Nightly Crypto Report: Trying To Break Upward

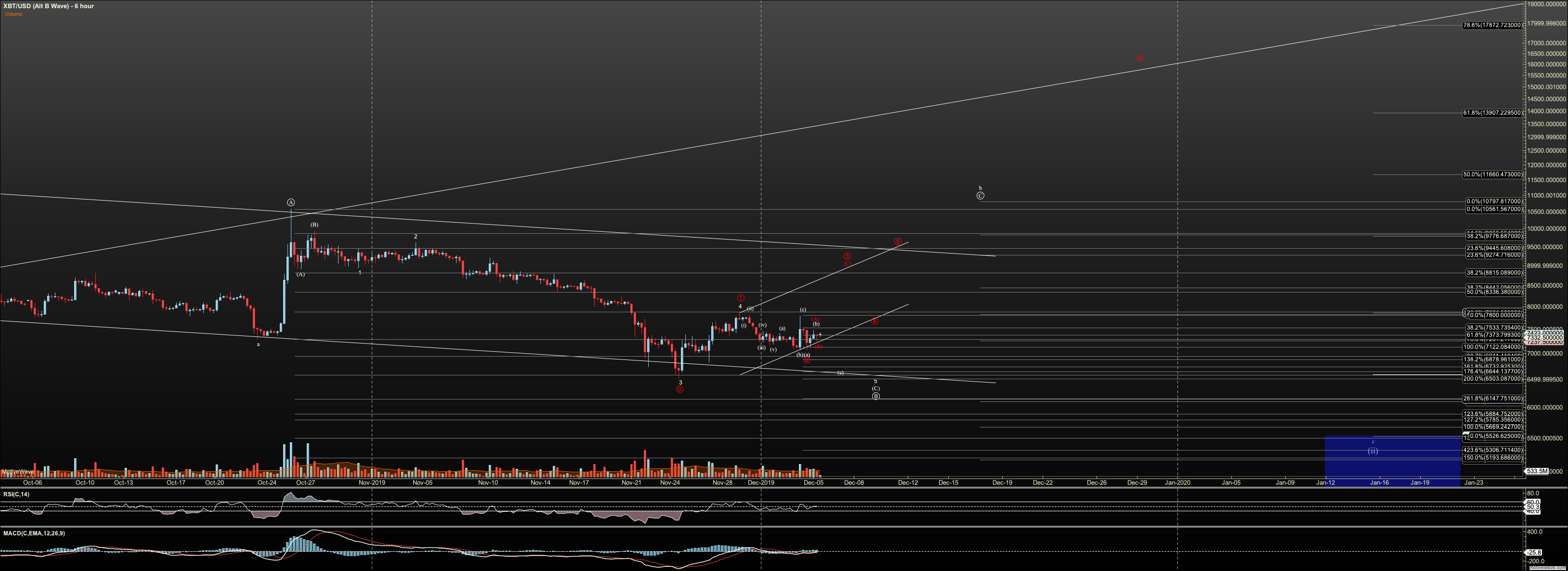

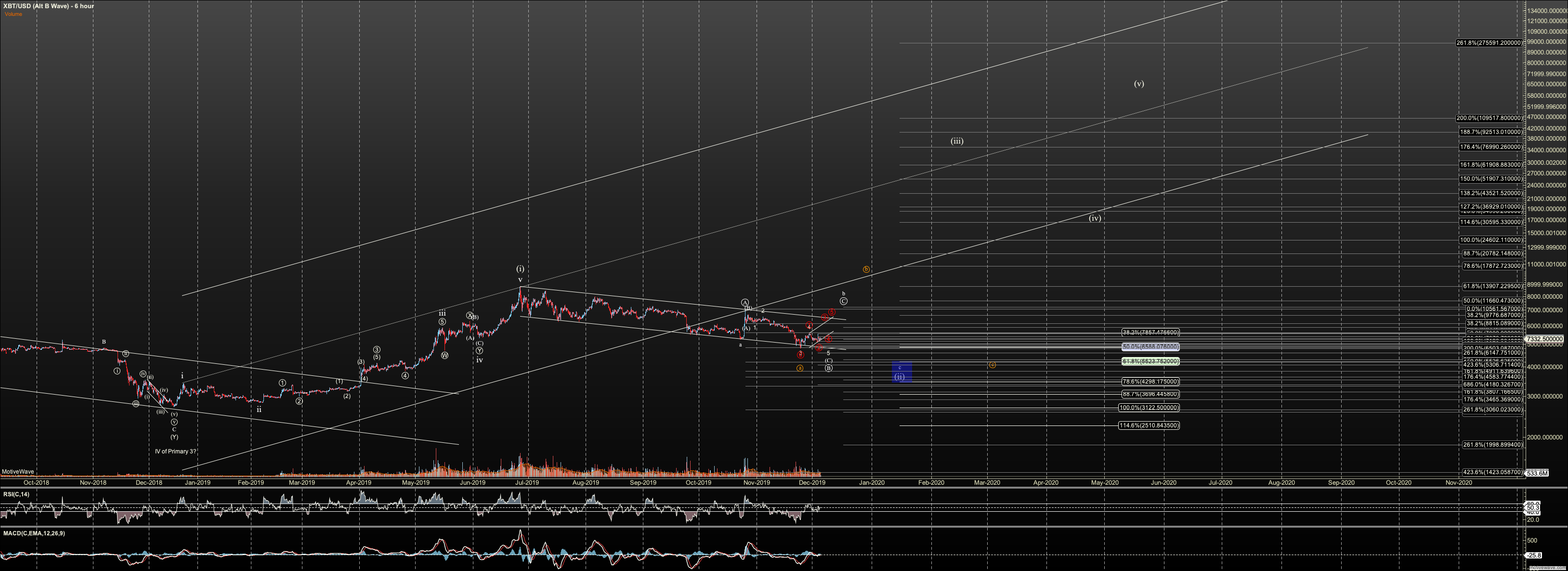

We have a bullish set-up in Bitcoin but a very risky and ugly one. Depending on your disposition, you might avoid playing this. If we are really going to bottom, the market will clean itself up and no one is going to miss the train from here. Further, the current setup doesn't eliminate the bearish potential.

Yesterday we saw a brutal rejection of our rally. I was bearish all day and that appears to have been right, but only short term. If you look at action today, we saw higher highs form. Further, the same indicator that told me yesterday would fail is showing the opposite today. But more than that, we starting to see shallow consolidations up against key resistance levels. This is a market trying to break upward. Further, the drop last night, either truncated or was simply three waves. We did not see an impulse complete.

Now, I just don't know whether this can be the final bottom. Because we have rallied off the lows in three waves we still need a five wave structure shown in red to anchor a bottom. If you are not nimble, you might want to wait for the red to fill in and buy the inevitable pullback. But what I see in the short term is a setup that targets $8300 and invalid below $7200. That risk to reward suggests an opportunity.

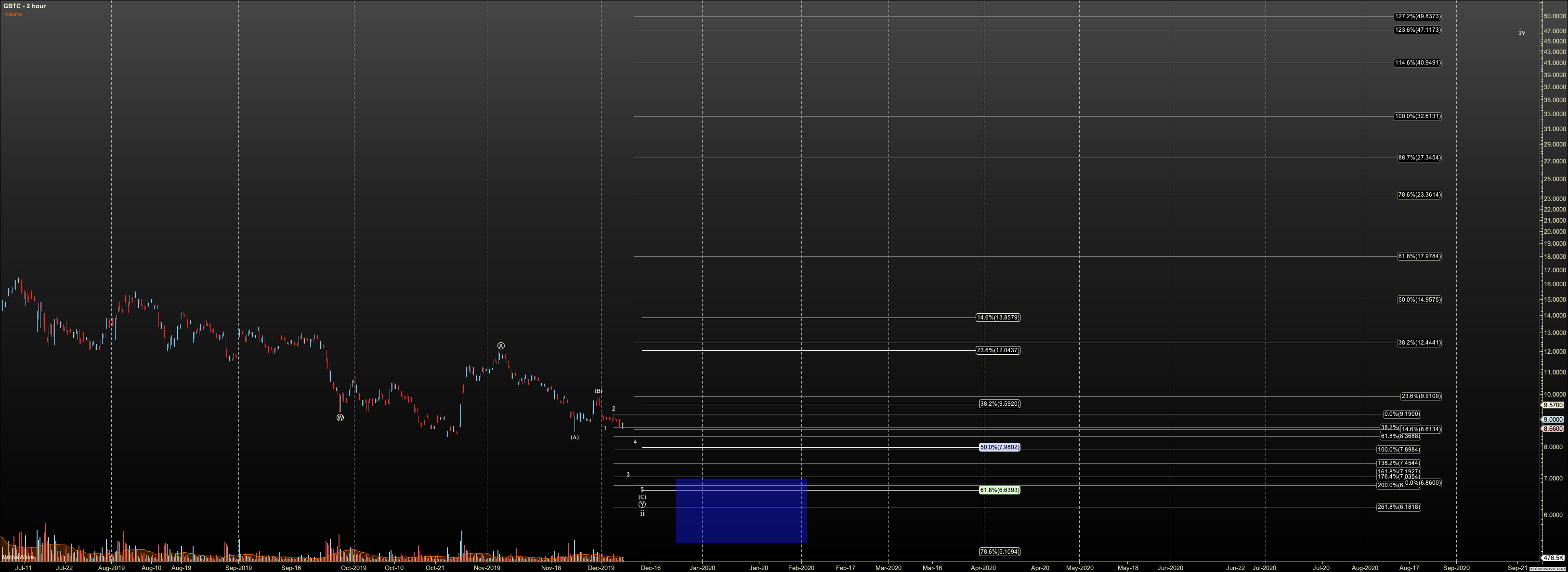

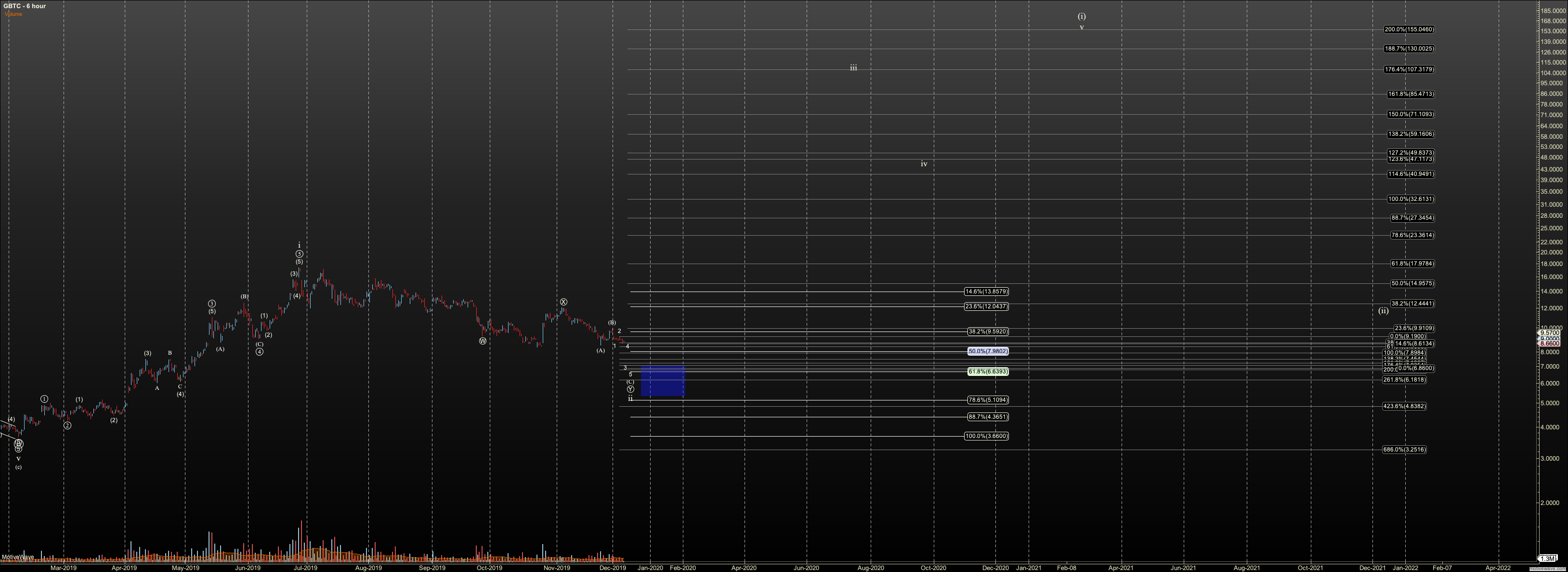

Now, on the bearish case, I do not have a similar setup in GBTC. I am wondering if we see a run in Bitcoin but GBTC just puts in a larger wave 2 which doesn't break over $10.18. That makes a lot of sense to me. But then, if the case, I would expect BTC to top in three waves in red and not get that 4th and 5th. Then it finally goes lower. I do not know yet as this market is showing us very messy structures in both directions. Yes, there is no clear red option for GBTC yet.

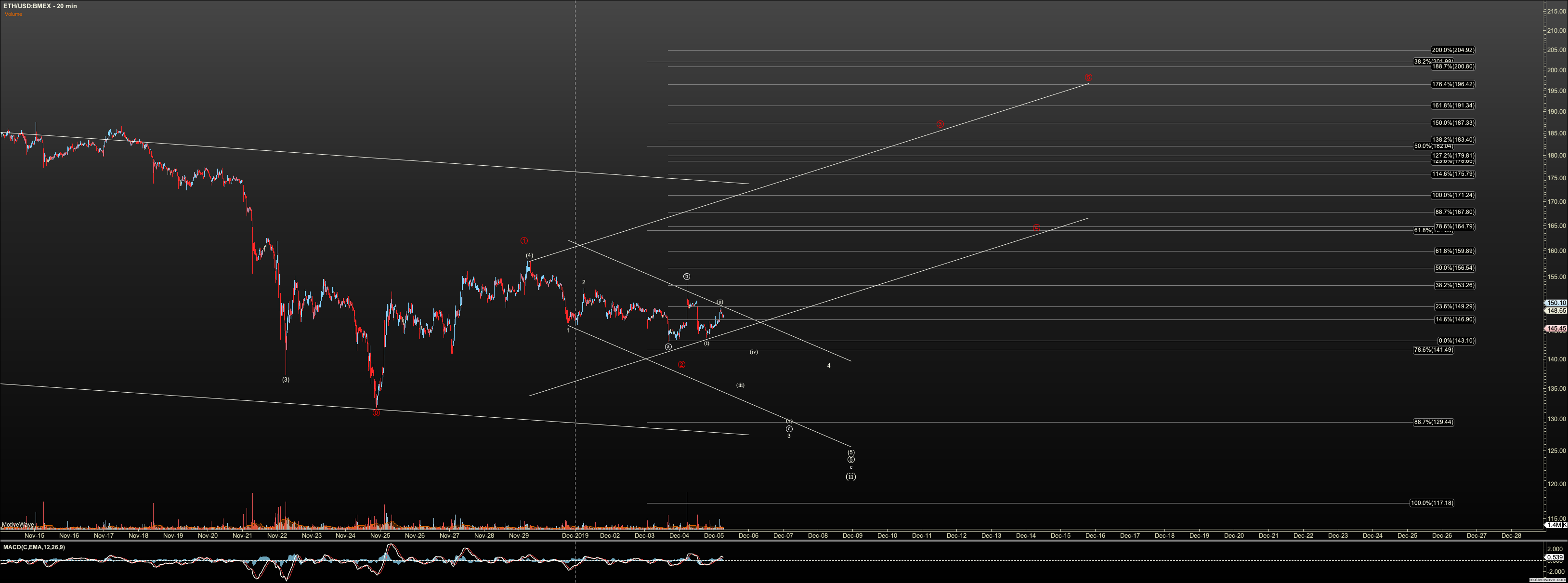

I have added red in Ether as well. I see an even less believable structure for higher in Ether, but I presume it will take the path higher. These two are so correlated.

Play this setup at your own risk. I cannot emphasize that enough. I am currently long and will roll up a stop as we go.

For intermediate- and longer-term analysis, please login.