Not Clear, But Letting The Bulls Run

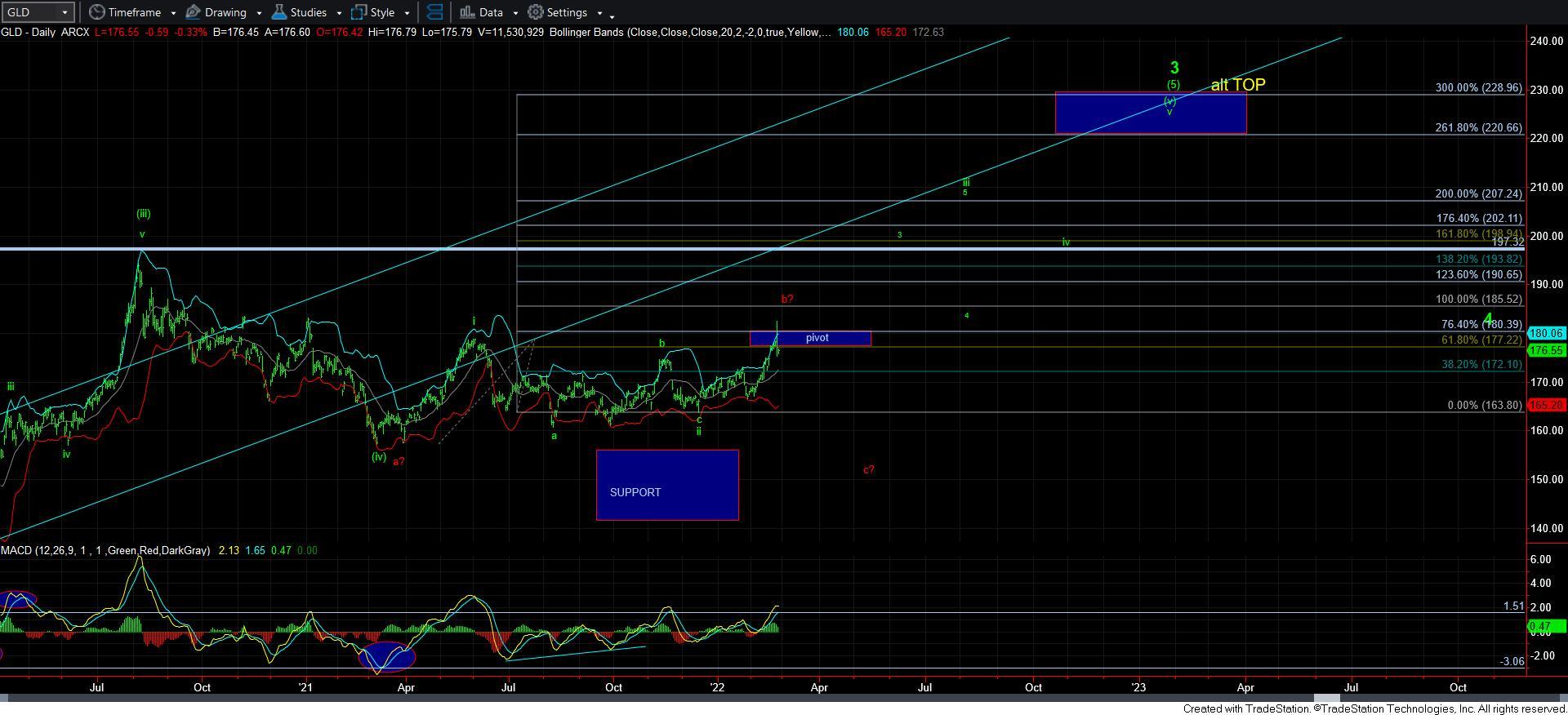

In the last several months, I have twice attempted to hedge my long positions in the metals complex, and each time, they have been stopped out. At this time, I have no reason to do so again, despite the lack of clarity in the bullish structure with which the bulls have been pushing the metals higher. And, as long as the support I cite below continues to hold in the coming week, then I will simply allow my long positions to run.

I think the clearest smaller degree structure is in the GDX chart. I have included an 8-minute chart in this update to show you the corrective pullback potential I am seeing. But, I have to say, I would not consider this potential as a high enough probability to trade it aggressively.

As you can see on the 8-minute GDX chart, there is potential for an [a][b][c] consolidation in GDX before it continues to march higher. And, as long as we hold the 32.90 region, then I will continue looking higher. In fact, if we see a 5-wave [c] wave which projects to bottom at the 1.00 extension target in the 32.90 region, I may even consider an aggressive short term long trade, to which I would add if we get a 5-wave rally off that support.

It would take a break down or a projected break down of that support for me to consider hedging my positions again. But, for now, I am going to keep looking higher, even though I cannot say that I have a strong pattern with which to work on the bullish side of the market just yet.

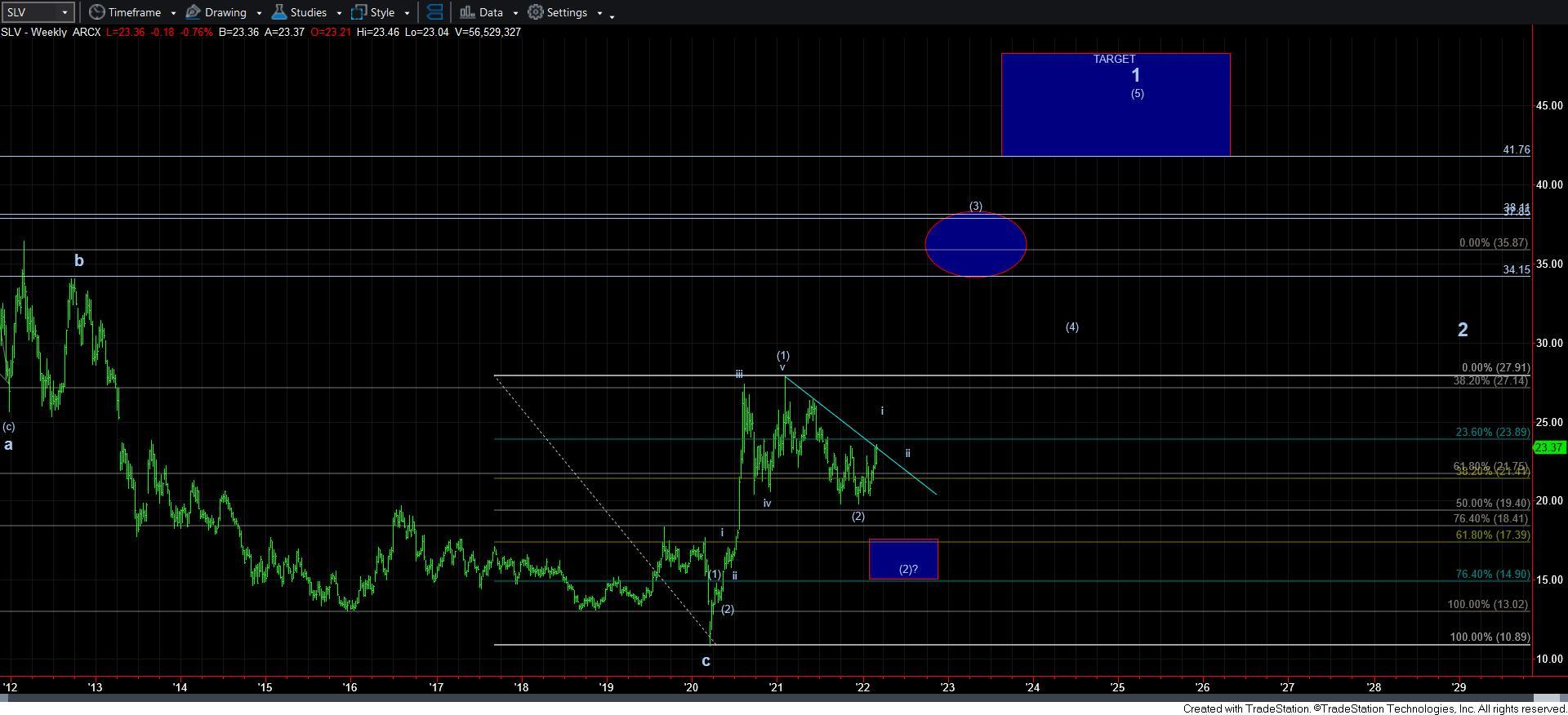

Now, I have to be honest with you when it comes to silver, and I do not have a reliable micro count to present to you. The overlap we have been seeing in the rally still has me concerned, but I do not have a break down potential set up in place yet for me to get immediately concerned. The best I can come up with is a leading diagonal off the December 2021 lows, which still is not yet completed, as we would still need to push higher before that leading diagonal completes wave i of wave [3], as you can see on the attached weekly SLV chart.

In the GLD, I can make out the same potential pullback structure as presented in GDX, which would target the 173 region in GLD. Again, I cannot say this is a high probability count which can be traded aggressively, but it is certainly a reasonable expectation. But, as long as we hold the 173 region in GLD, I am going to continue to look higher in the coming weeks.

For now, I still do not have a high probability count upon which I can rely for more aggressive trading on the long side in the metals complex. I am personally just riding my own long positions at this time for as long as I do not see anything concerning suggesting we could see a break down set up. And, as long as we hold the supports noted above, I am going to continue to ride my positions on the long side.