Nightly Crypto Report: No Need To Rush In

Cryptos continue to chop in a small rally that we expect to precede our next drop. With this structure, I need to be ready for surprises. My 'worry' is that this chop leads to a breakout before I expect it, and I don't want anyone left in the dust. And, most likely this count leads to changing counts over the next week or so. These changes may include larger diagonals and WXY structures.

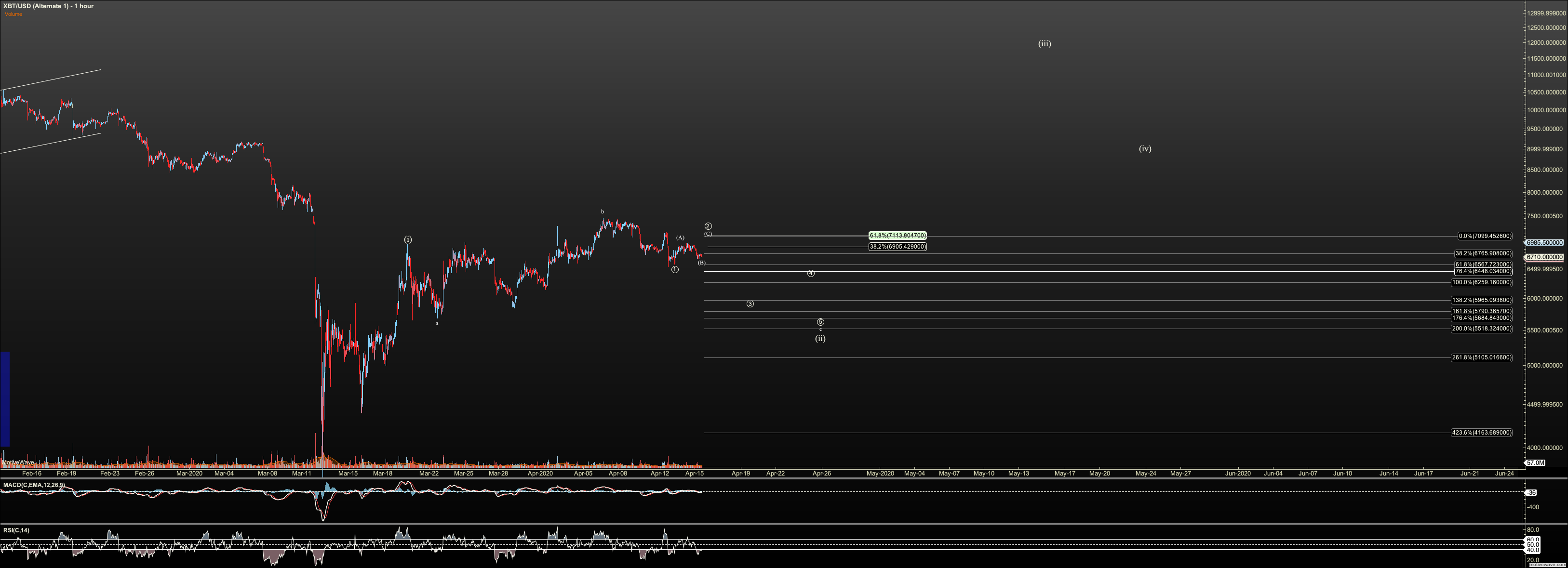

Bitcoin

I am looking for circle 2 to complete tonight or early tomorrow. In this circle 2, we have completed the (A) we should be in (B) now. It may be complete but it can rally as high as $7265. If impulsive over that level I'll need to look for a breakout. Once Circle 2 completes, we should see an impulsive drop to the high $5K's.

Ethereum

Ether can rally as high as $171 and still be in wave (2). Like Bitcoin, A has completed and we are in wave B. Impulsive over $171 will have me consider a premature bottom is in. Once (2) is complete we should begin to roll down toward $120.

ETHBTC

No change: I now count us bottomed in circle-4 because we breached resistance called out in Friday's report. I don't yet have action to guide a more micro count. Note the A wave can be either five waves or three. It appears we are still working on the fifth wave of a five wave A wave.

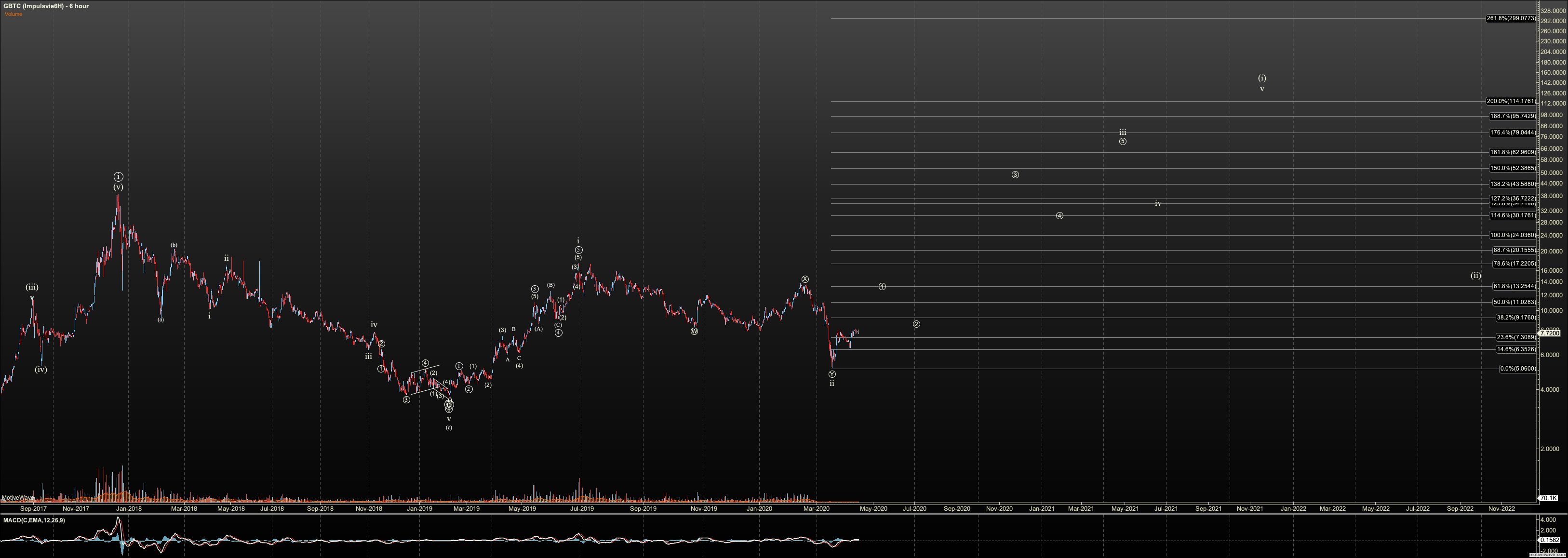

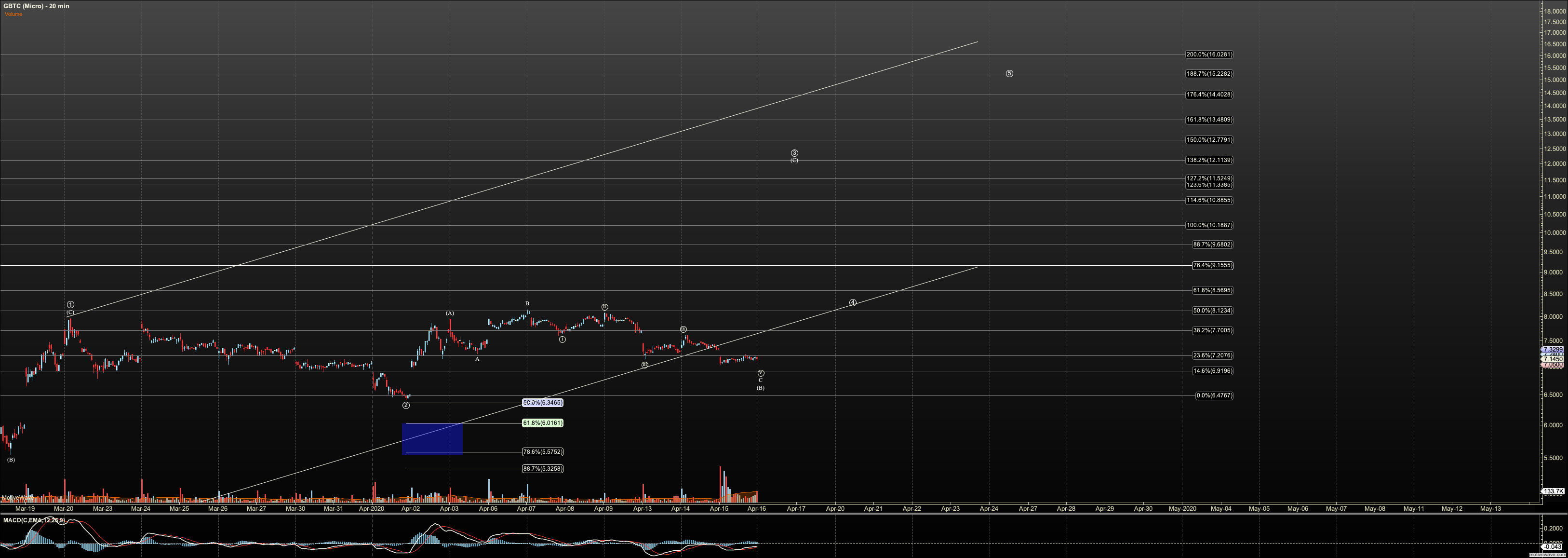

GBTC

$5.57 ideally does not break. At the moment, GBTC appears to have completed circle-iv and is now falling in circle v. If we turn over $7.60 a low may be in but I'll need to see a clear impulse to rely on.

ST Tactics:

I want to move from discussing my personal tactics to teaching better how to make your own plan.

Let's talk tactics again while this is slow. Per the webinar, how you approach this action depends on how long you've been, what timeframe you play, and how closely watch your trades. Some considerations:

Price Action:

1. We are not finishing good impulses down. So, while I lean bearish based on levels, this is the sort of action that gets bears excited, then wipes them out. I'd say my bearish view is just one foot in the water still. We should have seen more follow-through.

2. Given the above, I'll be surprised we see $4K. I even wonder about mid $5K's.

Strategy

1. If you are very long, de-risking a bit is reasonable.

2. If you have not been long off $3700 this is a reasonable range to accumulate with a stop at $4K. Take it very slow, because $4K can break even though I'd be surprised. So, until we have a clear impulse to push us over $7300, there is no need to rush in.

3. This can be a good play land for scalping both ways but very difficult with this chop.

4. If you only trade every once in a while and don't watch trades closely accumulating is smart, but you really should keep more cash than someone who watches their trades like a hawk.