Not What I Wanted To See

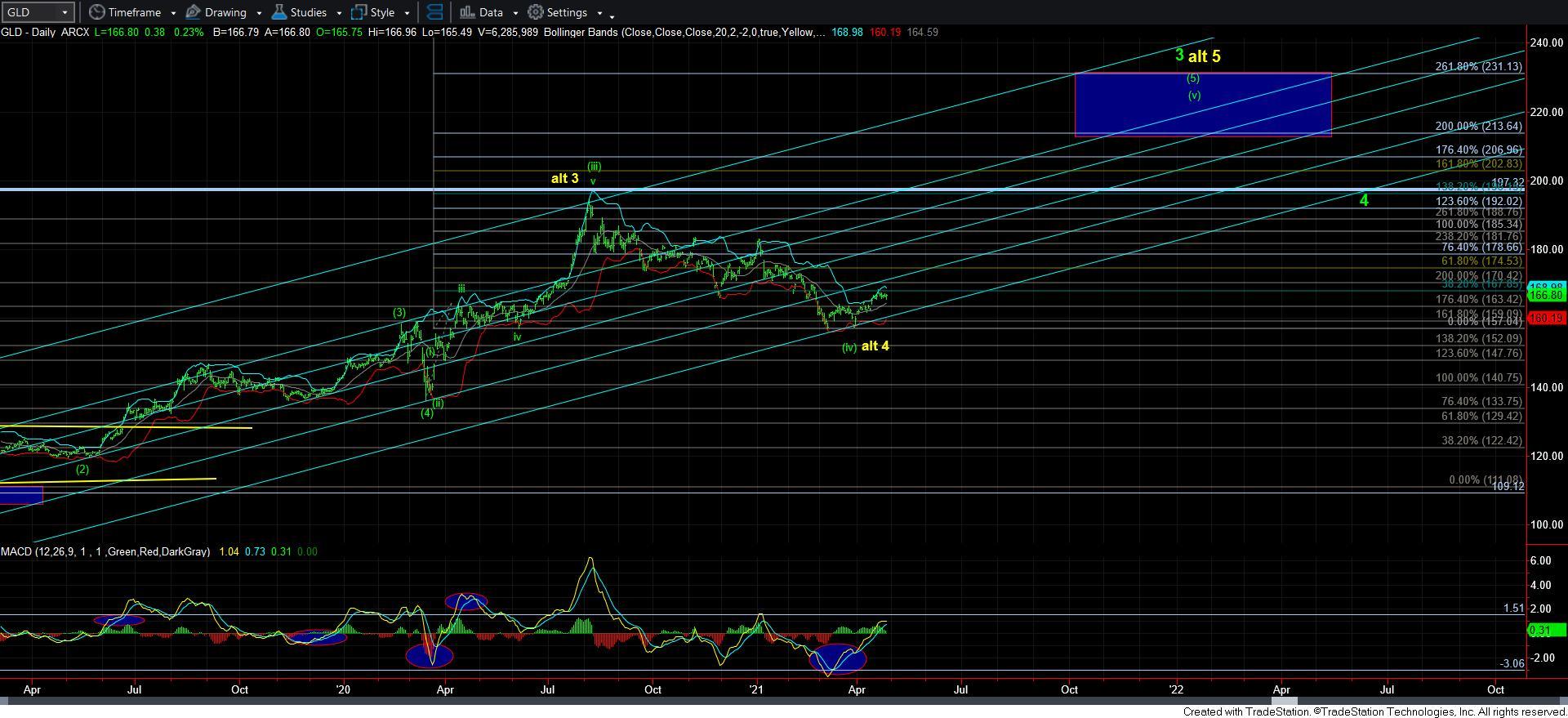

Believe me when I tell you that I am just as disappointed as you are with the action in the metals. While the bullish count is certainly not dead, the fact that we could not complete a standard impulsive Fibonacci Pinball structure is quite disappointing, and does leave the door open for a lower low in the complex still.

As you can see from the 8-minute GDX chart, we broke the support for the ideal impulsive Fibonacci Pinball structure, which has only left us with a leading diagonal as a possible 5-wave structure off the lows. And, for those that have followed my work over the years, you would likely remember that I do not trust leading diagonals as trading cues, at least not until they actually complete and provide us with a further 1-2 structure to suggest that wave iii has begun.

The main reason is because they look almost exactly like a corrective structure, and it is not easily discernable to determine which path which eventually play out. For this reason, I will likely add some protective puts as hedges in GDX until we can exceed the high of wave [iii]. Until we have a full 5 waves up now, I am more concerned today than I was yesterday regarding a potential lower low in the complex. Without a standard and reliable Fibonacci Pinball structure, the potential for that lower low has increased with today’s action.

In the micro structure, GDX would “look best” with one more lower low to complete the c-wave of the bullish wave [iv] count. If we get through 36, then I will be cautiously looking for that higher high in wave [v], but will be treating my own account protectively until we make that higher high.

By the way, there are other options for hedging your account, if you even choose to do so. You can always wait for the market to bounce, and if we then break below the low we create in this region after the bounce, you can always hedge at that time, for that likely means we will not achieve that higher high. Remember, there are many ways at approaching the market, and there is no one size that fits all. In fact, many members would not even attempt a hedge for a lower low, and just use it as a buying opportunity, which is also a very reasonable approach.

And, to be honest, GLD is presenting the same way.

Moreover, it also means that silver may still get that bigger alt iv, which I had previously taken off the chart. But, it is now back where it belongs.

So, while this is not the action I wanted to see off the recent lows, the bullish potential has not completely broken. But it certainly has affected my view of the probabilities it presented as of yesterday.