Nightly Crypto Report: Chewing out that Fifth

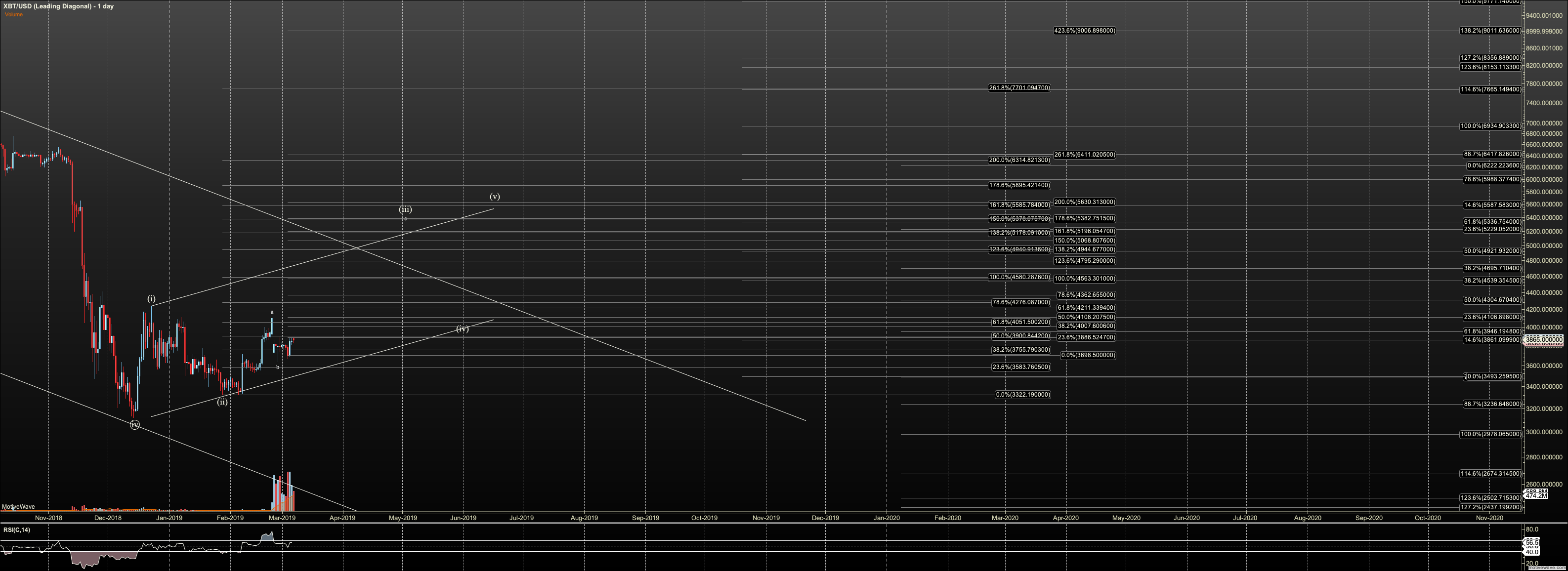

With respect to Bitcoin and Ether I have nothing more to say beyond the detailed roadmap last night. I don't even have that fifth wave to tune my support levels, as both coins have gingerly climbed northward.

I wrote:

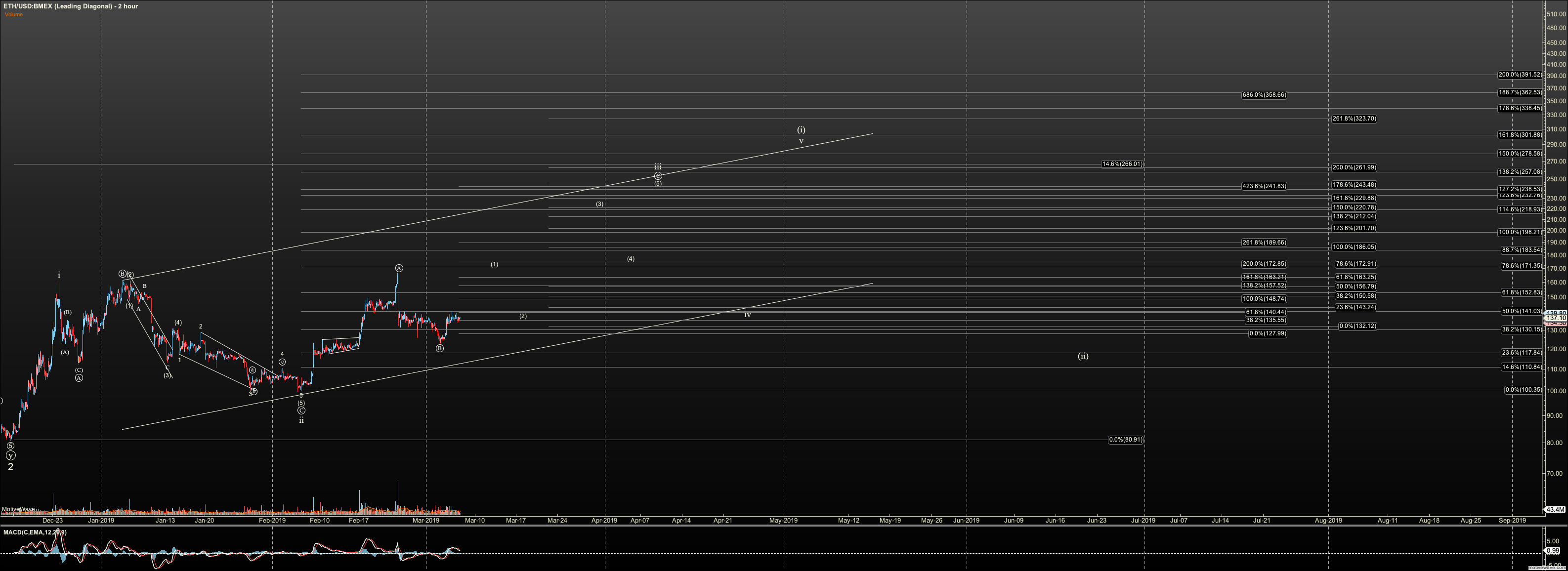

I'm going to make some roadmaps this morning as we have a key moment in the attempts for higher levels. I'll attach BTC after I work on it but here is Ether. In both coins we can call them 5up off the low. Although, in nano appears the high only be a B wave and that it will drop back to 4 and make another run higher. Any levels will change if they need to, by further extension. But that's nano and it is best in my view to treat it as done, and watch support.

As statedI am now flat short term. I may scalp short. Below I have marked support for red, the beginning of breakout. While it is possible that it takes a more direct route over the February 23 top, this is the minimum in red. A drop below the box marked by red two suggests strongly that we are in orange or headed to lower white 2. Note the red 2 box applies to Ether mainly because it has not put in a 1-2 yet. But Bitcoin's red 2 is the last low. Below the start of this move up is confirmation. I'll need to see structure to tell the difference between white and orange, but will see no reason to be long short term until deep into white.

Confirmation of the start of a third comes with a break of February high, however filling out red is our best early 'warning' of bulls in control.

So, the key level in Ether now is $126.63 for Bitcoin $3819, and I'll move that level up if we extend in this move higher.

To this I'll add that ETHBTC strongly argues for a wave 3 beginning, more so than BTC and ETH in USD basis. we now have 5up off the lows. Further, ETHBTC did not extend to the .764 but to .618. That would be awfully low for a C wave. So, I much prefer that it completed a wave 1 of three, unless we see a larger C wave. I don't see a bearish top as likely in this chart already is the main point....iii or C higher is the most probable read.

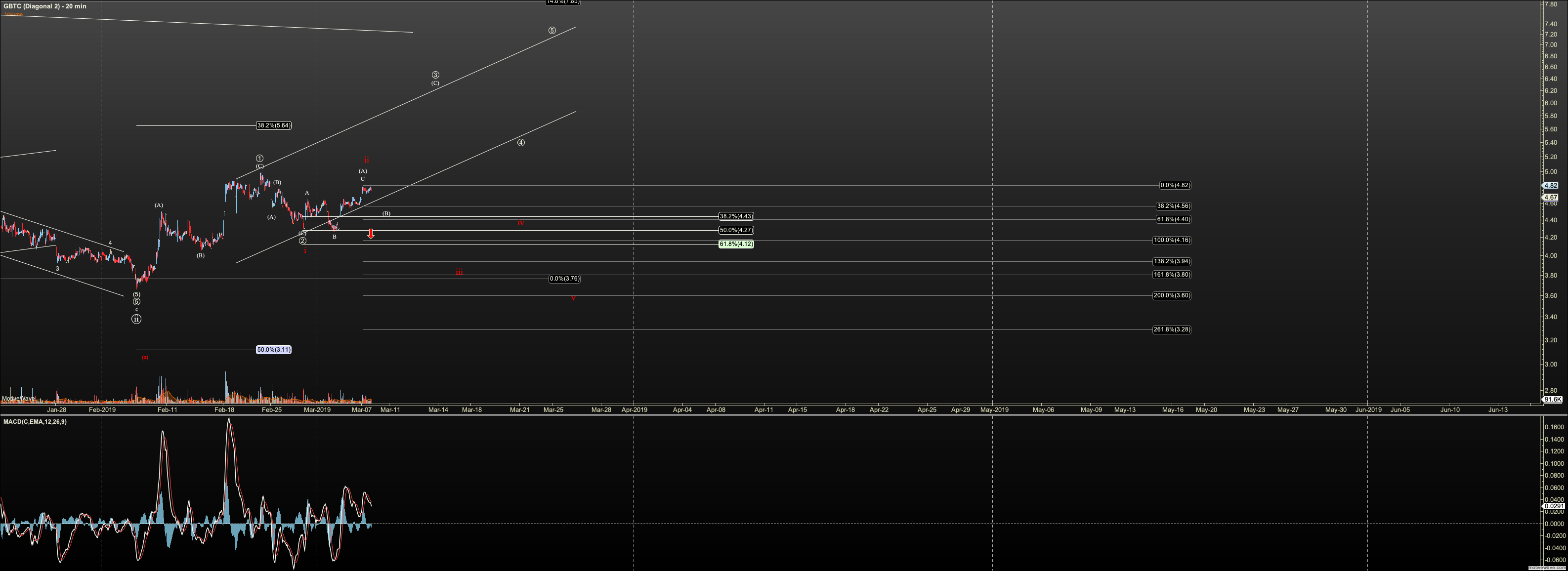

I do have material to regarding GBTC, I now have enough action to bring in another bearish count. Why do I have to do such a thing, you say? Well, we still have only a three wave rally for 2019. We need to see this diagonal complete. So, I have added the red count. We are either extending to new 2019 highs in C, or lower. And, the red count brings us into new bear market lows, but it isn't a concern until we see 5 down to between $4.56 to $4.40 with warning coming in with a break of the last local low.

Further I wanted to add to this report the alternate diagonal counts I posted in the main room last night, for Bitcoin and Ether. These counts reconcile the bullish stance of this market with the .764 extension hit in both coins, which has me concerned for the bullish count. After all we have coins rallying deep into third waves, and many with very bullish setups, more so than Bitcoin and Ether. So, I'll be surprised if our two largest caps take a downward turn. Anything can happen. However, these diagonal counts do a good job of considering some of the micro problems we have off the wave ii low. To the untrained eye, these may look similar. However, in a diagonal the third is usually lower: the 1.382 extension, not the 1.618, and the fourth crosses the wave 1. So, this would be a 'low swinging' bullish count. As I said yesterday, this count in BTC reconciles some lack of confluence with key targets for our breakout to over $65,000. But right now, I won't know whether the market is taking this path until we see which fibs above are hit, provided we breakout.