Nightly Crypto Report February 27, 2019

A Little Tree Shaking...Your Instruction Manual

(as if the market comes with a manual but I try ![]() )

)

Summary: With the movement today, we have a little clarity in the counts, but we also have new key levels to navigate through this correction. So, I want to give key levels I'm watching at a nano level to guide me personally into whether I'm going to go all in on the third wave, or retreat or even short the C wave top.

Both ETH and BTC have 3 options I see.

1) Wave 2 down with only A complete. On a raw take on the charts, with no correlation this is my primary.

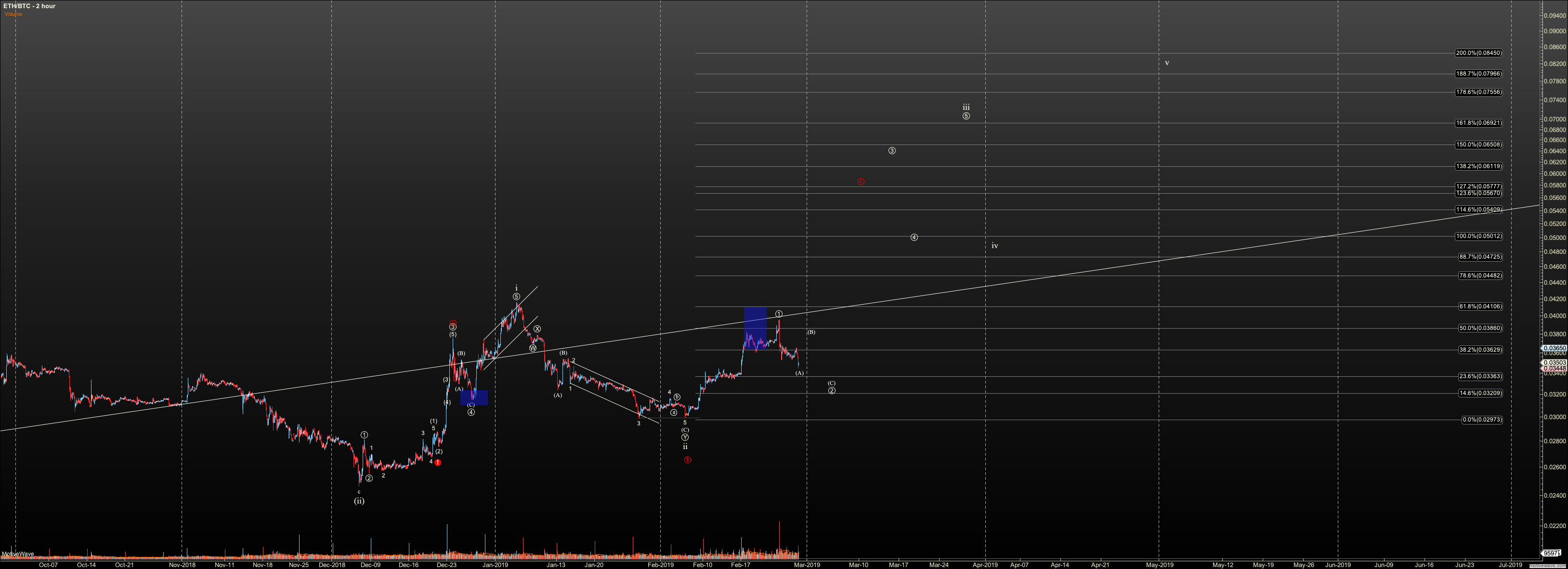

2) The correction finished TODAY, with a very awkward expanded flat. I come up with this possibility, as shared prior by looking at so many other charts (BCH, STRAT, ETC for example), and a hint of three waves in our recent peaks in ETH, and BTC also show this potential, but the peak was just too high to be reliable. ETHBTC also offers this potential.

3). We do in fact have a shortened C wave top, and this 5 down is beginning another bear move to new bear market lows. I have added the full count for this in orange on each chart, not because I'm betting on it yet, but because I want you to be aware, and cautious until we get escape velocity. Note that so few charts across the entire sector give room for this potential. But that's not a reason to not be cautious.

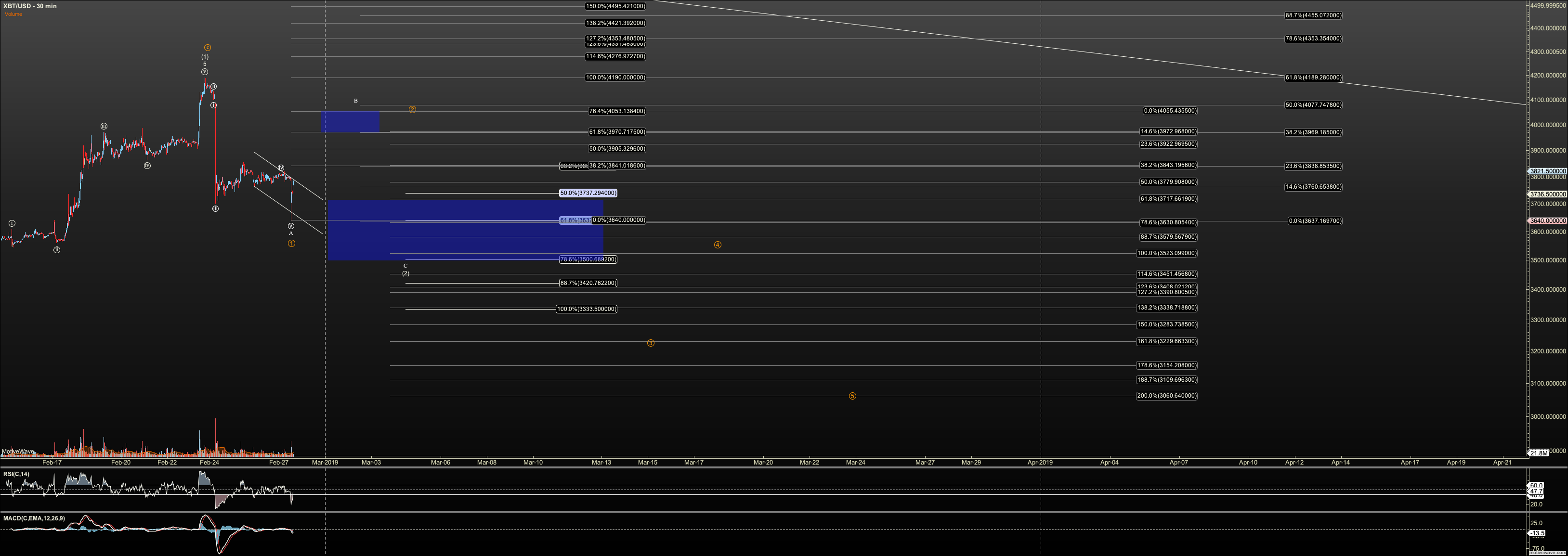

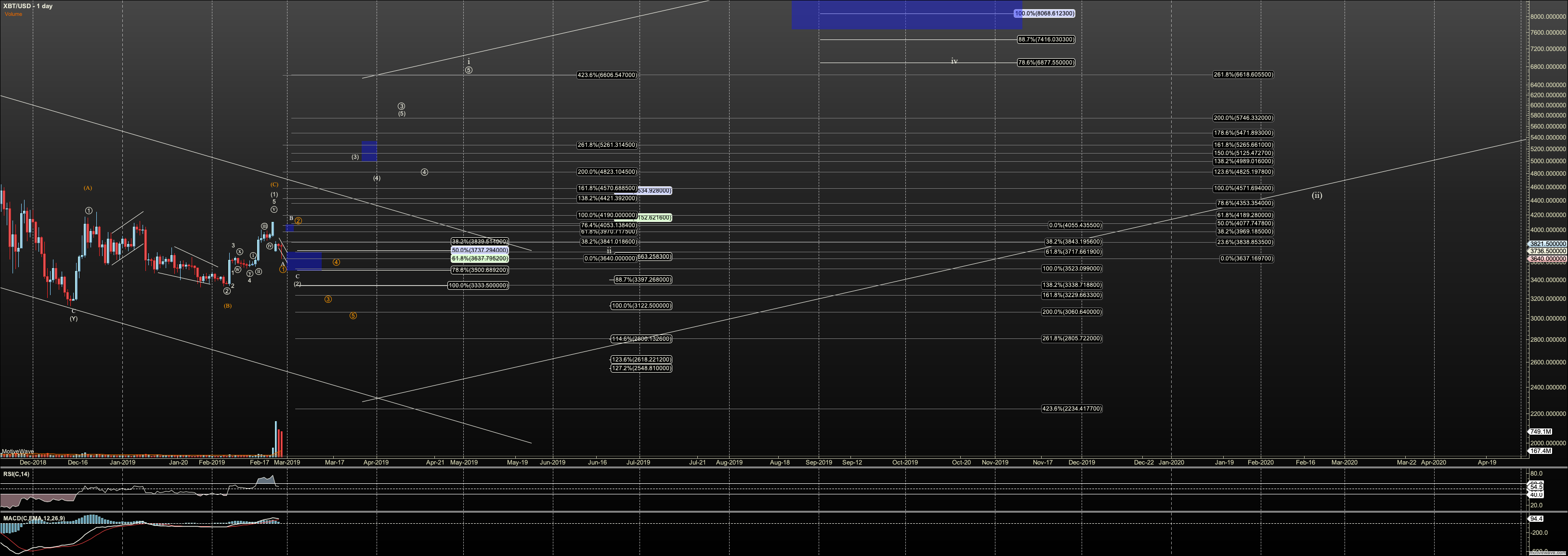

Bitcoin:

For Bitcoin the difference between #1 and #2 will be whether we are corrective out of this bottom. If impulsive (5 waves) over $4053, a retrace should be bought with a tight stop, at this low, or a tighter level which I'll offer when clear.

If corrective we have #2 and #3. If bearish number three, we'll see 5 down to the .618 most likely, not a symmetrical C wave, which are typically .764 to 1.0 of the A wave. That .618 extension which is on the fibs with the orange count, is where you usually see 1 of iii complete. Just note that these extensions are not in stone until a B wave peak is complete. But right now, I have at $3717. This means that 5 down completing deep in to support $3500 is most likely not the start of a bear move but a great place to catch a knife.

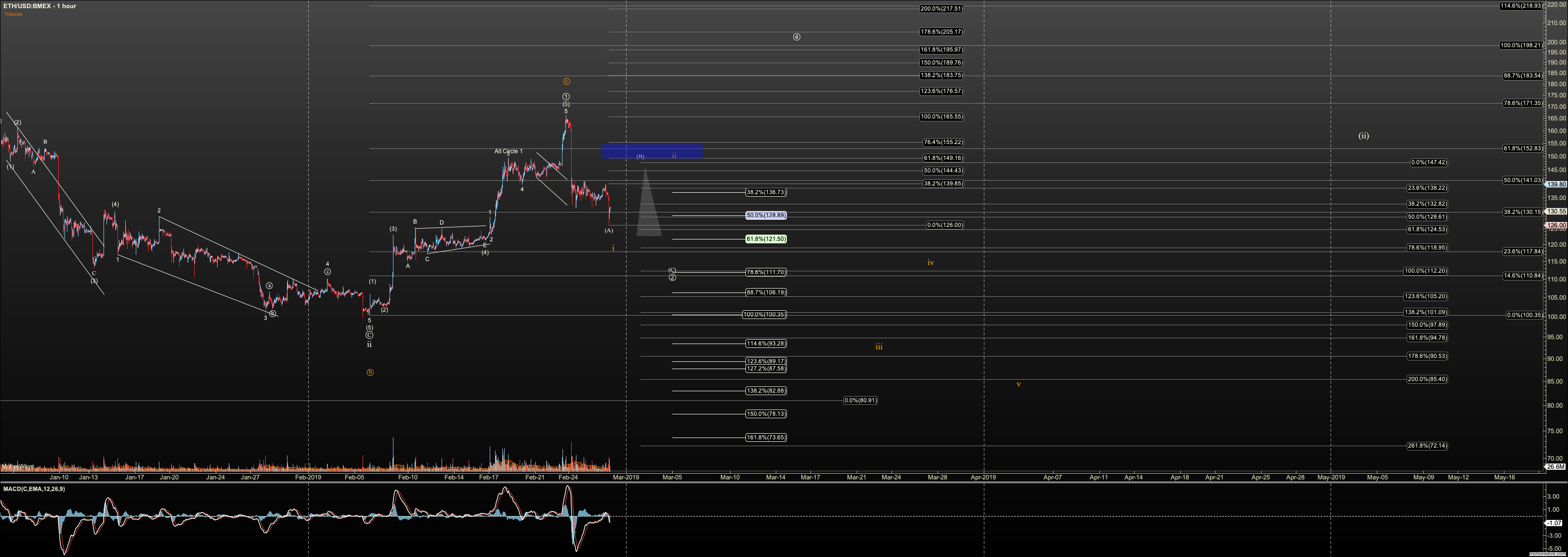

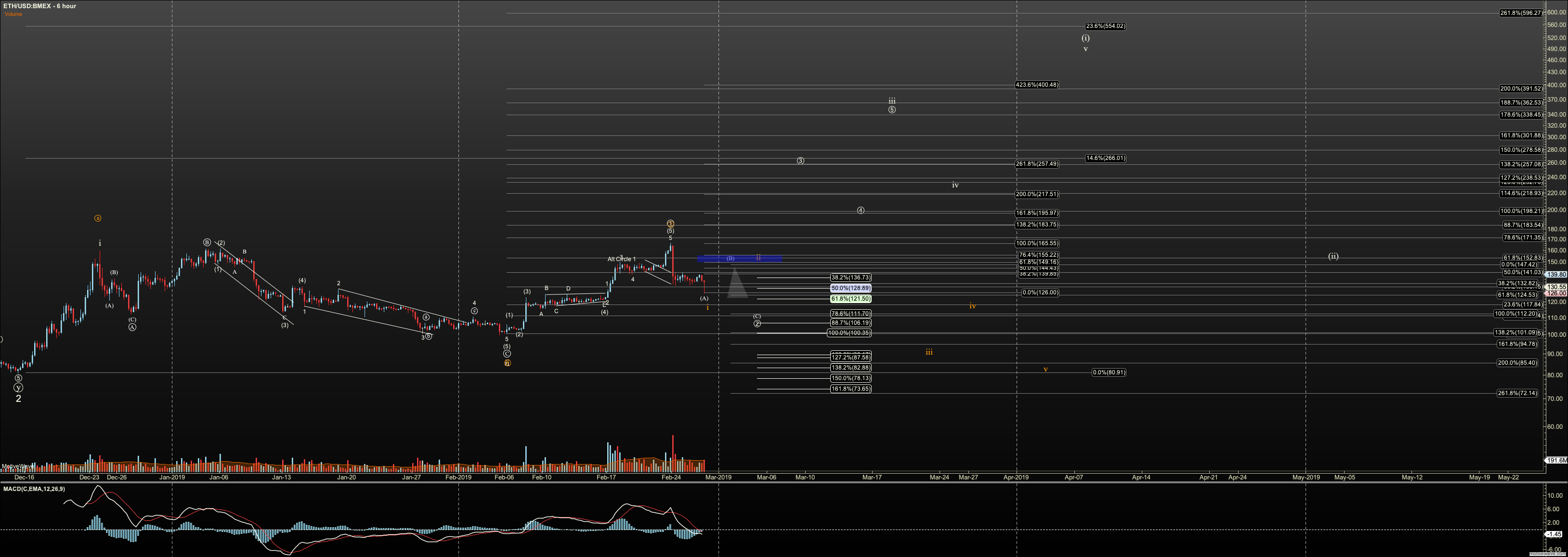

Ethereum:

Ether is similar to Bitcoin:

Impulsive over $155 makes the B wave unlikely. And, like Bitcoin, if C is symmetrical to A we do not likely have a bear move. Like Bitcoin, I'll bring these key levels up as structure is revealed.

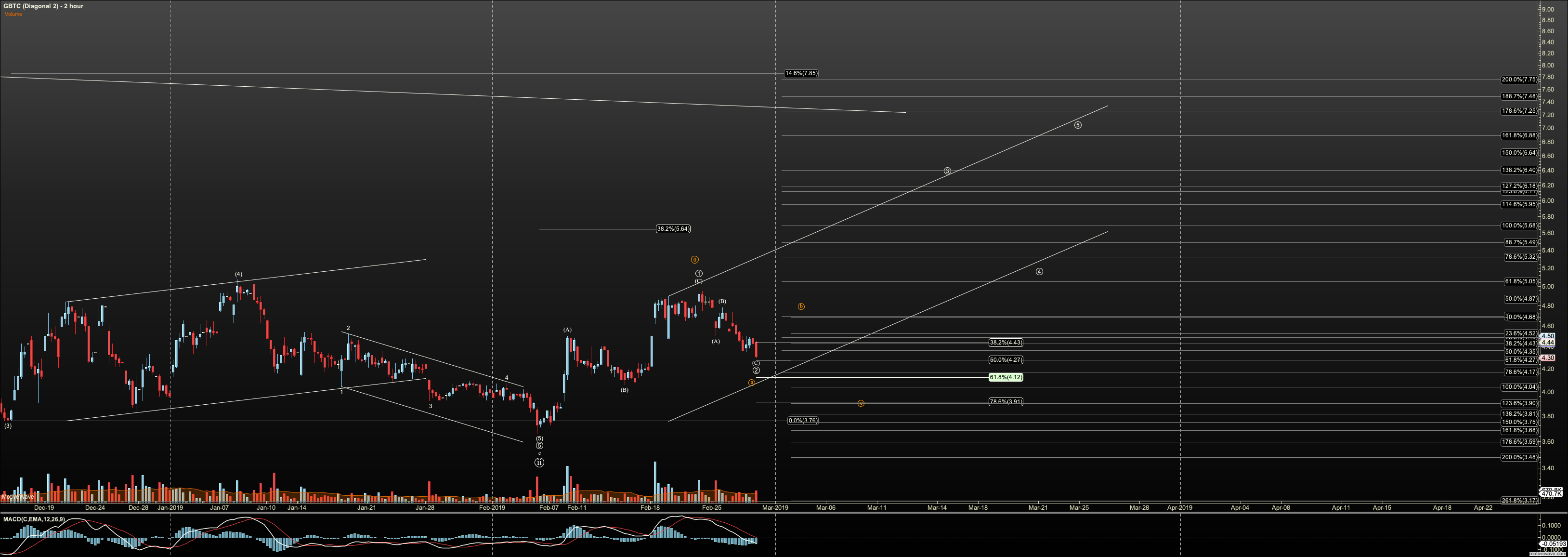

For GBTC, I'm now using my favored diagonal count. It is possible we completed all of ii now, but because it is a little shallow, I have included the alt orange where we are more complex in ii. This is not dissimilar to previous counts where I was looking for a more complex correction.