Not Much Has Changed

I wish there were further insights I could provide on the larger degree perspective in the metals complex, but much of the action thus far this week suggests that at least one more lower low is sitting out there. In other words, I do not have a break out over resistance, nor do I have a strong impulsive structure upon which I can rely which will take us over resistance.

Rather, after the GDX provided us with a 3 wave rally right into the heart of our resistance, it has dropped in what can be counted as a 5 wave structure down from that resistance. Thus far, the rally back up off that low this week seems quite correction. This leads me to believe that we have begun a 1-2 structure to the downside, which is likely targeting the 17.10-17.65 region. While I am uncertain if wave 2 has already completed, as long as we remain below this week’s high, this pattern will remain intact and pointing to a lower low.

Once we do strike that lower low in GDX, it CAN complete this entire correction, but I will need proof of that with an impulsive rally seen off that low. You see, the next lower low can complete a c-wave in a y-wave in this wave ii, which is less common than the standard a-b-c structure we follow. In fact, that standard a-b-c structure would classify that lower low as wave iii in the c-wave, as presented in yellow, with the rally off that low only being a 4th wave. But, that is only if the rally is corrective off that low. So, in other words, the next low CAN be the final low, but it will have to prove itself. And, NEM is exactly in this same position as well.

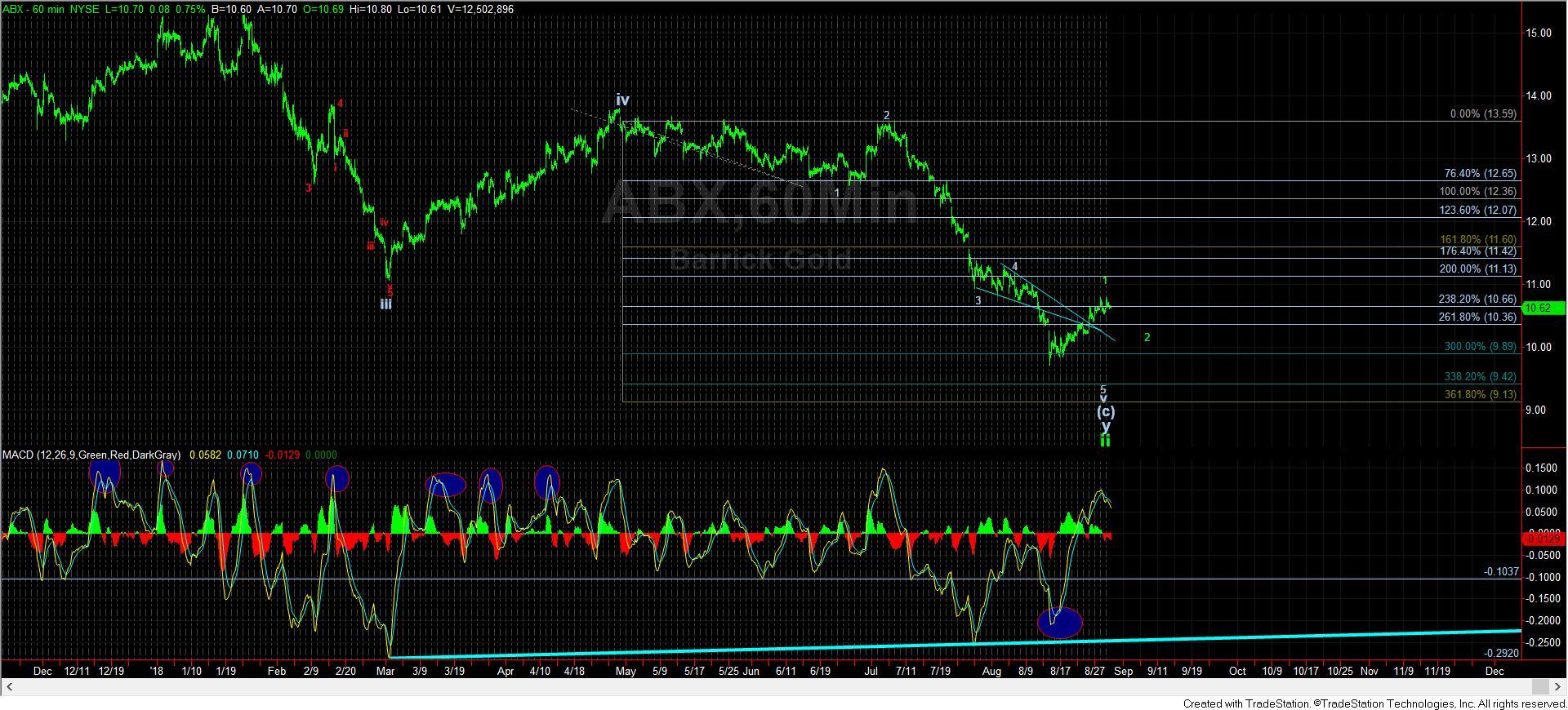

Yet, there are some miners in the complex which may have potentially bottomed, and may have completed 5 waves up off those lows. The ABX is one with such potential. But, clearly, we will need to see a corrective retrace, followed by a larger degree 5 waves completed to the upside, and then we will have a confirmed bottom in the ABX.

As far as the GLD is concerned, I am not convinced that it is set up to make a lower low, as the drop off this week’s high does not look nearly as impulsive as the GDX. Rather, this drop really only looks like a 3-wave structure, which suggests that this drop in the GLD may only be a b-wave in wave 4. Moreover, I still have no indications that a lasting low has been struck in GLD just yet.

And, as far as silver is concerned, it counts best as a micro 5 waves down off its recent highs, and as long as we remain below this week’s high, then the 14.25 region is the minimal downside target. But, I cannot say that I am confident about the drop this week being a 5-wave structure, as it is not wholly clear even on the 5-minute chart.

At the end of the day, I still have nothing to hang my hat onto which suggests the final low has been struck in the complex, as a whole. Rather, there are some miners which have strong potential for having bottomed, but they, too, have to prove that over the coming weeks. Yet, please do take note that the daily charts are starting to repair themselves, and we are starting to see positive divergent setups developing, which warns us of a bottoming structure now being developed. So, the market is preparing itself as it is ripe for bottoming over the coming weeks.