Nothing Has Really Changed In Metals

With the metals pushing a bit higher today, based upon the comments and questions I am seeing, many are turning rather bullish. So, I thought it would be appropriate to write another quick update to our membership.

While I can certainly understand the bullish “feelings” based upon the price action, I want to remind you of a few things.

First, as we came into this week, I noted that I was going to take a cautious stance until I see how the next retrace in the market shapes up. As we began moving through the week, it became clear that GLD was NOT going to provide us with a 5-wave downside structure. And, I immediately sent out an update highlighting that we did not have to worry about a strong likelihood for a long-term top to have been struck in the metals complex.

However, that does not mean that this pullback/correction has been completed. I still think the greater likelihood is suggestive of another leg lower before we consider this pullback complete.

But, as you know, since we really do not have a bearish case to worry about (at least from a probabilistic perspective), it is within the realm of possibility that we can see a direct break out with the last lows providing us all the retracement we see. Again, this is not my primary perspective, yet I will outline what will have me view the probabilities for this potential as much greater.

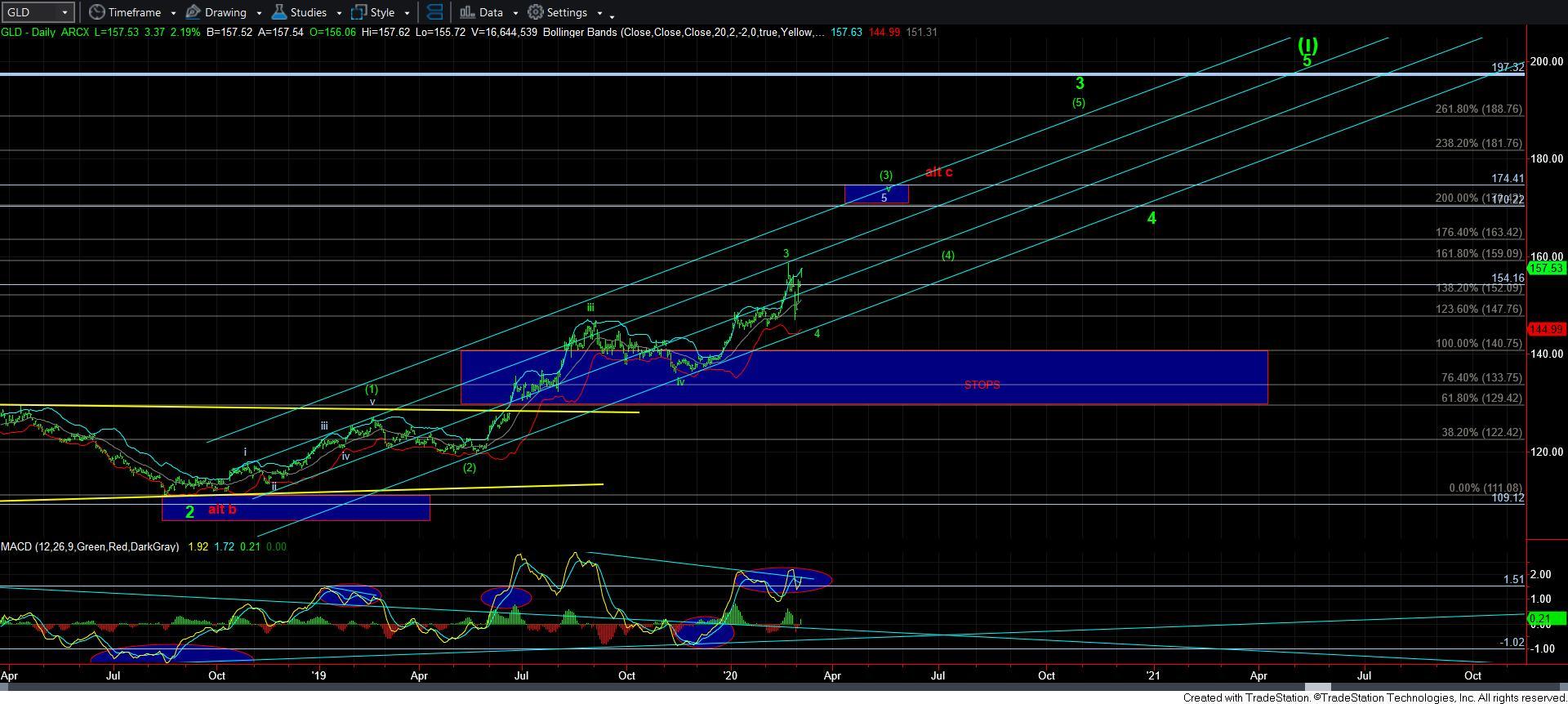

In looking at GLD, I warned you over the last two days that we had a micro set up which can take us as high as the 159-160 region, and still remain within the b-wave structure. Moreover, if you look at the daily chart of GLD, we are now at the upper Bollinger Band, which should provide some resistance and slow us down. But, as long as we remain below the 159/160 region, I still maintain a primary perspective that we will see a c-wave down in this wave 4. However, if we see a move through 160, I will have to set our sights on the 170-74 region sooner rather than later.

In GDX and silver, we are still within our resistance zones. So, again, nothing has really changed just yet, but the action at least should provide us with taking an alternative count in consideration. But, the market has a lot to prove to suggest that we are finally ready for that heart of 3rd wave in GDX and silver, which should LEAD in the next major rally phase in the market in order to catch up to the GLD count.