Nightly Crypto Report: Who Is Fibbing?

Short-term Traders:

General

There is a marked difference between Ether and Bitcoin as Ether basically has a high consolidation vs. its recent range. Bitcoin, on the other hand, continues to risk a severe drop. Therefore I must maintain my bearish alternate count in Bitcoin, but a bearish perspective in Ether, at least short term, is not clear. Who isn't telling the truth?

Bitcoin

There is little change to my perspective in Bitcoin. However, ideally, the weekend low at $34,845 is not breached. That low markets a symmetric retrace in C, vs. that in B of my bullish triangle. So, ideally, it holds. Below $34,845, I'd have to say a breach of $33,420 is likely, as are further breaks of support and a possible drop in the bearish count to $24K. Just note, as shared on the webinar, this is an exceedingly sloppy chart right now, therefore it can see surprises in both directions.

The only doubt I have that the bearish triangle is in play is that our drop is not impulsive. But a diagonal is possible.

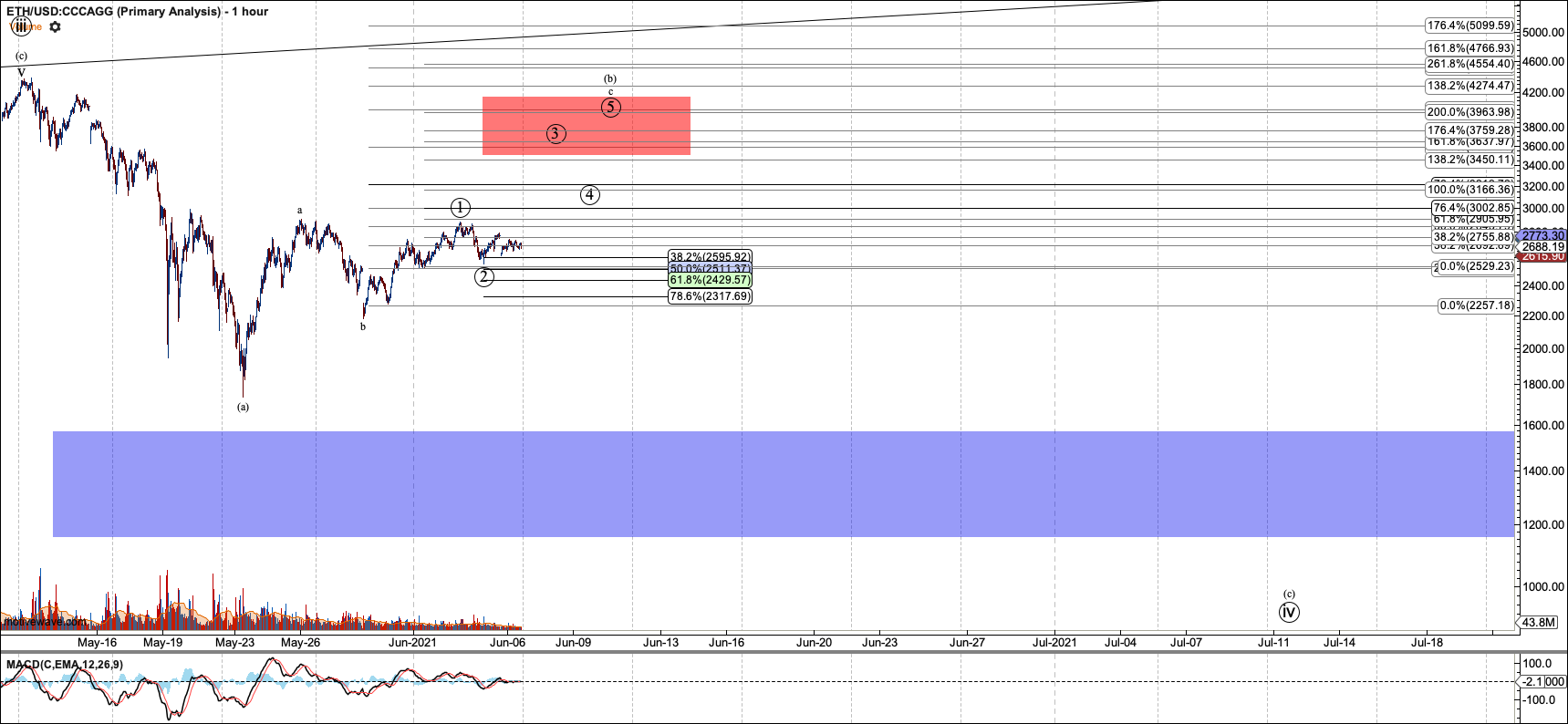

Ethereum

Circle-2 continues to have plenty of room with invalidation not occurring until $2180 is breached. Ideally, circle-2 holds $2317.

ETHBTC

ETHBTC appears to have completed wave-b and should head to 0.081 to 0.095 for a top in the larger degree (B) wave.

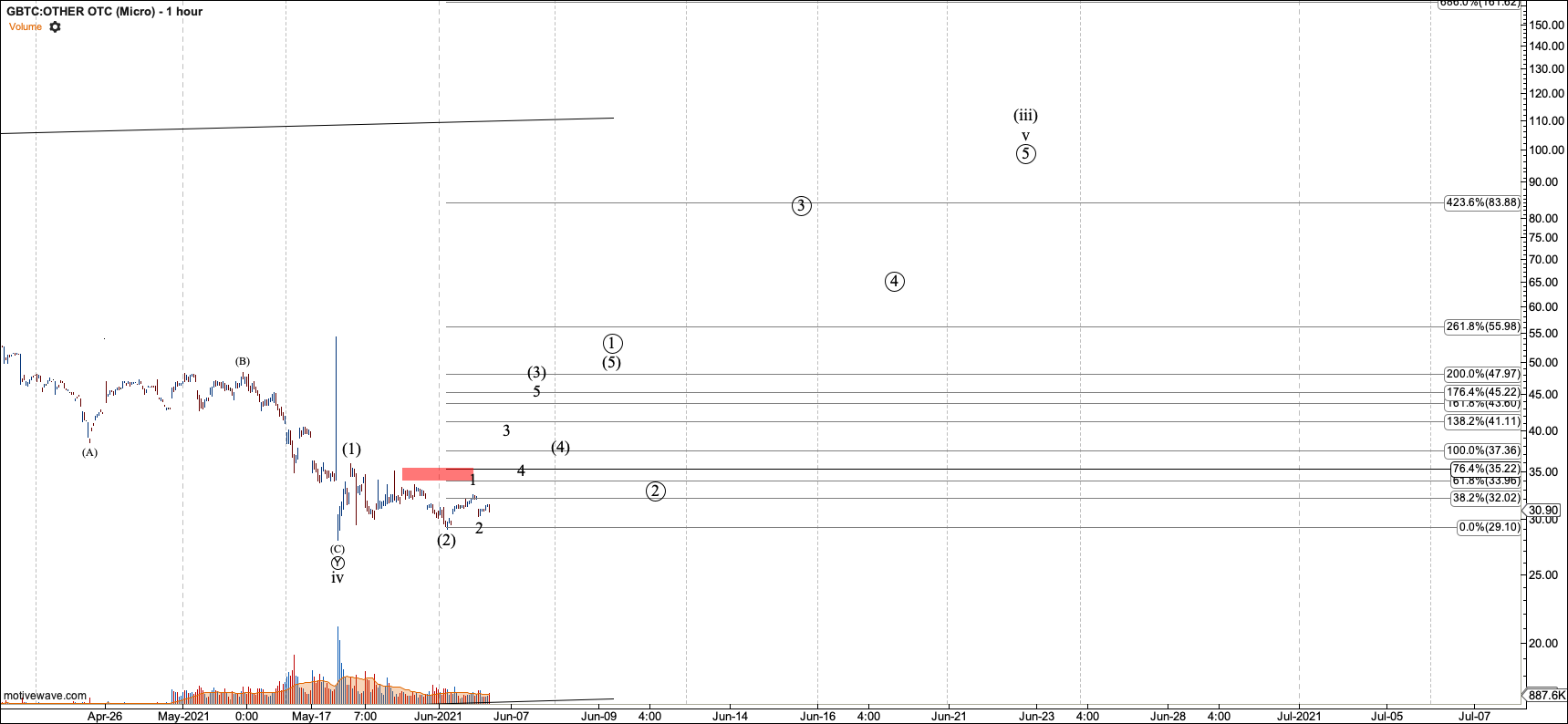

GBTC

We will revisit GBTC as it trades tomorrow.

Bitcoin Intermediate View

Provided the key bull/bear pivot holds, Bitcoin is on its way to $150K in this cyclical bull market. The bull/bear pivot lies at $24,000 currently, giving Bitcoin some room. As it stands now, a break of the bull/bear pivot confirms that Bitcoin's rally since 2019 is not impulsive but is in a diagonal. A wave four in that diagonal may still hold at $17-$20K, however, it would lower the target for the fifth wave. If we break below the August 2020 low, the bull market is over and a multi-month decline would be in progress.

Provided that we fill in all five waves on the daily chart, I’ll count our 2019-2021 rally as an extension on circle-3, which I previously believed to have topped in December 2017.

After this cyclical bull market finally completes, probably in early 2022, Bitcoin should start a large, perhaps multiyear bear market in its primary 4th wave. You can review my weekly chart for alternate views, but all views suggest a cyclical bear will begin in 2022.

Zooming in, the question is whether we hold the low at $29,900 and details are covered on the micro above.

Ethereum Intermediate View

Ether is in a cyclical bull market, which, if it fills in all five waves on my chart, will reach close to $12,000. Recently I shared two alternatives for my weekly chart after that top.

Ether’s structure between March and August 2020 was left in a very questionable state and is key to assessing where the bull/bear pivot lies. The best I can tell this key pivot lies at $1120. But should that level break, I’ll refine the channel to watch for the fourth wave to hold at the lower parallel of the channel.

After five waves complete, now likely close to $12,000, we can expect a cyclical bear market. However, where that bear market is likely to take Ether, depends on my two alternate views of the weekly chart. One view will take Ether below $80 in a large wave 2. The other will hold $80 in the 2nd wave of a large third wave.

Zooming in, the current correction is counted as a B wave rally in the larger circle-IV.

GBTC Intermediate View

I expect the 2019-2021 cyclical bull in GBTC to culminate in a five-wave rally to the $150 region. This five-wave rally is most likely the first wave of a large third wave. However, the discordance in the long-term GBTC and Bitcoin charts, due to GBTC's shorter life, leaves that questionable. I’ll explore long-term options in a supplemental write-up.

Zooming in, GBTC continues to hover in a potential wave 2, in a setup that eventually points to $88 where wave-(III) should top.