Not Much To Add On Metals

I wish I had some outstanding insight to be able to add to my weekend analysis of metals, but since it was rather detailed, there really is not much more I am able to add at this point in time.

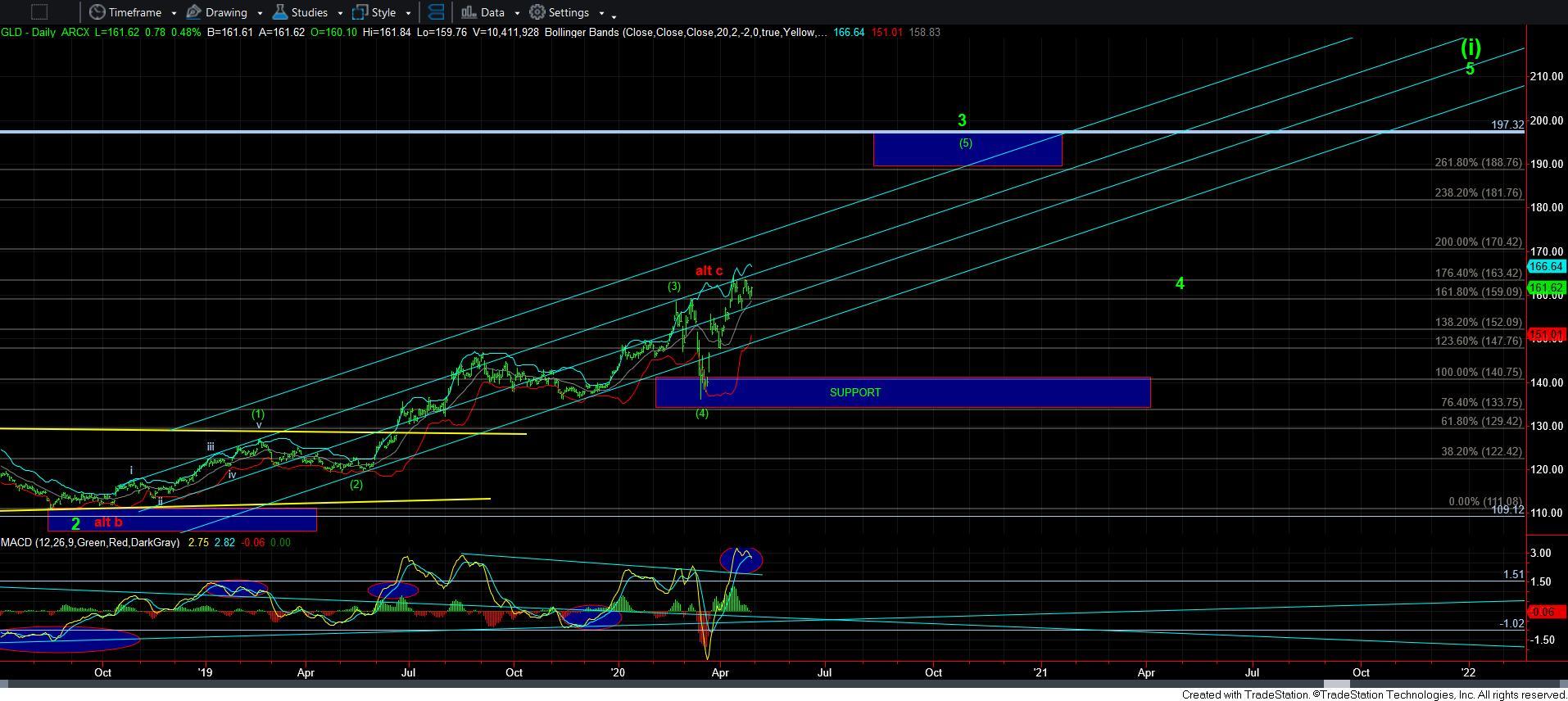

Both GLD and silver still remain set up for their respective c-waves down as long as we remain below last week’s high. So, nothing has changed there.

As far as the miners, they are simply consolidating as one would expect for the ones that have broken out already. But, this does lead me to able to add one point.

Keep in mind that when a chart breaks out in a 3rd wave, we often do not see large pullbacks. The manner of a 3rd wave is a gap up, high consolidation, followed by another gap up, and it continues until it reaches its intermediate targets. This pretty much explains what we are seeing in those mining charts that have broken out. So, as long as we remain over the break out points, there really is not much else to expect in these charts until they reach their next targets.

But, I do want to caution anyone who is attempting to micro trade in the heart of a 3rd wave. If you intend on getting out while expecting a pullback, you may be left at the station as the train goes on without you. When a metals chart is in a 3rd wave, you should be focused on adding on consoldiation/pullbacks, rather than trying to micro trade them. So, this is probably the most useful information I am able to provide in this mid-week update.

So, while I am still expecting some weakness in the near term driven by the GLD and silver c-wave’s, I would view this as an opportunity to add to your long positions. And, should GLD and silver break out over last week’s high sooner rather than later, then we may not be seeing much more in the way of pullbacks for some time.