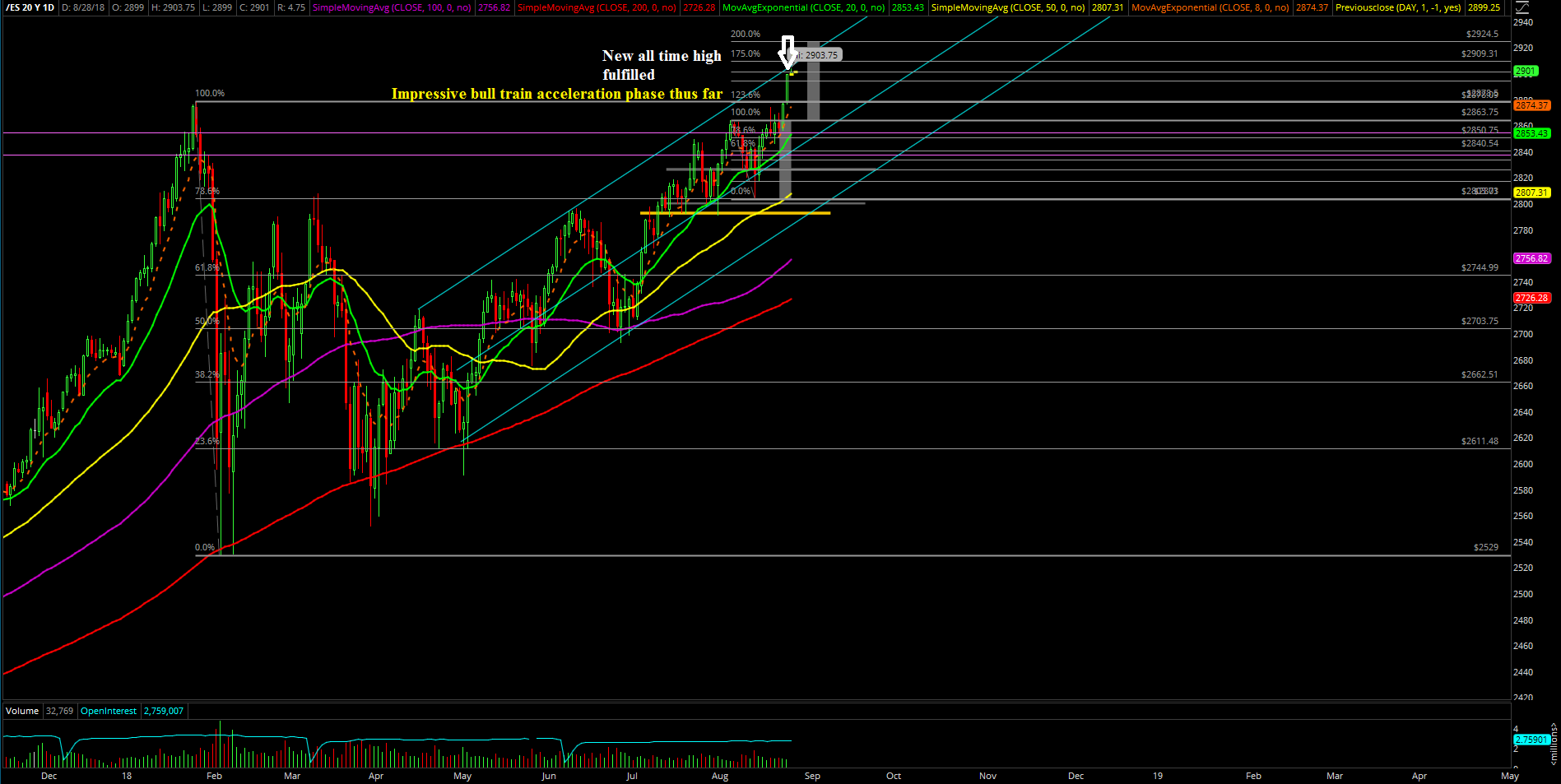

No Surprises Yet, Impressive Bull Train Acceleration Phase

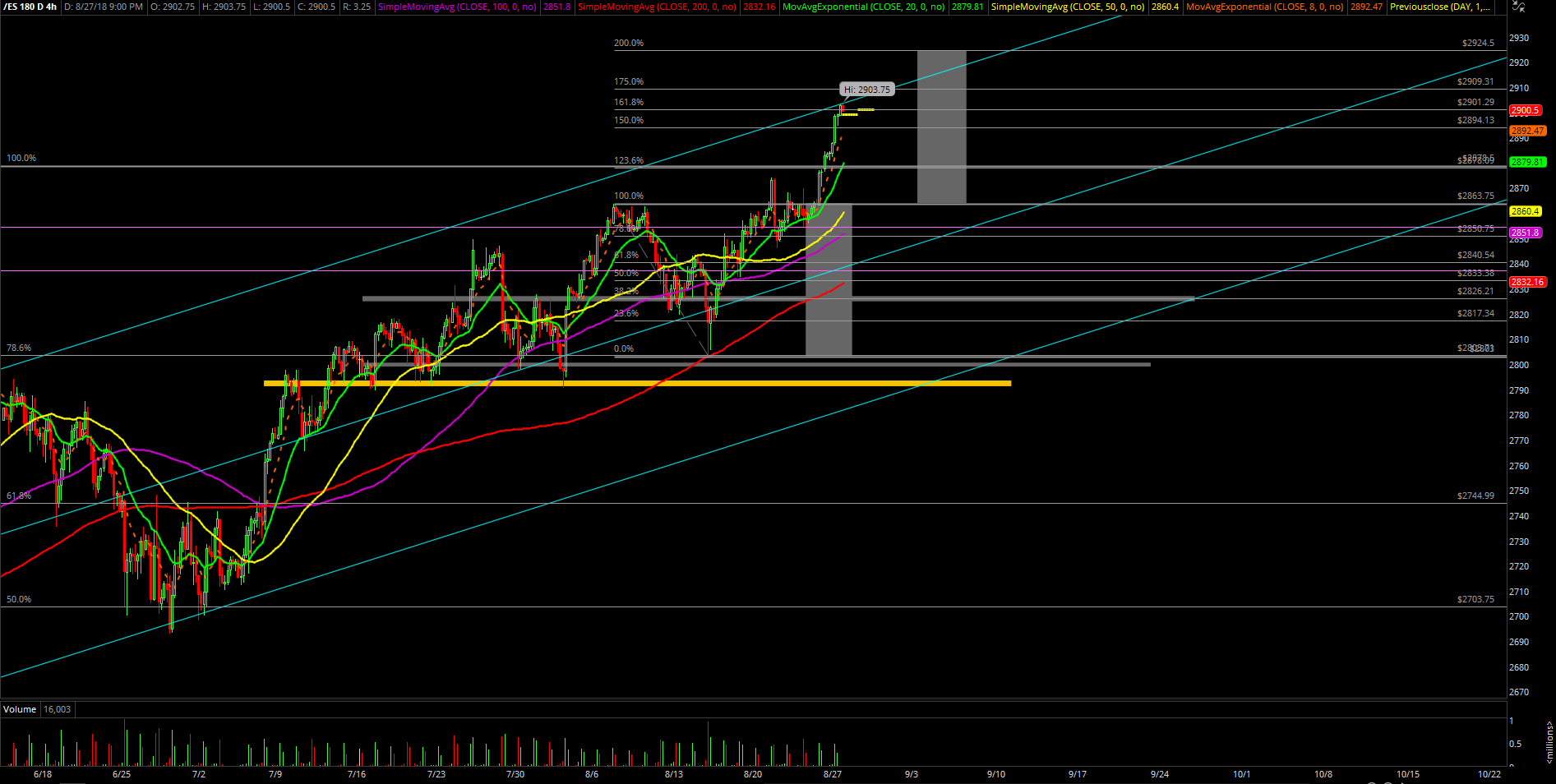

Monday was just a bull trend/train acceleration day. The price action really started from the Sunday night tiny gap up and go pattern, and the bulls were able to maintain full control of the train overnight with the tight bull flag. The true acceleration began around the US regular trading hours (RTH) open with price gearing towards the 2900 major level magnet on the S&P 500 alongside the fact that a new all-time high has been established versus the Jan 2018 high from earlier this year. In simplest terms, it was a vicious feedback loop cycle of trapped shorts being squeezed alongside with the usual chasers and stopruns.

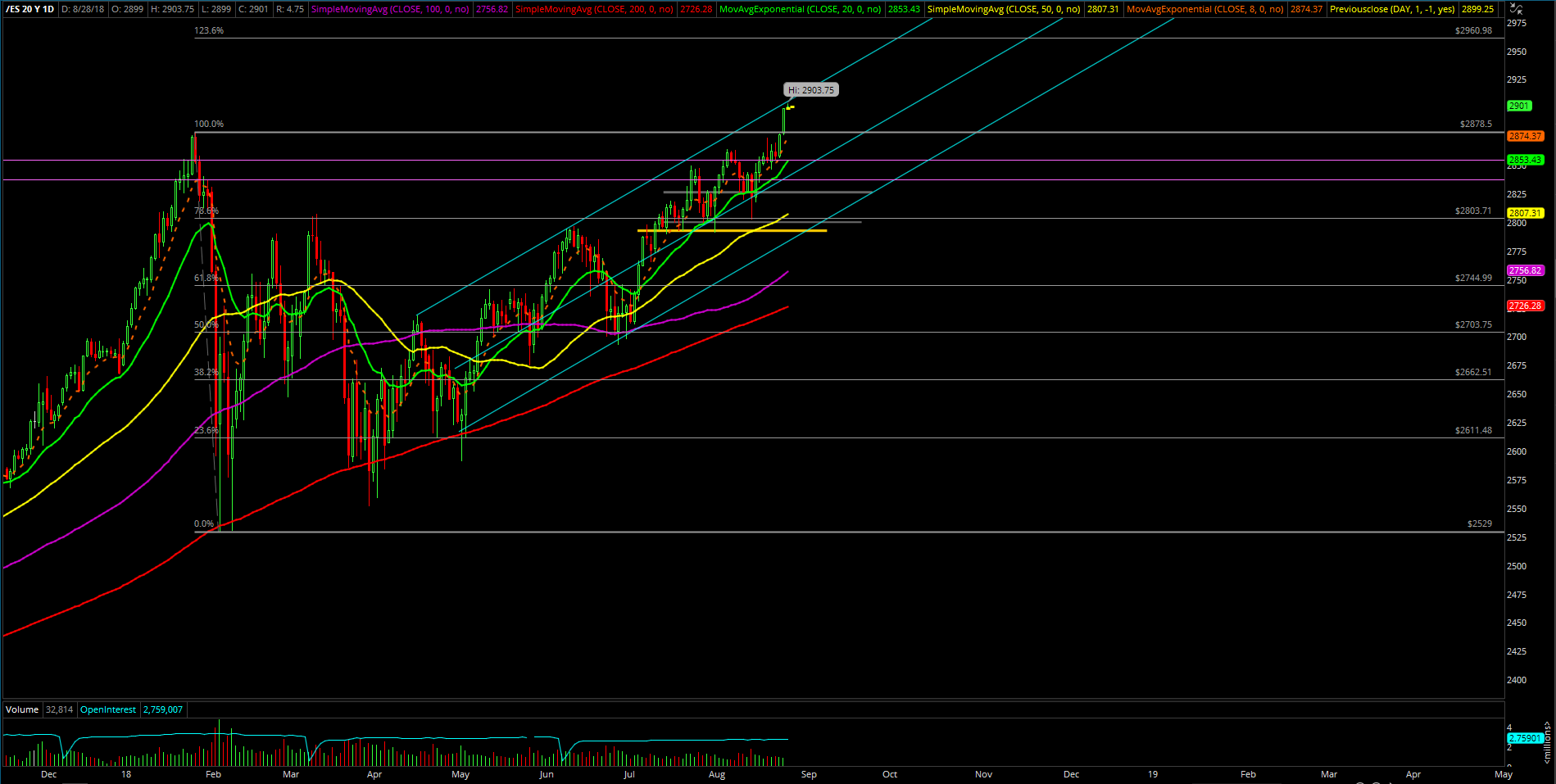

The main takeaway from this session is that the price action is hovering around the major 2900 level and it’s getting fairly close to 2924.5 measured move target from Aug 16. This is the part where we ought to stay focused and manage our risk across portfolios by utilizing the level by level approach on support versus resistance alongside with our pre-determined plan. Obviously, it’s an accelerated bull train until actual support breaks (bears haven’t shown up yet).

What’s next?

Daily closed at 2899.25 at pretty much the dead high of the session to cement the new all time high print. It was a straight trend continuation session off of the huge bullish weekly candle that the bulls completed last Friday so that means the train momentum is doing great.

The daily timeframe key support has moved from 2856.25 to 2876 which is Sunday’s low and obviously the current week’s low. This means that bulls have nothing to worry about until this level gets taken out on the daily chart. The immediate micro trending supports have also moved up, they are now located at 2894 and 2884. These are just levels for potential quick intraday BTFD opportunities if a corrective pullback does occur instead of the rare linear up scenario.

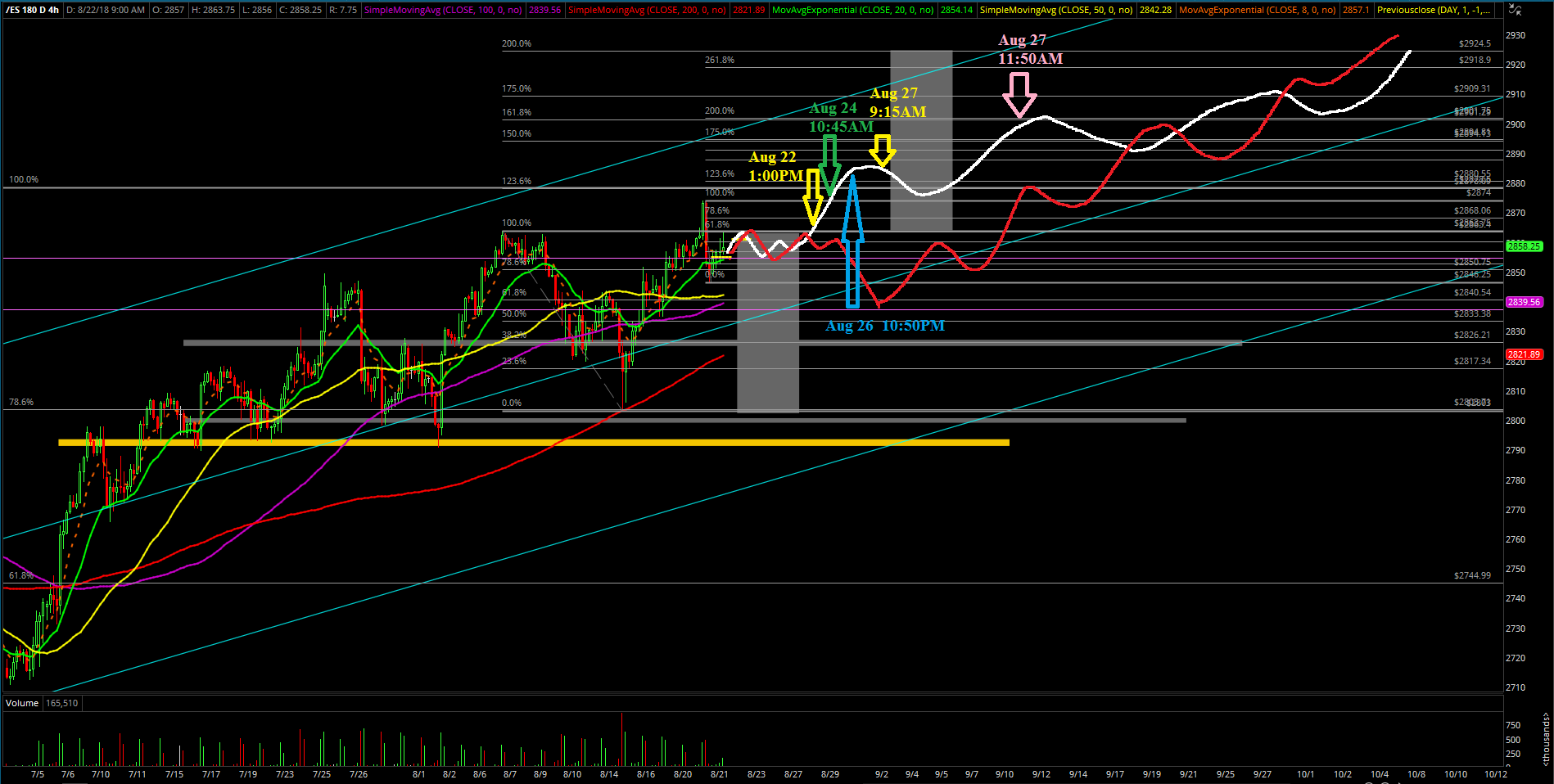

We’re going to view tomorrow as likely some sort of typical inside day/consolidation in order for price action to catch its breath following the 4hr white line projection. This is only valid when price is below ES 2905, then we expect the train to continue ramping up again on Wednesday. However, if above 2905, then it’s immediately ready to fulfill the 2924.5 target faster than our expectations and would be a wonderful surprise. Either way, it’s the same bull train acceleration phase until actual supports start breaking.

Nothing new has changed to deter our overall perspective/thesis so repeat main points for additional context:

Given the Sunday gap up and go pattern; the market is in an immediate acceleration phase where there’s no major res level until 2900. If you recall, every 100 points is a major level for us given the first try basis rejection tendency/stat from the market. Traders should be aware of this and take some profits accordingly if so depending on their timeframes.

Heading into this new week, anything above Friday’s low of 2856.25 is considered immediately bullish on a daily chart timeframe. The immediate micro trending supports are located at 2864 and 2868 where price action is very heavily bull biased focused when above these levels. Know your timeframes.

In simplest terms, bigger picture wise we have nothing new to say as the 4hr white line projection chart continues to remain king/valid towards 2924.5 measured move until something else/new happens in order to change the bull train’s route like breaking support for instance. (in a rarer scenario, it is also technically possible for bulls to accelerate this as linear up without the shallow pullbacks indicated on the 4hr white line projection so be aware as we ride this bull train until the wheels fall off in our ES trading room)