Not out of the woods yet, but this CHOP is clearing some trees.

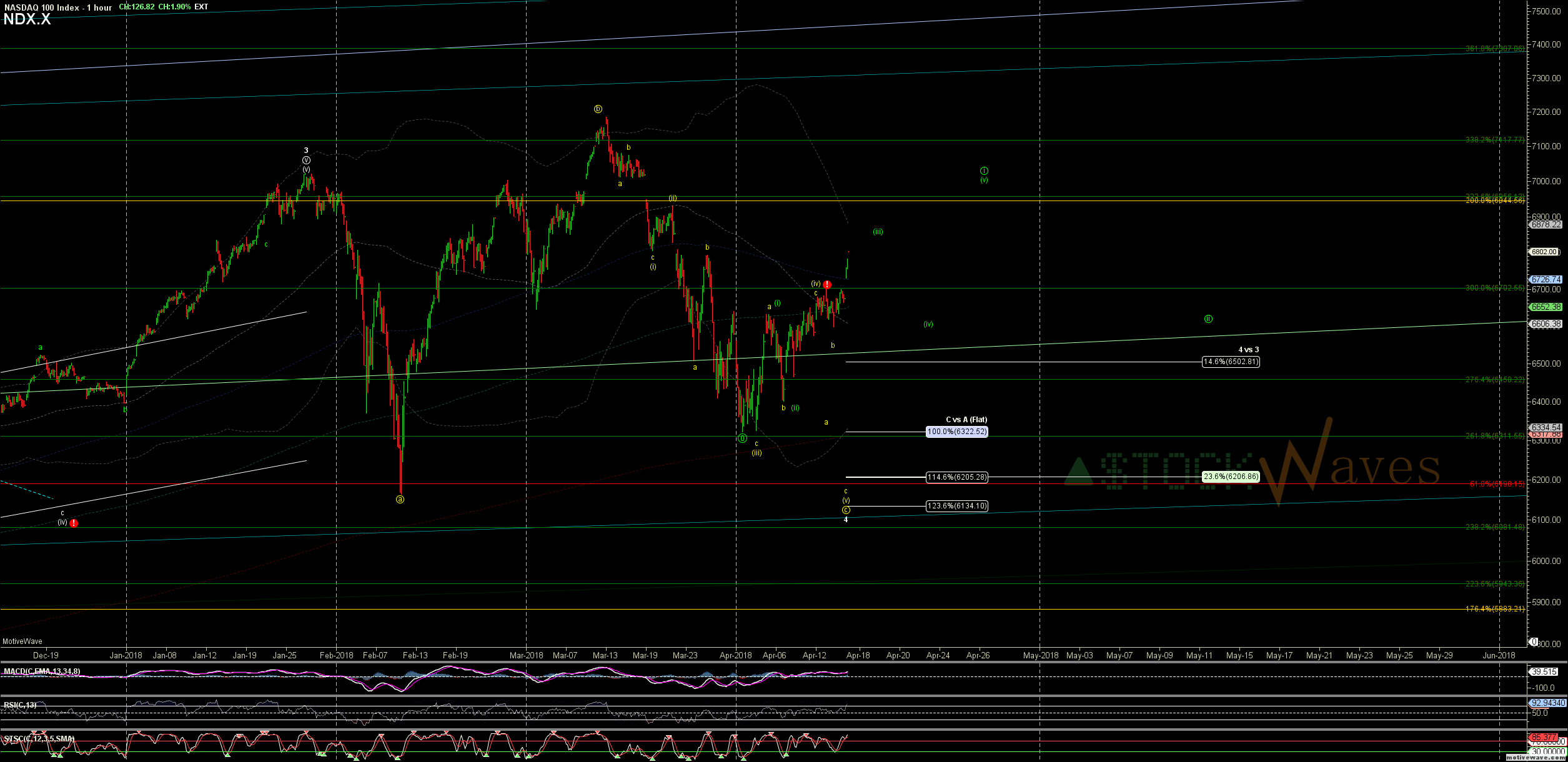

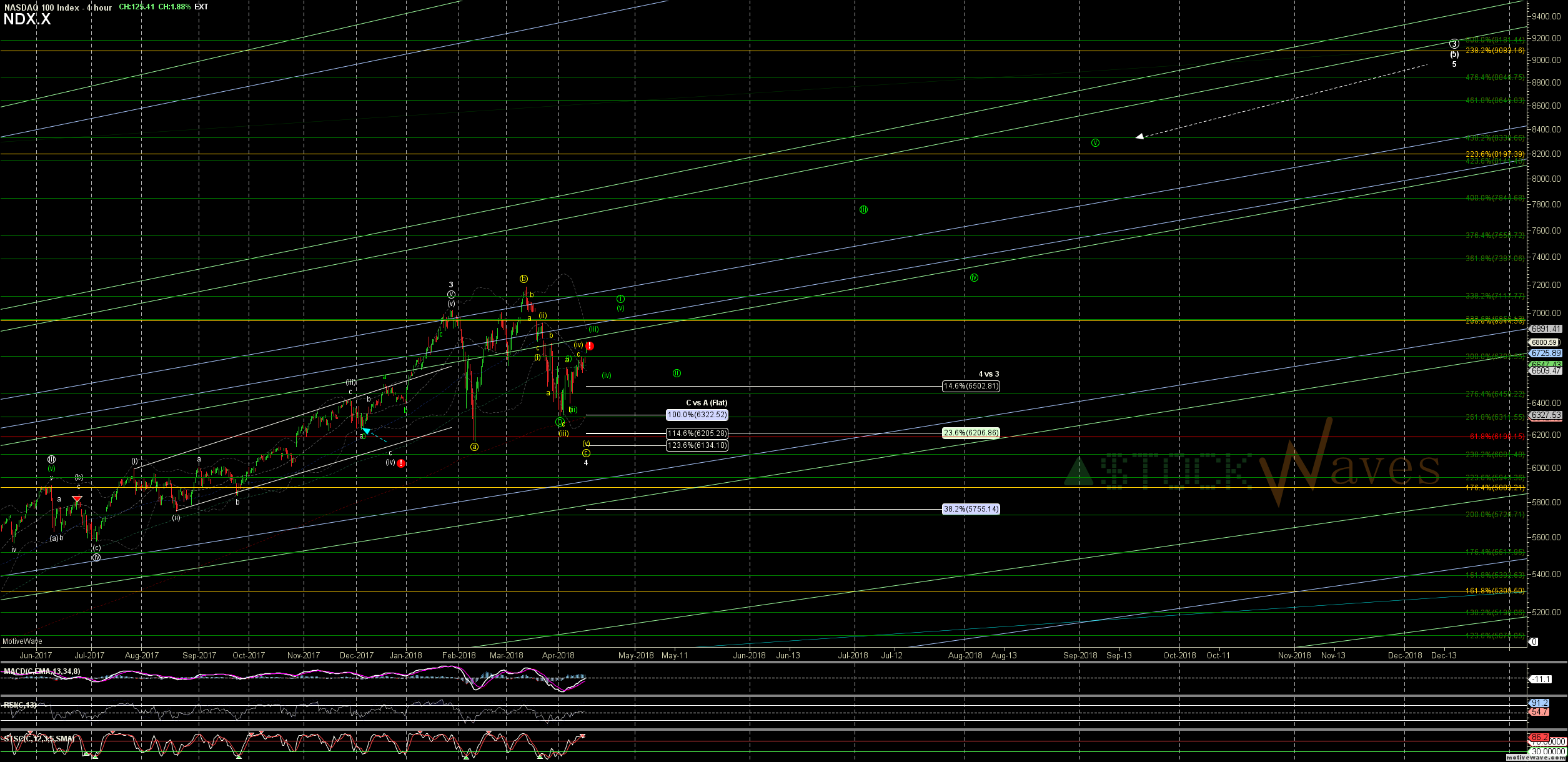

NQ pushing further past 6762 now makes this less likely as a (iv), though still possible. The green LD we have been tracking in ES and also AAPL & MSFT among other in StockWaves works in NDX, but interesting to note this projects a more muted 5th than previously expected. (not b/c it is an LD, but b/c of its size).

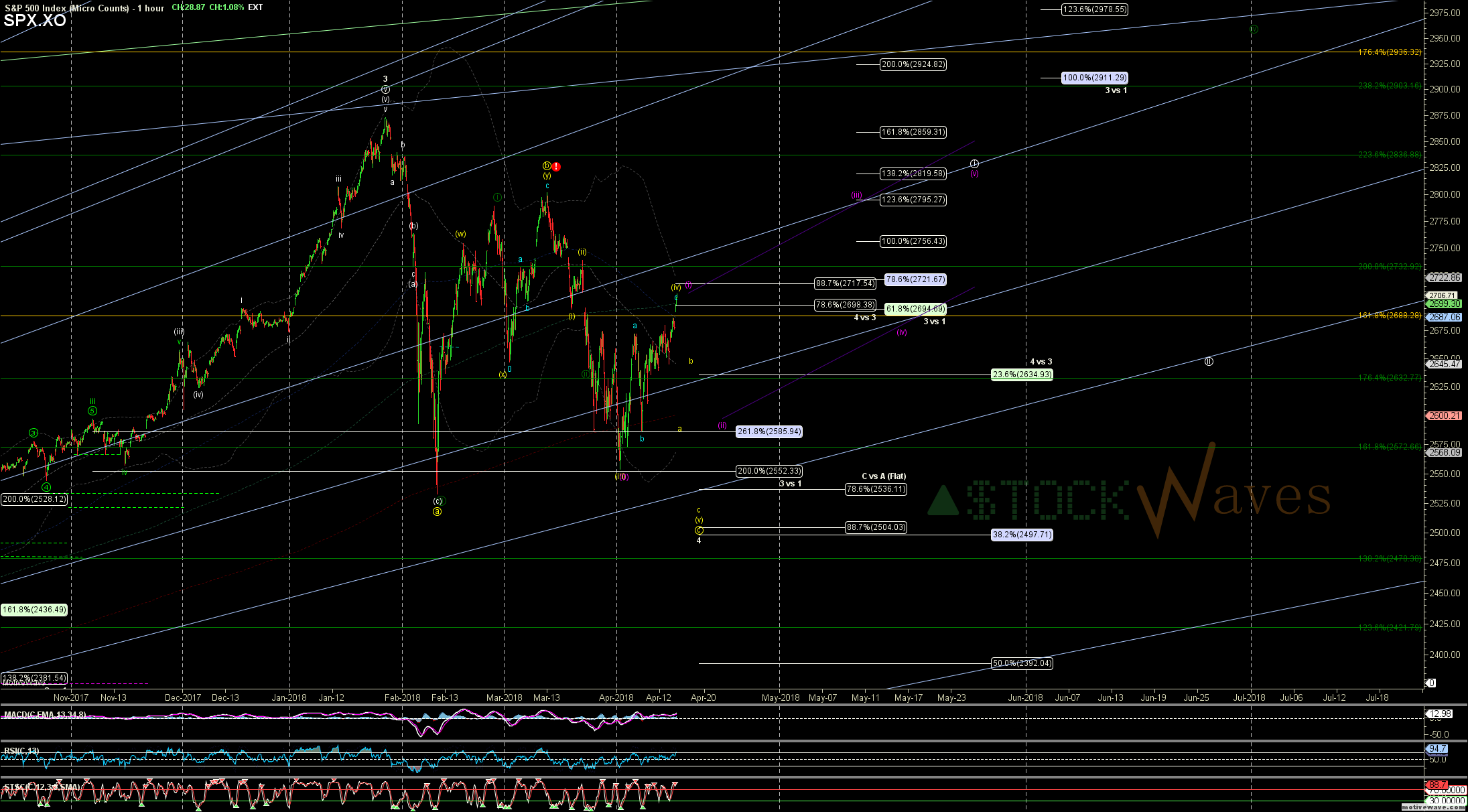

The purple larger LD mentioned in SPX the other day could easily be applied to the NDX/NQ charts and then if this is only completing abc up for (i) of a larger circle i the previous NDX targets can still be reached.

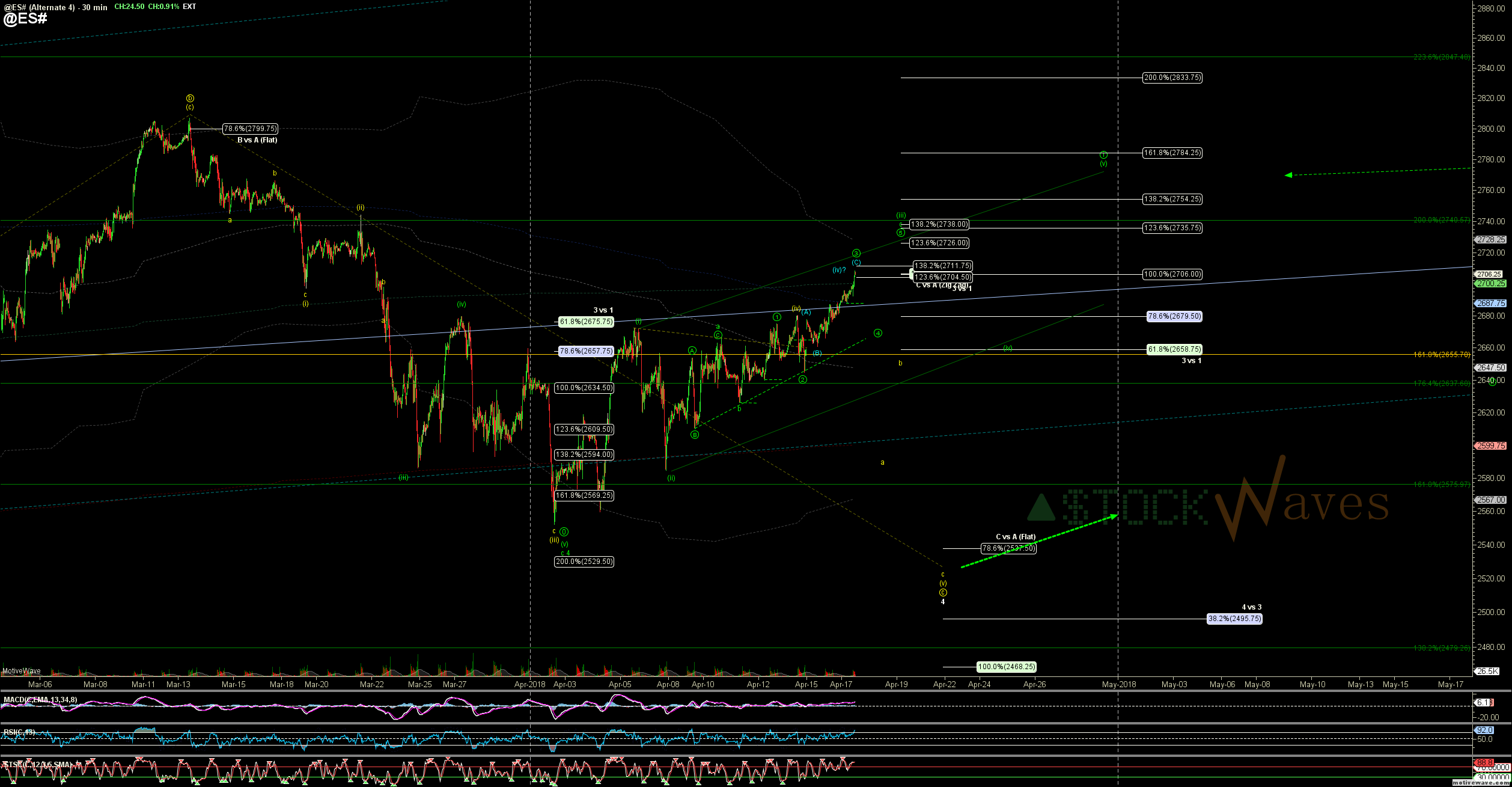

The green LD in ES though still fits within the expectations of the original wave i of 5 so no "worries" there viz. a more muted 5th, but the larger purple LD would also give MANY of the charts and sectors like XLF the ability to make or at least still attempt final drops.

ANY structure down from here should be initially corrective EVEN if ultimately attempting a new low and the SAME support regions should get tested and provide bounces before possibly being broken. So watching the structure and supports is important for both warnings of breaks and setups for next longs.