No Confirmation Of A Bottom YET

As I noted over the weekend, the market has still not provided confirmation of a bottom, but it was likely that GLD would see lower lows. This week, the GLD and silver did see lower but GDX held quite strong.

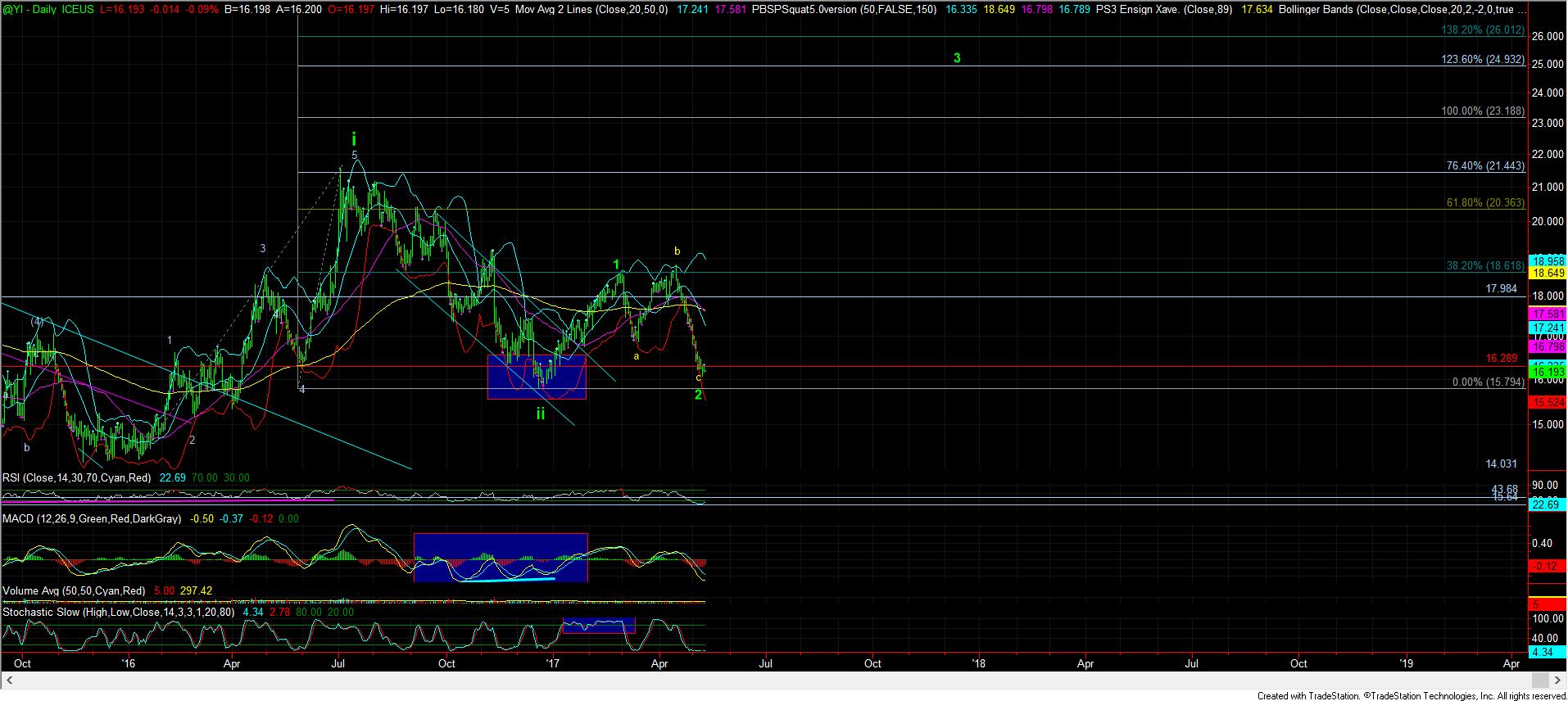

While the GDX MAY be considered as a potential impulsive structure off the lows, I cannot say that it is anywhere near the cleanest structure off those lows, nor one for which I can confidently claim the bottom has been struck. Thus far, this rally can easily be a 4th wave, as presented in yellow on the 8 minute chart, which means that we may still see the 20.31 a=c target. It would take a continued strong rally through resistance to suggest the low is in place at this time.

As far as GLD and silver are concerned, while we also have enough waves in place to consider the downside as complete, I would rather see a move through resistance on GLD to suggest the bottom is in, if a lower low is not to be seen.

Moreover, silver has finally given me a lower low with the positive divergence I had wanted to see on my 144-minute chart, but bottoms have been struck on that chart either with one or two divergent lows. Since we have only one divergent lower low at this time, it leaves me in the same place as the other instruments where there is still potential for a lower low to be seen.

Now, I know everyone hates the dreaded lower low potential. Sometimes the market has provided us with those lower lows, and other times not. For this reason, I have been trying to be as clear as I can that one should be using this region as a place to add longs, and using the GDX 20.31 and 18.58 levels noted in the past to trade off of. Ultimately, the market is still LIKELY in a bottoming zone, whether it chooses to give us that lower low or not, and you have to treat it as such.