No Surprises, Stampede Continues

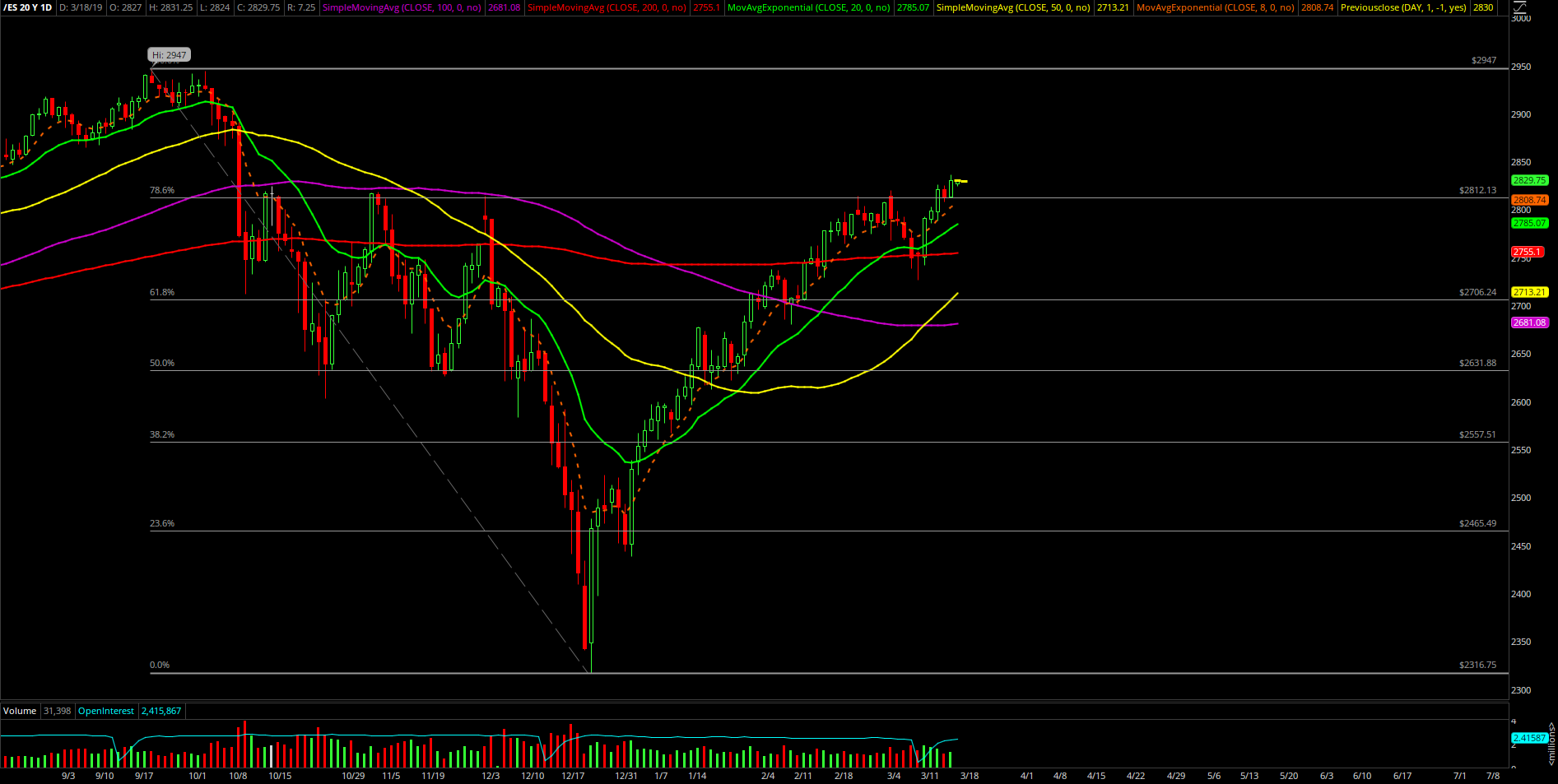

The second week of March was very easy after what transpired on Monday. If you recall, going into the week the bears needed to do the ‘hold half and go’ downside setup. However, the bulls retraced 78.6% of the losses of the prior week’s range on the S&P 500 (2819.75-2726.5) by Monday’s close already. This meant that the market was likely going to a repeat of déjà vu again as the bears failed and it’s time for the bulls to shine.

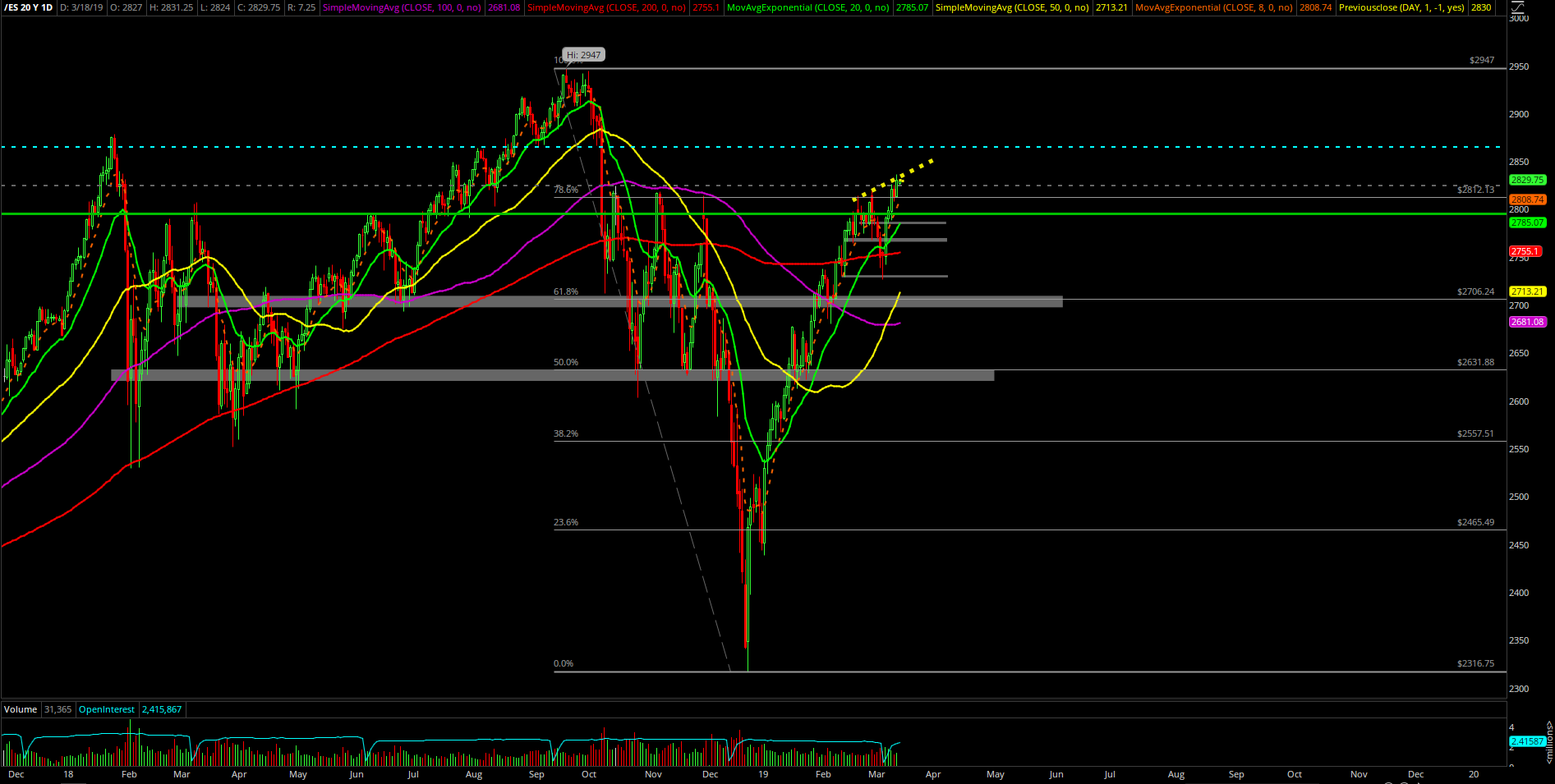

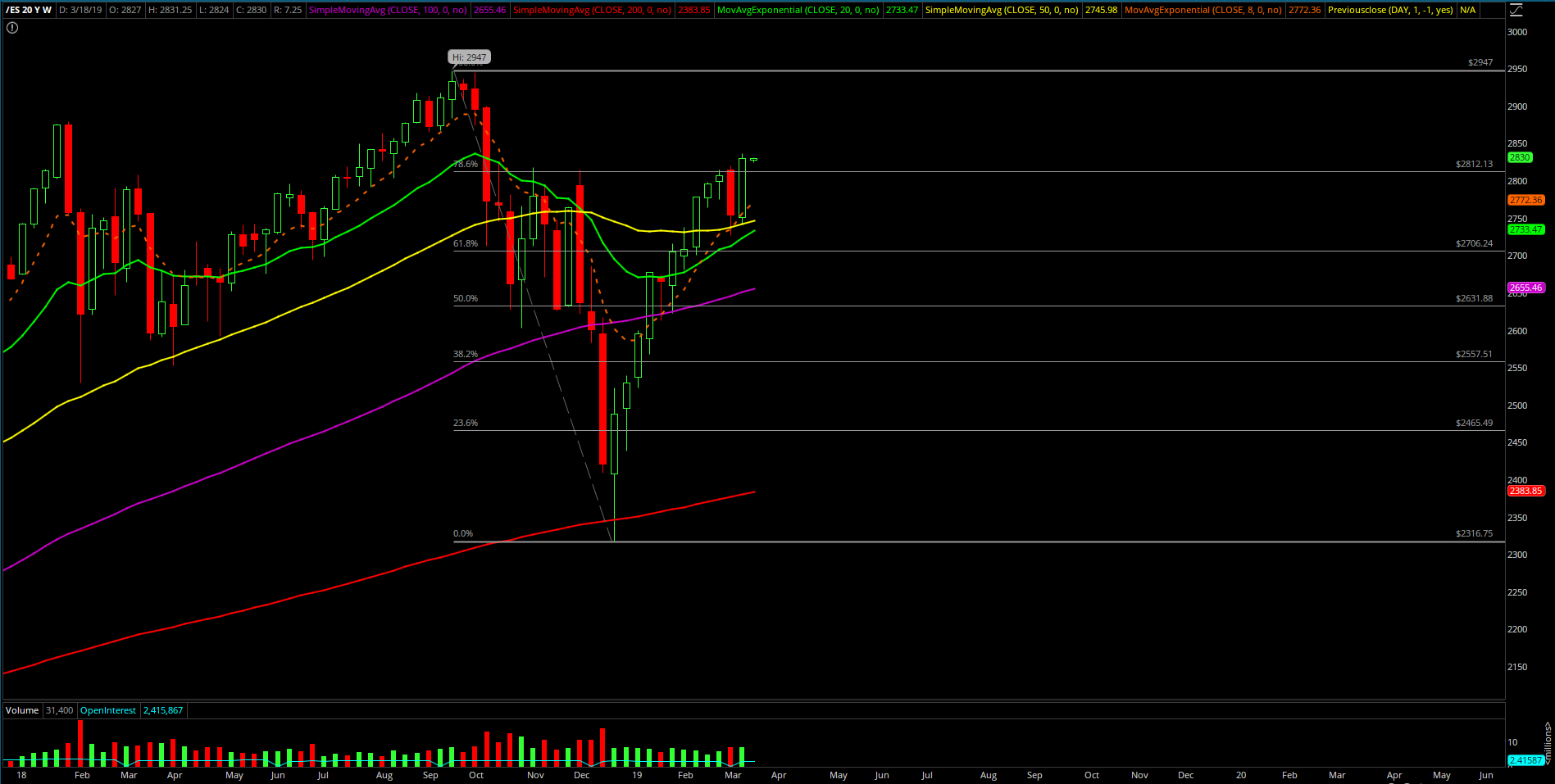

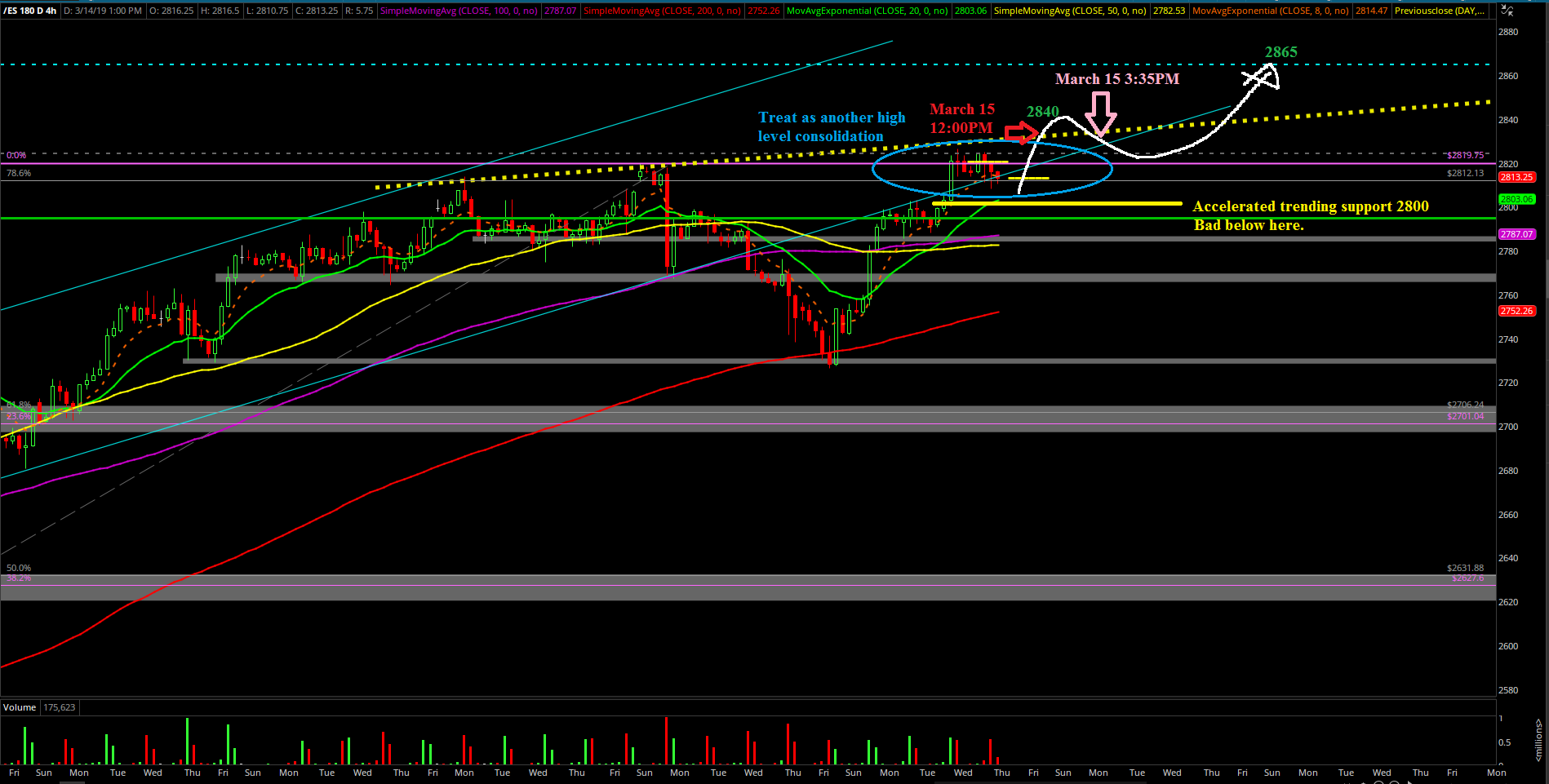

You already know the good old déjà vu pattern for the 3 months grinding higher, consolidate and eventual breakout pattern. In reality, this is exactly what occurred as we bought every dip for the rest of the week as price action kept making higher lows and higher highs going towards the continuation targets of 2820, 2840 and beyond.

The main takeaway from this week was that the bears failed their weekly bear engulf downside continuation pattern and in reality we got the opposing massive bull reversal into new highs of 2019. The bull train is looking to continue leveraging this strong momentum and inertia by going towards the pre-determined destinations.

What’s next?

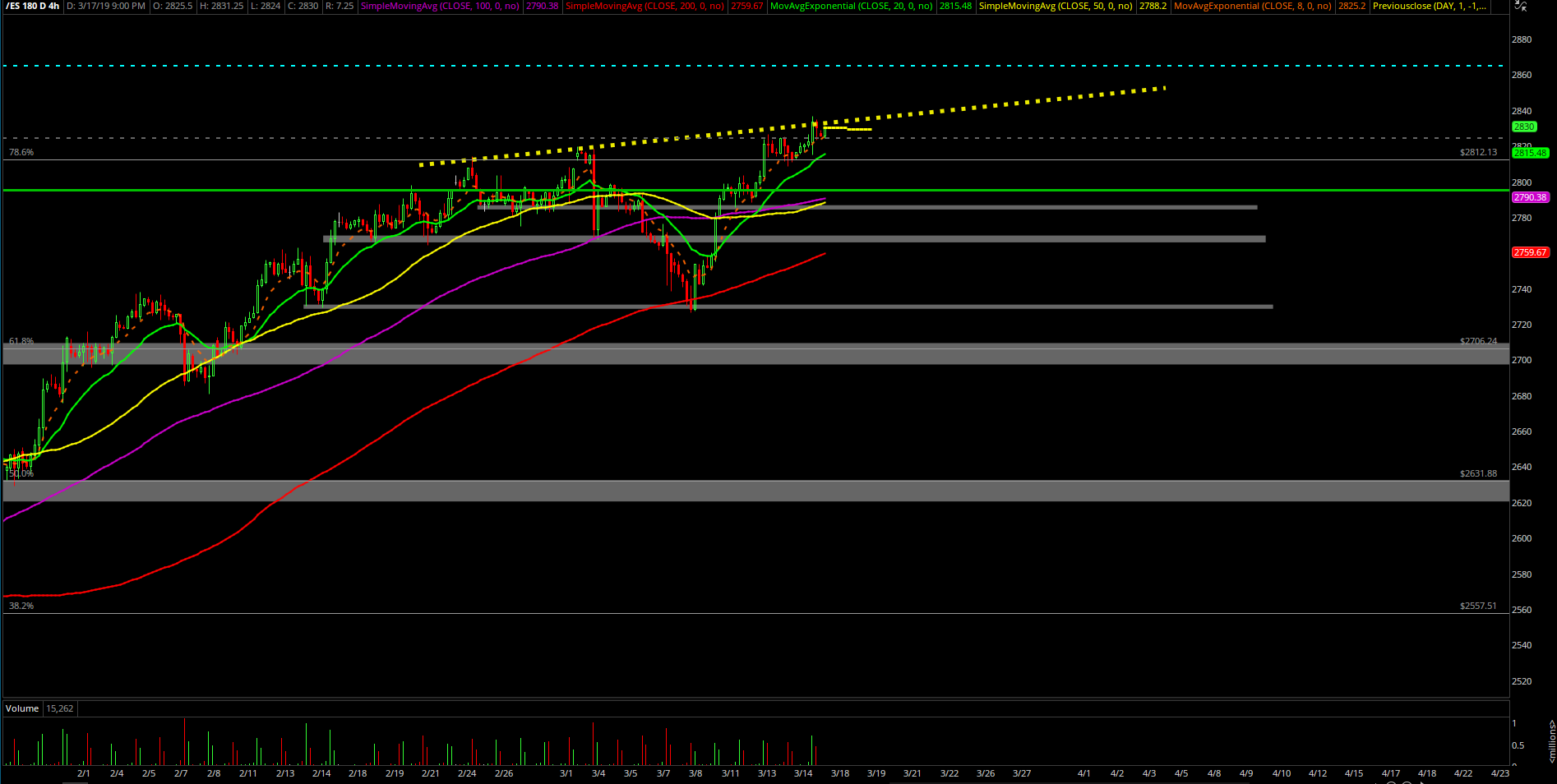

Friday closed at 2830 gaining 76.25 points or 2.8% vs. the March 8th weekly close. As price action is getting closer and closer to the next continuation targets of 2840/2865, the accelerated trending support has moved up to 2808. This means that any dip that remains above 2808 is considered a buying opportunity and not a risk because of the bull train remaining in full control.

Current parameters:

Heading into this new week, it’s very simple on what the bulls need to do as there are currently only two high probability scenarios. Establish the standard ‘hold half and go’ setup or do a straight up continuation towards our pre-determined continuation targets. In simplest terms, when price action is immediately trending above 2808, then we’re looking for 2840 and 2865 to be fulfilled sooner rather than later. Also, last week’s 4hr white line projection remains king for now until further notice.

If breaks below 2808, then likely dead wrong for short-term and be stay cautious of a prolonged consolidation or false breakout vs. 2820~ that is playing out from Nov-Dec 2018s highs.

Clear and concise context for March:

Treat as immediate bull train acceleration phase to the upside 2840/2865/2900+ until key trending supports break. However, if/when support do break, then be mentally prepared for a fast and sharp drop to backtest the elevated supports on daily/weekly/monthly charts given the past 12 weeks upside. (shallow 23-38% fib retracements come to mind of the entire 2316.75 lows to 28xxs rise)

Stay focused on key levels, level by level approach. Get in and get out on quick high probability setups.