Nightly Crypto Report: Inklings of Breakout

Inklings of Breakout

Long Term Traders: Watch micro counts for long term entries below. Consider scaling into this drop with a $4K stop, or at the March 12th low to avoid a stop run.

BTC: $6400, $5650, $4000, $3000, $2200, $1600

ETH: $172, $141, $116 $95, $83, $40

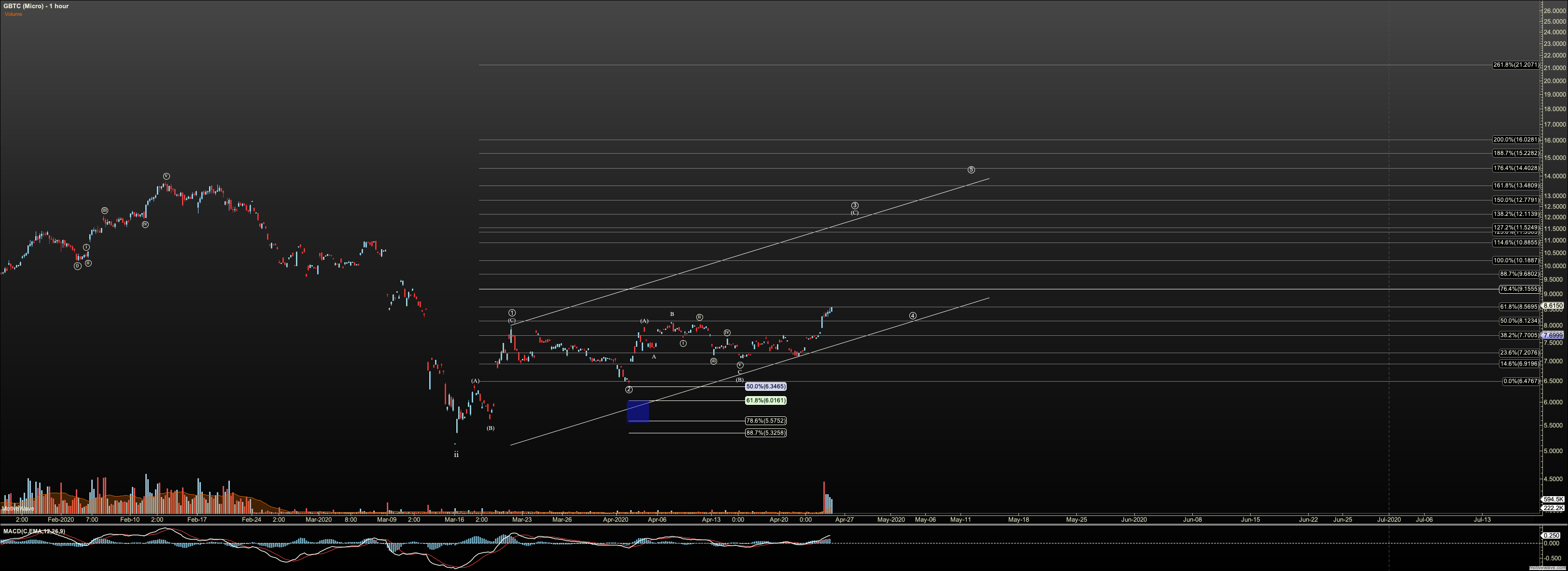

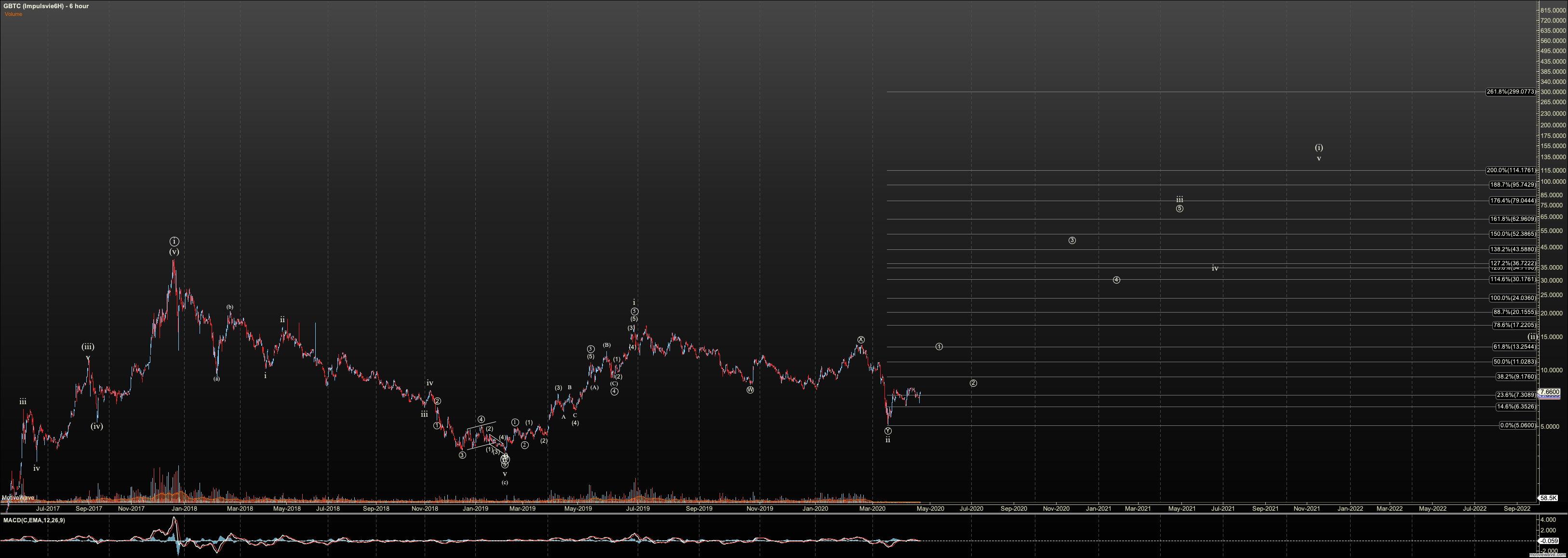

GBTC: $6.93, $5.57 , $1.71, $0.73

Short Term Traders

General

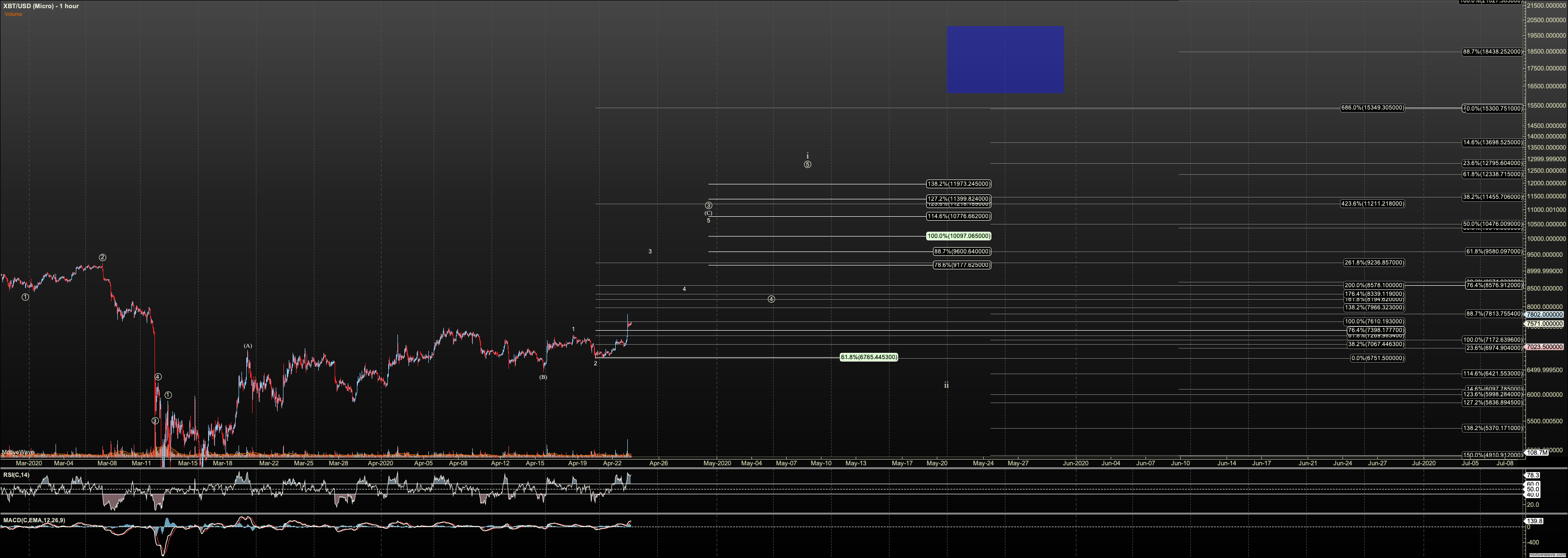

Nice action today as both coins pushed over recent highs. That said, we have 'bifurcation of clarity' between our two big coins. So, far Ether has pushed to the .618 extension in a clean leading diagonal. On a nano-level I already have enough break of support to say circle ii has started. But Bitcoin pushed straight through to the 1.0 extension. That can be an extension on the 5th of a diagonal but it is obnoxiously long. So, I remain cautious on whether I have a handle on the Bitcoin count, nano at least.

In other important 'news', Bitcoin has retaken the 'point of fear' where price began to accelerate down on March 12th. But we have to see a decisive of $8125 to say this battlezone has been retaken by bulls. Further, GBTC has pushed through two levels of resistance and taken back the March 12th gap, analogous to Bitcoin's 'point of fear'.

Bitcoin

There are times when the micro is not clear EW wise and this is the case for the Bitcoin nano. Pulling from the price action school of thought, breaking $7190 can be viewed as a significant retake by bears, and I'll then look to see if our low at $6720 is retaken by bears. That would be significant. But again our 1-2 setup is not dead until $6460 is retaken.

Ethereum

In nano, we've appeared to have started the pullback in circle ii and ideal support is $172. Invalidation of the leading diagonal Circle i and ii, will come t our low at $166.60

ETHBTC

We've pulled back

GBTC

Great work GBTC. It appears we have 5up off the low at $7.12. This means we ideally hold $7.29, the .764 retrace of our five waves off that low. I will add a more nano degree to my chart when. pullback starts.

ST Tactics:

(same)

I'm discussing tactics based, again, on your starting point.

If you are not long and looking for a setup, we have a very clear short term long setup with the parameters above.

If you are long like I am already, You have a choice here whether to add risk here. But regardless we have a very tight stop on the long side. You may also lean toward hedging, and that is reasonable if already long. but stops on hedges should be considered at $7300 Bitcoin and $190 Ether.

Bitcoin Intermediate-Term

On March 12, we saw a broad Crypto crash. Not only did we breach $7125, support for the potential wave 1 and 2 off the December 2019 low, but breached $4300, key support for the 2019 wave 1 and 2 of higher degree. While much of the character is like an ‘evil scenario’ I posted back in November where we have a high B wave like the one we saw at $10,500 and then decline to the $5-4K region before resuming the run to six figures, the breach of $4300 suggests it may be more than that. While the 2019 wave 1 and 2 is not invalid according to Elliott Wave rules until the origin of wave 1 is breached ($3120 on Bitmex), we know from Avi’s work that when the .764 is breached ($4300) often invalidation follows.

In light of this, and the strong reversal we saw from the nominal breach of $4300, I have to have one foot in the ‘bearish’ camp where the run to six figures plus is delayed, and one in the bullish camp, with a reset of the 1-2 setup. The nominal targets for the bullish case took a haircut with a drop near a clean $100K. However, that certainly can be regained by extensions in the third wave.

For the immediate bear case, I see a slide continuing to $2000, and if we can’t rally impulsively there, $1600 and $400 provide the next long term support. However, if our current reversal pattern reaches $8000 I’ll consider such a scenario unlikely.

For the evil scenario, our rally in 2019 is still considered 5 waves, but the breach of support still warns that the bear market that started in December 2017 had not ended a year later at $3120. Rather, that five waves was an ‘a’ wave of a much larger B wave. The low on March 12th would be ‘b’ of said B wave, and we’ll see a ‘c’ wave rally within that large B. The ‘c’ has already started in this count. The ideal target if the March 12th low holds is $17K but can reach as high as $31K. Once complete, Bitcoin should begin a C wave down to $2K or slightly lower. This also confirms that the current bear market is the larger degree primary wave 4, an alt in that can be found in my Long Term Crypto Challenge write up. Because it is a primary wave 4, the wave 5 to come will more likely not culminate until north of $300K in a multi-year incline.

Ethereum Intermediate-Term

As to the 2019-2020 wave 1 and 2 in the bullish scenario, the same can be said about Ethereum, as was said about Bitcoin. While the 1-2 setup was not invalidated it is now questionable. In fact, Ethereum only missed invalidation by $9. Fib for Fib, that is a much deeper retrace than Bitcoin on March 12. So, much like Bitcoin I question that our rally in the bullish scenario will offer a large scale impulse. At the very least our nominal targets in the bullish scenario have dropped from the previous $2900 to $2290. To solidly regain the uber bullish perspective, I'll need a rally through $675 though I may see structural evidence earlier than that that supports this scenario.

Where Bitcoin has already rallied higher than I'd expect for a bearish outcome, Ether only did slightly and is back under resistance as of writing. Taking out $154 again will make the bearish case less likely. Below $95 from here makes it primary and suggests a break down below $60, even to the $30-40 range.

The high B wave scenario which is what I am currently expecting should rally to $465, and may rally as high as $675 before dropping in the large scale C wave. Right now I have $45 as a placeholder target for C of ii, but that level will be refined based on where the B wave tops if we take this path. After this scenario plays out Ether should be in a large scale third wave that lines up with Bitcoin's primary 5th.

GBTC Intermediate-Term

In my updated intermediate-term view of Bitcoin I discussed the importance I place on the .764 retrace. If the .764 retrace of a 1-2 is breached it doesn't invalidate the 1-2 but often something else plays out, including future invalidation. In Bitcoin, this level was breached at $4300 on March 12th. However, this has not occurred in GBTC. It held its support by one penny. So technically I should not drastically change my point of view on GBTC as long as the March 16th low holds. However, the nominal target for the fifth wave projection is lowered from $178 had the December 2019 low held. It is now $114. Considering less intermediate bullish scenarios is purely based on considering BTC's breach of support, not GBTC's action

The first scenario to discuss is bearish, though I already consider this view low probability since the clawback we've seen in Bitcoin. This would be a tumble to $2 in a deeper wave two. This view is not invalid until we rally back over $13.47 but since Bitcoin is already too high to offer a typical 4th prior to a 5th wave to $2K, I have to hold the same setup in GBTC less probable.

The scenario I do like is for GBTC to top in the High B wave (aka evil scenario). The current target for the high B lies between $24 and $40, before we drop to $2. Besides this view making sense of Bitcoin's breach of support and rally, it also lines up the long term between GBTC and Bitcoin. After $2K I expect a major multiyear rally north of $300K in Bitcoin primary fifth wave. GBTC in my previous count would call for a much smaller fifth wave. In this high B wave we would see GBTC put in a much deeper 5th, setting up a larger third wave during Bitcoin's primary 5th. I would expect these two degrees to line up better in scale.