Nightly Crypto Report: The Pause that Refreshes

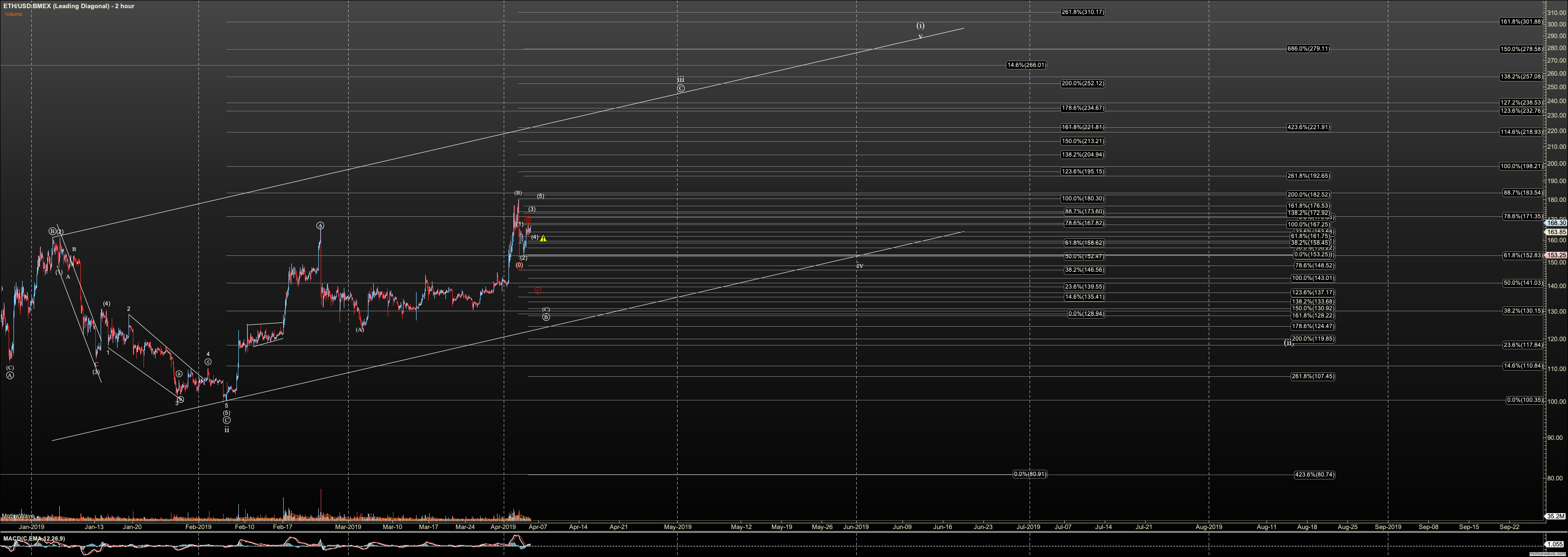

So far there is nothing about this action that gives me concern that our rally is about to be undermined. We have purely corrective action, over close in support. So for now, we should see the next targets to come in range once this correction is done. But keep your eye on support. And, honestly, where Ether failed to hold support recently, I am honestly tentative as to whether we'll see such a deep B wave flat. This action can change, but so far it is sublime.

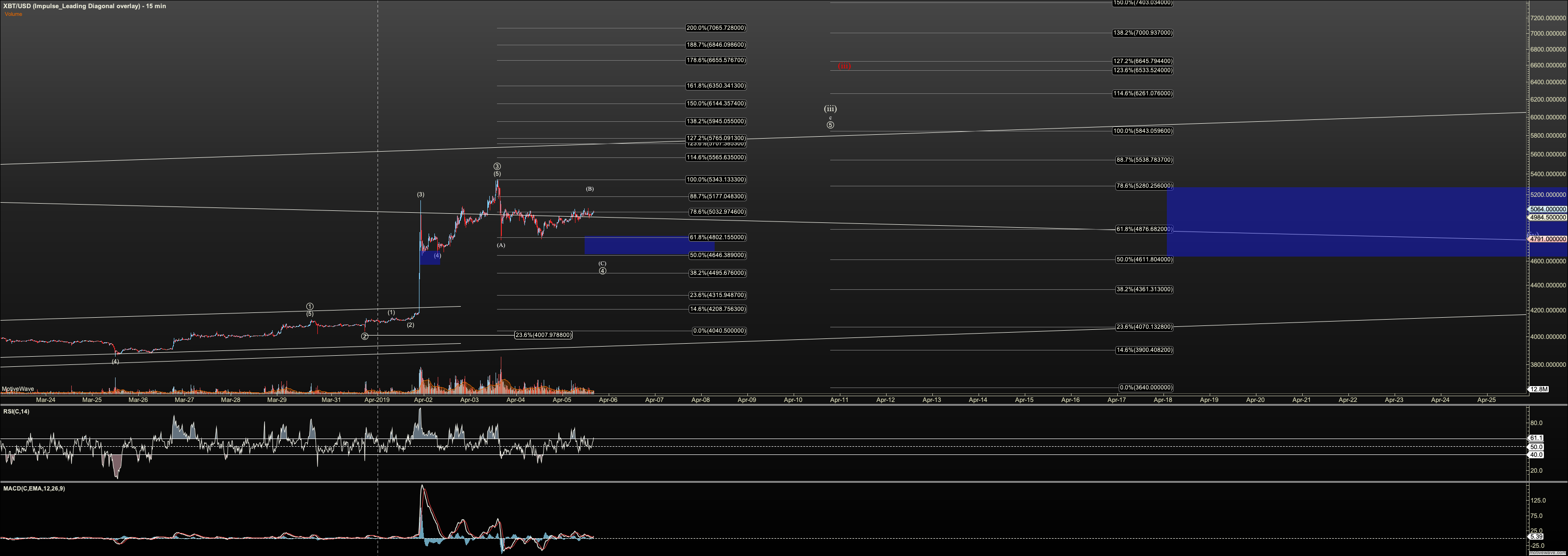

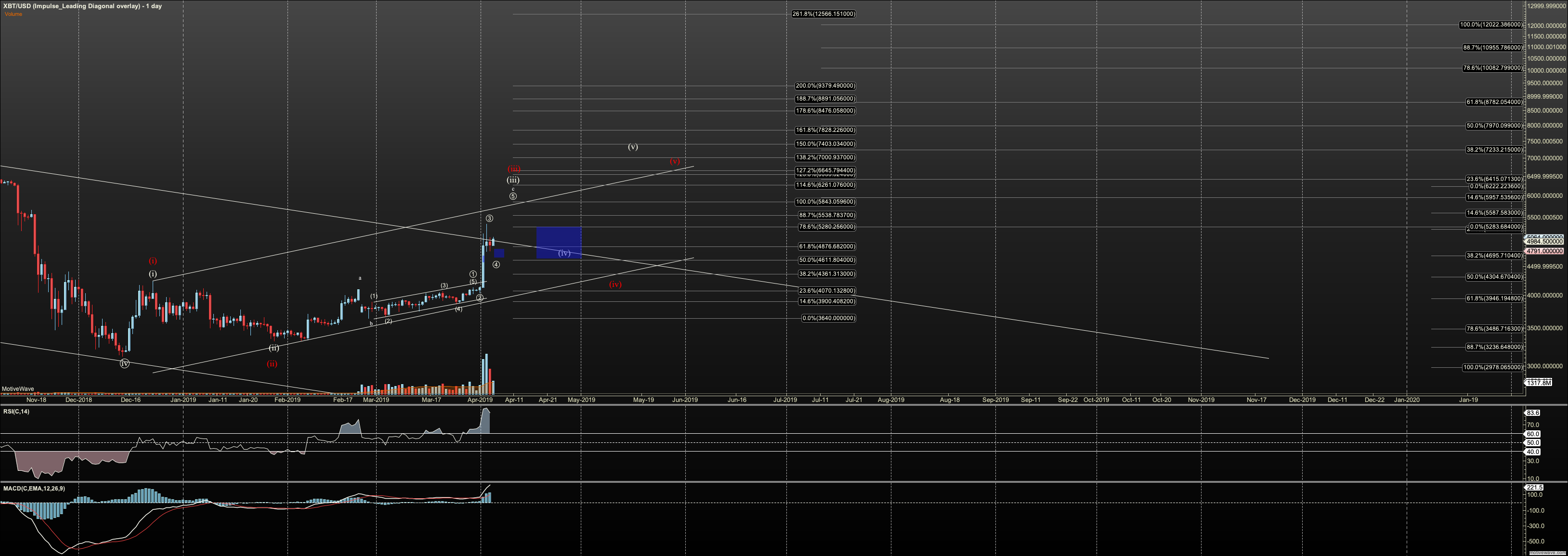

I want to take this report and dive into the BTC structure a bit in detail. As I had recently said, I am now tracking a diagonal. However, that diagonal does have an issue which suggests the possibility that we are in an extended impulse. I know this is Greek to some but hopefully this will offer some clarity. Basically, the impulsive potential pushes both our support and targets higher. The latter should push into the $7K region.

The 'bogey' in the room is that Feb 22 hit of the .764 extension and in a way that looked like it was three waves (the A of our third wave in the diagonal count). I had said if the high we had that night was actually a high B after a wave 1, we are not in a diagonal. Honestly, the way that correction ended confirms that potential. Further, today I re-checked all my fibs, and realized that our third wave is already high enough to make the C longer than 1.382 of A in log. This is rare in highly liquid assets. This suggests we have the potential that we are in an impulse and one very extended. So, I present to you now a chart with the impulse as primary in white, and the diagonal, in red.

The difference is the ultimate target: $7000-7500 for the impulse versus $6650 for the diagonal. But more striking is how low the wave iv can go, typically near the channel or a little bit lower in the diagonal, where the wave iv of this impulse should hold over $4600. It is going to be the quality of our fourth wave which confirms which count we are in, but the 'too long C wave' suggests to me, that the impulse is the winner right now.

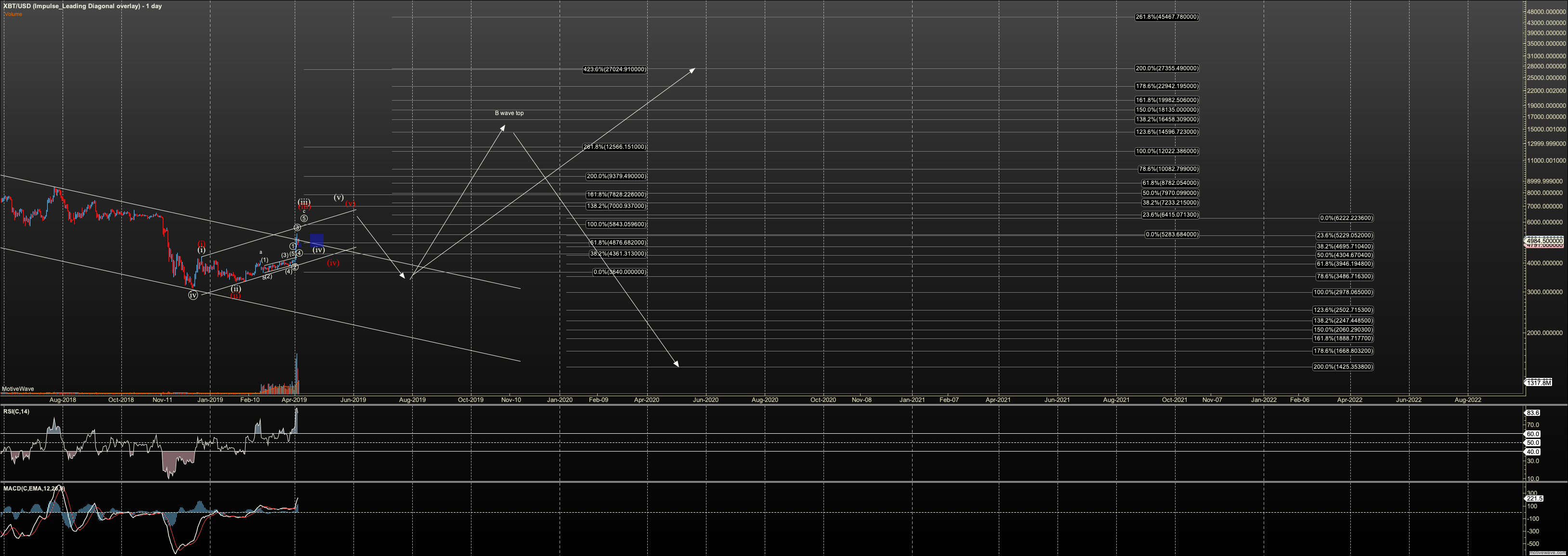

Also, now that I can see our first degree forming, I did some fib work out into the future and what is see is that if impulsive, and the next degree in BTC is impulsive suggests a rally to $27K in BTC. That can easily stretch to $65K if there are extensions, my next long term target. Also, we'll need to watch for a high B wave around the 12 to 16K region. See arrows on the zoomed out daily chart.

To recap local support and targets:

I'd like Bitcoin to hold over $4645 and we should move on toward the $5700 region.

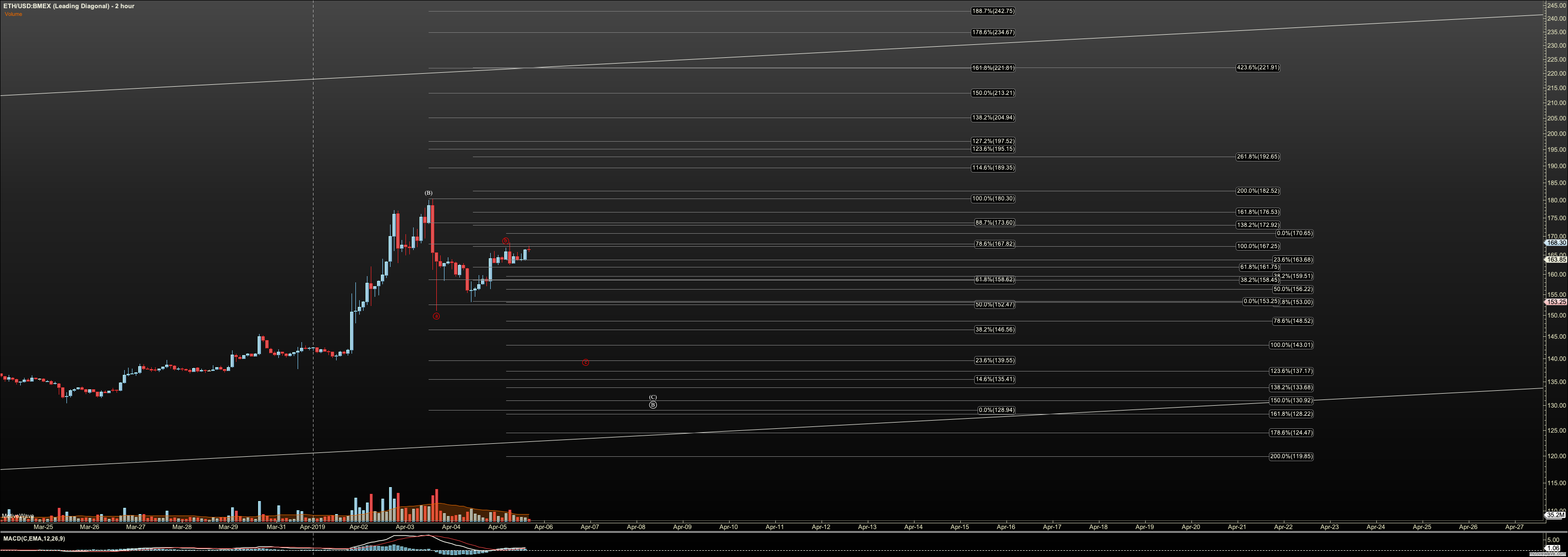

Ethereum should hold over $128 for the B wave bottom, However, right now I only have an A=C projection to the $140 region, so we may hold here.

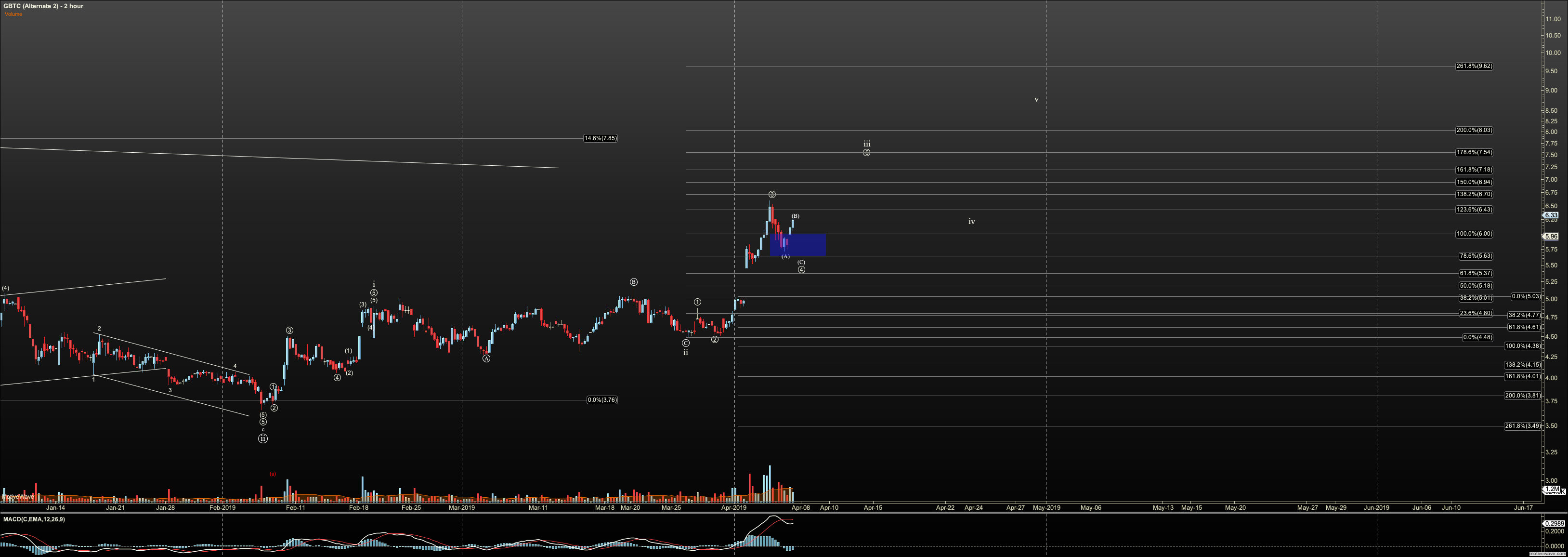

GBTC is still holding the impulsive count. I tried my hand at another swing trade position today. So far so good, and I suggested the possibility that if Bitcoin sees its C wave this weekend, we may see GBTC gap up if BTC also reverses over the weekend.

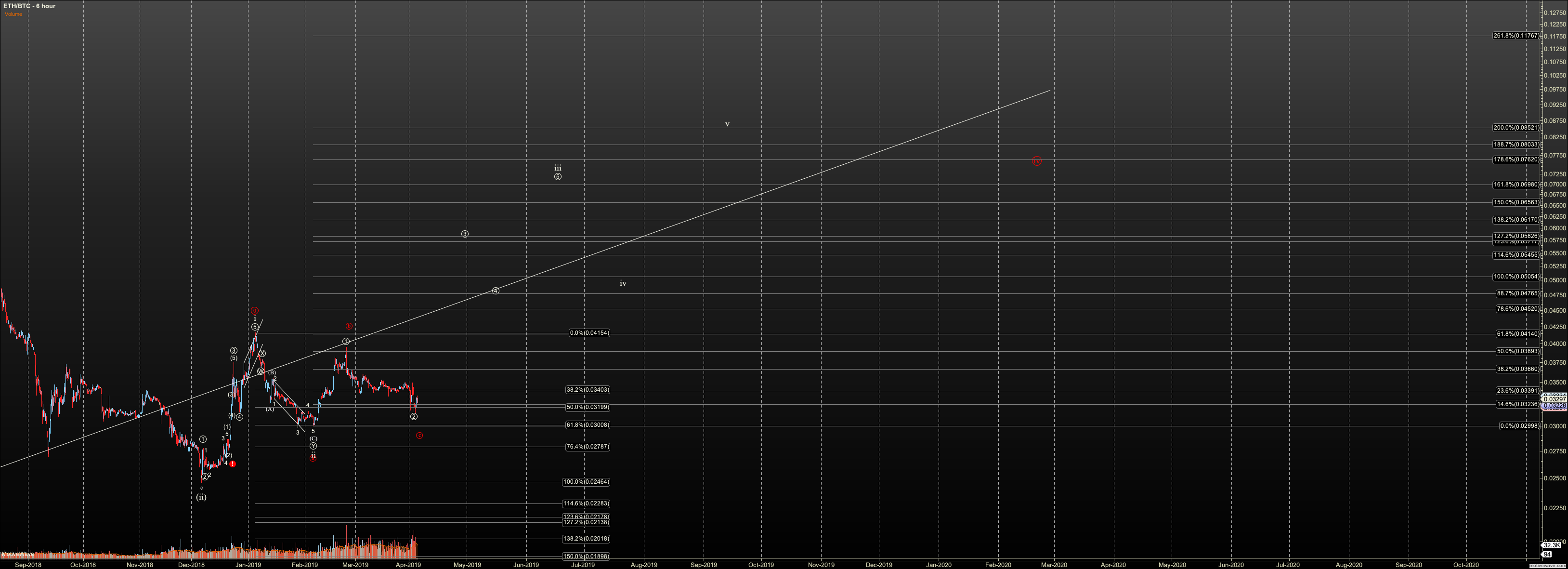

No change to ETHBTC at this time.