Nightly Crypto Report: Sideways To Up-Bias In Price Action

Short-Term Traders

It appears that at least Ether is pushing for the 5th, but otherwise there is nothing in today's report that is new. We've seem to have a sideways to up bias in price action. The only source of room excitement today was the first trial of the new ETHScalper algo, which signaled long overnight at $610.50 and for which I provided a late signal when I got on the board.

I did catch that I had not moved the B wave top label on the Ether chart last night. I had done that work on my global average chart and not transferred to Bitmex. It's caught and corrected.

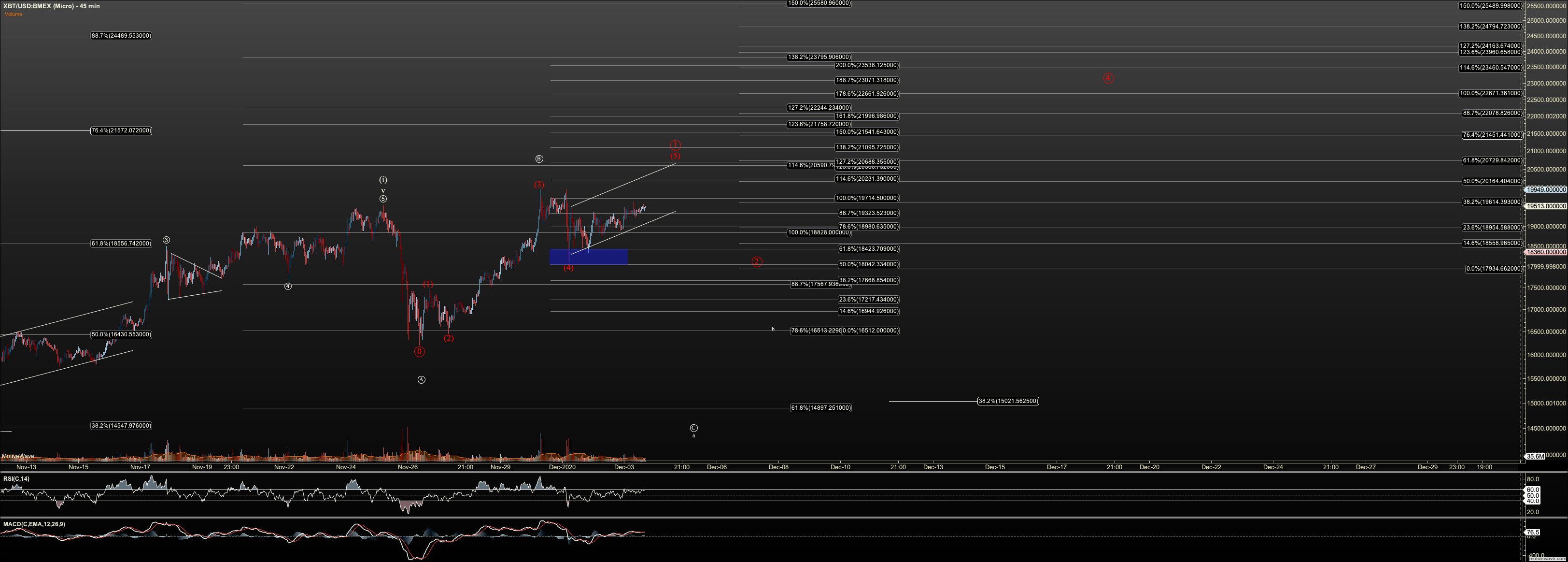

Bitcoin

$18080 is still key in the key battle line in Bitcoin. We held it to the line overnight and there is a potential that we are in an ending diagonal for the red (V). But an impulse is not possible based on micro action today and we have been putting in lower highs midday, so Bitcoin may retest that support again. If broken, I must call this structure three waves, and assume Bitcoin truly is in white (ii). I suspect we'll have an answer in the next 24H to 48H.

I remain long with put options to defend my position.

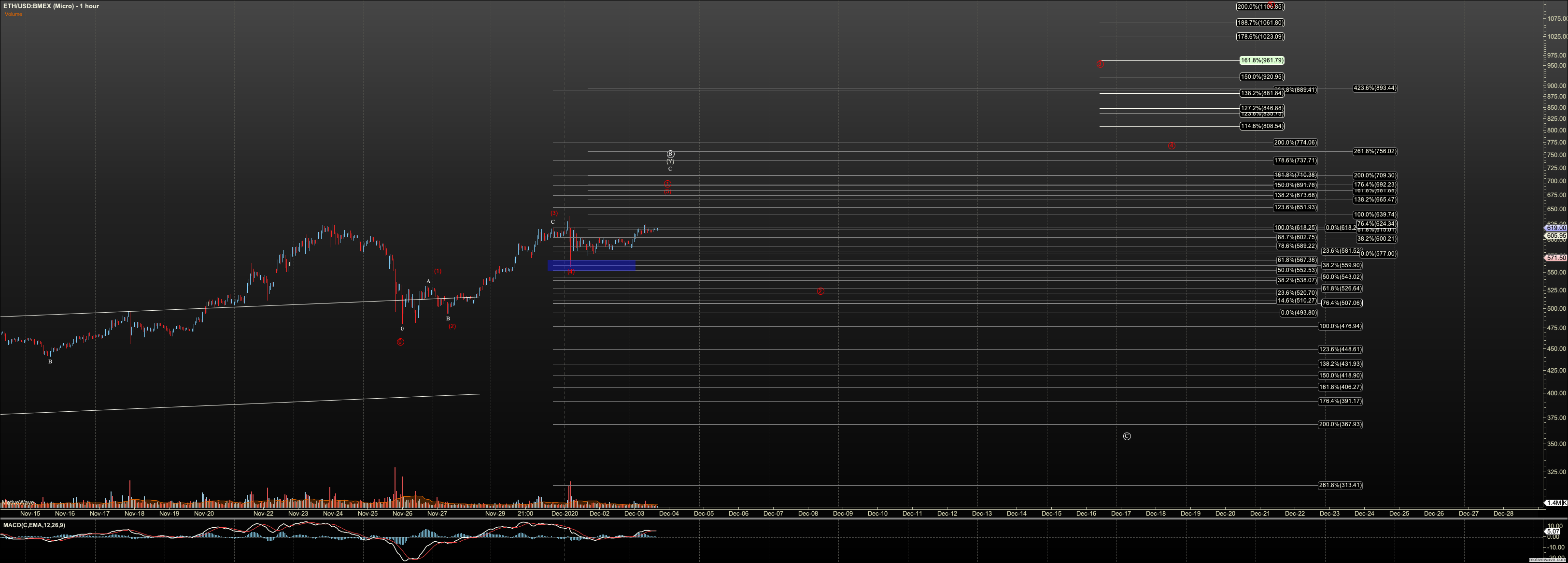

Ethereum

With the invalidation of the 1-2 setup to the downside I am projecting Ether's move to $1100+. But first it must now hold $513. If it doesn't, it has topped in one of the most choppy B waves I've seen in crypto and should move to the box below at least in alt circle-c, which is similar to the one projected prior. Note due to the lack of confluence in multiple timeframes, I am fairly likely to change targets for sub-waves above, as we move to $1100. Circle 3 through 5 are placeholders for now forced into confluence with the daily chart but do not fit the micro without hyper extension. Sometimes hyperextension of micros is what happens to meet larger targets but it is hard to know from below. While probabilities for targets are still low, supports are clear and we can rely on them for long trades. I simply need more time to become confident in targets.

Zooming into the nano, Ether held $555 and saw a strong bounce. But it is corrective. If Ether is going to put in a more defined fifth wave, it will be in the form of a diagonal targetting $650. This would be a welcome addition to the bull case. However, if we break $555 now, we are in circle-2 with support at $513, or alt circle-C if breached.

I have a small Ether position based on the new ETHScalper algo.

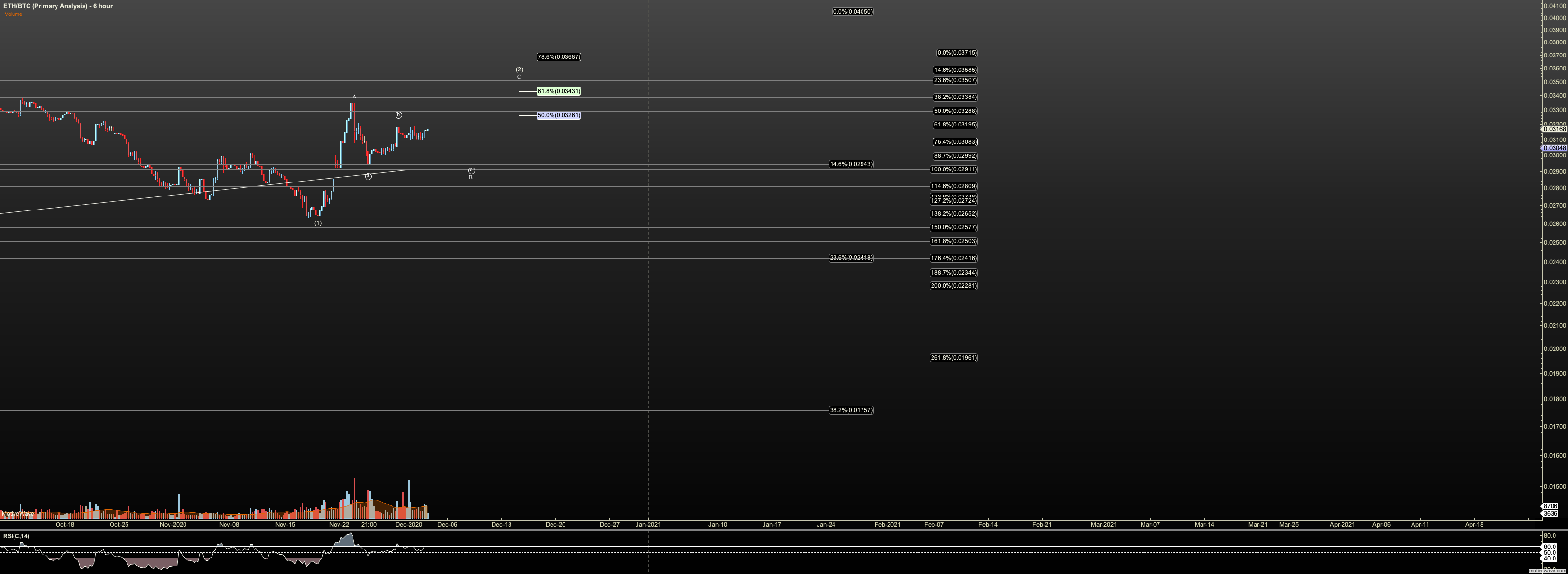

ETHBTC

No additional clarity today as the nano structure was exceedingly choppy.

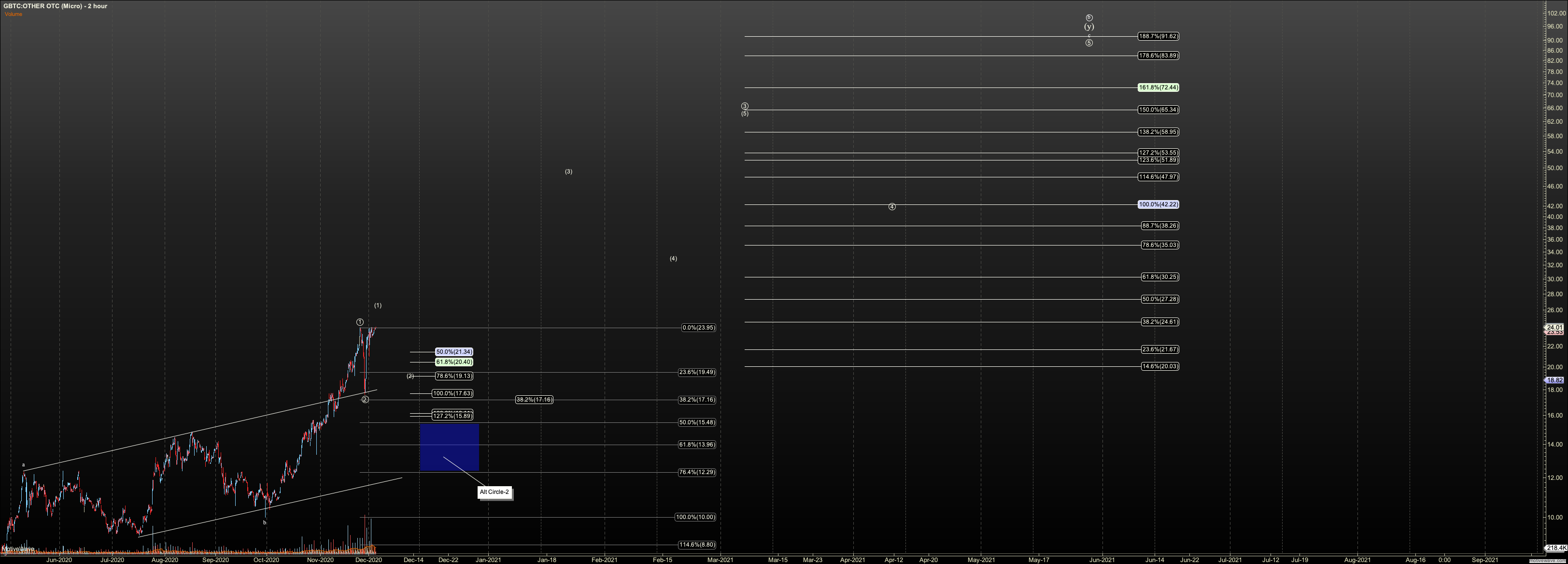

GBTC

We saw continued strength in GBTC despite weakness intraday in Bitcoin. It is possible to call our move off the low I've marked circle-2 five waves. It is just a low probability judgement I'm making based on very illiquid micro structure. We need to hold Circle-2 or the door is open again for a drop to $12, but this would not change the count, just adjust targets based on a new wave 2.

In reply to questions I saw a few times today, I want to clarify a few things about the GBTC micro. And I added the degree with (xx) nomenclature. This ultra bullish count assumes we're in (1) which I added, and circle 2 will hold. And, that we'll see a higher low in (2). This is viable as long as $18.75 holds. However, with the unreadable micro structure of (1), which is not uncommon in GBTC, it is hard to see where (1) will likely end. Zooming out a degree, fibs suggest it can be in a range of $24 to $30, an area we have just barely touched. So it's possible we climb further into that region before topping in (1). As as mentioned above, if circle-2 doesn't hold as shown, we'll look to $12 as low support and adjust targets above. If you are looking for a pullback to add for your 'EW trade allocation', you'd add into (2), but it is floating until a clear top in (1), which best I can tell by structure requires a break of $21. I hope that helps but let me know if more questions.

Magicbus and MOMO are long so I continue to stay long in those buckets of risk allocation.