentially, as we head into next week, the probability of a downside risk/pullback into daily 20EMA has increased. Bulls would need to get above 4550 quickly and decisively to change distribution pattern.

"ES hovering around 4520s-4540s is not the time to get uber aggressive on the long side in regards to short-term, more about managing risk and maintaining a proper portfolio balance as we head into September. Short-term longs are not as optimal/ideal here given the risk vs reward, we will be trimming more profits for rest of this week and currently actively hedging our overall portfolio."

Quick recap: Price topped at 4549.5 on the Emini S&P 500 (ES) -- now trading in the December contract -- with a multi-low at 4446.5, so we outperformed the market while being away with our prudently hedged portfolio as demonstrated in our ES Trade Alerts service.

Highlights of our plan and thinking for today's trading:

- Treat 4447 vs 4447 as temp bottom/double bottom setup on the daily chart timeframe.

- Both ES+NQ backtested into daily 20EMA with ES overshooting a little more.

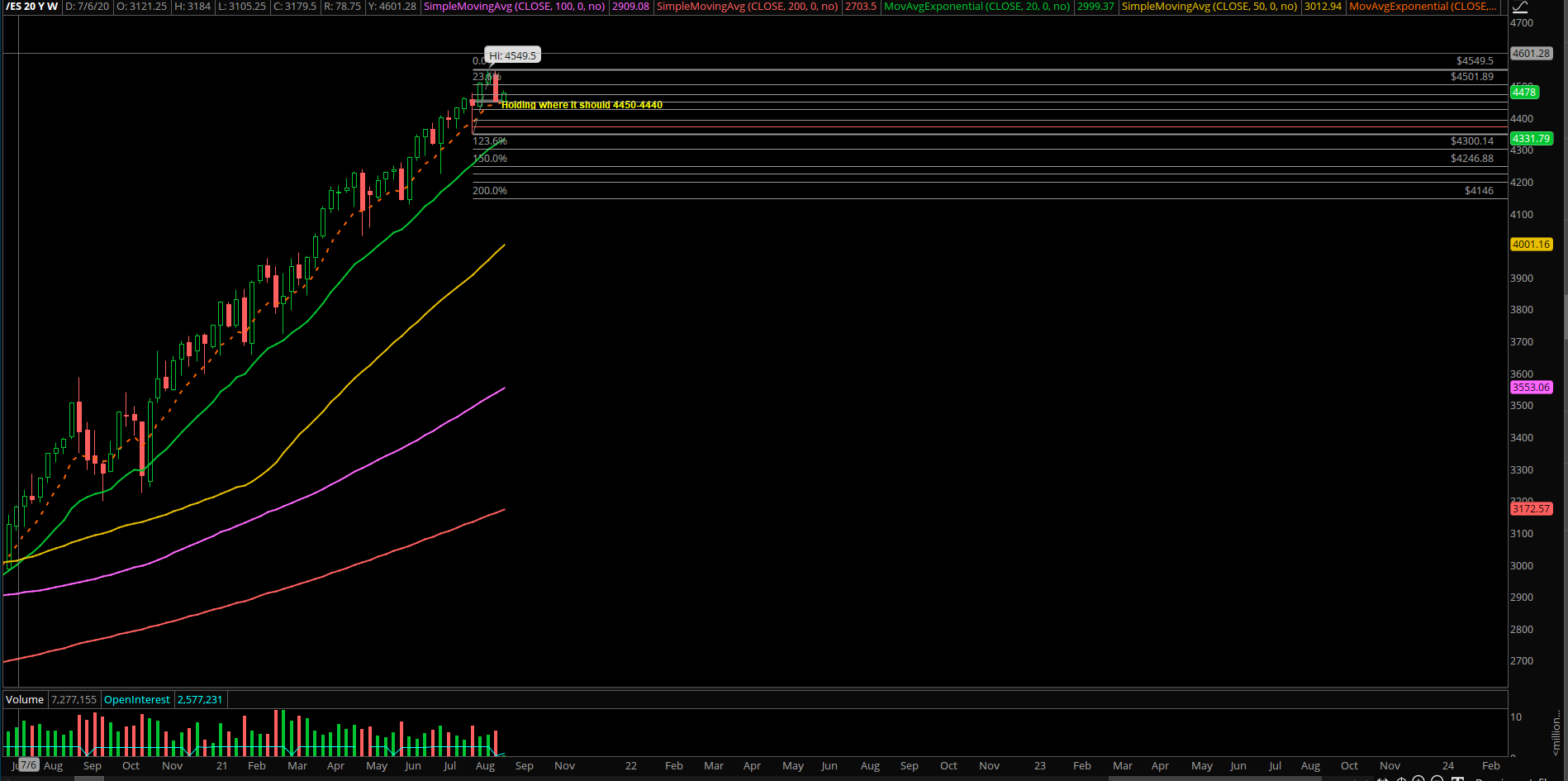

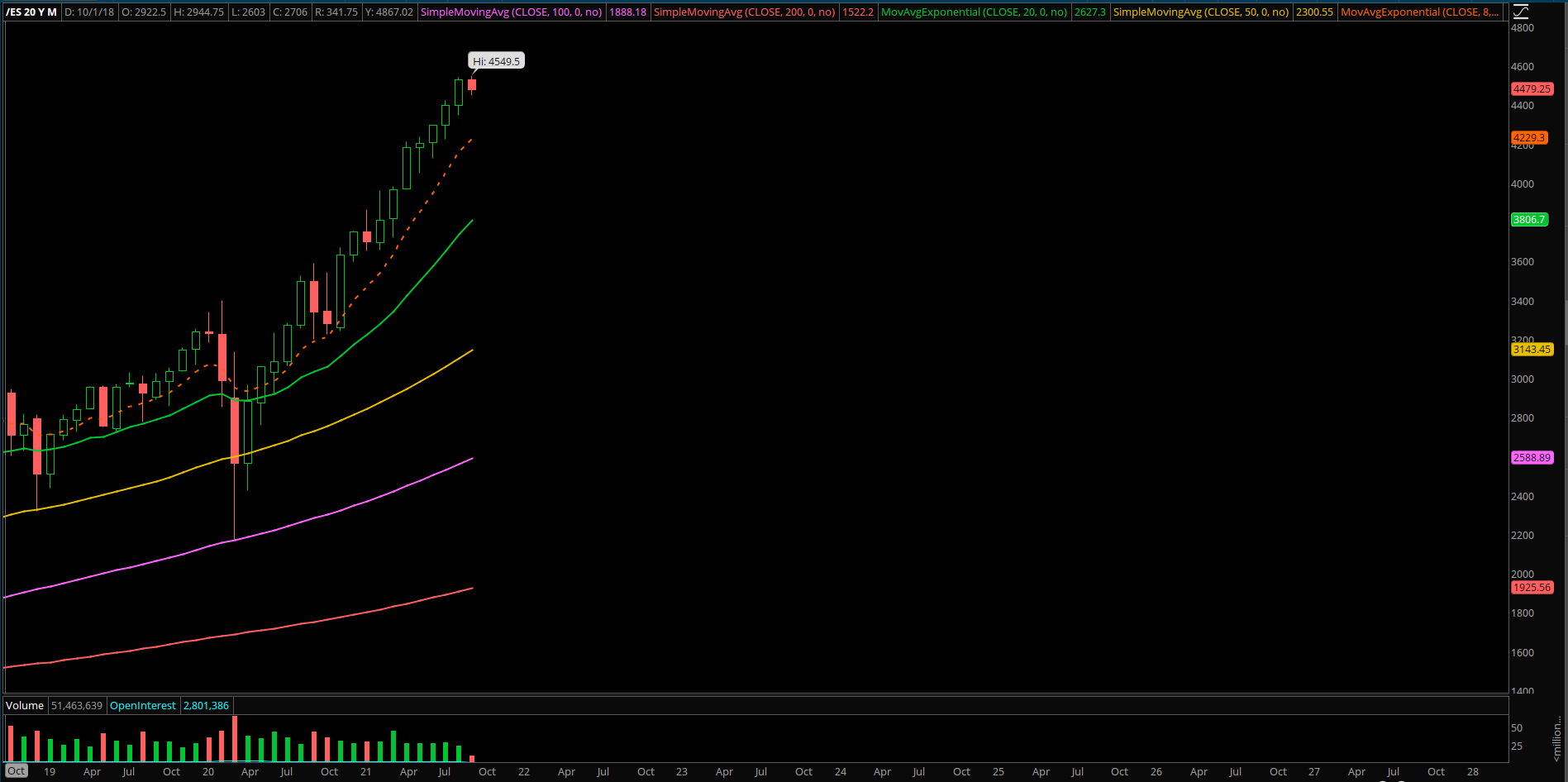

- Typical consolidation and historically weak seasonality stats for S&P 500 in Sept.

- Fun fact, market following the tradition of pulling back into daily 20EMA area when I’m away and then attempting to pump, see if it’s more of the same or finally a surprise.

- Expecting a higher lows formation back into 4492/4500/4512 if overnight low/structure keeps holding. Level by level, if maintains temp bottom then it would build a multi-day low again.

- Failure to hold puts the whole market at risk, more downside levels at 4435/4440/4375.