Nightly Crypto Report: Testing C Wave Resistance

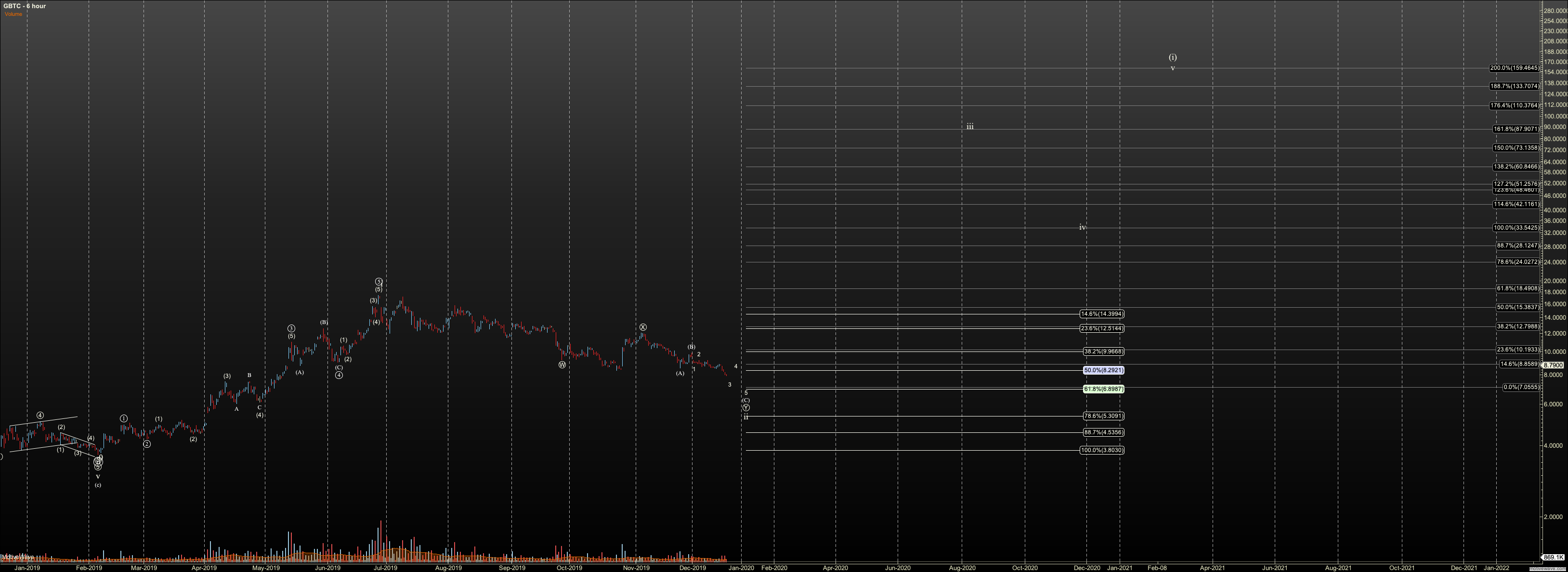

GBTC during premarket went straight into C wave resistance. If it gets through today's premarket high at $8.83, I'll at least need to be short-term bullish. But the overall price action is quite messy, so structure for such a count is not clear at the moment. I just know that level is key resistance.

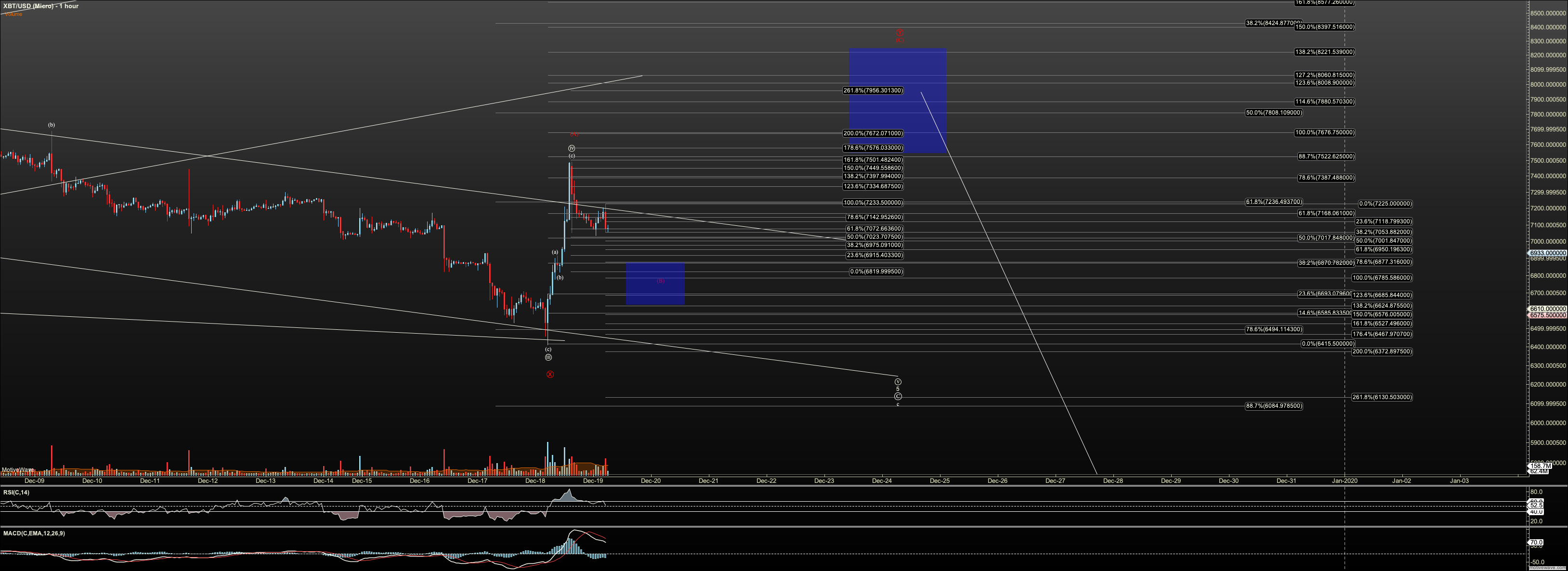

In studying BTC further, if we have a break of $7023 we have a failed impulse because currently we have three waves. However, I like the structure here for a WXY shown in this slight red modification. This means we can see a low B in the $6K's. Below $6625 suggests we're taking the direct route down. I have to say I really like this count in the current structure and we see similar structures in Bitcoin as this count quite often. But this is intuitive until we have an impulse to start C.

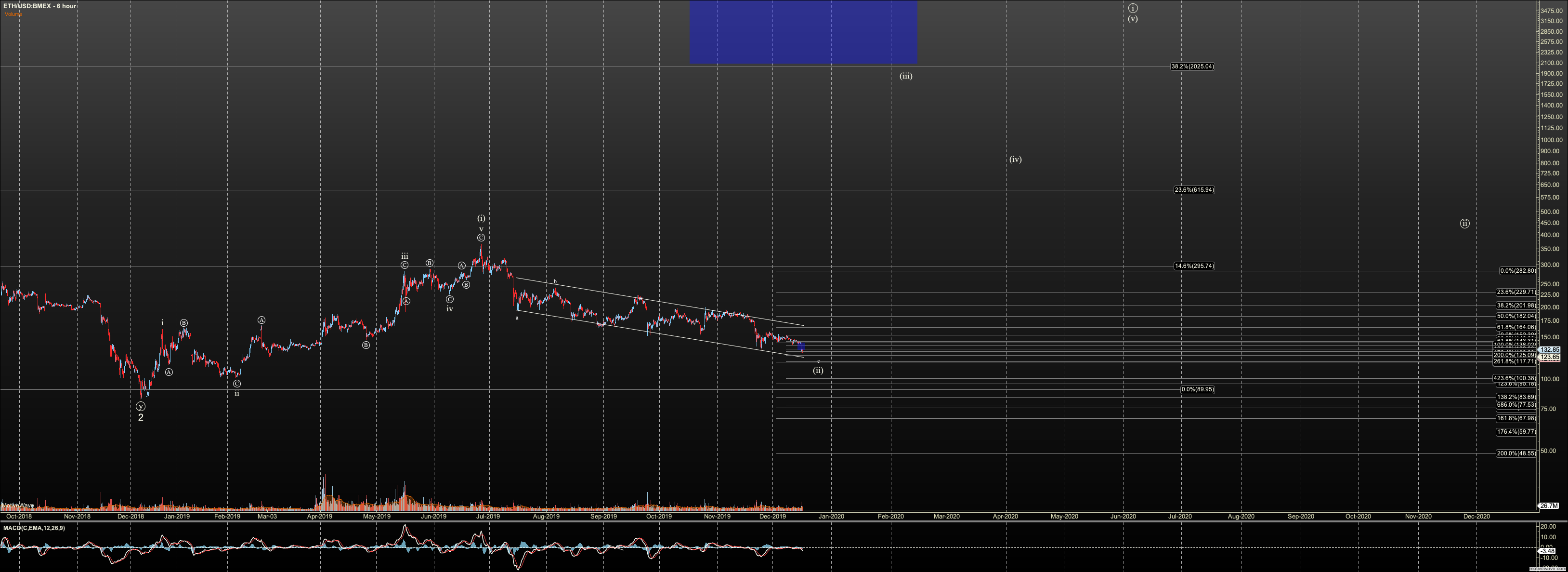

I've filled out a red count in Ether. It has potential five waves, and I have room for a wave two down to $120. I also like this count. Further, it makes much sense with ETHBTC entering the lower support region. I'm watching for that pair to reverse anytime.

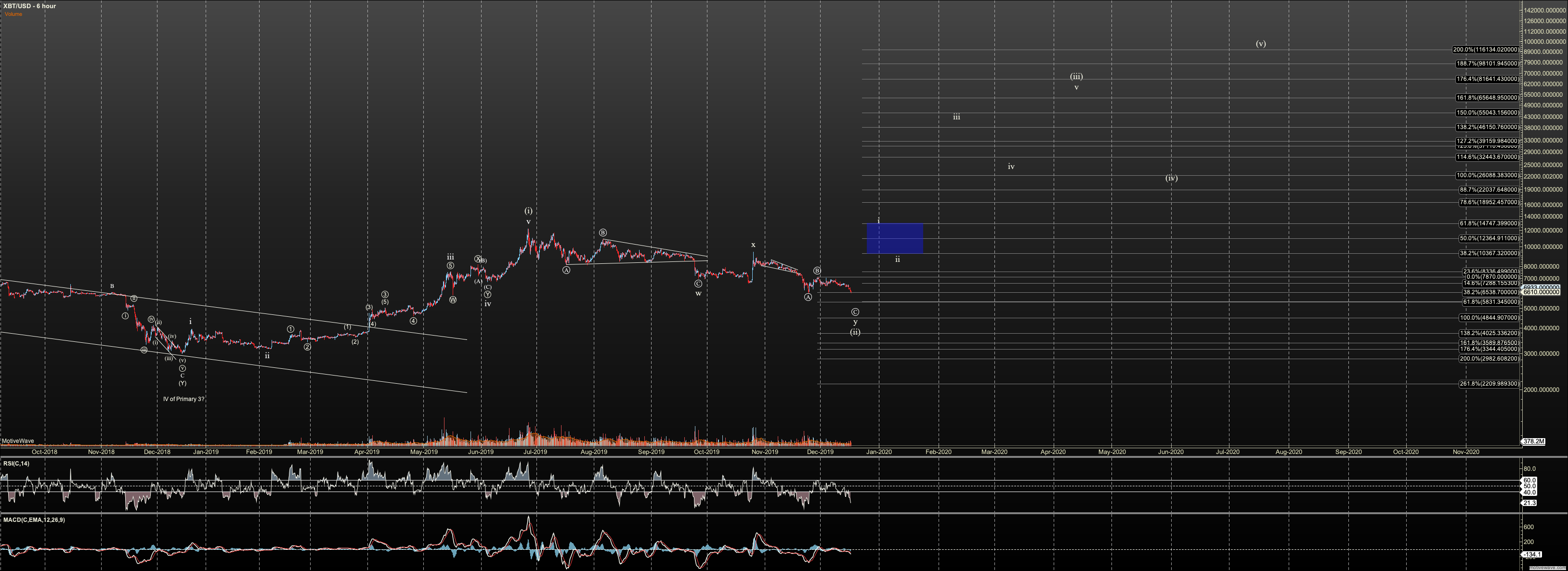

Here is my extended write-up from yesterday on Bitcoin:

While we expected a move off recent lows, and I even cautiously went long, this move higher is unexpected. But Houston, we have a problem. By and large we completed three waves lower, not five. This means we really can't trust our bottom. We've been here before. This same structure has shown at various bottoms in this correction, important and minor. And where did get us? A correction that continued lower. This is no different.

While I can loosely hang on to white count in Bitcoin, we are through the channel. I do not trust expanding diagonals a structure in cryptos. I have NEVER seen one complete. So, getting that white 5 down, may now be unlikely. But because we bottomed in three waves, where does that leave us? It leaves us with a probable ride back up in red C. And, I'll hold to that view as long as below $8300. This means we can rally to high a $8300 and THEN come down toward our final target at $6100-5500. This is exceedingly evil if you are unaware. But for me, this is a great trading opportunity.

But this can be a challenge if you are not used to the tactics of managing such bifurcation. Here is my method:

I picked a long off the low yesterday. By and large I took profit as we hit the channel. We are still in three waves, and an impulse is invalidated if we drop from here below $7023. So, my stop on the rest of my position is $7015 where I go flat and assess. By and large in red C we can top anytime as we already reached the box. NOW if we reach five waves, which looks to need $7900, and then only see a corrective retrace, we are very likely to breakout. There are likely to be other nuances I look for but you must stay tuned for that. So, if you are not already long, you don't need a stop but might be interested in an entry. I personally, if not long and I was not a scalper, I'd wait for 7900 to be hit, then go long in a clearly corrective pullback. I'll mark support for that pullback when I have a confirmed top in five waves, if we get it.

Bitcoin Intermediate-Term

Bitcoin put in a strong bottom at $3120, which aligns with the long term support for my primary count, at $3000. Holding there suggests good probability that we see a run to $65,000 - $225,000.

We currently remain in our wave two correction as we failed to hold the $7300 low. This opens up potential lows between here and $4300. $5500 is the next key level to watch. Until this wave two bottom finds its bottom, the long term trader has choice. She might choose to scale in, saving cash for a deep wave two. However, with every position they take on she must count that below $4300 opens the door to $3000, then $1600. With every break of support, one needs to look lower. So, it is often wise to wait for a decent short term setup before deciding to take on tranches. The high probability bottom from here would involve an impulsive rally to $15000. A pullback would offer a less risky entry than the current free fall.

Holding somewhere above $4300 keeps the door to six figure Bitcoin open, but how deep into six figures is not known until a bottom is clear.

Ethereum Intermediate-Term

Much that has been said about Bitcoin applies to Ethereum, but Ether is already very deep into the wave 2. If it breaks $113 risk is high that the December low is not held and the door to the $40's is open.

GBTC Intermediate-Term

GBTC based on fibs has quite a bit support below. Though it defies logic to many, it has not corrected as deep as Bitcoin as measured by fibs. $8, $6.60, and $5 are the last key fibs before the February low is at risk.