Nightly Crypto Report: Consolidation Before Breakout

Yesterday I wrote about the paradox created by Bitcoin's recent strength. I spent the evening zooming out on the Bitcoin chart to see what I am missing and came back to an alternate view I shared when we first came off the July low.

If you recall, both Jason and I considered that low very unorthodox. I shared the potential that the low and subsequent structure could mean we were in a diagonal. That fits with the current micro, so I am digging that count up again.

I know this report is going to get people back to the usual question, "Which is primary?" My answer will be, "I don't have enough information yet." This is just an alt to watch, and I'm going to stick to what I have been watching in micro because doing so will eventually lead to a conclusion.

Regardless, one should view us in a consolidation before breakout. It takes a break of $32K to warn otherwise. So, tactically speaking, it's best to accumulate and not get cute as we are likely on the cusp of a third wave ride.

So I'll briefly review the micro in Bitcoin and Ether and follow up with the alternate diagonal potentials.

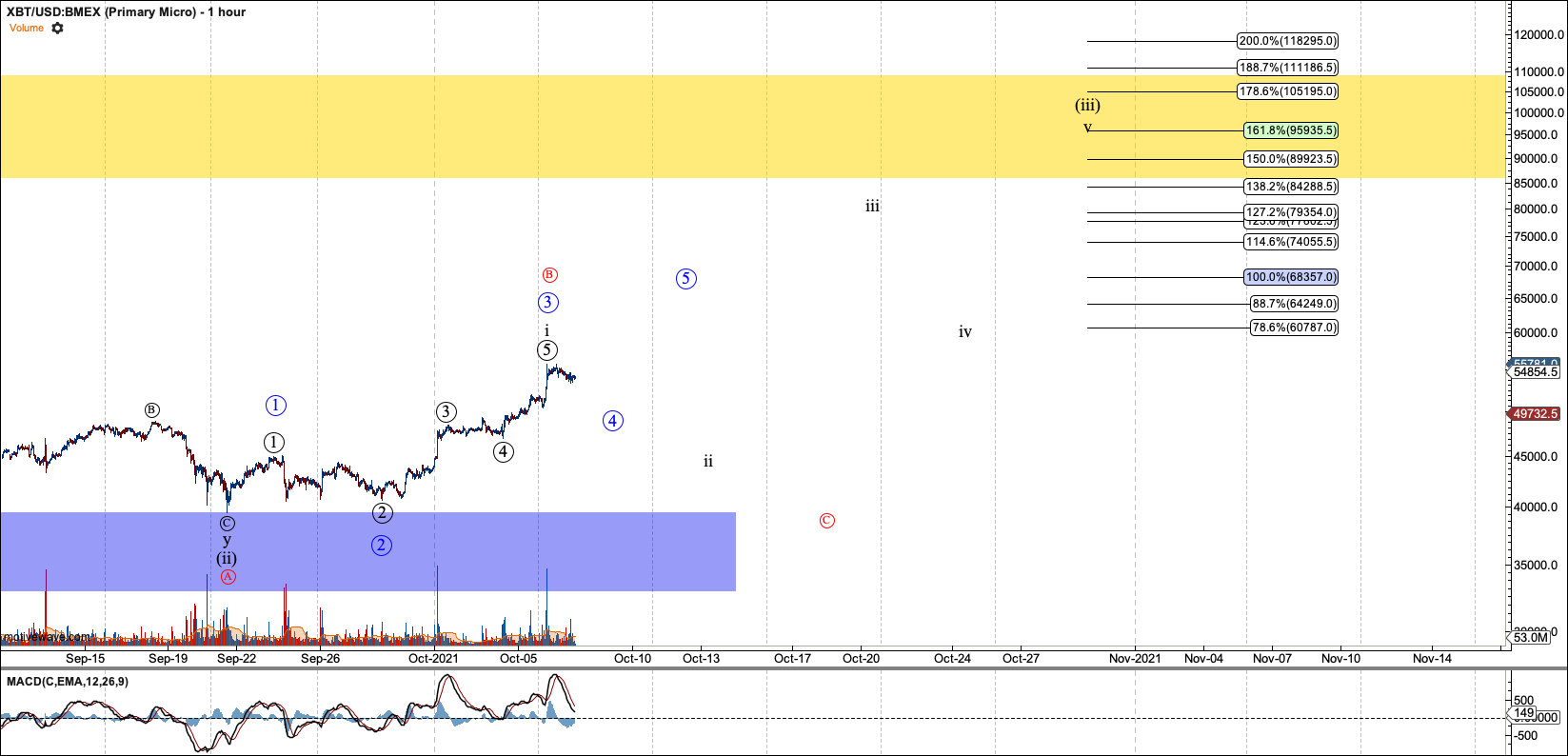

Bitcoin

In micro, I still prefer to see a more defined five wave structure. I've layered the blue count over the black to make sure what I mean by 'more defined' is clear. Support for blue circle-4 is $47,690. Should we fall through that level, we are either in the red count, or we did see a very questionable five waves in the black count.

The alternative mentioned above is a large diagonal. This diagonal gives us an ultimate target in the $105K region. This count fits action well for two reasons. 1. I can argue that Bitcoin rallied off the July low in three waves. An impulse requires a truncated bottom, per the deep dive I wrote in August. 2. This structure also supports a three wave rally here as the A-Wave of the third. If the case then the B wave presents a solid entry zone, with support at $42,536. Regardless of our alternates, a rally through $62,700 puts us squarely in the third wave breakout.

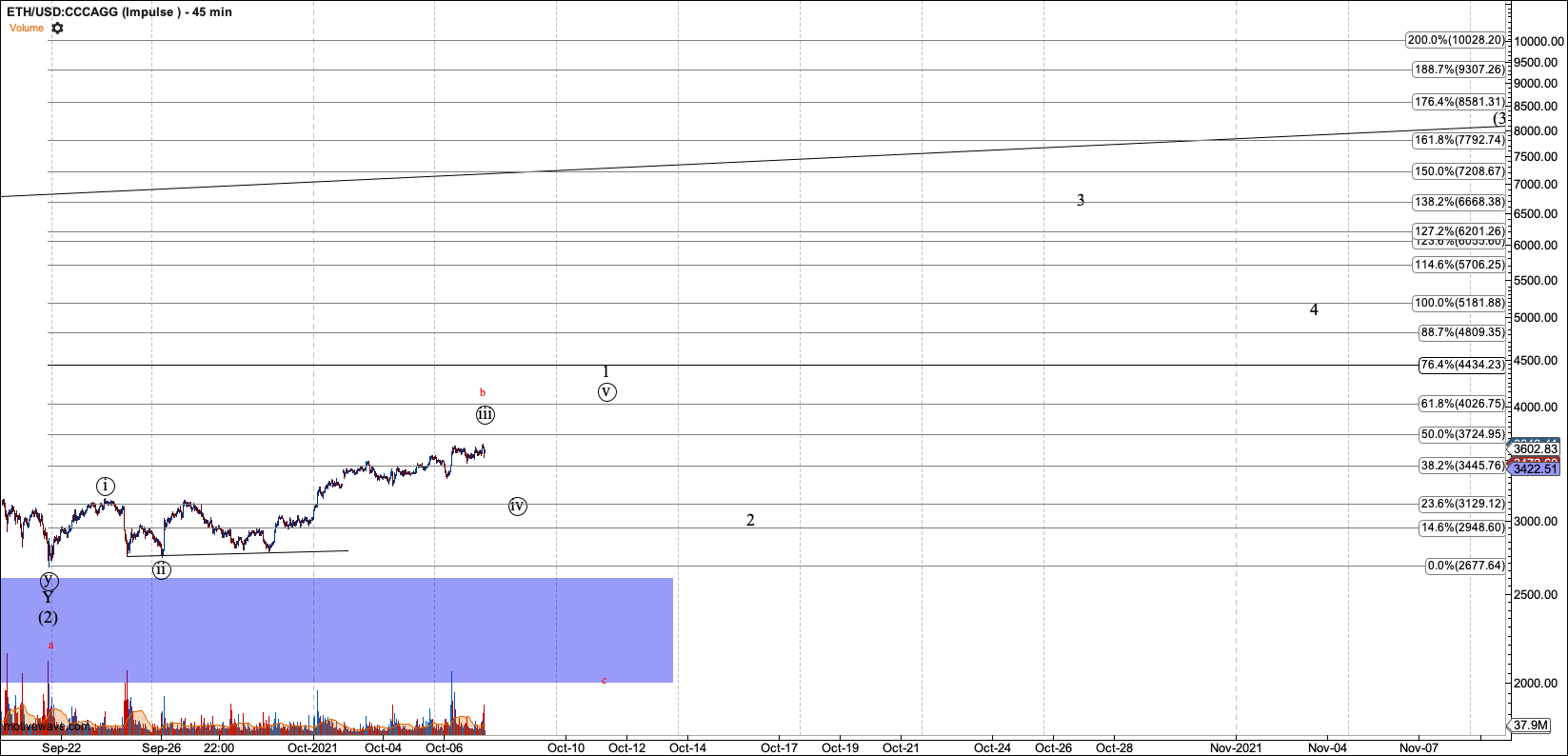

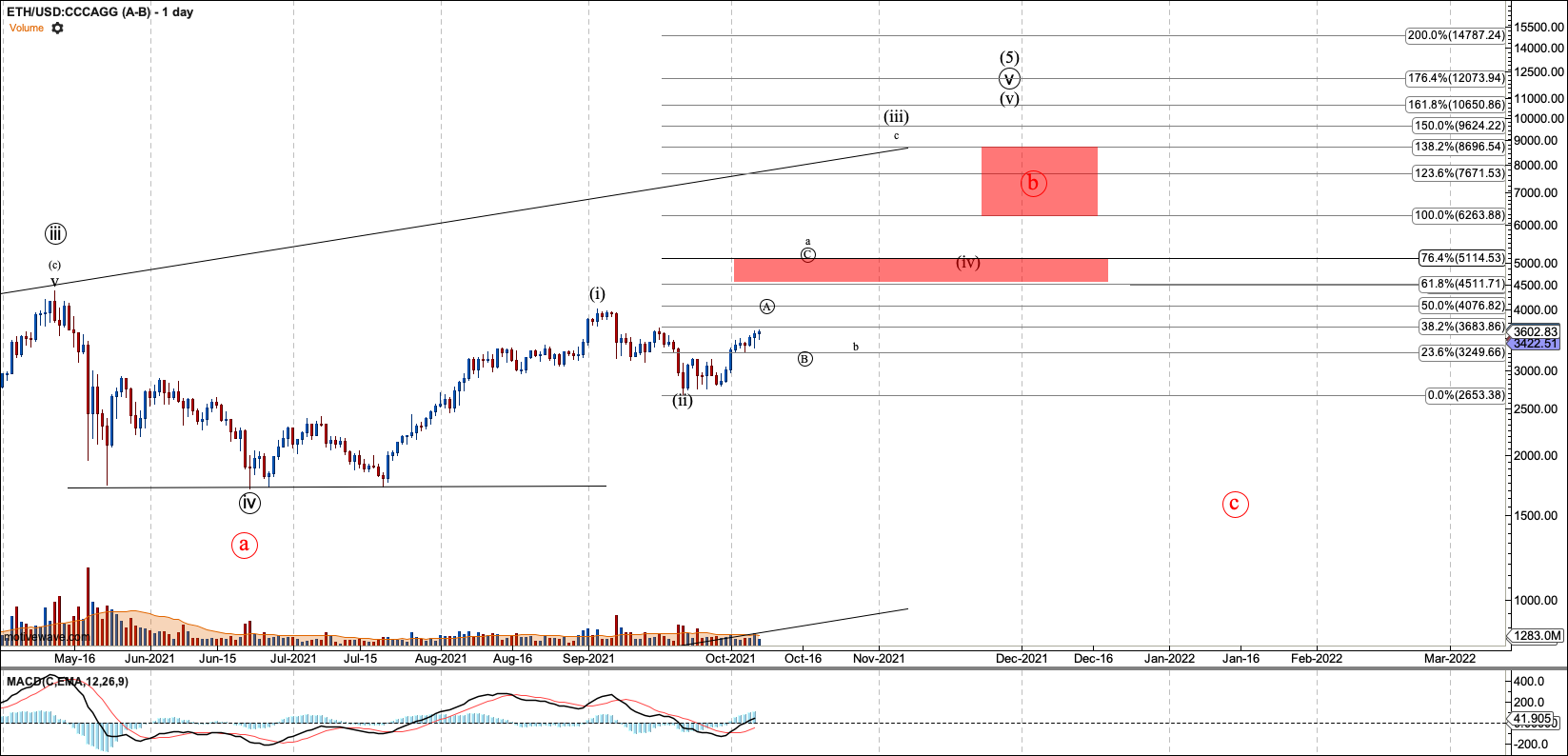

Ethereum

In micro, Ethereum continues to extend in the third. It does not struggle with being an overextended three wave structure like Bitcoin. Currently support is $3210 for the fourth wave.

The alternate count in Ethereum is also a diagonal. If this count is to play out the current A-wave (Circle-A of a) is low, so I'd expect a higher circle-C/a to top near $4500 before a pullback in b. It is too early to identify the support for b, but it should be near the $3200 region. A move through $5100 indicates we are in the wave-(iii).

Lastly, there is still a chance that Ethereum is one degree ahead of Bitcoin in the larger fourth wave. See the Sunday report for the daily chart. IF the case, then Ethereum should be stopped between $6200 and $8600 as a B of that larger B wave. This region. is the larger red resistance box.

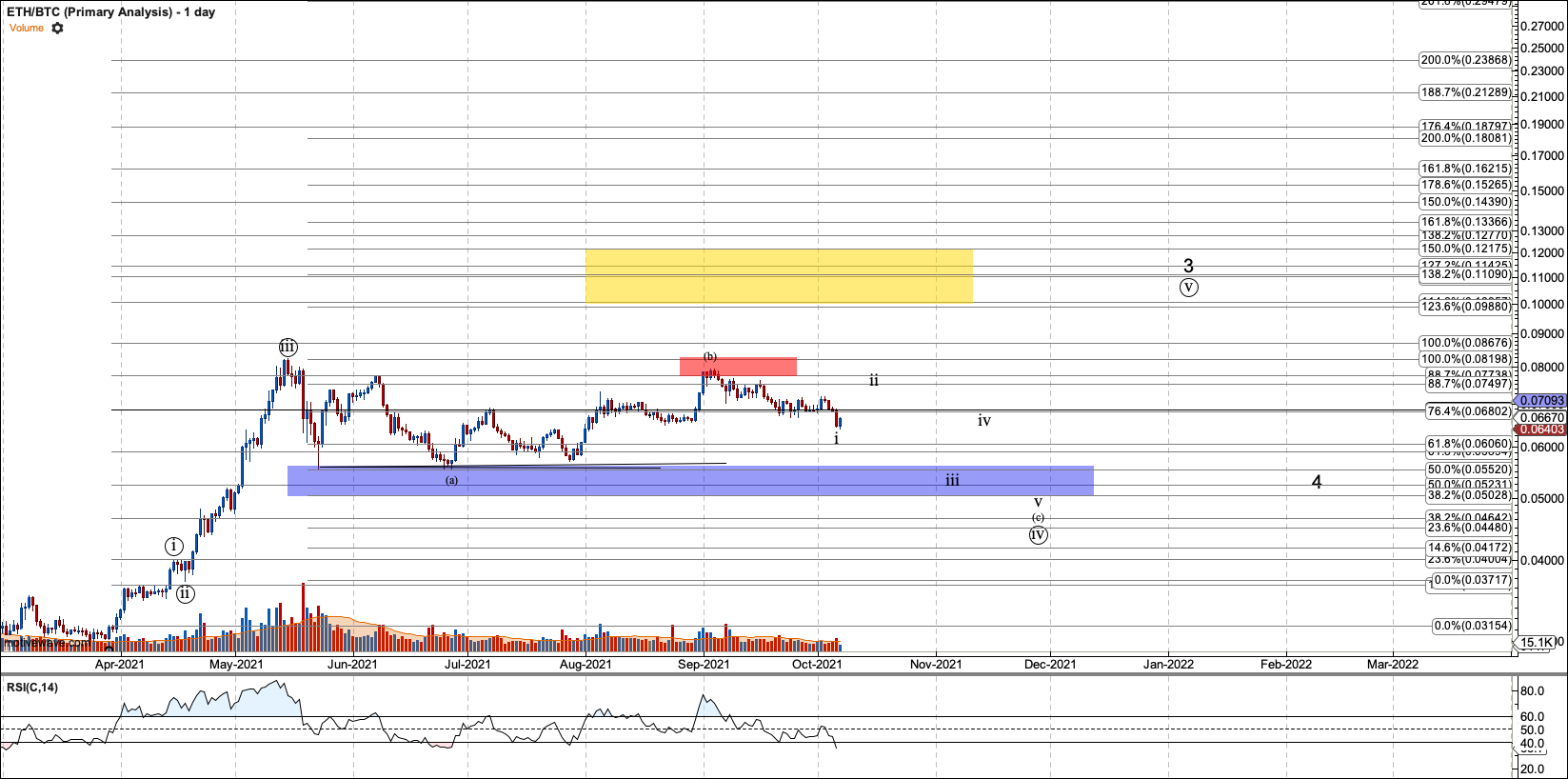

ETHBTC

I have no change in ETHBTC:

I warned about a breakdown in ETHBTC over the last few days and we have it. I have moved to my previous red count as primary, which includes a C wave back to 0.05. I also have a reasonable five down in wave-i. My only caveat is that this chart is exceedingly sloppy, which can indicate lots of surprises.

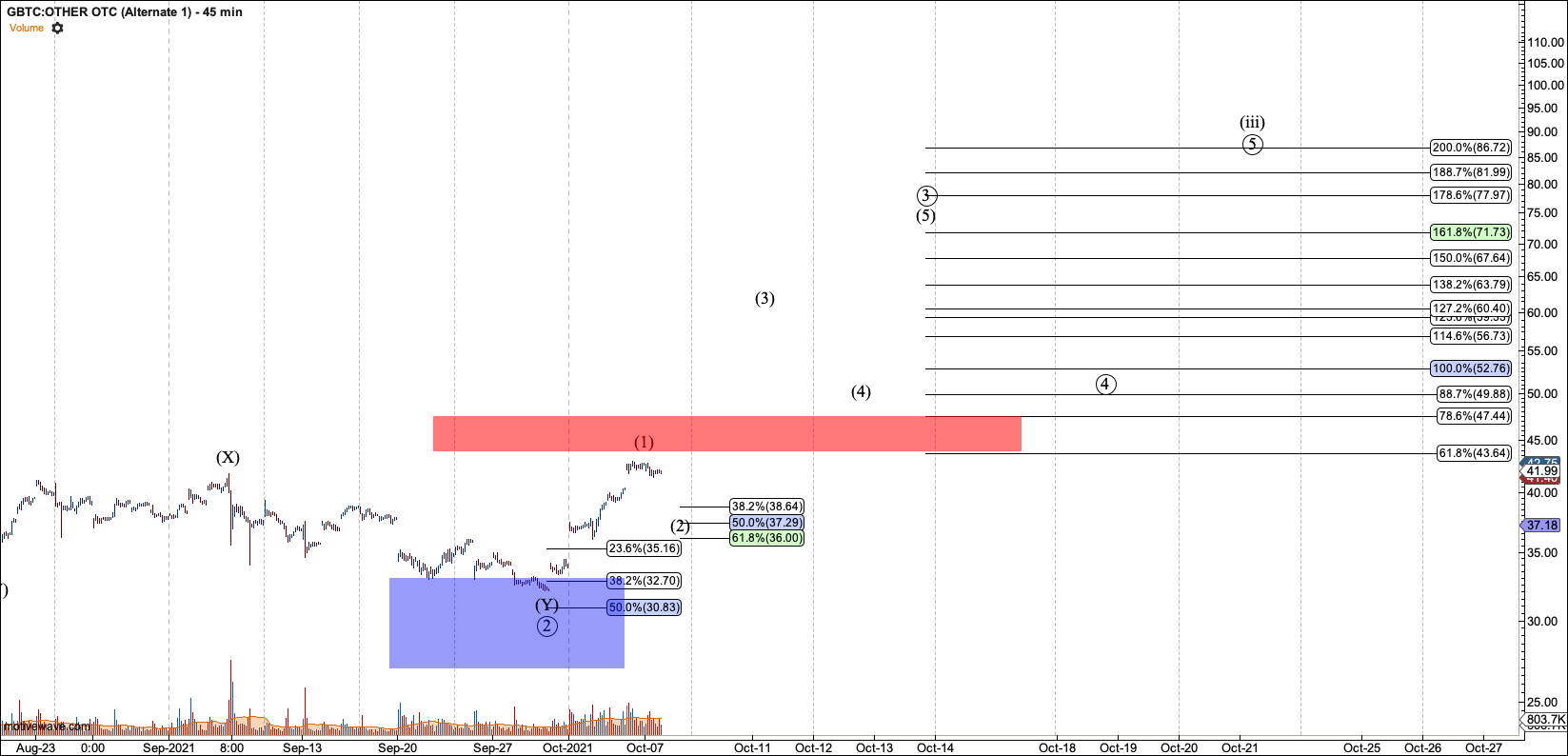

GBTC

I have no change in GBTC. I am simply waiting for a top which should form without breaching. $47.44. A breach above that level indicates the third wave in progress.