Nothing Immediately Bullish YET

Yes, I am still looking for a bit more downside before we begin the next rally because I really am not seeing anything immediately bullish in the smaller degree structures. Yet, I am trying to keep an open mind.

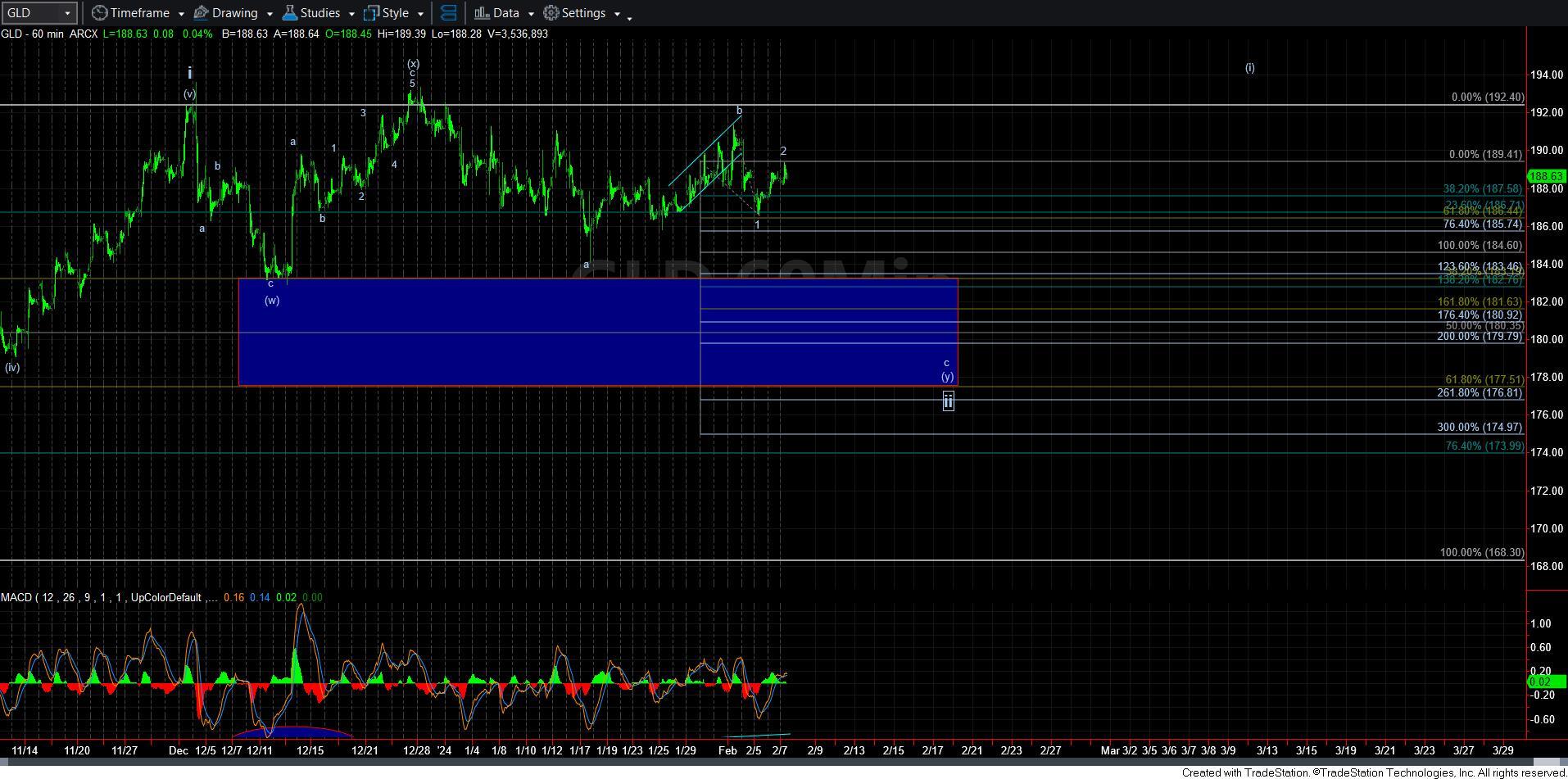

Starting with GLD, while some may want to classify the rally off the low this week, the only way to do so is as a leading diagonal. And, to be honest, I am not even considering that potential at this time, as the last decline actually counts better as a 5-wave structure. Therefore, I am going to view this as a 1-2 downside structure until we are able to invalidate it by a move over last week’s high.

Should this structure break down below 186.65, it opens the door to drop down to the 180 region, and if we see strong extensions, then we could see the .618 retracement region in the 177 region. I simply have no strong immediate bullish structure to otherwise rely upon as long as we are below last week’s high. But, again, please also focus on the daily chart, as it is a very bullish set up in the larger time frame, even if we get one more spike lower to complete a deeper wave ii.

In silver, you can see from the 144 minute chart that we are continually following the top of the former downtrend channel as we move lower, but are still holding over it. And, on the 8-minute chart, we are sitting quite precariously over a micro pivot. Should that pivot break, then our next lower target is the 21.60 region, and I don’t think that wave [5] in purple will necessarily stop there. With extensions, there is potential to drop all the way down to the 1.00 extension off the highs in the 20.18 region. But, we are going to have to take this one step at a time, since the overlap has made this exceptionally complex.

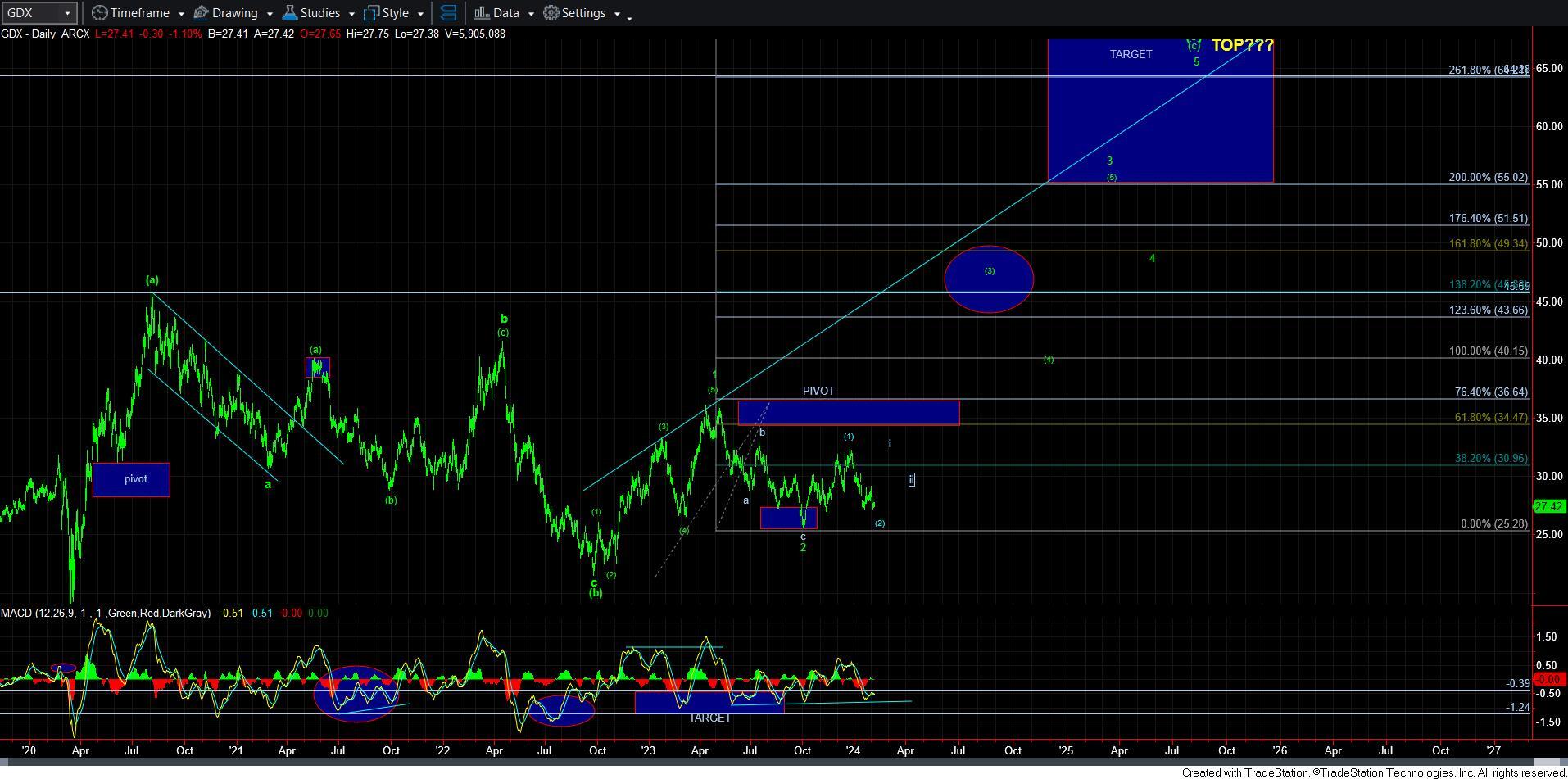

GDX still has no indication that it has yet bottomed, as NEM is still likely holding it back. The one thing I can point towards on the GDX chart is the nice positive divergence evident on the daily chart. But, I still want to see an initial 5 wave rally for wave i before I am ready to go on a "break-out-alert." This has a lot of catching up to do.

So, for now, I am still looking lower until we see initial signs of bullishness. The greatest potential still can be seen in silver as it is still just barely holding on to a potential 1-2 off the recent low, yet I am not seeing any strong bullish evidence in the micro pattern suggesting an imminent follow through to the upside.