No Evidence of the Top in Sight

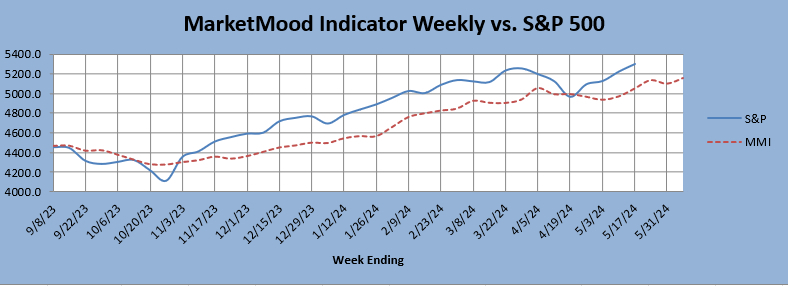

As much as it seems it should be there, I'm not finding any specific evidence I can point to that says that the top *should* be here yet. The weekly chart (below) is showing a good spot for a pullback up ahead as end of May approaches, but that's the most I can find suggesting *a* top approaching once again (as opposed to a definitive *the* top).

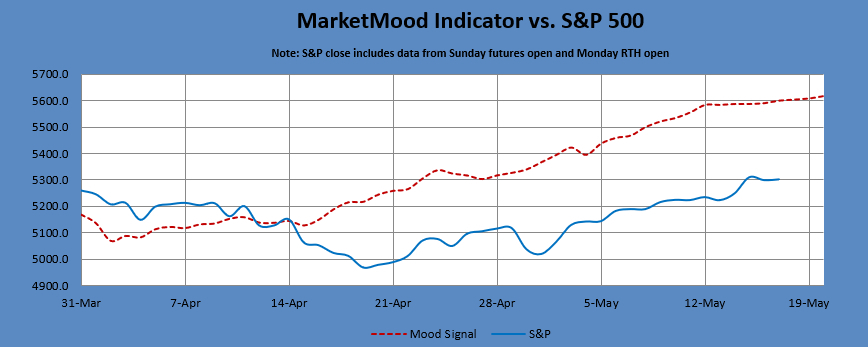

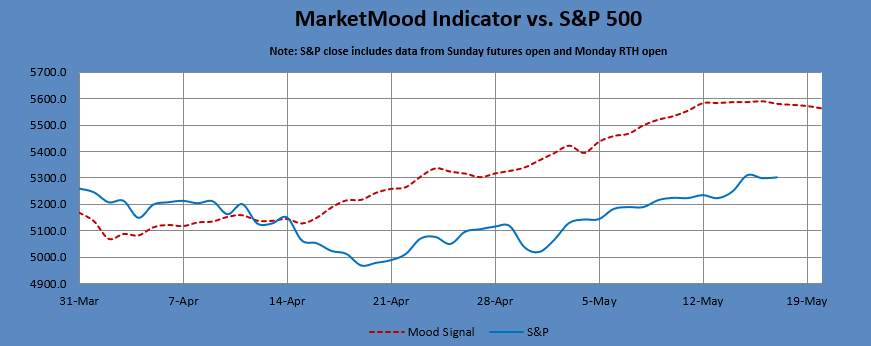

As far as whether a potential flip (signal inversion) occurred today or not, if it did, I'm not able to tell. Within the context of the daily mood pattern, it would make more sense if there was a flip today. Without the flip, the weekend pattern points to the beginning of a next leg up. That makes little sense without a pullback first today, and the market is up as the close approaches (how can a next leg up begin without some down first?). If the potential flip did occur today, then the weekend pattern would point to a sense of deteriorating circumstances and both Monday RTH open and Monday's MMI would be down. In the no flip case, MMI would be up for both RTH open on Monday and for Monday itself. Officially, there will likely be no call until after seeing what happens this weekend and Monday.

Enjoy your weekend!

MMI vs. S&P 500 (no flip case):

MMI vs. S&P 500 (flip case):

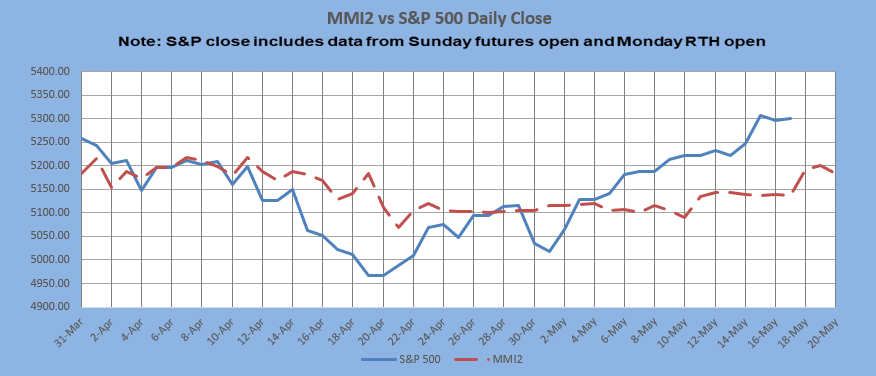

MMI2 vs. S&P 500 (either way):