Not Much To Add In Metals

Over the weekend, I highlighted that the bulls have everything to prove based upon the potential failure of the larger impulsive structure. And, I still feel that way, especially having reiterated the two main issues I have had with the last bottom many times over the last several weeks.

In fact, I will be using this bounce to be adding more protective puts over the coming week – should I be around to see that opportunity.

You see, as I noted over the weekend, unless the bulls are able to break back out over last week’s high, the structure has developed in such a manner which has significantly increased the potential for a lower low in GLD and GDX. And, for this reason, I will add protective puts on bounces, with stops at last week’s high.

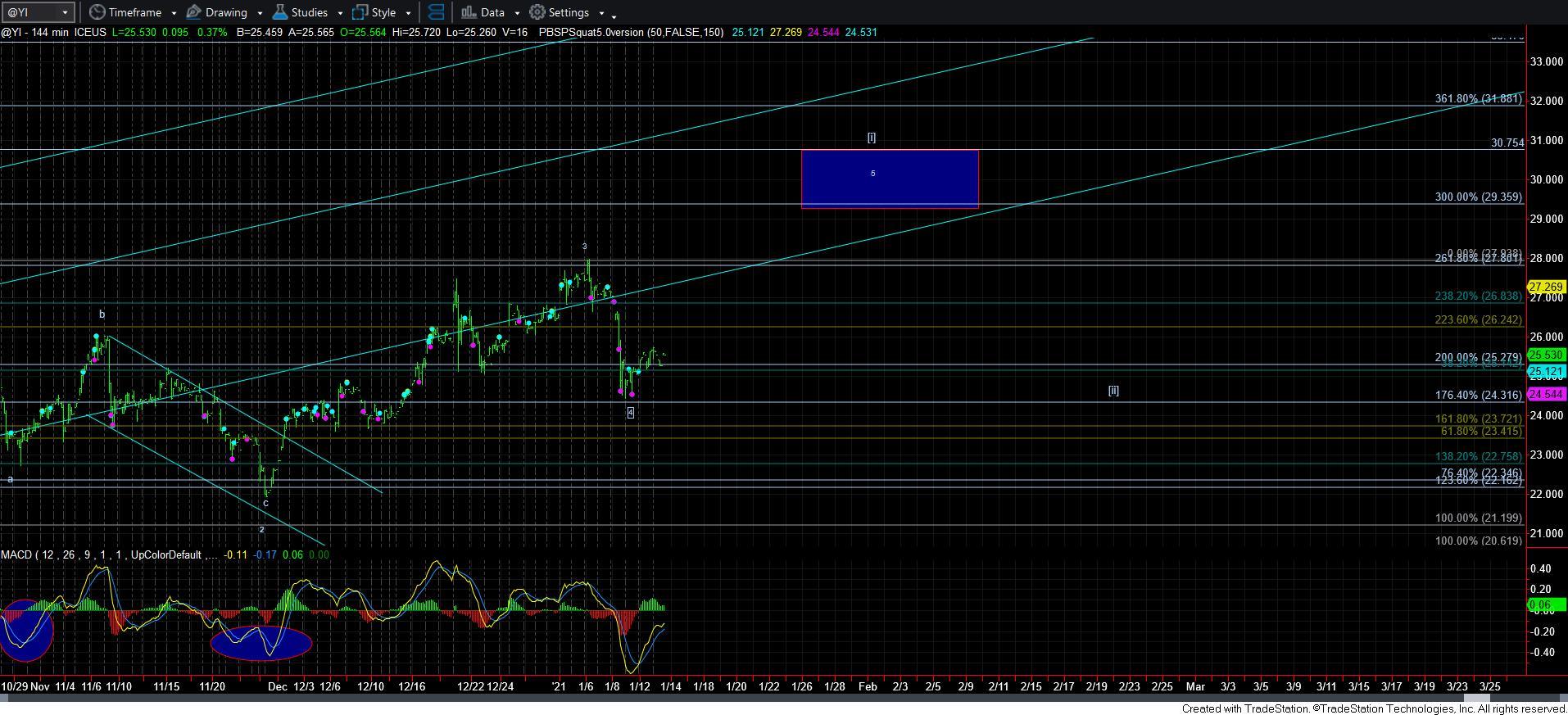

But, I will note that silver still retains strong potential to complete a leading diagonal AS LONG AS WE HOLD OVER LAST WEEK’S LOW. Should silver break that low, it opens the door to drop to the 20/21 region, but it may not be in a direct fashion.

There is no question that the action we have seen since the highs struck in August/September in the complex that this overlapping decline has been difficult and has tested everyone’s patience. And, unfortunately, we may still see further lows unless the market can take out last week’s high. But, overall, my bullish expectation for 2021 still remain. We are simply patiently waiting for the market to make it clear that this multi-month pullback has finally run its course.