No Man’s Land

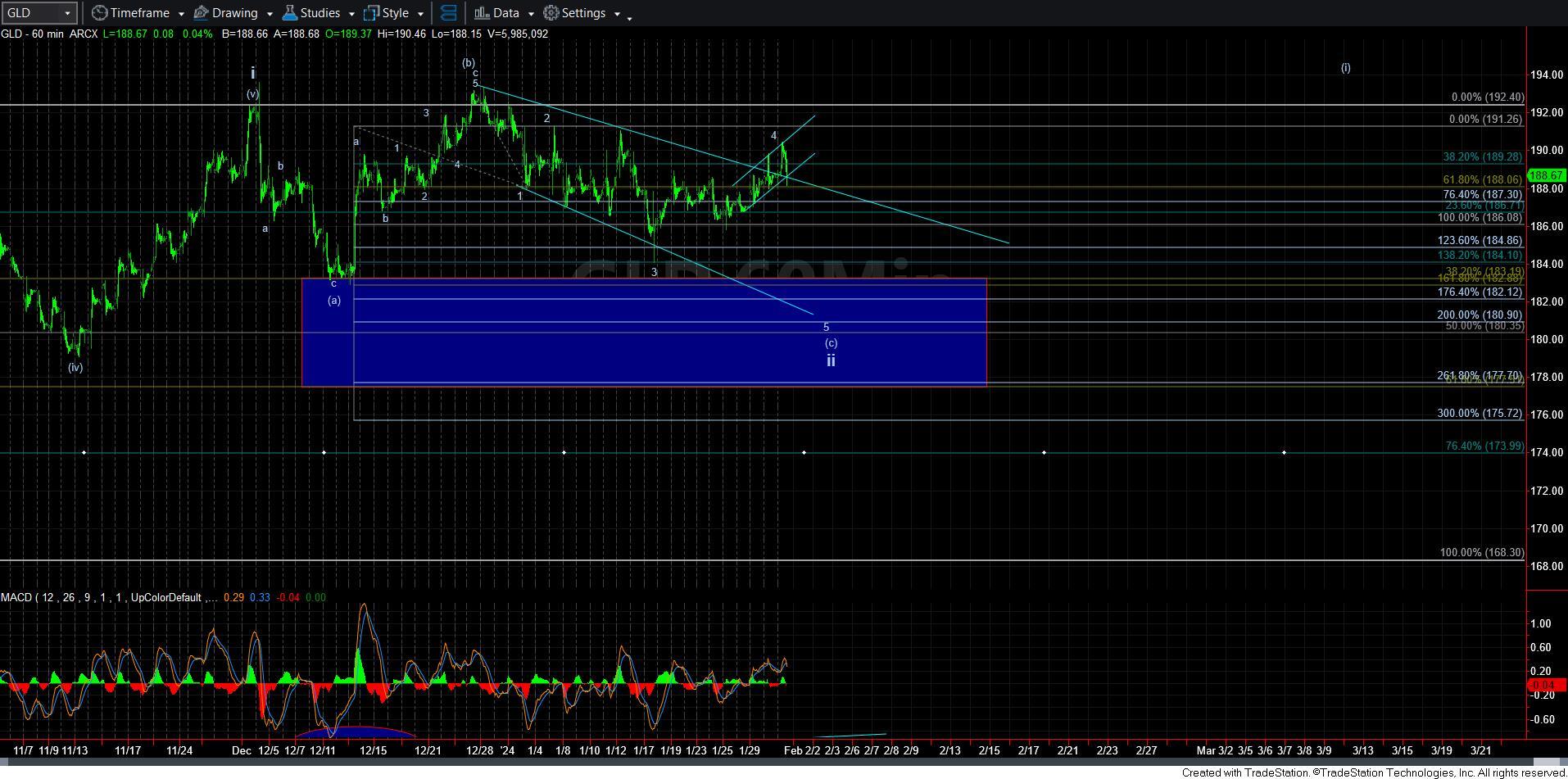

Today, GLD pushed through the trend channel again, and seems to have again topped in the near term in a very overlapping a corrective looking move up. The move through the downtrend channel certainly makes this look a bit like we are out there in no-man’s land. But, I have to say that without a clear bottoming structure, and without a clear 5-wave rally off a low, I am forced to maintain my perspective of a lower low to complete this larger wave ii.

As I also posted today, if we see a break out over 191.26, that would invalidate this potential.

Silver seems to be holding its resistance box. But, in all truth, there is a potential to consider the rally off the support box below from which the rally began as a 5-wave structure. It is a bit forced though. But, if we see a corrective pullback, followed by a rally through the resistance overhead, then I may have to view the bottom as being in place.

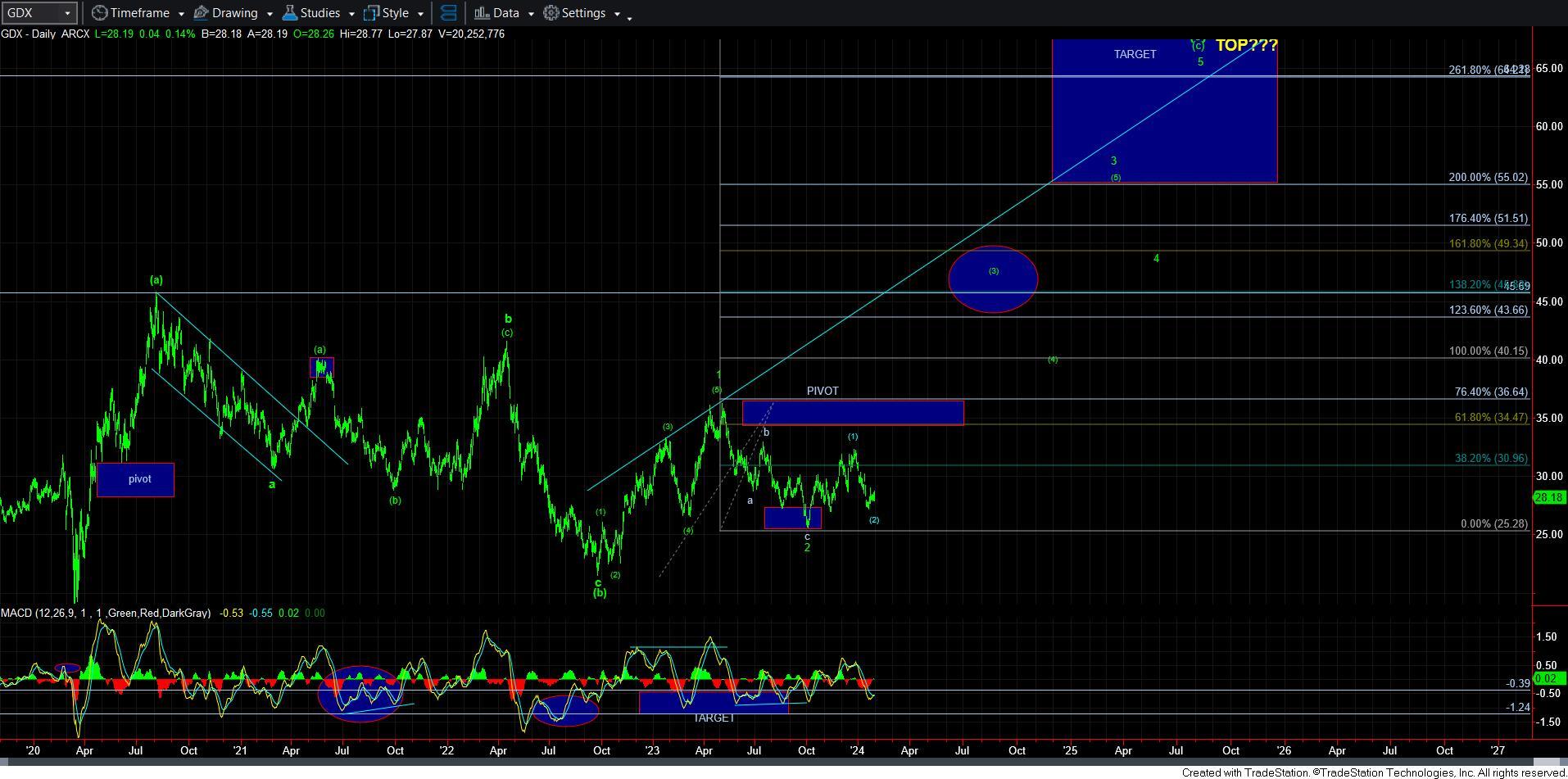

GDX is still stuck in the middle. It is overlapping to the upside as well as to the downside at the moment. So, I am still not sure it has indeed bottomed, but I think I am leaning towards one more drop before it bottoms.

With all that being said, I want everyone to please make sure you are viewing the bigger picture, which is most clearly seen on the daily GLD and GDX charts attached. Yes, I still think there remains potential for a bit lower, but I think the upside is presenting much greater opportunity in 2024 than any remaining downside. So, please do not lose sight of that.