Nightly Crypto Report: Chop City

There is little to say since last night’s report, so we have some simple notes:

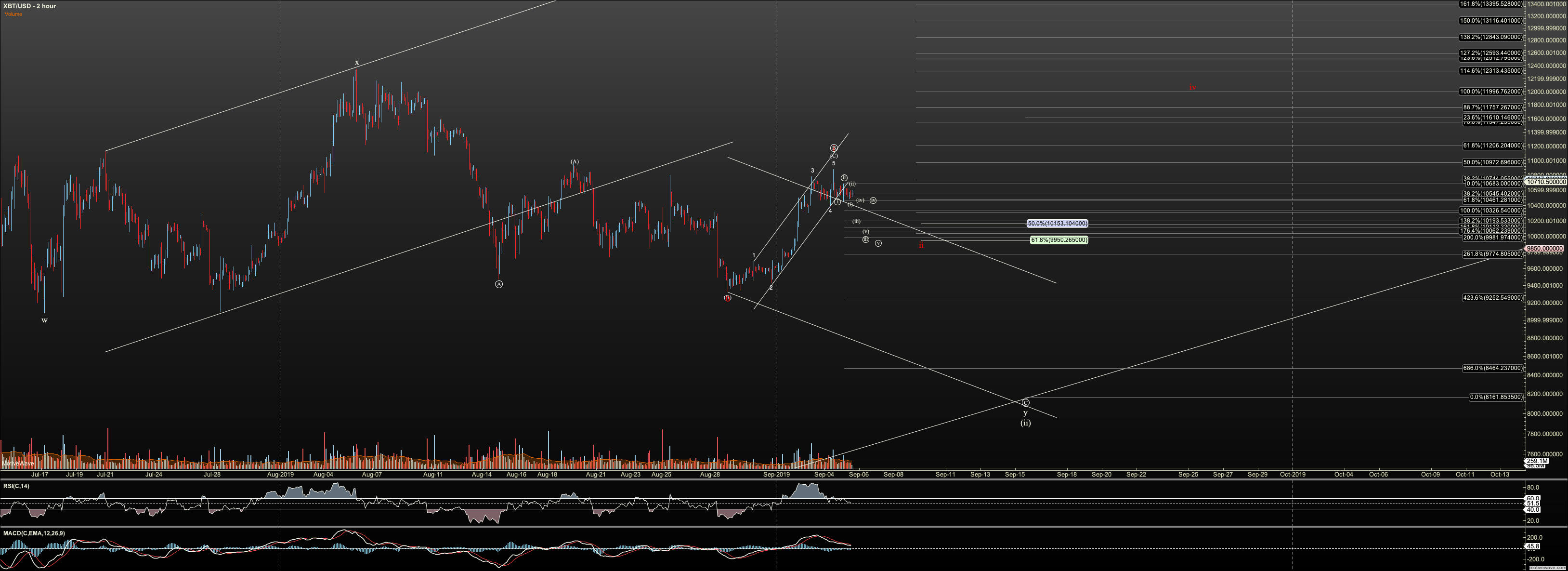

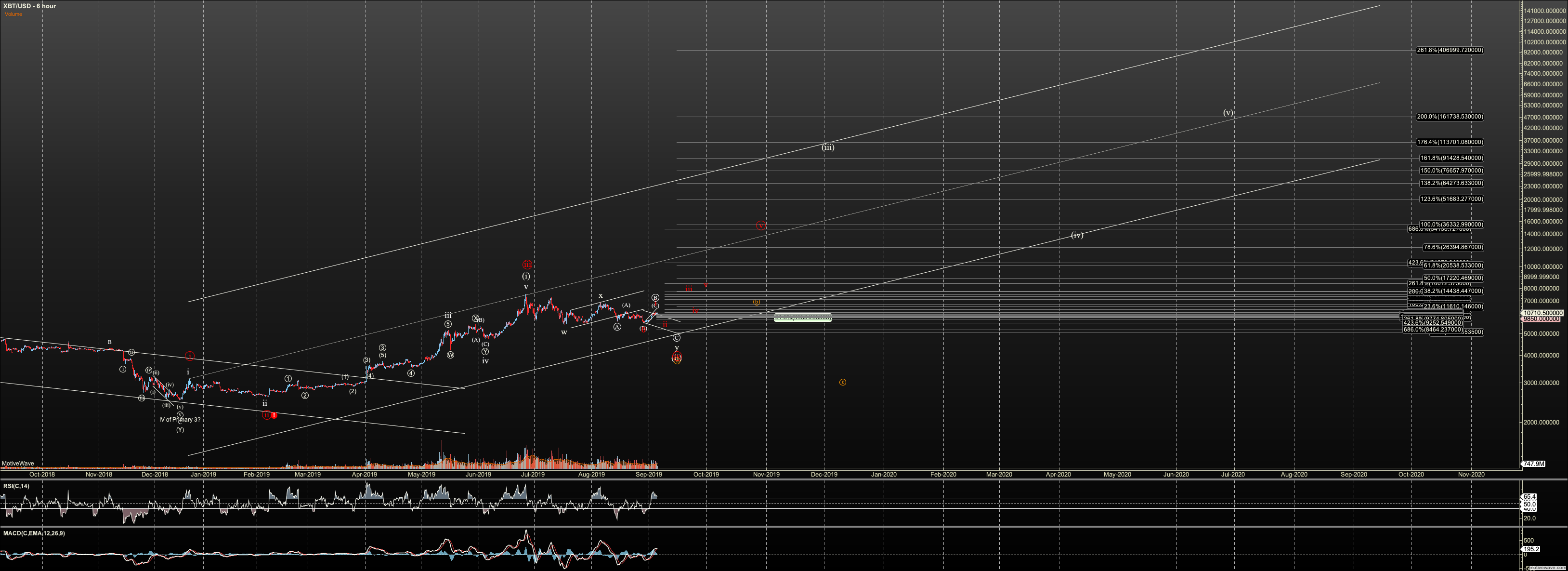

1. Bitcoin has not confirmed that the higher B has topped though it has given warning. I have a nano projection to $9980. If we see follow through, then I’ll consider it likely the B wave has topped.

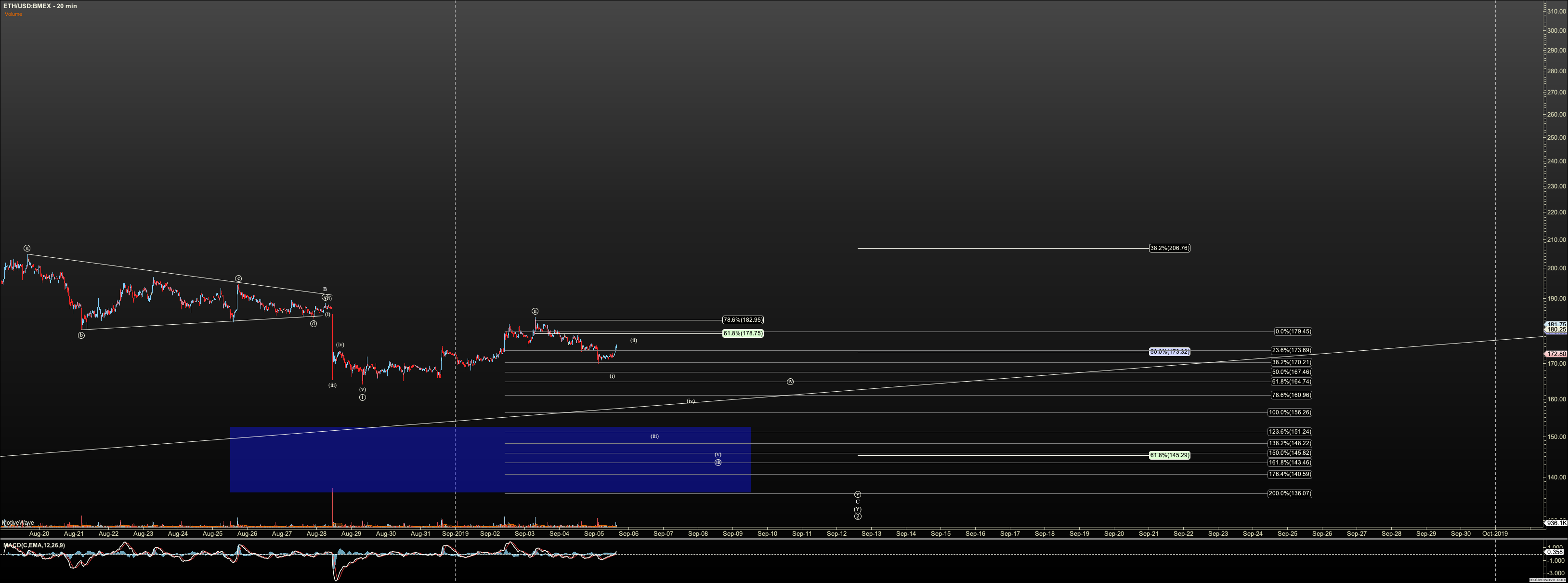

2. Ethereum has more than likely held its wave 2 setup and has started down in a third. But I am relying on a diagonal that has broken support, so I don’t have the highest probability which would have been an impulse which likewise broke support.

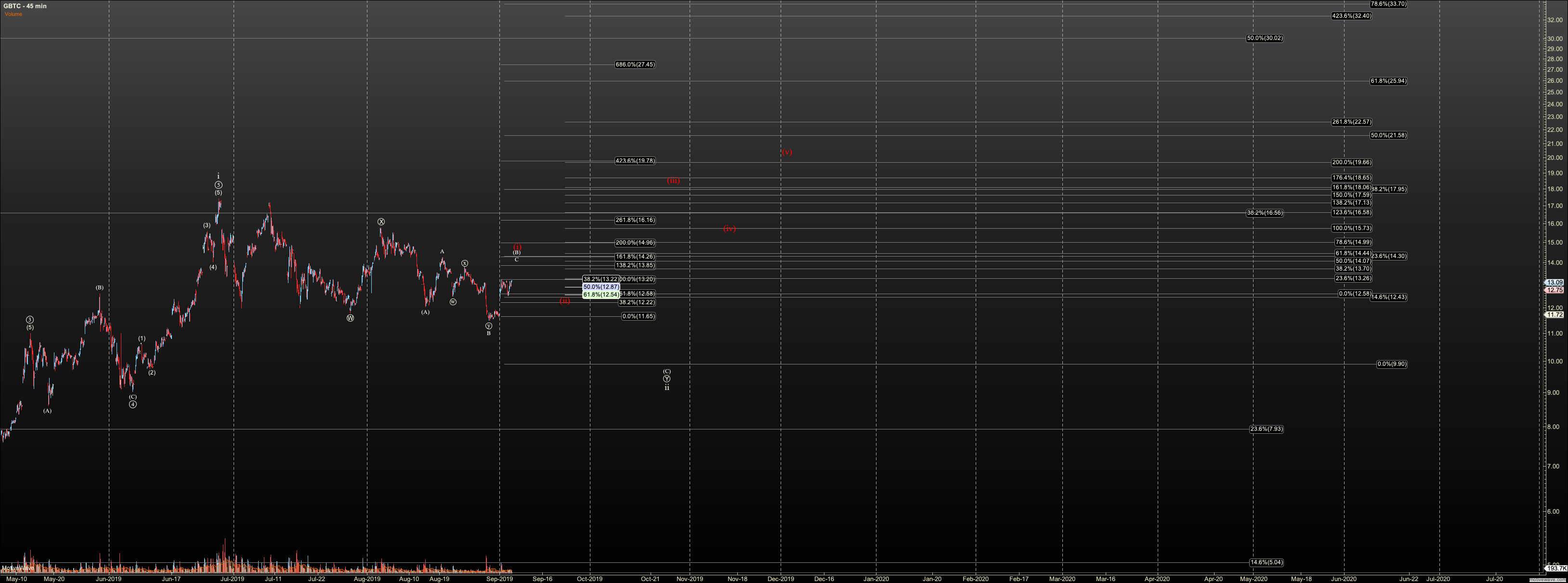

3. GBTC really looks primed to rally in one last push toward $13.80-$14.00 before topping in B. However, we have seen many times where gaps have left GBTC with incomplete patterns. I don’t advise relying on this.

Bitcoin Intermediate Term (No Change Today):

Bitcoin put in a strong bottom at $3120, which aligns with the long-term support for my primary count, at $3000. Holding there suggests good probability that we see a run to $65,000 - $225,000. The current correction is primarily viewed as a wave 2 correction, which has support at $4300. We may never see that low, and the current leg of this correction targets $8,400 to $7,800. If we see an impulsive rally in that zone, though this is considered a shallow wave 2, I will look forward to a completing a larger degree pattern potentially to between $129,000 and $160,000. By this we see how the smaller pattern refines targets for larger pattern.

The alternate intermediate view is that this is merely a wave four. In that view, the next wave, to the $20K’s may terminate the 2019 bull with a nominal new. Although, it is remotely possible we hold for a higher degree which will be discussed when important.

Ethereum Intermediate Term (No Change Today):

Ethereum did not hold my ideal long term perspective by $10 in the 2018 bear, suggesting that the low was a wave 2, and not the wave 4 which was primary. This creates some questions about its future as well. Further, it opens the door to a much deeper wave 2 to $40.

For the 2019 rally, there is some question whether we have a five wave move. If so, it is a diagonal. $113 is the litmus test. Below $113 and risk we see $40. Currently the local correction which, if wave two of the larger wave 1 of our third wave, targets the $145, and if we bottom there, the fifth wave suggests we hit the $3000 region before a higher degree correction.

GBTC Intermediate Term (No Change Today):

Note there is discordance between the long term GBTC count and that of Bitcoin, because of its release to the public does not match BTC genesis. And, so the question in my mind is whether GBTC will see a large ABC, or a full impulse in the longer term. If I am strict to the impulsive view, GBTC can bottom in the $9 to $10 region, corresponding to the $8,400 to $7,800 bottom in Bitcoin. And, the rally in Bitcoin to $129K+ can correlate to a move to $220 target in GBTC. If we only see a C wave, we should not see GBTC one higher than $85. Knowing which from this vantage point is not possible and we’ll need to see the market progress.