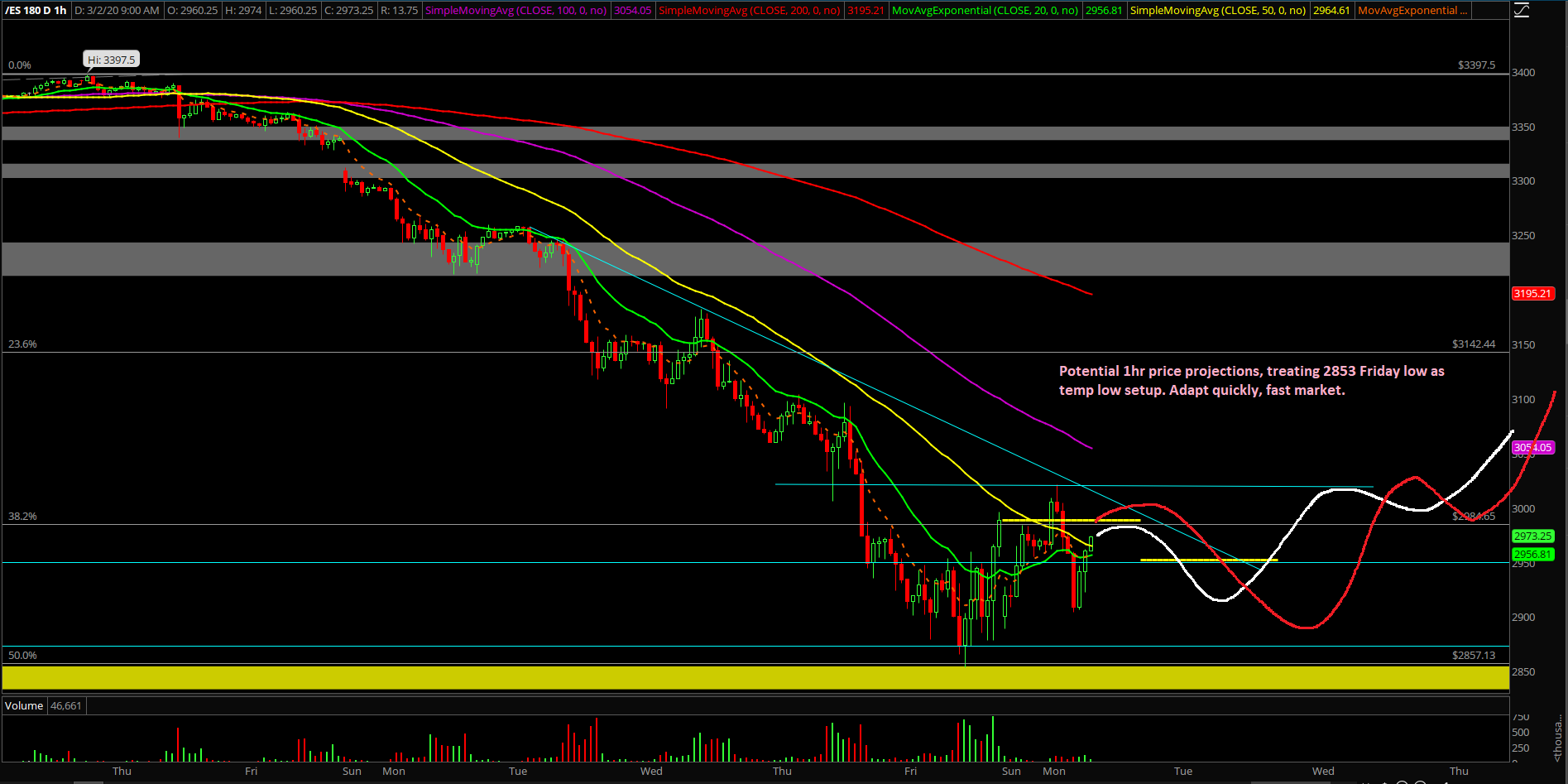

No Panic Yet - Market Analysis for Mar 2nd, 2020

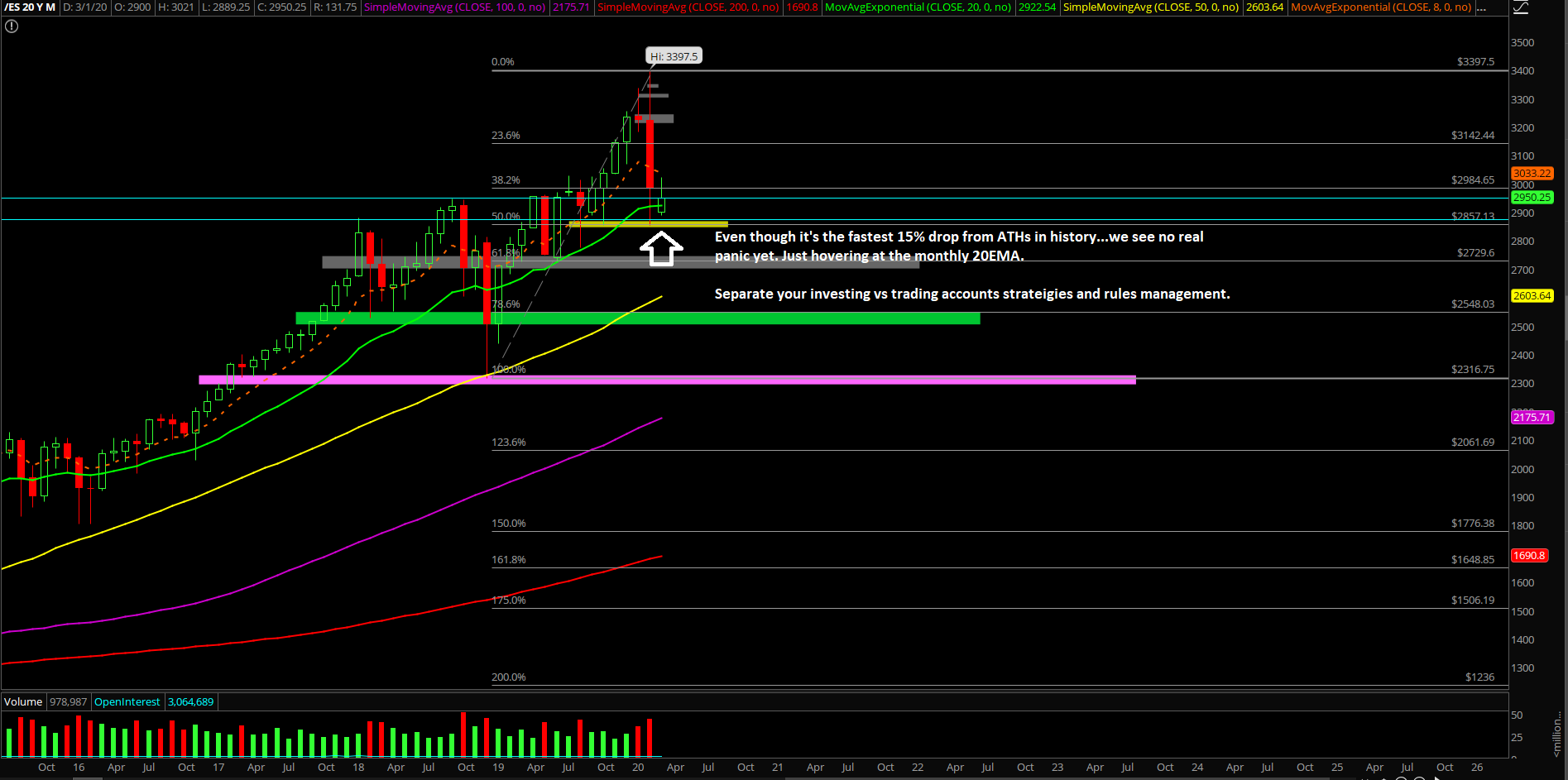

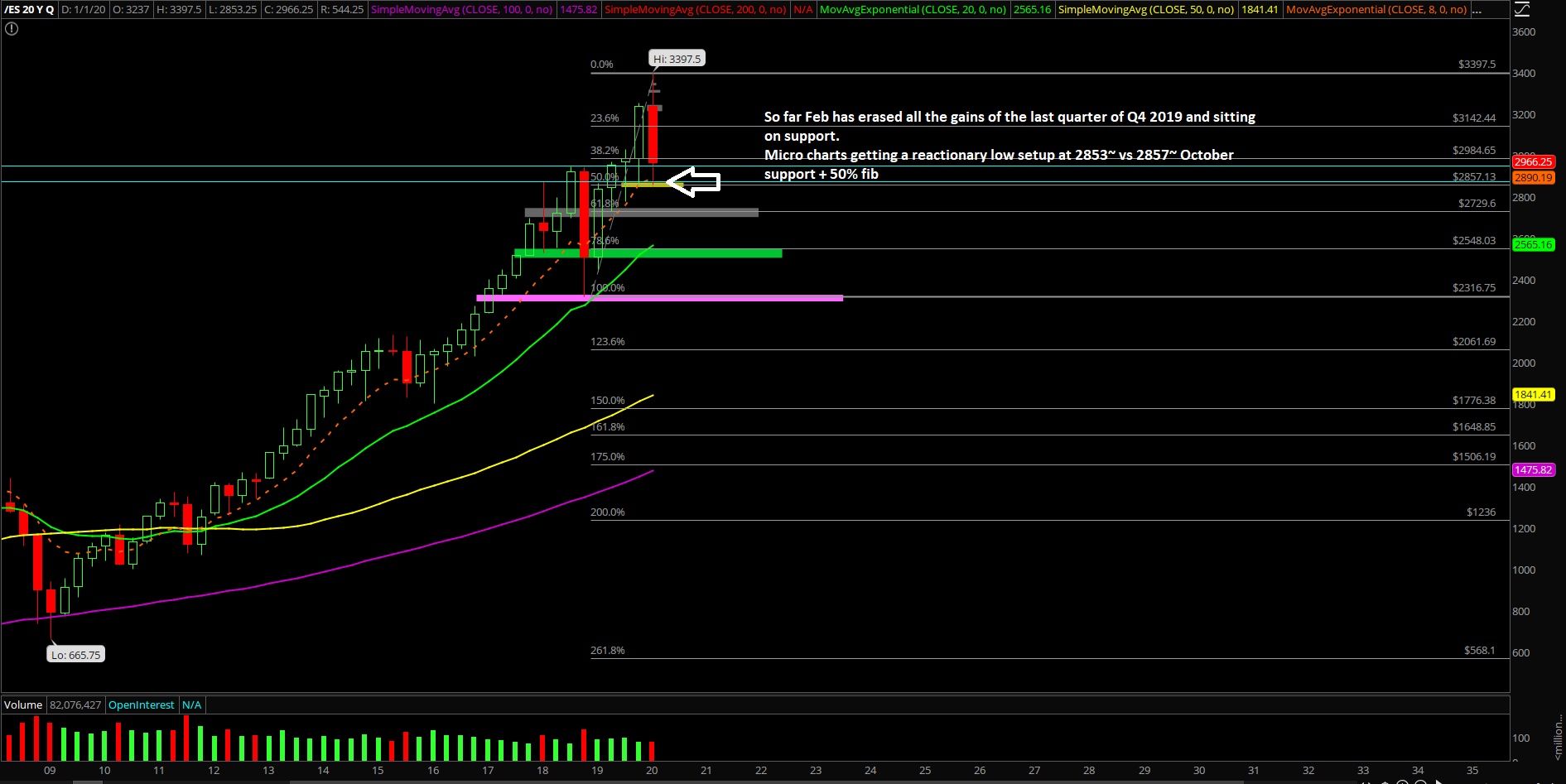

The last week of February was a quick liquidation across the board as the broad market couldn’t hold the key daily 8/20ema trending supports and after the large gap down action on Monday Feb 24,2020. This meant that there was a cascading effect across many stocks, ETFs and variety of asset assets running for the hills as momentum has shifted since the October 2019 upside acceleration.

As we discussed in the past 2 weeks when market was hovering against the 2 standard deviation highs, hedging and buying dirt cheap insurance via equity + volatility lottos if operating an uber bullish portfolio like ours is appropriate. This proved its effectiveness as we finally got paid on hedges and minimized our potential losses in many of the best in breed stocks that we’ve held since April 2019 (even though we were late and missed the Dec 2018 bottoms up train). This is not a bragging rights thread, but it goes to showcase that anyone could manage a portfolio + trading through it in a sensible and logical way. It’s not hard when following a ruleset with strict management. And NO, we do not BTFD at every support, it must be clearly defined as vs key levels on first try basis with appropriate R/R. Vice versa for STFR approach.

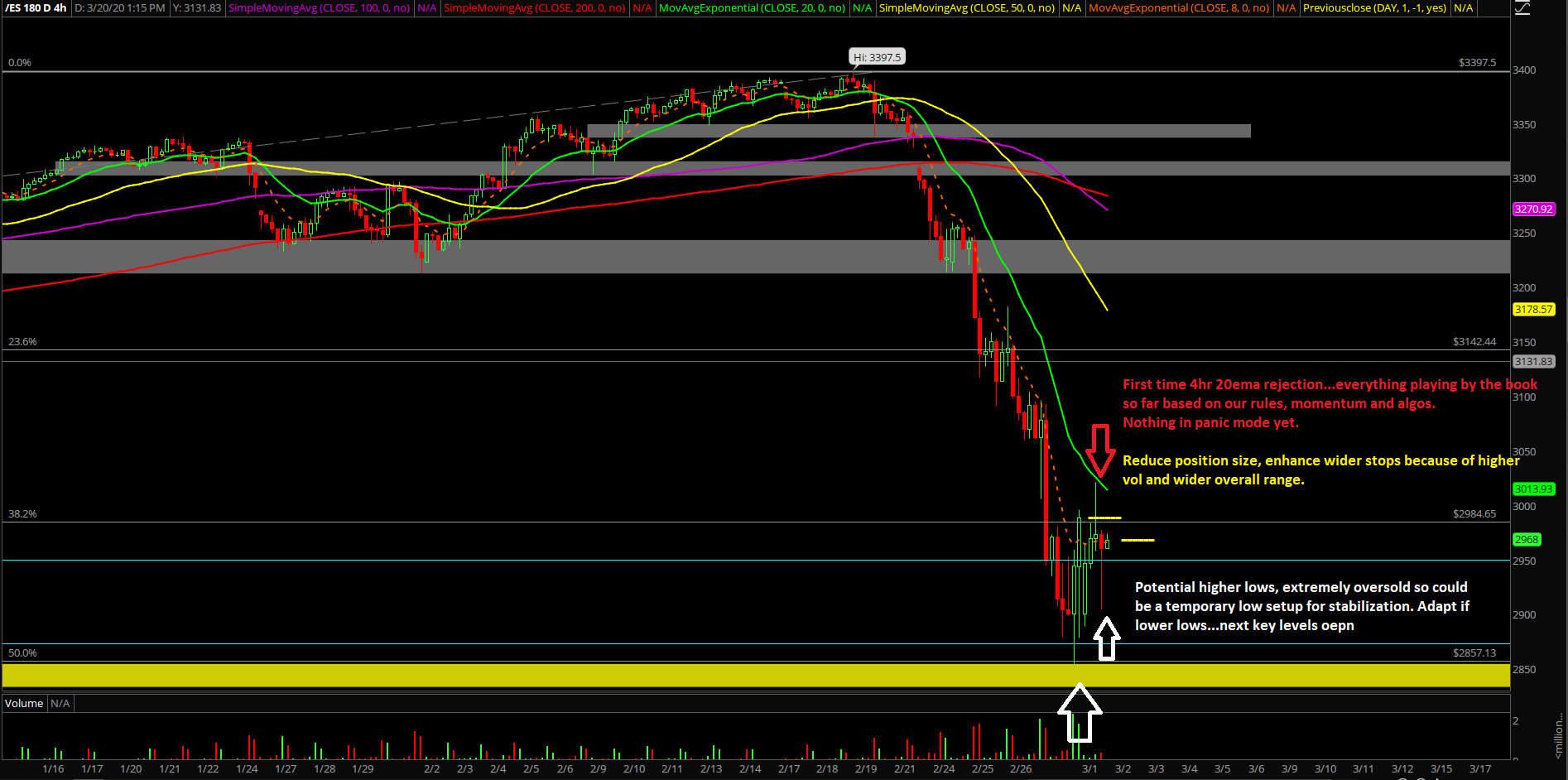

Friendly reminder, when volatility is high and the market’s price action range being enormous on a day-to-day basis, the key to trading short-term is to lessen your regular position sizes and enhance wider stops so you’re basically trading the same % risk of the portfolio. If each trade setup was 1-2% max risk, then it should remain constant in this environment. In addition, cash is a legitimate trading position as well.

Anecdotal fact, we’re now seeing a few too many bear cubs celebrating too early after being wrong for months and last week’s carnage is being hyped up so pay attention for a potential quick reactionary short squeeze as the temporary bottom setup from Friday remains pivotal. (the market is also extremely oversold on the short-term indicators so there is potential) Be wary of those that celebrate too early as price action has now hit key levels on weekly+monthly charts and attempting to stabilize.

Did the bulls/bears fail overnight? What is the next highest probability plan

- Sunday night till now showcasing HL structure and starting to confirm the initial expectations of a temporary low setup

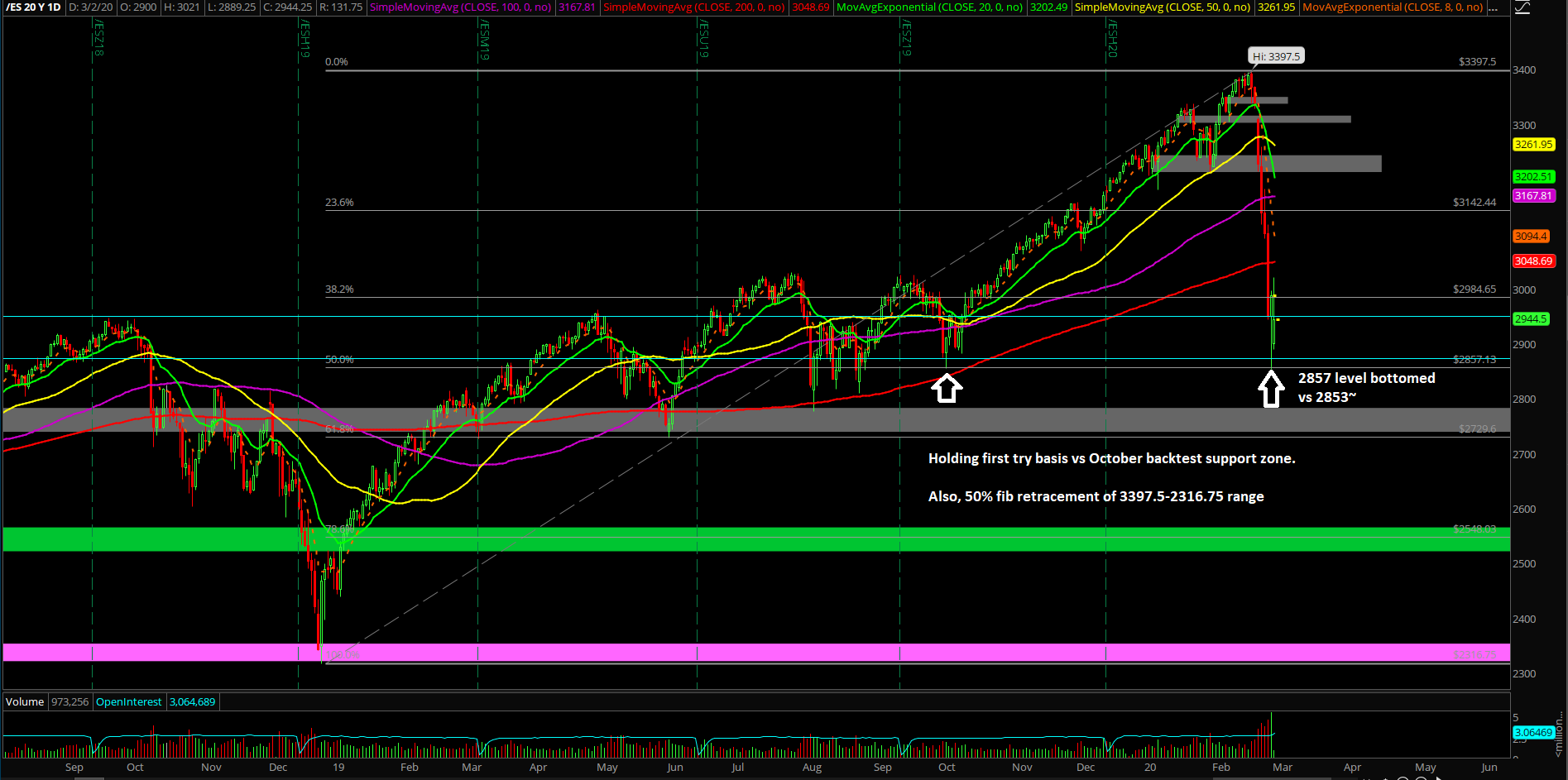

- Friday’s low was ES 2853.25 that bottomed out vs. our predetermined 2857 key level derived from 50% fib retracement, monthly 20EMA support and backtest vs. October 2019 support zone

- Unrelated anecdotal recent tradition: market tends to tank when we’re on vacation and bottom out when we come back. Will it continue? Who knows/cares…stick with level by level approach and strict risk management as the overall range is wide and position sizes need to be adjusted accordingly. We easily outperformed the market easily by staying fully hedged out since Weds Feb 12 as discussed and rode a lot of weekly+monthly March via lotto options as insurance was dirt cheap. Minimized a lot of the damage from the 15~% week drop from ATHs. A lot of cash to deploy now at cheaper levels if applicable setups appear in both investing/trading accounts

What is the bias/gameplan going into today? Do you see a feedback loop setup?

- Treat 2853.25 as temporary low setup from Friday as it bottomed vs 2857 predetermined level on first try basis

- Likely day-to-day approach here so today focus on HL-HH setups when applicable for quick scalps

- Price projections on micro 1hr chart, white line primrary and red line alternative. Fast market so must adapt.

- If wrong with price action breaking below Friday’s low, then the next major level could open up at 2729 which is coincidentally the 61.8% fib retracement of 3397.5-2316.75

- Filter out the noise, break below support1, look for support2, break above resistance 1, look for resistance 2. There are lots of fear mongering across the internet nowadays, utilize a level by level approach and GTFO when uncomfortable/honour stops.